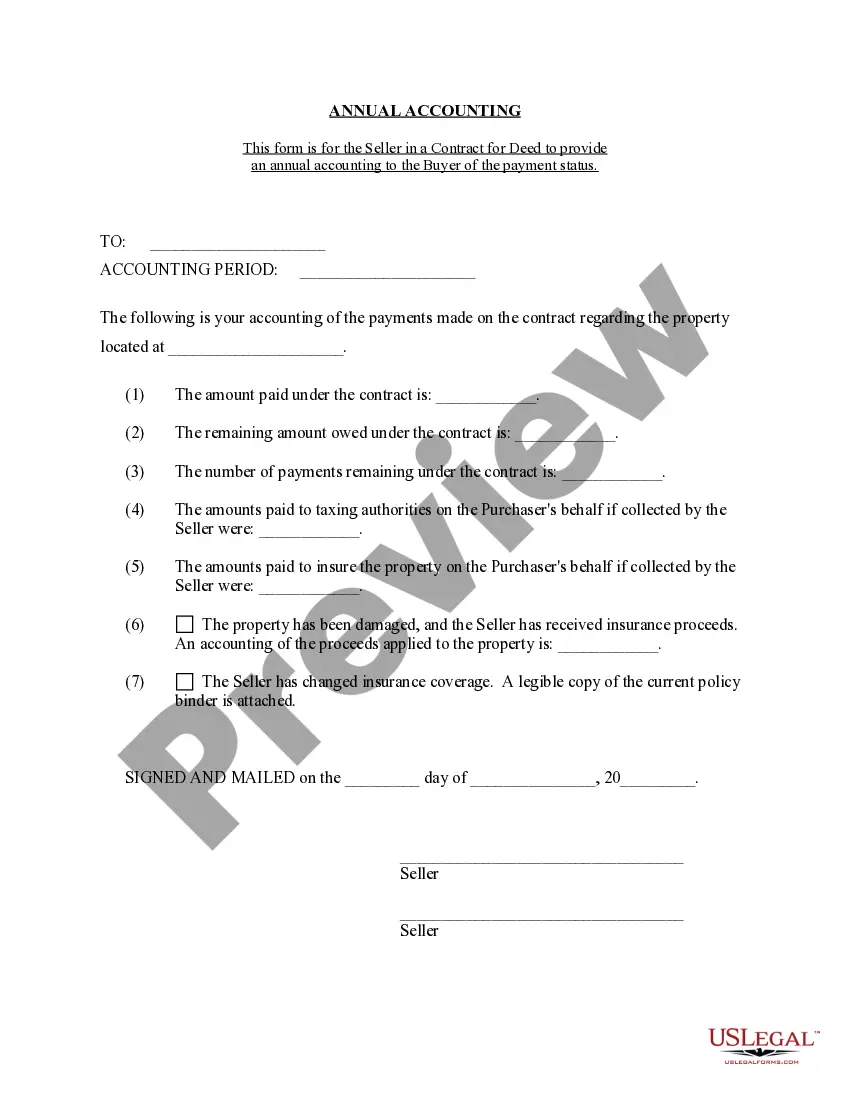

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Thornton Colorado Contract for Deed Seller's Annual Accounting Statement is an essential document used in real estate transactions, specifically in the context of contract for deed agreements. This statement serves as a comprehensive financial report prepared by the seller to provide an overview of the financial aspects of the agreement. The purpose of the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement is to ensure transparency and accountability between the seller and buyer. It outlines the financial status of the property and the various payments made by the buyer throughout the year. The seller's annual accounting statement includes several key components. Firstly, it details the total purchase price of the property and any down payment made by the buyer. It further provides a breakdown of principal payments, interest charges, and other fees or expenses incurred by the buyer. Moreover, the statement specifies the payment schedule, indicating the due dates and amounts paid on a monthly, quarterly, or annual basis. It ensures that the buyer is aware of their financial obligations and keeps track of their payments. Additionally, the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement may also encompass any escrow payments made by the buyer for property taxes, insurance, or other related fees. This section provides a detailed explanation of these escrow items, their amounts, and any adjustments made throughout the year. By including these elements, the statement highlights the financial transactions that have occurred between the buyer and seller, helping both parties to understand the current financial status of the contract for deed agreement. Different types or variations of the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement may exist depending on specific terms and conditions agreed upon between the seller and buyer. Some variations may include additional sections, such as late payment penalties, prepayment options, or additional services offered by the seller. In conclusion, the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement is a vital document that provides a comprehensive overview of the financial aspects of a contract for deed agreement. It ensures transparency and accountability between the seller and buyer by detailing the various financial transactions that have taken place throughout the year.The Thornton Colorado Contract for Deed Seller's Annual Accounting Statement is an essential document used in real estate transactions, specifically in the context of contract for deed agreements. This statement serves as a comprehensive financial report prepared by the seller to provide an overview of the financial aspects of the agreement. The purpose of the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement is to ensure transparency and accountability between the seller and buyer. It outlines the financial status of the property and the various payments made by the buyer throughout the year. The seller's annual accounting statement includes several key components. Firstly, it details the total purchase price of the property and any down payment made by the buyer. It further provides a breakdown of principal payments, interest charges, and other fees or expenses incurred by the buyer. Moreover, the statement specifies the payment schedule, indicating the due dates and amounts paid on a monthly, quarterly, or annual basis. It ensures that the buyer is aware of their financial obligations and keeps track of their payments. Additionally, the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement may also encompass any escrow payments made by the buyer for property taxes, insurance, or other related fees. This section provides a detailed explanation of these escrow items, their amounts, and any adjustments made throughout the year. By including these elements, the statement highlights the financial transactions that have occurred between the buyer and seller, helping both parties to understand the current financial status of the contract for deed agreement. Different types or variations of the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement may exist depending on specific terms and conditions agreed upon between the seller and buyer. Some variations may include additional sections, such as late payment penalties, prepayment options, or additional services offered by the seller. In conclusion, the Thornton Colorado Contract for Deed Seller's Annual Accounting Statement is a vital document that provides a comprehensive overview of the financial aspects of a contract for deed agreement. It ensures transparency and accountability between the seller and buyer by detailing the various financial transactions that have taken place throughout the year.