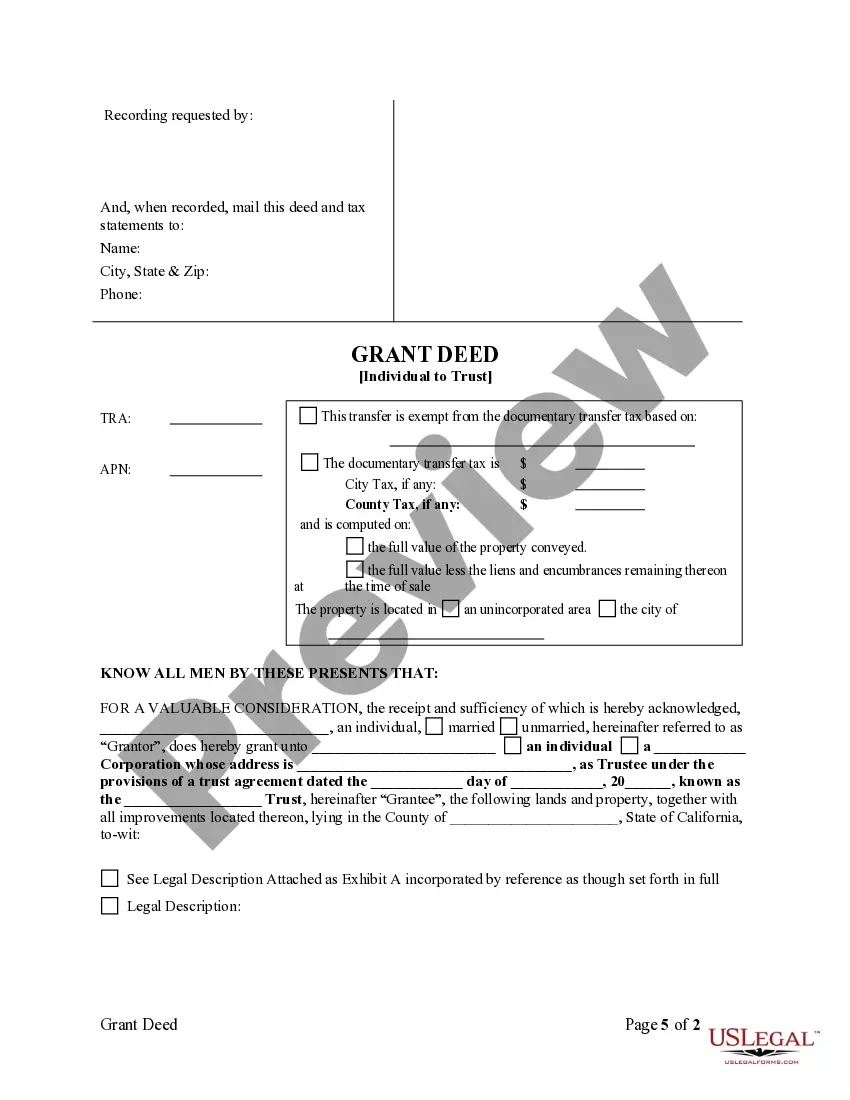

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Oxnard California Grant Deed from Individual to Trust

