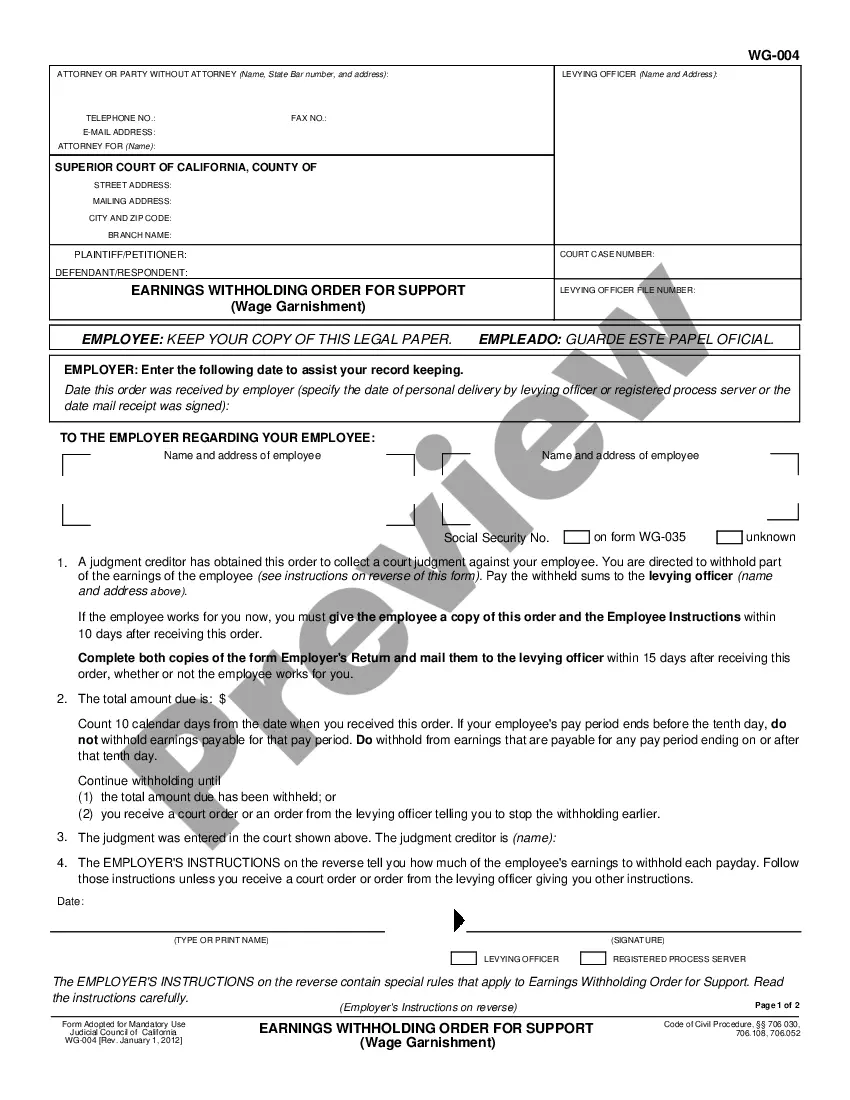

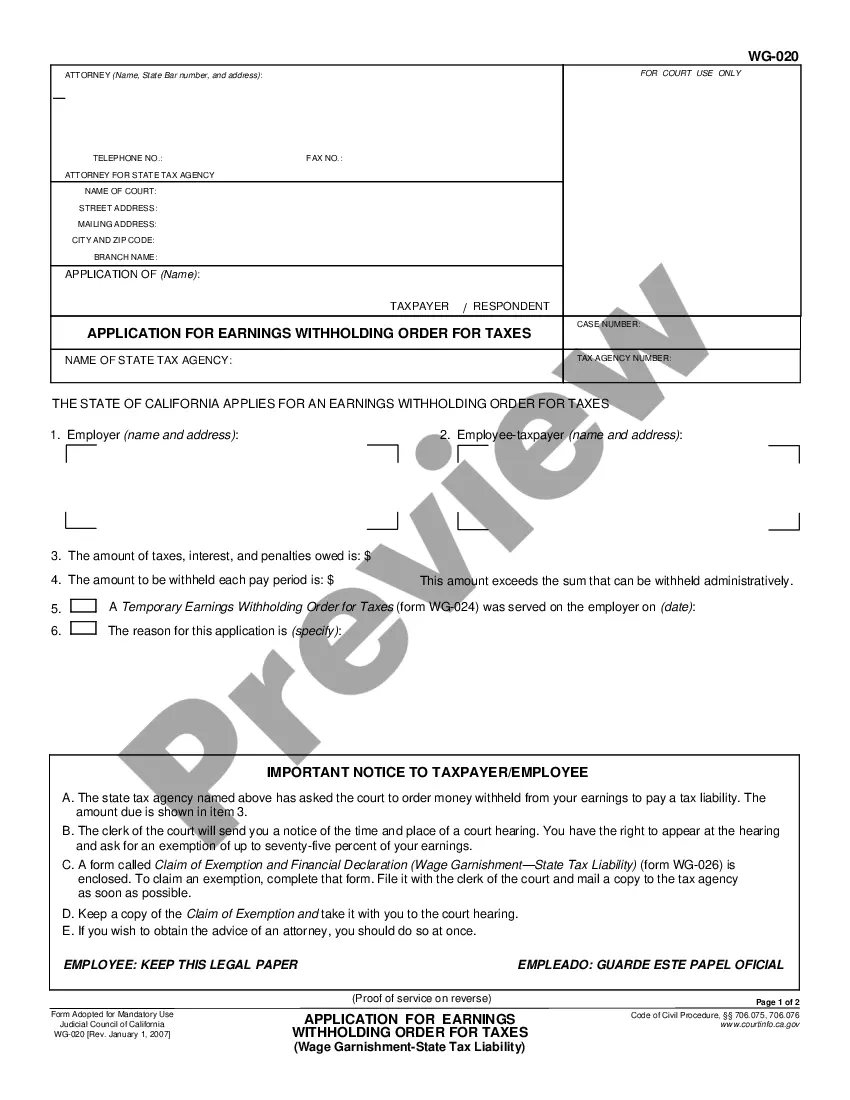

Application for Earnings Withholding Order: An Application for Earnings Withholding asks the Sheriff to garnish the wages of the Judgment Debtor. It states that he/she has not satisfied the judgment against him/her, and the Judgment Creditor wishes to recoup some of his/her losses.

Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment

Description

How to fill out California Application For Earnings Withholding Order - Wage Garnishment?

If you are seeking a legitimate form template, it’s tremendously challenging to find a superior option than the US Legal Forms website – one of the largest online repositories.

Here you can discover thousands of document examples for corporate and personal uses by categories and regions, or keywords.

With the sophisticated search feature, locating the most recent Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the file format and download it to your device.

- Additionally, the accuracy of each document is verified by a team of skilled attorneys who regularly review the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and have a registered account, all you need to do to obtain the Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just follow the steps outlined below.

- Ensure you have located the sample you wish to use. Review its description and use the Preview option (if applicable) to examine its content. If it does not satisfy your requirements, use the Search box at the top of the screen to find the suitable document.

- Validate your choice. Click on the Buy now button. Then, select the preferred pricing plan and provide details to create an account.

Form popularity

FAQ

The speed at which a wage garnishment can be stopped largely depends on the circumstances surrounding your case. Once you submit a Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment or contest the garnishment, the court may process your request promptly. Generally, you could see results within a few weeks if all necessary documentation is properly filed. Taking immediate action is crucial for the best outcome.

In California, certain income types are exempt from wage garnishment. For instance, Social Security benefits, unemployment compensation, and disability payments often cannot be garnished. You might also find that a portion of your wages may be exempt based on your personal circumstances. Knowing your rights can help you effectively respond to a Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment.

To quickly stop a wage garnishment, you can file a Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment with the appropriate court. You may also consider negotiating directly with your creditor to reach a settlement or repayment plan. Additionally, if your financial situation qualifies, you might explore the possibility of claiming an exemption. Acting swiftly is key to preventing further deductions from your earnings.

