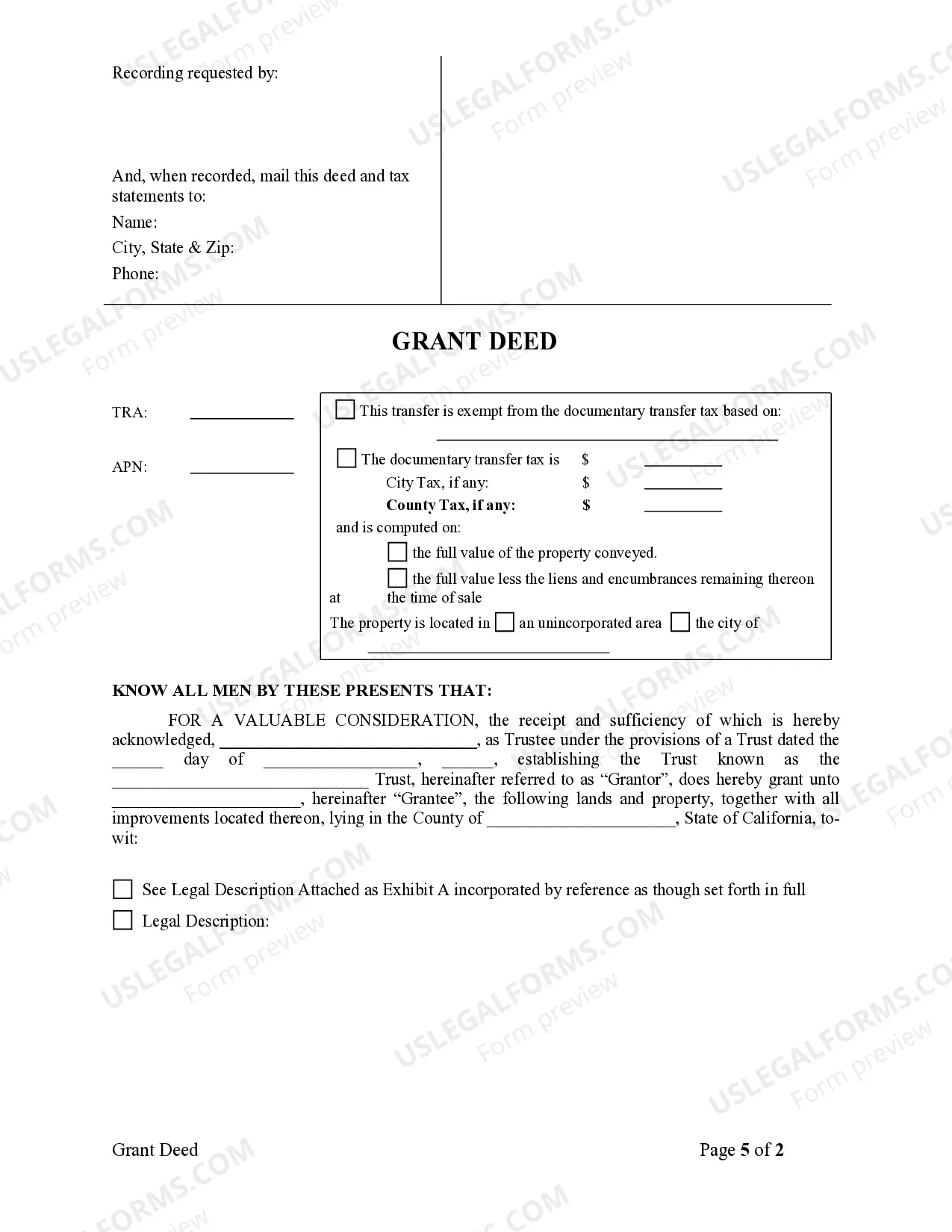

This form is a Grant Deed where the grantor is a trust and the grantee is an individual. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

Oxnard California Grant Deed - Trust to Individual

Description

How to fill out California Grant Deed - Trust To Individual?

