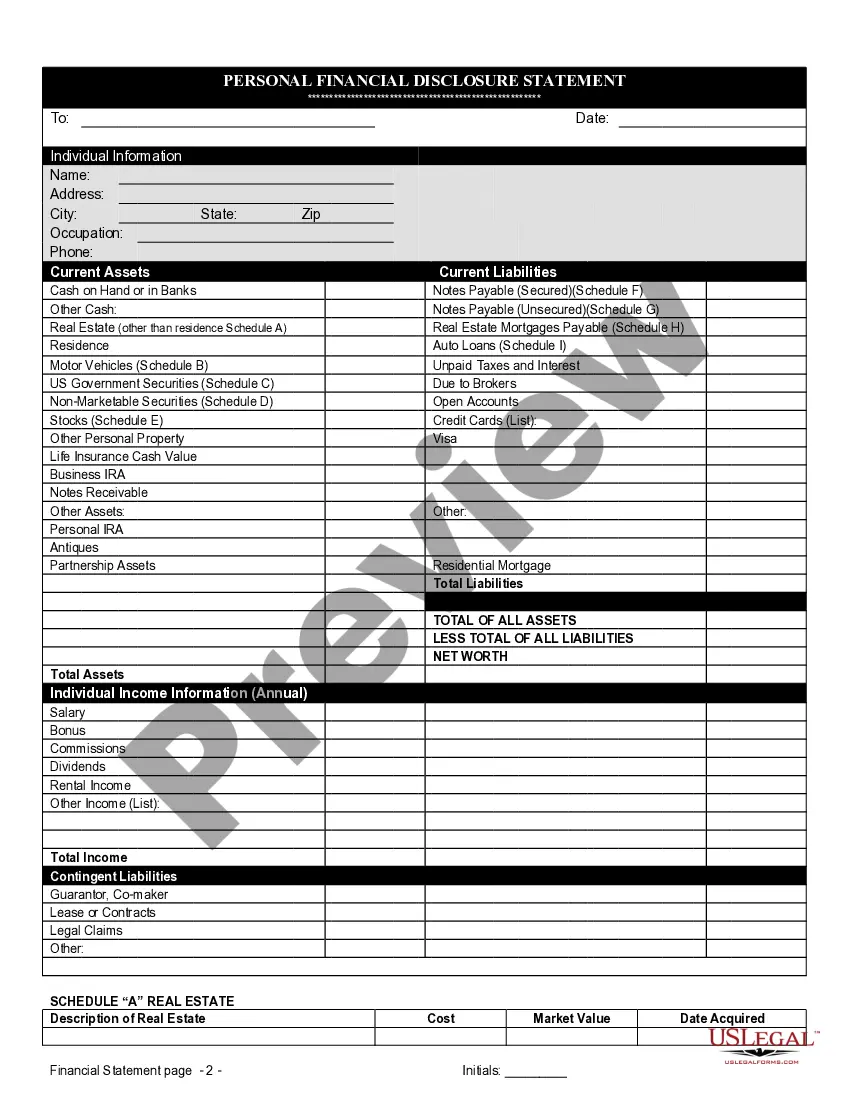

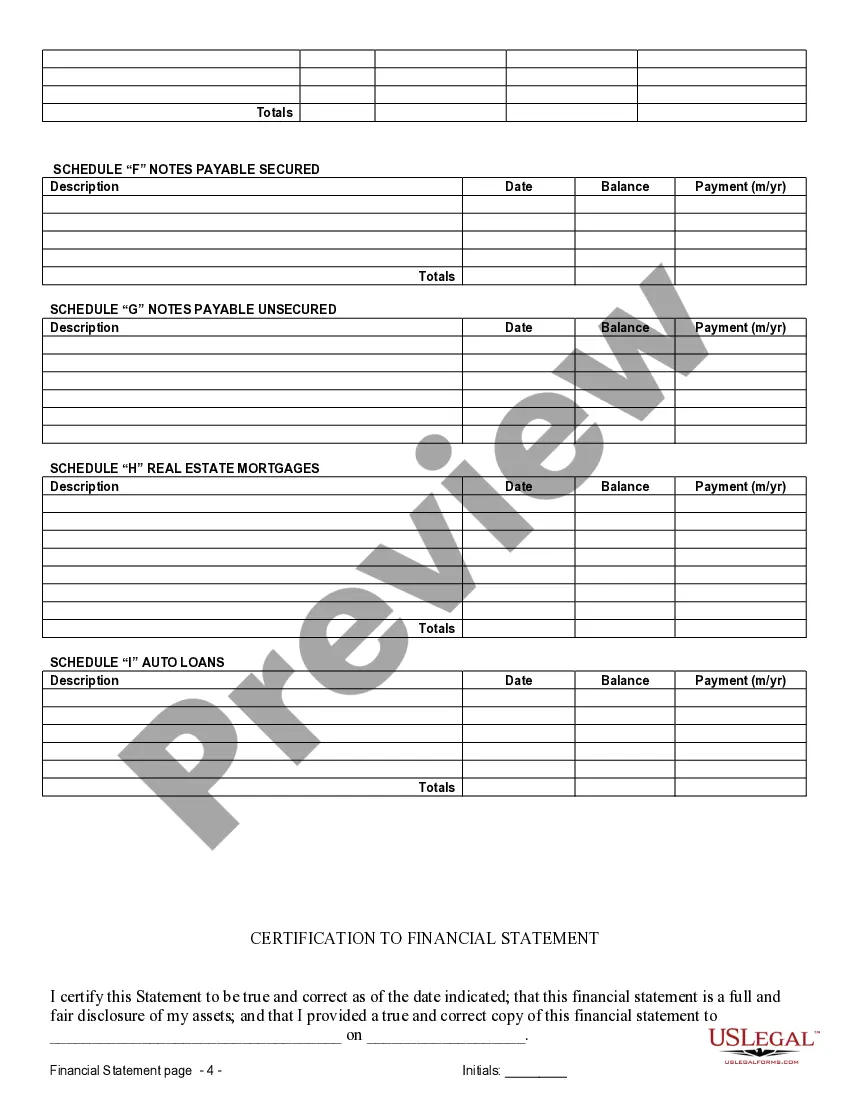

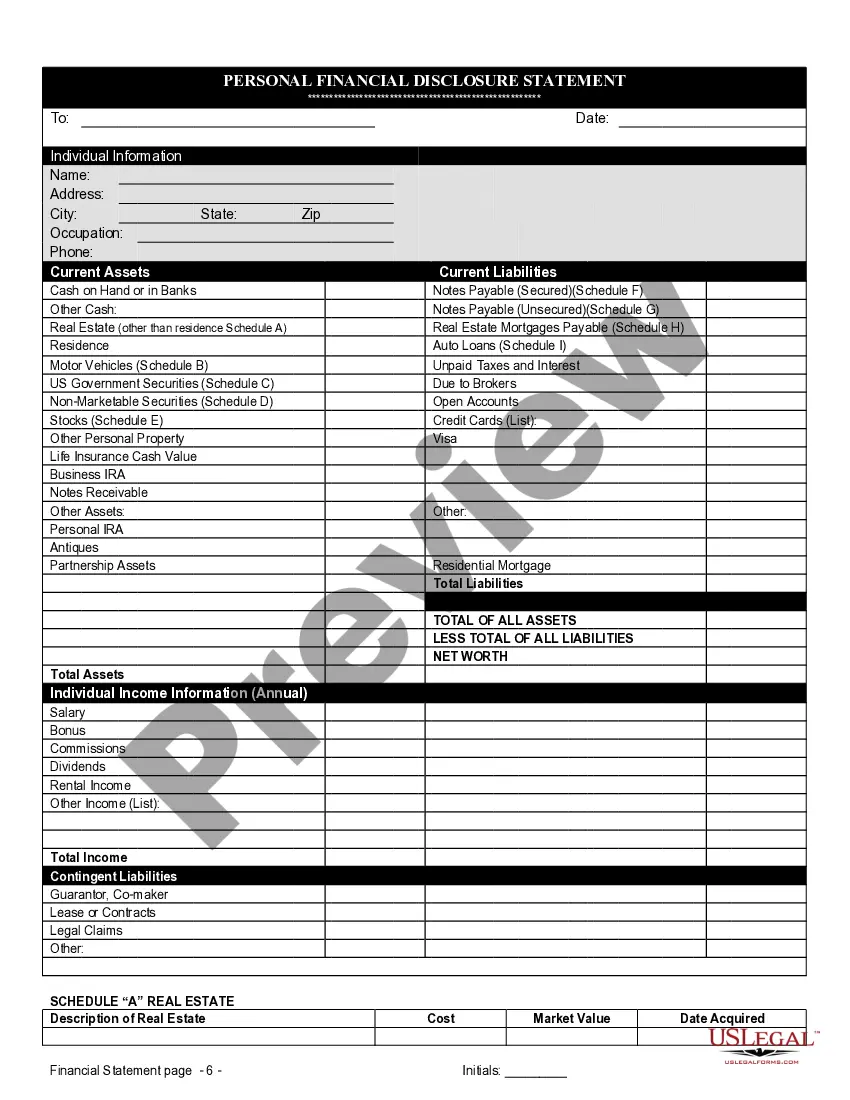

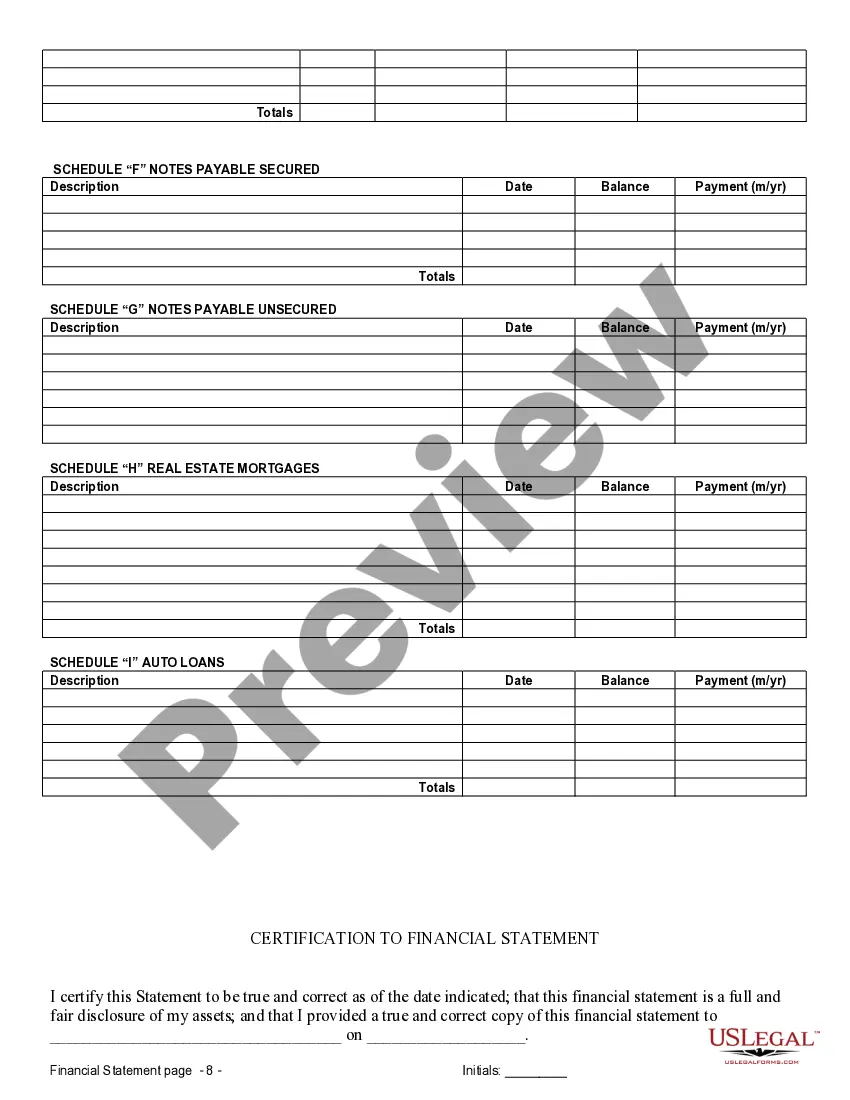

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

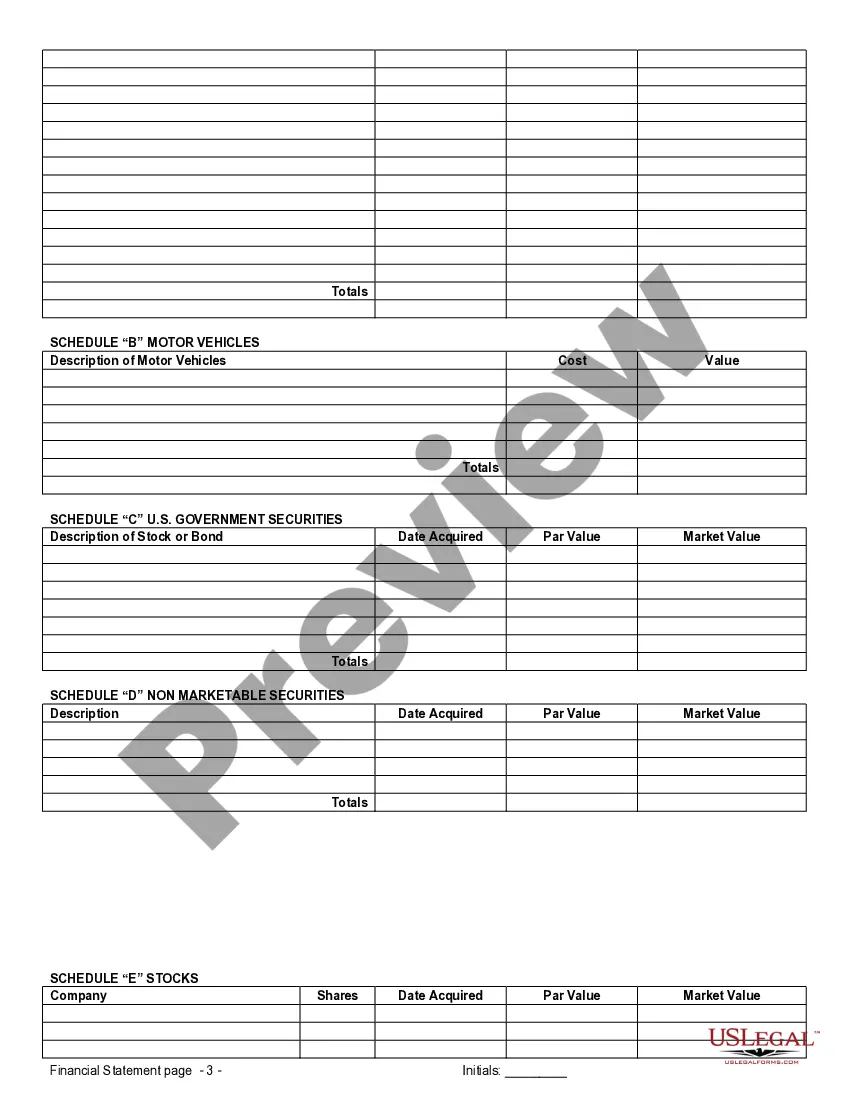

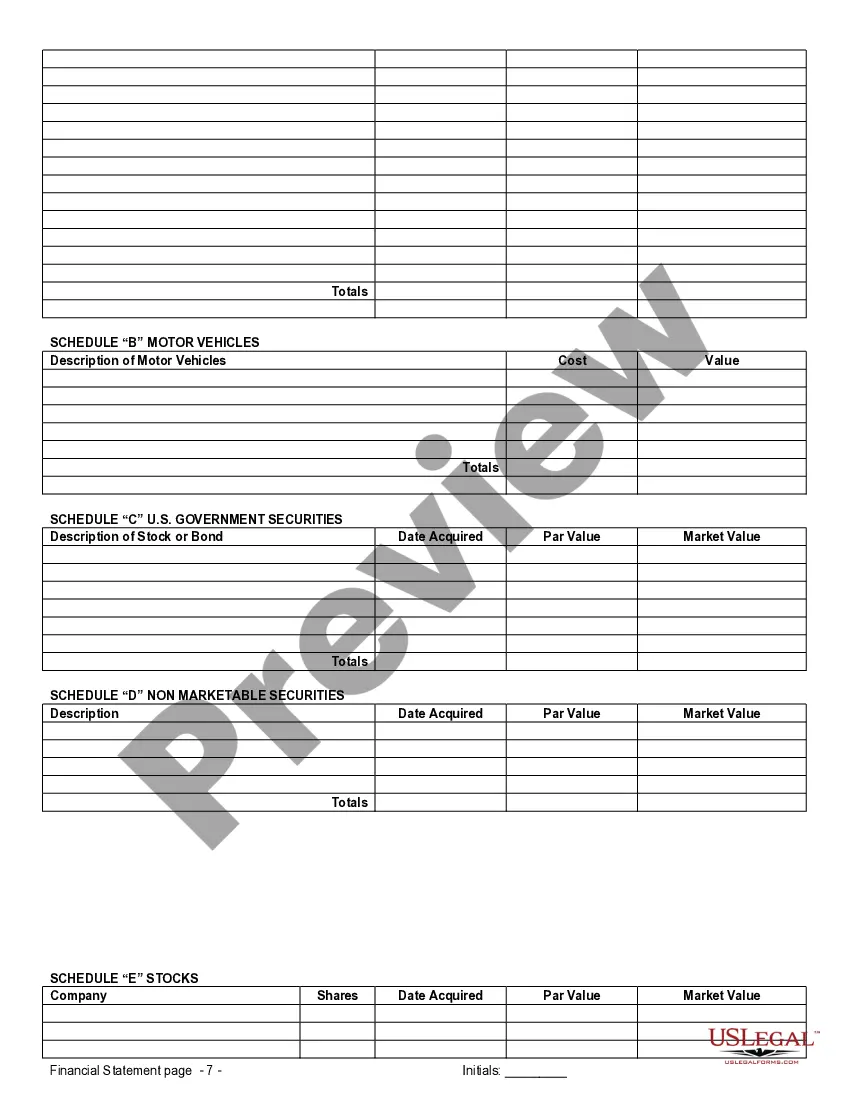

In Aurora, Colorado, financial statements play a crucial role in prenuptial or premarital agreements. These statements provide a comprehensive overview of the financial standing of each party involved, ensuring transparency and clarity in the event of a divorce or separation. Aurora Colorado Financial Statements in connection with prenuptial agreements are designed to safeguard the rights and interests of both individuals, allowing them to make informed decisions about their shared finances. The various types of Aurora Colorado Financial Statements commonly used in prenuptial or premarital agreements include: 1. Personal Asset Statement: This document outlines the individual assets and liabilities of each party, including bank accounts, investments, real estate properties, vehicles, valuable personal possessions, and outstanding debts. 