Garden Grove California Allowance of Lien for Workers' Compensation: Understanding the Benefits and Types In Garden Grove, California, the Allowance of Lien for Workers' Compensation is a crucial provision that aims to protect injured workers and ensure they receive proper medical treatment and compensation. This legal right grants healthcare providers a lien against any potential workers' compensation settlement to recover the costs of medical services provided. Healthcare providers, including doctors, hospitals, and clinics, play a vital role in aiding injured employees in their recovery process. Under the Garden Grove California Allowance of Lien for Workers' Compensation, these providers have the right to assert a lien against the workers' compensation benefits payable to injured workers, ensuring they are adequately compensated for their services. There are different types of Garden Grove California Allowance of Lien for Workers' Compensation, depending on the healthcare providers involved and the nature of the medical treatment and services provided. Here are some common types: 1. Medical Liens: These are the most common types of liens and are asserted by doctors, hospitals, and other healthcare providers who offer medical treatment, surgeries, rehabilitation services, and related services to injured workers. 2. Hospital Liens: Hospitals that treat workers injured on the job can assert a hospital lien, which provides them with a legal claim against the workers' compensation settlement. This lien ensures that hospitals can recover the costs associated with emergency room visits, surgeries, overnight stays, medications, and other medical services provided. 3. Diagnostic Services Liens: Healthcare providers offering specialized diagnostic services such as X-rays, MRIs, lab tests, and other types of diagnostic imaging may assert a lien to recover the costs incurred in performing these essential services. 4. Rehabilitation and Physical Therapy Liens: Providers of rehabilitation services, physical therapists, and occupational therapists can assert liens to cover the costs of therapies aimed at helping injured workers regain their strength, mobility, and overall functionality. It's important to note that these liens typically apply when a workers' compensation claim is approved, and a settlement or award is received by the injured worker. They are intended to ensure that healthcare providers are adequately compensated for the services they have rendered. Understanding the Garden Grove California Allowance of Lien for Workers' Compensation is crucial for both injured workers and healthcare providers. This provision ensures that injured employees receive the necessary medical care and that healthcare professionals are compensated fairly for their valuable services. By allowing these liens, Garden Grove prioritizes the health and well-being of its workforce, promoting equality and fairness in the field of workers' compensation.

