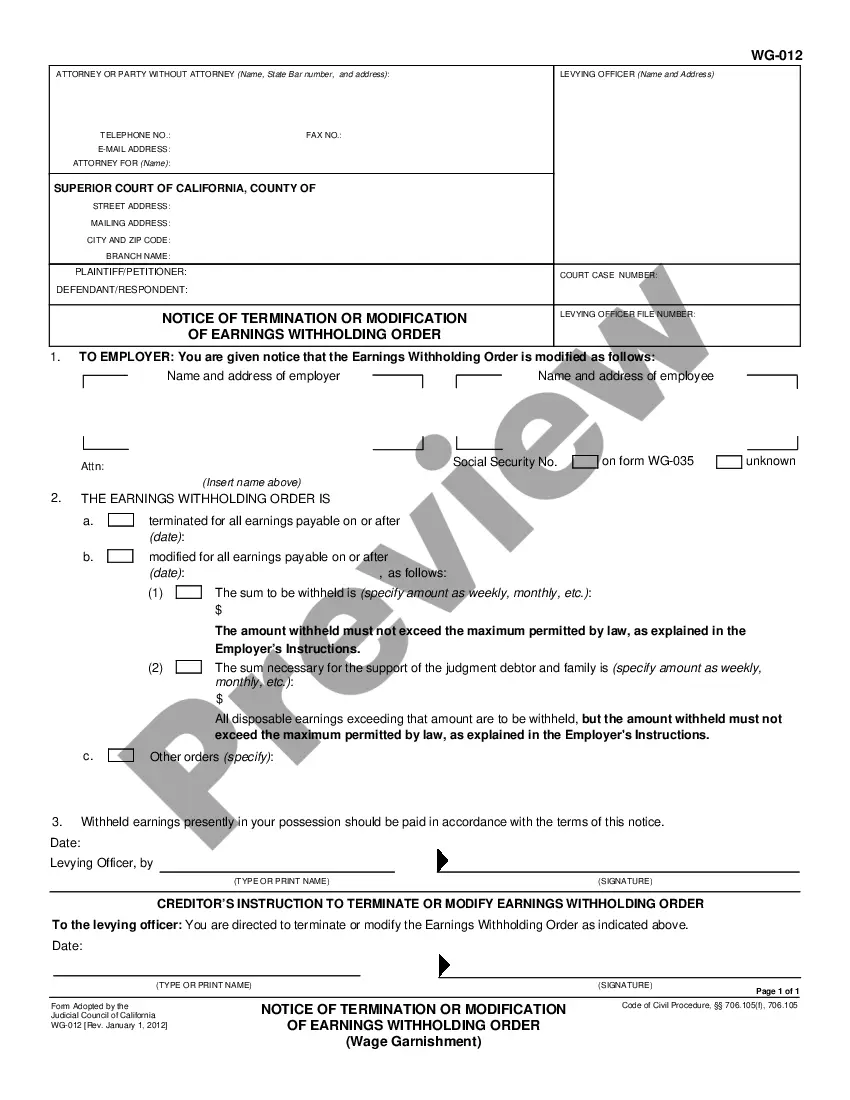

This is a California Judicial Council form that provides legal notification to a party of an upcoming hearing in Wage Garnishment - State Tax Liability proceedings. Failure to provide proper notice can cause delays in the progress of the case.

Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes

Description

How to fill out California Notice Of Hearing - Earnings Withholding Order For Taxes?