2. Income Statement: The income statement details the sources of income for each individual, including employment wages, business profits, rental income, and any other revenue streams. It additionally highlights the financial obligations, such as alimony or child support, that may impact future financial decisions. 3. Tax Returns: Tax returns serve as essential evidence of income, deductions, and overall financial health. Providing tax returns for the past several years helps establish a comprehensive picture of each party's financial situation. 4. Credit Report: Credit reports offer insights into personal credit history, including outstanding loans, credit card debt, payment patterns, and credit scores. This information helps assess the individual's financial reliability and potential future obligations. 5. Business Financial Statements: If one or both parties own a business, including partnership stakes or sole proprietorship, the prenuptial agreement may necessitate presenting company financial statements. These documents outline business assets, earnings, debts, and their potential impact on future finances. 6. Retirement Account Statements: Preparing financial statements for retirement accounts, such as 401(k), IRAs, or pensions, is crucial to understand the extent of each party's retirement savings and the implications of potential division in case of separation or divorce. When crafting prenuptial or premarital agreements in Aurora, Colorado, it is essential to ensure these financial statements are accurate, up-to-date, and disclosed willingly by both parties. Seeking professional advice from lawyers, financial advisors, or accountants experienced in family law can enhance the integrity and legality of these statements while safeguarding the interests of all parties involved.In Aurora, Colorado, financial statements play a crucial role in prenuptial or premarital agreements. These statements provide a comprehensive overview of the financial standing of each party involved, ensuring transparency and clarity in the event of a divorce or separation. Aurora Colorado Financial Statements in connection with prenuptial agreements are designed to safeguard the rights and interests of