Description

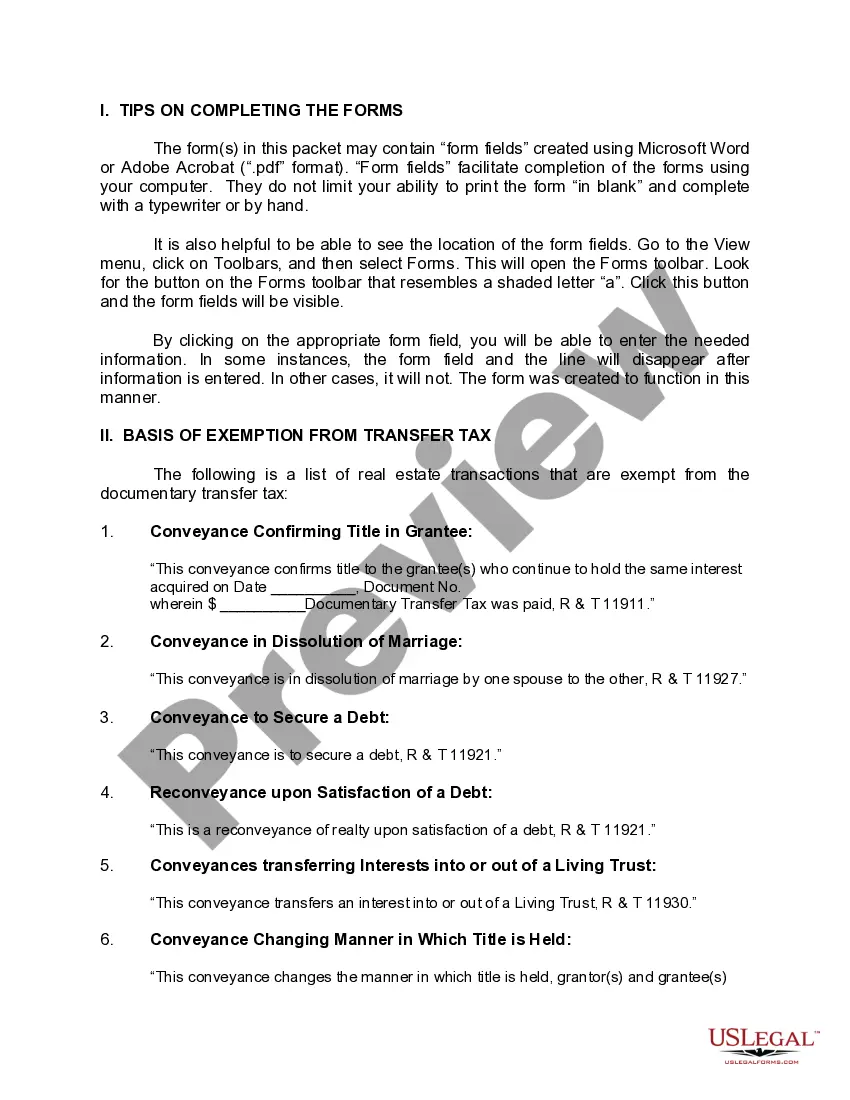

How to fill out California Grant Deed From Individual To Trust?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly platform with numerous templates simplifies the process of locating and acquiring nearly any document sample you desire.

You can store, complete, and sign the Oxnard California Grant Deed from Individual to Trust in just a few minutes instead of spending hours online searching for the correct template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you do not yet have an account, follow the instructions below.

Locate the template you need. Confirm that it is the correct form: review its title and description, and use the Preview feature if available. If not, use the Search field to find the suitable one.

- Our knowledgeable attorneys frequently review all the documents to ensure that the templates are applicable to a specific state and conform to new laws and regulations.

- How can you access the Oxnard California Grant Deed from Individual to Trust.

- If you already possess a profile, simply Log In to your account.

- The Download option will be activated on all the documents you view.

- Additionally, you can retrieve all previously saved documents from the My documents menu.