Garden Grove California Allowance of Lien for Workers' Compensation

Description

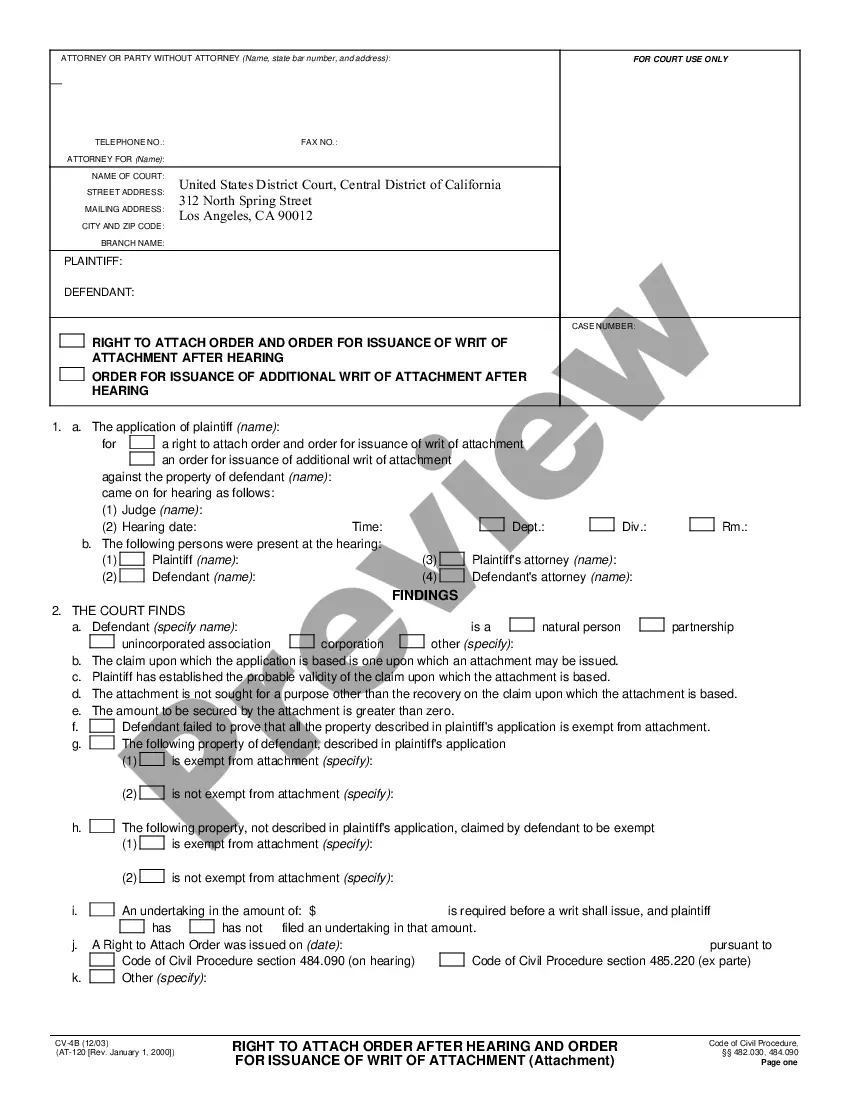

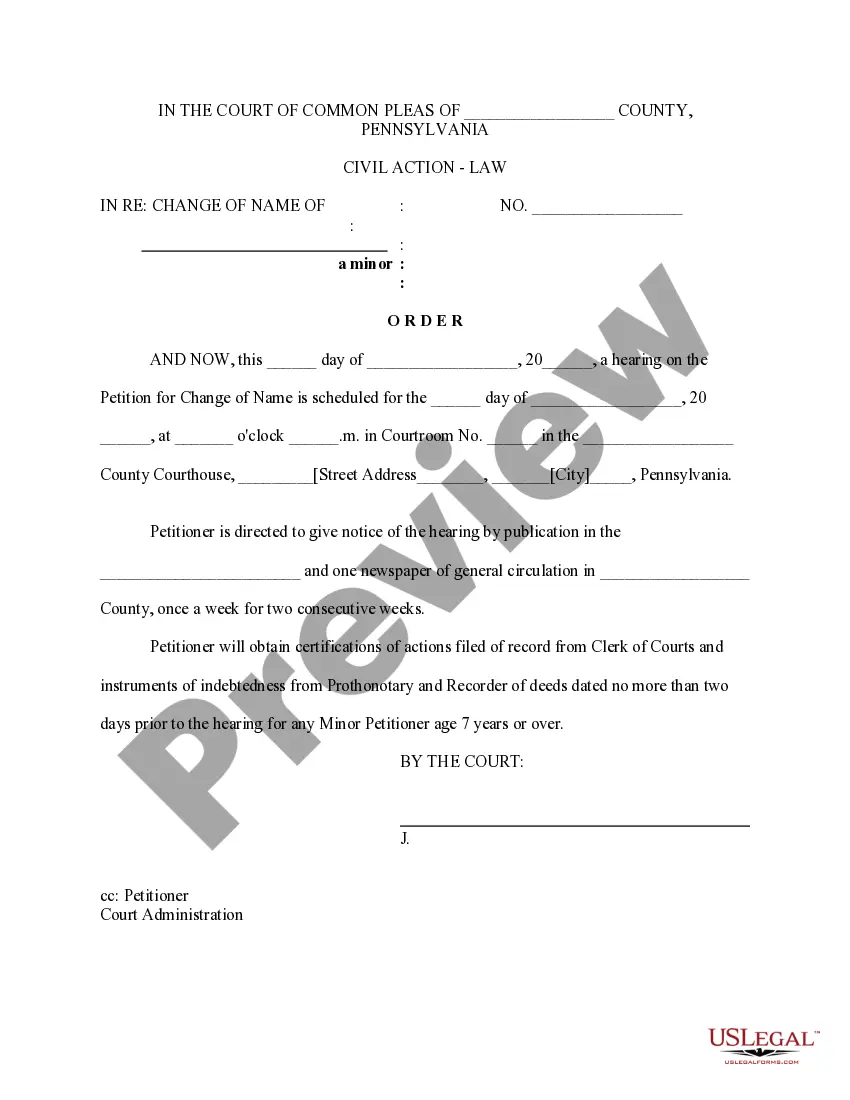

How to fill out Garden Grove California Allowance Of Lien For Workers' Compensation?

We consistently aim to minimize or evade legal complications when addressing subtle law-related or financial issues.

To achieve this, we engage legal services that are often quite expensive.

Nevertheless, not all legal situations are equally intricate.

The majority of them can be handled by ourselves.

Utilize US Legal Forms whenever you require to locate and download the Garden Grove California Allowance of Lien for Workers' Compensation or any other form effortlessly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our library enables you to take control of your matters without needing to rely on legal advisors.

- We offer access to legal form templates that are not always freely accessible.

- Our templates are specific to states and regions, significantly easing the search process.

Form popularity

FAQ

In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage. This is set by state law and also has a maximum allowable amount.

Visiting a local DMV service provider is a fast way to remove a lien from your title. These businesses are authorized by the California DMV to provide a full-range of DMV registration services quickly in-house. DMV service providers charge a nominal fee for processing, but often have little or no wait time.

2-Year Benefit Limit for Most Cases In the typical workers' compensation claim filed in California, benefits can be provided for 104 weeks or 2 years' worth. The 104 weeks of benefits can be parceled out across 5 years, though, if you do not need to use all 104 weeks consecutively.

A. No. If the same medical treatment expense claim by the same provider is filed in two or more cases by the same injured employee, only one lien filing fee of $150.00 is required to be paid. However, you will need to file your lien in both cases.

The Division of Workers' Compensation (DWC) announces that the 2022 minimum and maximum temporary total disability (TTD) rates will increase on January 1, 2022. The minimum TTD rate will increase from $203.44 to $230.95 and the maximum TTD rate will increase from $1,356.31 to $1,539.71 per week.

For a vehicle valued over $4000, the lienholder must submit an Application for Lien Sale Authorization and Lienholder's Certification (REG 656) form with the appropriate filing fee to the Lien Sale Unit at DMV headquarters within 30 days of the date the lien arose.

Filing your own lien in California also goes through county offices. Filing your mechanics lien with the project's county recorders' office can cost between $95 and $125, depending on the project's location.

A Stipulation and Award pays the injured worker for permanent disability. This must be paid at a specific dollar amount every week. A check is sent to the injured worker every other week. There is no lump sum payment.

To attach a lien to real estate, the creditor can take or mail the Abstract of Judgment to the county recorder's office in any California county where the debtor owns real estate now, or may own it in the future.

Filing a lien Anyone filing a lien for reasonable medical expenses incurred by the injured employee and filed on or after Jan.The lien must be filed electronically by one of two methods: E-Form or Jet File.Failure to pay the lien filing fee will result in the lien being invalid and will not be considered filed.