both individuals, allowing them to make informed decisions about their shared finances. The various types of Aurora Colorado Financial Statements commonly used in prenuptial or premarital agreements include: 1. Personal Asset Statement: This document outlines the individual assets and liabilities of each party, including bank accounts, investments, real estate properties, vehicles, valuable personal possessions, and outstanding debts. 2. Income Statement: The income statement details the sources of income for each individual, including employment wages, business profits, rental income, and any other revenue streams. It additionally highlights the financial obligations, such as alimony or child support, that may impact future financial decisions. 3. Tax Returns: Tax returns serve as essential evidence of income, deductions, and overall financial health. Providing tax returns for the past several years helps establish a comprehensive picture of each party's financial situation. 4. Credit Report: Credit reports offer insights into personal credit history, including outstanding loans, credit card debt, payment patterns, and credit scores. This information helps assess the individual's financial reliability and potential future obligations. 5. Business Financial Statements: If one or both parties own a business, including partnership stakes or sole proprietorship, the prenuptial agreement may necessitate presenting company financial statements. These documents outline business assets, earnings, debts, and their potential impact on future finances. 6. Retirement Account Statements: Preparing financial statements for retirement accounts, such as 401(k), IRAs, or pensions, is crucial to understand the extent of each party's retirement savings and the implications of potential division in case of separation or divorce. When crafting prenuptial or premarital agreements in Aurora, Colorado, it is essential to ensure these financial statements are accurate, up-to-date, and disclosed willingly by both parties. Seeking professional advice from lawyers, financial advisors, or accountants experienced in family law can enhance the integrity and legality of these statements while safeguarding the interests of all parties involved.