Form popularity

FAQ

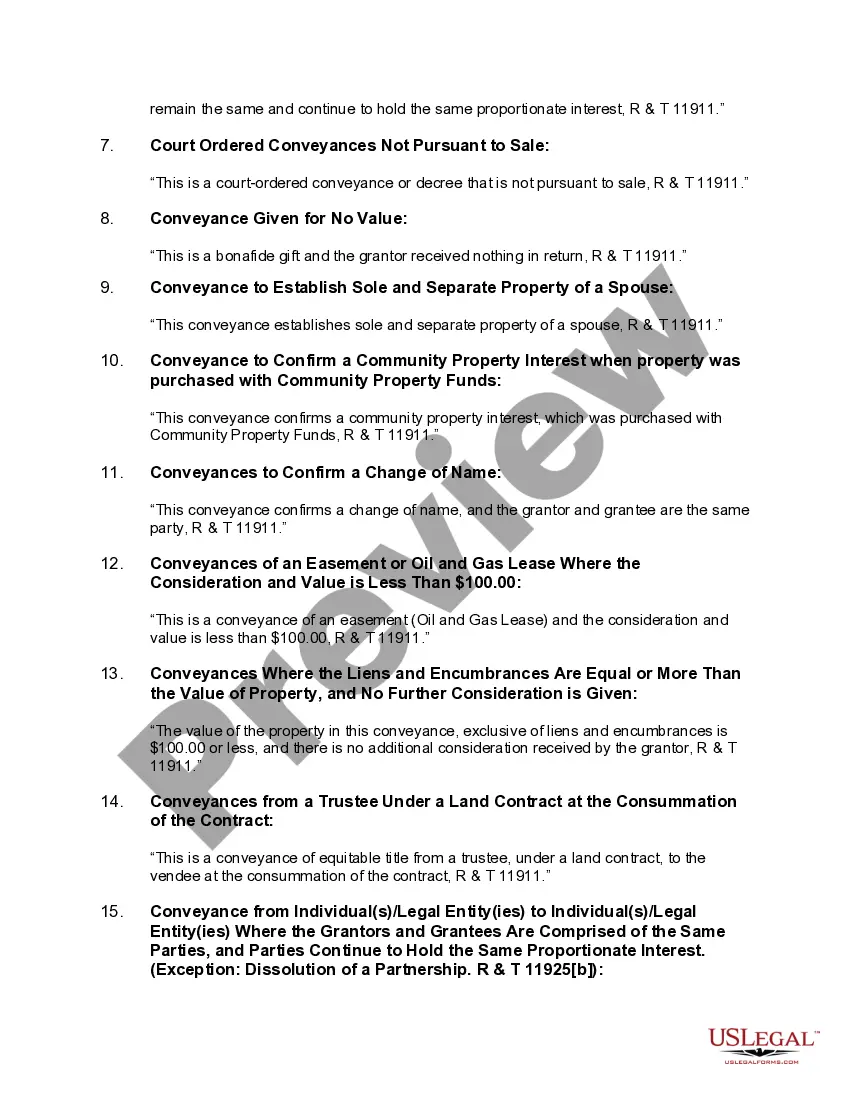

When transferring ownership in Oxnard, California, you can use either a grant deed or a quitclaim deed, depending on your specific situation. A grant deed provides a guarantee that the grantor has the right to transfer the property and that there are no undisclosed liens. In contrast, a quitclaim deed offers no such assurances and simply conveys whatever interest the grantor has. Understanding the differences can help you make an informed decision when utilizing an Oxnard California Grant Deed from Individual to Trust.

To transfer a deed to a trust in California, you must complete a grant deed form that clearly indicates the transfer of property ownership from an individual to the trust. Ensure that the document is properly signed and notarized to validate the transfer. Once completed, the deed must be recorded at the local county recorder's office to finalize the transfer. This process is essential when managing your assets through an Oxnard California Grant Deed from Individual to Trust.

To transfer your home into a trust using an Oxnard California Grant Deed from Individual to Trust, you will need to complete a grant deed form. This form typically requires your personal information, the description of the property, and the name of the trust. After filling out the form, sign it before a notary public and then record it with the County Recorder's Office in Oxnard, California. To simplify this process, consider using UsLegalForms, as they offer templates and guidance tailored to your needs.

A grant deed is a transaction between two people or entities without securing the property as collateral. A deed of trust is used by mortgage companies when a homeowner takes out a loan against the property.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.

A legal document (which may be a deed or other instrument) that creates a trust. The trust document appoints the trustees and states the terms of the trust, including who the beneficiaries are and the trust property that will be subject to the trust.

To do this in California, you will need a copy of the current deed ? for San Francisco property, visit the assessor-recorder's office in city hall ? as well as a preliminary change of ownership report form and a new grant deed form. You can find the forms online at a court or county law library website.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)