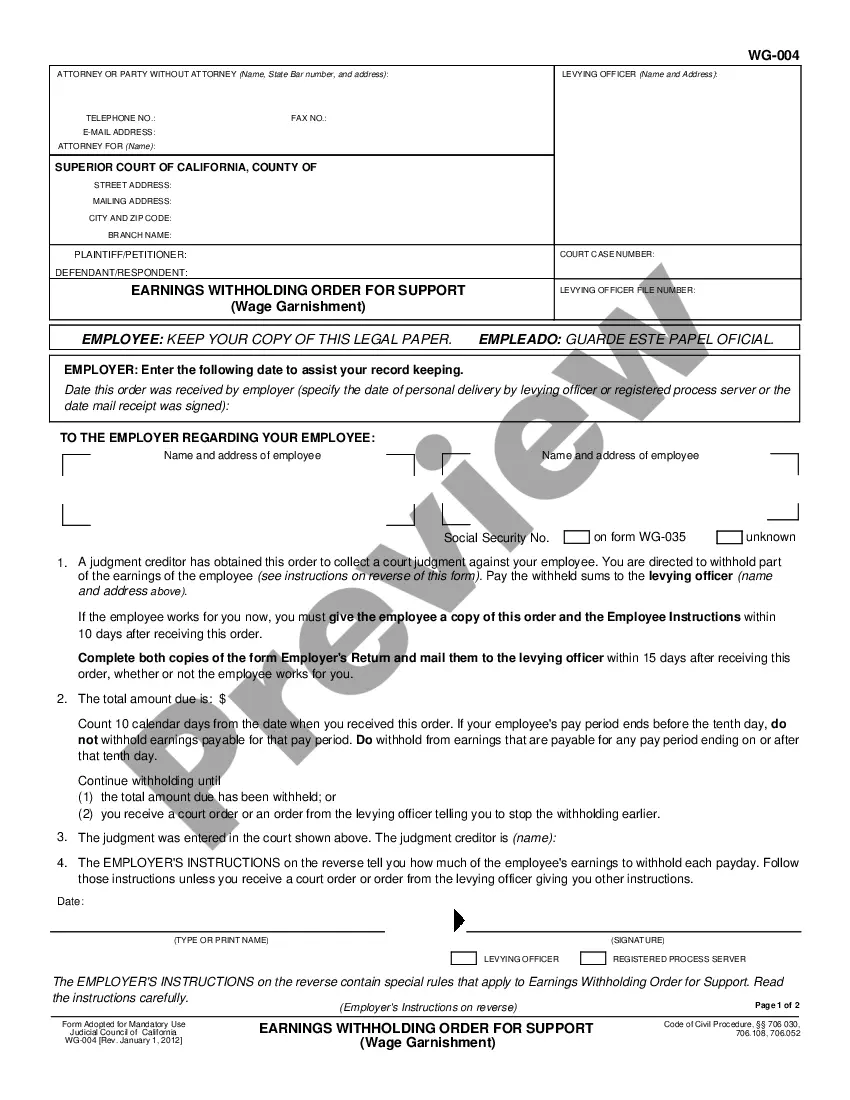

Earnings Withholding Order: An Earnings Withholding Order is issued by the Court, stating that the wages of the Judgment Debtor are to be garnished until he/she satifies the judgment against him/her.