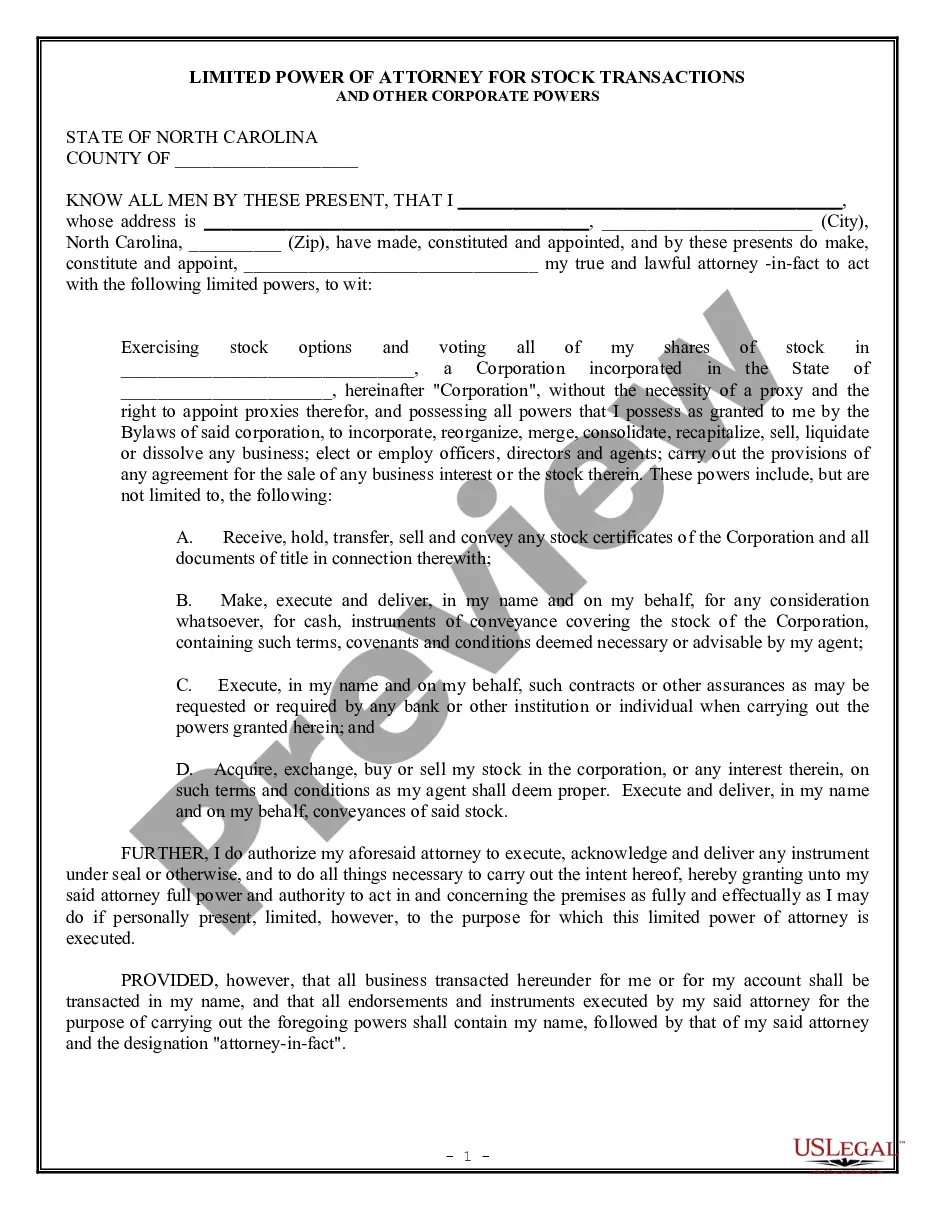

Obtaining verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms catering to both personal and business requirements and various real-world situations.

All documents are systematically categorized by field of application and jurisdiction zones, making it as simple as ABC to search for the Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes.

Once you have registered an account, you can easily Log In and acquire the Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes with just a few clicks. It is important to keep your paperwork organized and in adherence to legal standards. Make use of the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Review the Preview mode and form description.

- Ensure you've selected the appropriate one that satisfies your requirements and fully complies with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you detect any discrepancies, use the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To stop a wage garnishment immediately in California, you can file a claim of exemption or request a hearing. This process allows you to challenge the garnishment and potentially obtain relief. It's essential to act swiftly, as time limits apply. Resources like USLegalForms can provide the necessary documentation and guidance when dealing with a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes.

An income withholding order is a court directive that requires an employer to withhold a specific amount from an employee's paycheck for debt repayment. In the context of Bakersfield, California, this order may relate to child support or tax obligations. It is an important tool for ensuring that financial responsibilities are met. You may see this referenced in a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, which highlights its relevance.

An earnings withholding order for taxes is a legal mechanism that allows the state to collect unpaid taxes from your earnings. Specifically in Bakersfield, California, this order mandates that a portion of your wages be sent directly to the tax agency. This process ensures that the obligations are met efficiently and can help you avoid further penalties. Understanding this order is crucial for anyone who receives a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes.

To calculate disposable earnings for garnishment in California, start with your gross income and subtract mandatory deductions like taxes, Social Security, and retirement contributions. This figure helps you understand your earning capacity after necessary expenses. If you find yourself facing a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, knowing how to calculate this can aid in managing your financial obligations.

Removing a California franchise tax board lien requires specific actions initiated by you, typically involving payment or negotiation. Upon receiving a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, understanding your rights and options can make a difference. Consulting resources available through US Legal Forms can help you navigate the requirements to clear a lien.

Yes, a tax garnishment can be reversed under certain conditions. If you receive a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, it is crucial to assess your financial situation and determine if you have valid grounds for reversibility. Engaging with US Legal Forms can provide forms and guidance necessary for this process.

To stop a franchise tax board garnishment, you need to respond promptly to the Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes. Filing the appropriate paperwork can halt the garnishment process. Working with a tax professional can also provide clarity and options to resolve the issue effectively.

In California, the termination of an order to withhold tax signifies that the state has ceased its authority to withdraw funds from your paychecks. Common reasons include full payment of debts or successful negotiation with the tax authority. If you are reviewing a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, understanding these regulations can help you navigate your financial responsibilities.

A notice of earnings withholding order termination is an official document that indicates the cessation of wage deductions as mandated by a withholding order. This notice confirms that all obligations have been met or that another resolution has been reached. For those managing a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, recognizing this notice can signal relief and clarity.

A withholding order is a legal directive that requires an employer to deduct a specified amount from an employee's earnings to satisfy debts, such as taxes or child support. This process helps ensure that obligations are met in a timely manner. If you have received a Bakersfield California Notice of Hearing - Earnings Withholding Order for Taxes, knowing the terms can empower you to take appropriate action.