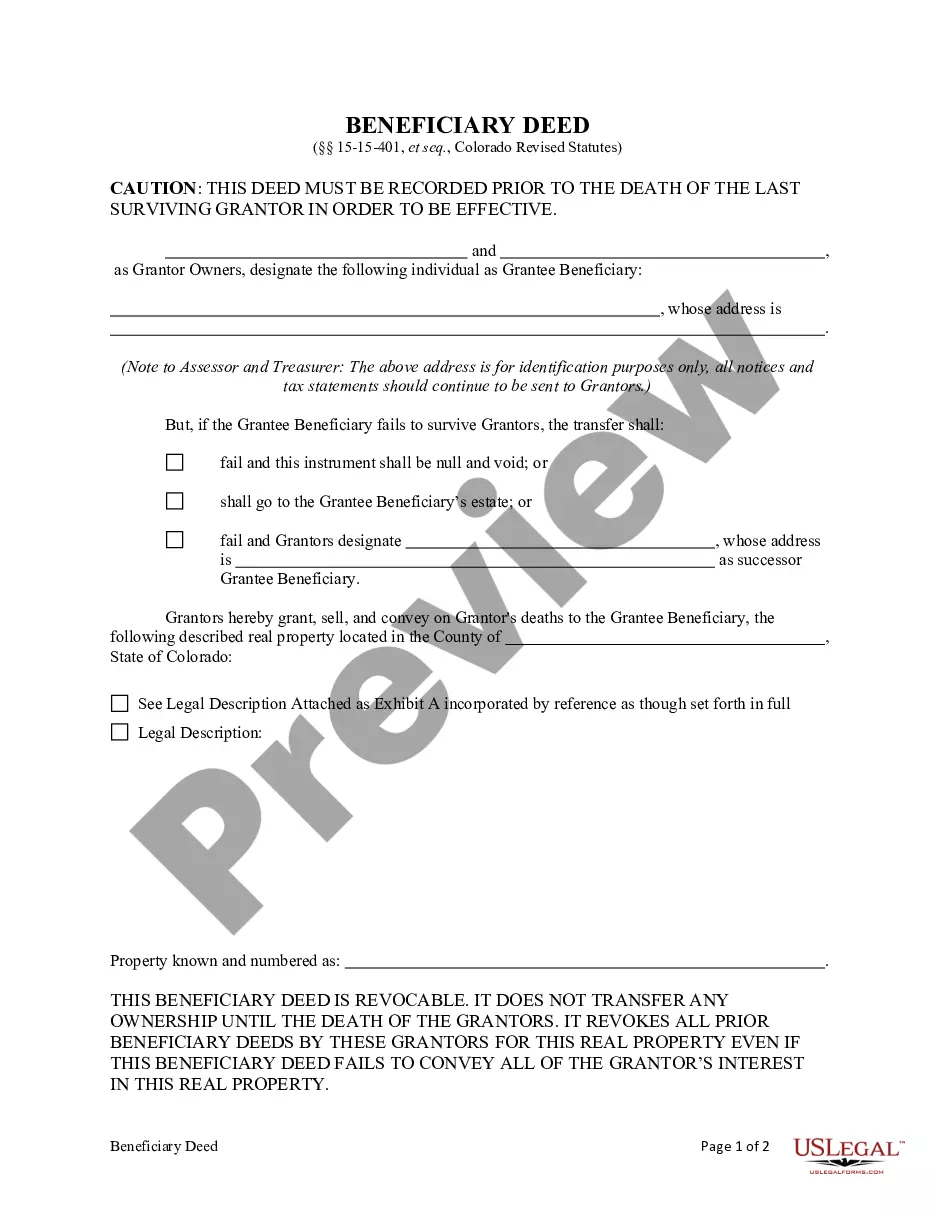

Transfer on Death Deed - Colorado - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time.

Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual

Description

How to fill out Colorado Transfer On Death Deed Or TOD - Beneficiary Deed - Husband And Wife To Individual?

If you have previously employed our service, Log In to your account and download the Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to procure your document.

You have continuous access to every document you have purchased: you can locate it in your profile within the My documents menu whenever you need to use it again. Leverage the US Legal Forms service to swiftly discover and save any template for your personal or business needs!

- Confirm that you’ve found the correct document. Review the description and utilize the Preview option, if available, to determine if it suits your needs. If it does not align with your requirements, use the Search tab above to find the appropriate one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or the PayPal option to finalize the transaction.

- Receive your Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

While you do not need an attorney to create a Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual, it can be beneficial to consult one. An attorney can provide valuable insights, ensure all legal requirements are met, and help you create a deed that aligns with your overall estate plan. Platforms like uslegalforms offer resources to guide you through the process, keeping it efficient.

One disadvantage of the Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual is that it does not protect your estate from creditors after your death. Additionally, if you have multiple beneficiaries, it may lead to disputes or complications in the distribution process. It’s important to weigh these factors carefully against the benefits that a TOD deed can offer.

Yes, you can transfer a deed without an attorney in Thornton, Colorado. The process involves filing the Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual with the appropriate county office. However, it’s essential to understand that while the process is straightforward, legal guidance can help you avoid potential mistakes and ensure the transfer is valid.

While naming a beneficiary and executing a Transfer on Death Deed (TOD) share similarities, they are not identical. The Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual explicitly states the transfer of property upon death, avoiding probate processes. Simply naming a beneficiary may not include the legal protections or procedures associated with a TOD, which clearly delineates property transfer. It's important to understand these distinctions for effective estate planning.