If you have previously employed our service, sign in to your account and retrieve the Oxnard California Grant Deed - Trust to Individual on your device by selecting the Download button. Ensure your subscription is active. If it's not, renew it according to your payment arrangement.

If this is your initial interaction with our service, follow these easy steps to acquire your document.

You have continual access to every document you have acquired: you can find it in your profile under the My documents section whenever you wish to retrieve it again. Utilize the US Legal Forms service for fast access to and saving of any template for your personal or professional requirements!

- Confirm you've found the correct document. Review the description and utilize the Preview feature, if available, to see if it satisfies your requirements. If it doesn’t suit your needs, use the Search tab above to discover the suitable one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Enter your credit card information or use the PayPal method to finalize the purchase.

- Receive your Oxnard California Grant Deed - Trust to Individual. Select the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

In California, the property in a trust is owned by the trust itself, which is represented by the trustee. The trustee manages the property according to the trust's terms for the benefit of the beneficiaries. This arrangement allows for efficient management and transfer of assets. When setting up your trust, ensure that the Oxnard California Grant Deed - Trust to Individual is utilized to clarify ownership and responsibilities.

Transferring assets out of an irrevocable trust is generally not allowed, as this type of trust is designed to be permanent. However, under certain circumstances, you may be able to change the trust terms if all parties agree and legal conditions are met. If you're considering adjustments, consult a legal professional to explore your options. A clear understanding of the Oxnard California Grant Deed - Trust to Individual can guide you in this process.

To transfer property out of a living trust in California, you need to execute a Grant Deed that records the change in ownership. This process involves completing the deed form with accurate information and signing it before a notary. After that, file the deed with the county recorder's office to make the transfer official. Using the Oxnard California Grant Deed - Trust to Individual will simplify this process significantly.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define the purpose and terms of the trust. Without specific instructions, beneficiaries may misunderstand their responsibilities or rights. It's vital to ensure that all legal documents, including the Oxnard California Grant Deed - Trust to Individual, are set up correctly to prevent conflicts in the future. Consulting with a legal expert can help clarify these details.

To transfer property from a trust to an individual in California, you must execute a grant deed that indicates the trust is transferring title to the named individual. This deed should be recorded in the county where the property is located to ensure the change is official. It’s beneficial to refer to the trust’s terms to know any restrictions or procedures. For a seamless experience, USLegalForms offers forms specifically tailored for the Oxnard California Grant Deed - Trust to Individual.

Transferring property into a trust in California may have tax implications, including potential reassessment of property taxes. However, many transfers to revocable living trusts are exempt from reassessment, which helps maintain the current property tax rate. Additionally, individuals can retain benefits such as capital gains tax advantages. For detailed information on how the Oxnard California Grant Deed - Trust to Individual affects your situation, consider resources from USLegalForms.

In California, a deed of trust requires a clear description of the property, the names of the trustors, and the trustee. The document must be signed by the trustor and notarized before recording it with the county. It’s important to ensure that the deed adheres to California laws to avoid complications later. For assistance, USLegalForms provides resources specific to the Oxnard California Grant Deed - Trust to Individual to make this straightforward.

To transfer a deed to a trust in California, you need to execute a new grant deed that names the trust as the property owner. You must also complete a preliminary change of ownership report to file with the county recorder. It’s essential to ensure that the trust agreement is properly drafted and includes necessary details regarding the property. To simplify this process, consider using USLegalForms, which offers templates and guidance tailored for the Oxnard California Grant Deed - Trust to Individual.

You can change the beneficiaries of a trust at any time, provided you have the legal authority to do so. This process often requires creating a written amendment that reflects the intended changes. If your trust involves real estate and an Oxnard California Grant Deed - Trust to Individual, it is essential to update this documentation to maintain clarity and alignment with your estate planning objectives.

A transfer of trust refers to the process of changing the administrator of the trust or moving assets to a different trust structure. This can be a strategic move to ensure better management of assets or to align with new estate planning goals. Utilizing services from platforms like USLegalForms can ensure that your transfer adheres to necessary legal requirements, especially for an Oxnard California Grant Deed - Trust to Individual.