An earnings withholding order wage garnishment is a legal process where an employer is mandated to withhold a portion of an employee's wages for debt repayment. This type of garnishment ensures that creditors receive payments directly from the employee's earnings. Engaging with the Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment gives you access to critical information for managing wage garnishment effectively.

In California, the maximum amount that can be garnished from your paycheck is typically 25% of your disposable earnings, which is the amount after mandatory deductions. However, courts may also impose limits based on your individual financial situation. It's vital to understand these limits when navigating the Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment, ensuring that you stay informed about your rights.

In California, you can apply for a garnishment hardship by submitting a claim of exemption form to the court along with supporting documents. This form details your financial situation, proving to the court that garnishment would cause undue hardship. Utilizing resources through the Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment can guide you through this important process.

To stop a wage garnishment immediately in California, you can file a claim of exemption with the court that issued the garnishment order. This process allows you to request that the court stop the garnishment based on certain financial hardships. Exploring options through the Santa Clarita California Application for Earnings Withholding Order - Wage Garnishment can help you understand your rights and responsibilities.

To file wage garnishment in California, you typically need to obtain a court judgment in your favor, then complete the necessary forms to request an Earnings Withholding Order. This process requires attention to detail and an understanding of legal protocols. Utilizing services like USLegalForms can simplify filing and ensure that you meet all requirements when submitting your application for wage garnishment in Santa Clarita, California.

The California income tax withholding form is the DE 4 form, which helps employers calculate the correct amount of taxes to withhold from employees' paychecks. This form is essential for every employee to fill out upon hiring or when changes occur in their tax situation. If you're navigating wage garnishment issues in Santa Clarita, California, understanding this form can aid in ensuring proper compliance with tax laws.

In California, wage garnishment is subject to specific regulations designed to protect employees. Generally, creditors can garnish up to 25% of a person's disposable earnings, or the amount by which earnings exceed 40 times the state minimum wage, whichever is less. For those in Santa Clarita, California, understanding these rules is crucial when filing for an Earnings Withholding Order - Wage Garnishment.