Yes, Colorado does allow Transfer on Death Deeds (TOD), enabling property owners to designate beneficiaries who will receive their property upon their passing. The Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual is a legally recognized instrument that simplifies the transfer of ownership. This method also alleviates many concerns associated with probate, making it a favorable option for many property owners. If you want to learn more, consider visiting uslegalforms for templates and guidance.

The primary difference between a Transfer on Death Deed (TOD) and a beneficiary deed lies in their legal implications and operational processes. A Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual permits the transfer of real estate upon the death of the owner, bypassing probate entirely. In contrast, a beneficiary deed may include additional provisions such as the ability to change beneficiaries or specific instructions for after death. Understanding these differences is crucial for effective estate planning.

Determining whether a Transfer on Death Deed (TOD) is better than a beneficiary deed often depends on your specific needs and circumstances. A Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual provides a straightforward method for transferring property directly to beneficiaries without going through probate. This can simplify the transfer process and reduce potential complications. However, it’s essential to consult with a legal professional to understand which option suits your situation best.

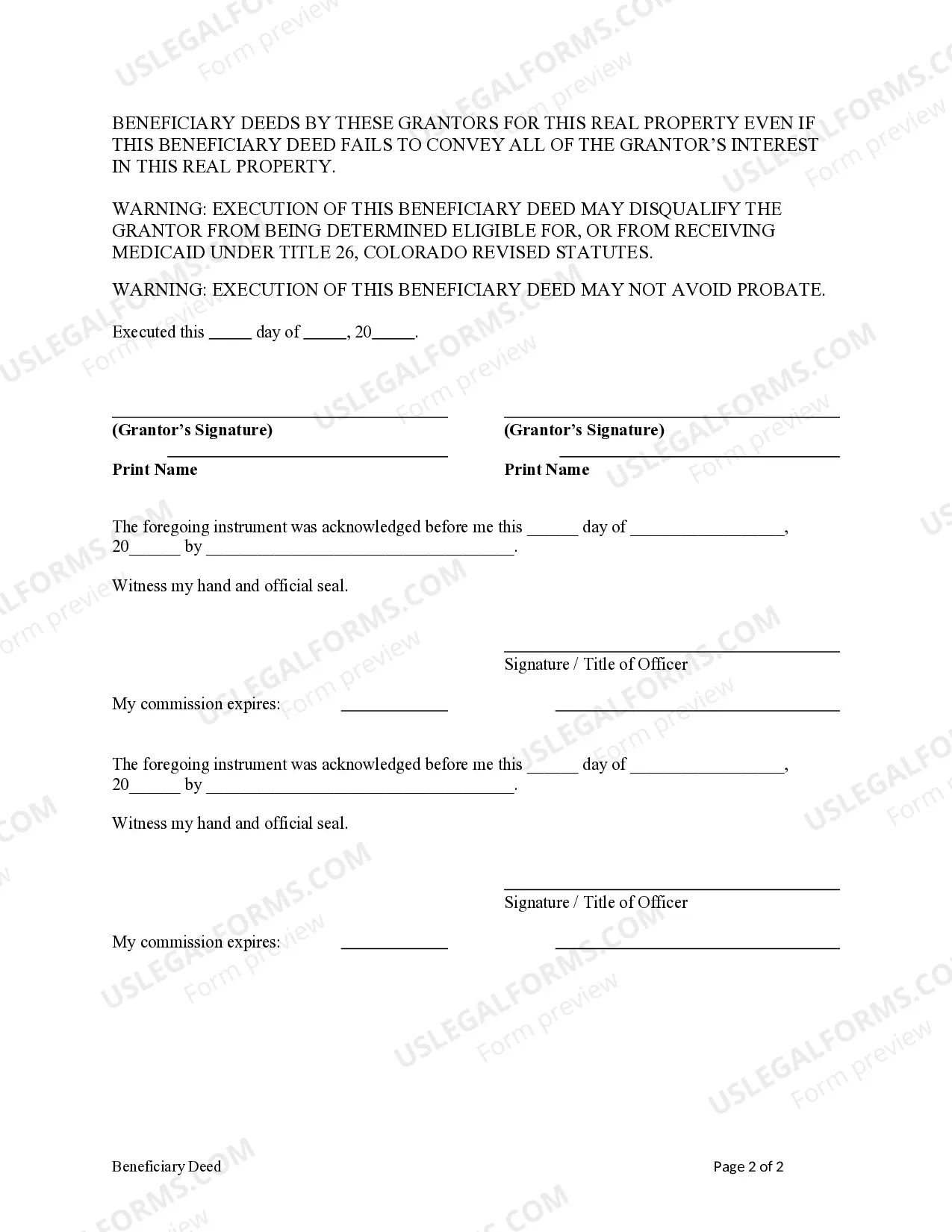

Filing a Transfer on Death (TOD) deed in Colorado involves several key steps. First, complete the TOD deed form with accurate details about the property and your chosen beneficiaries. Then, make sure to sign the form in the presence of a notary. After that, you must submit the completed and notarized deed to the local county clerk and recorder's office. Resources like US Legal Forms can provide you with the right documentation to facilitate this process smoothly.

To file a Transfer on Death (TOD) deed in Colorado, you must first complete the necessary deed form, ensuring that it includes the required information about the property and the beneficiaries. Next, you need to have the deed signed and notarized. Finally, you must file the deed with the county clerk and recorder's office where the property is located. Consider using platforms like US Legal Forms for templates and guidance on filing the Thornton Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual.

Yes, Colorado is a state that recognizes Transfer on Death (TOD) deeds. This legal instrument allows individuals to transfer property to named beneficiaries upon their death, without subjecting it to probate. This feature can be particularly beneficial for husbands and wives in Thornton, creating a straightforward process for transferring property to an individual.