San Jose California Earnings Withholding Order - Wage Garnishment

Description

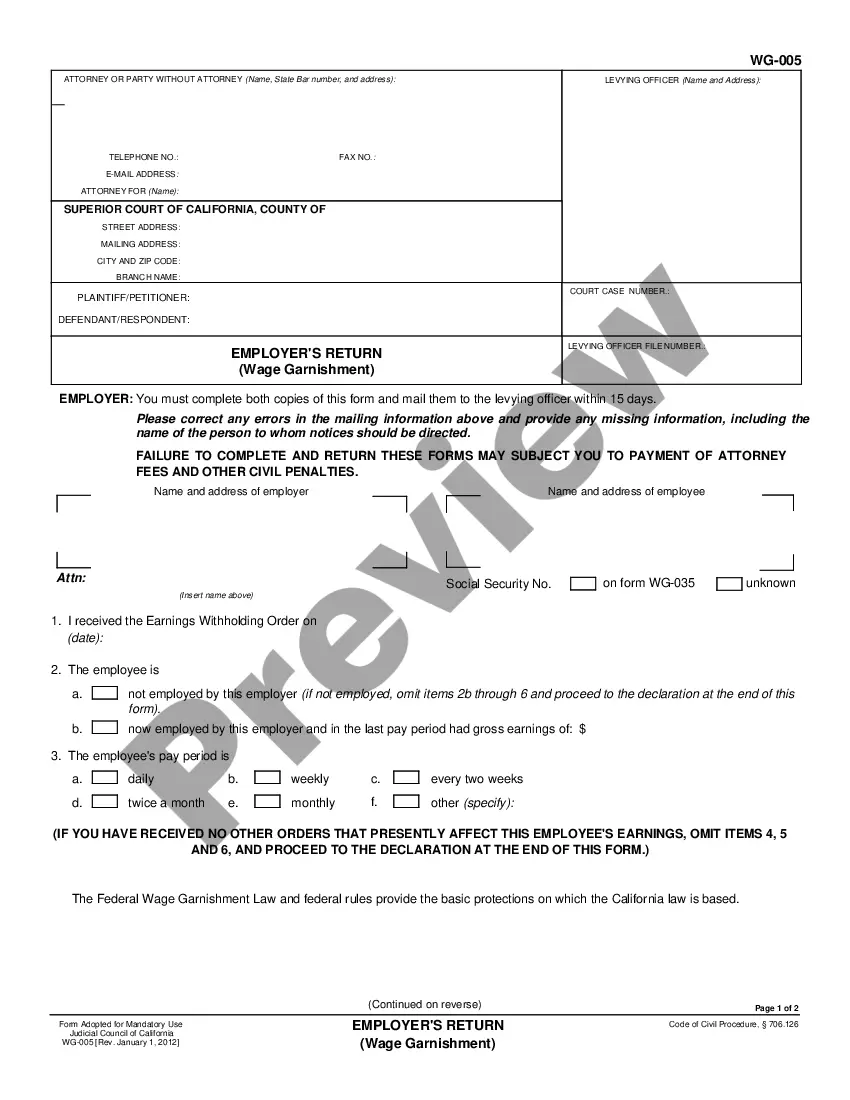

How to fill out California Earnings Withholding Order - Wage Garnishment?

Obtaining verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online resource containing over 85,000 legal forms to cater to both personal and professional requirements as well as various real-life situations.

All documents are neatly organized by usage area and jurisdiction, making the search for the San Jose California Earnings Withholding Order - Wage Garnishment straightforward and quick.

Maintaining documentation neatly and compliant with legal requirements is crucial. Take advantage of the US Legal Forms library to always have essential document templates readily available for any purposes!

- Review the Preview mode and form description.

- Ensure you have chosen the correct document that satisfies your requirements and aligns with your local jurisdiction standards.

- Search for an alternative template if needed.

- If you encounter any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Complete the purchase of the document.

Form popularity

FAQ

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

We have 20 years to collect on a liability (R&TC 19255 ).

If you work in California, creditors, debt collectors, and debt buyers can garnish your wages for past-due consumer debt, such as credit card debt, back rent, car loans, medical bills, or payday loans. Generally, creditors must get a court order judgment to collect consumer debt.

In California the law allows creditors to garnish 25% of your net income. This is a substantial amount if you are living paycheck to paycheck and may affect your ability to provide for your necessities and your family's needs. What are Your Options If a Creditor Has Served Your Employer with a Wage Garnishment Order?

Earnings withholding orders for taxes (EWOT) Personal Income Tax wage garnishments can collect up to 25% of your pay until your balance is paid in full. See our payment amount table on the How much to garnish from an employee's pay page for more information.

Limits on Wage Garnishment in California Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

Example: The federal minimum hourly wage is currently $7.25 an hour. If you make $500 per week after all taxes and allowable deductions, 25% of your disposable earnings is $125 ($500 × . 25 = $125).

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

Personal Income Tax wage garnishments can collect up to 25% of your pay until your balance is paid in full.