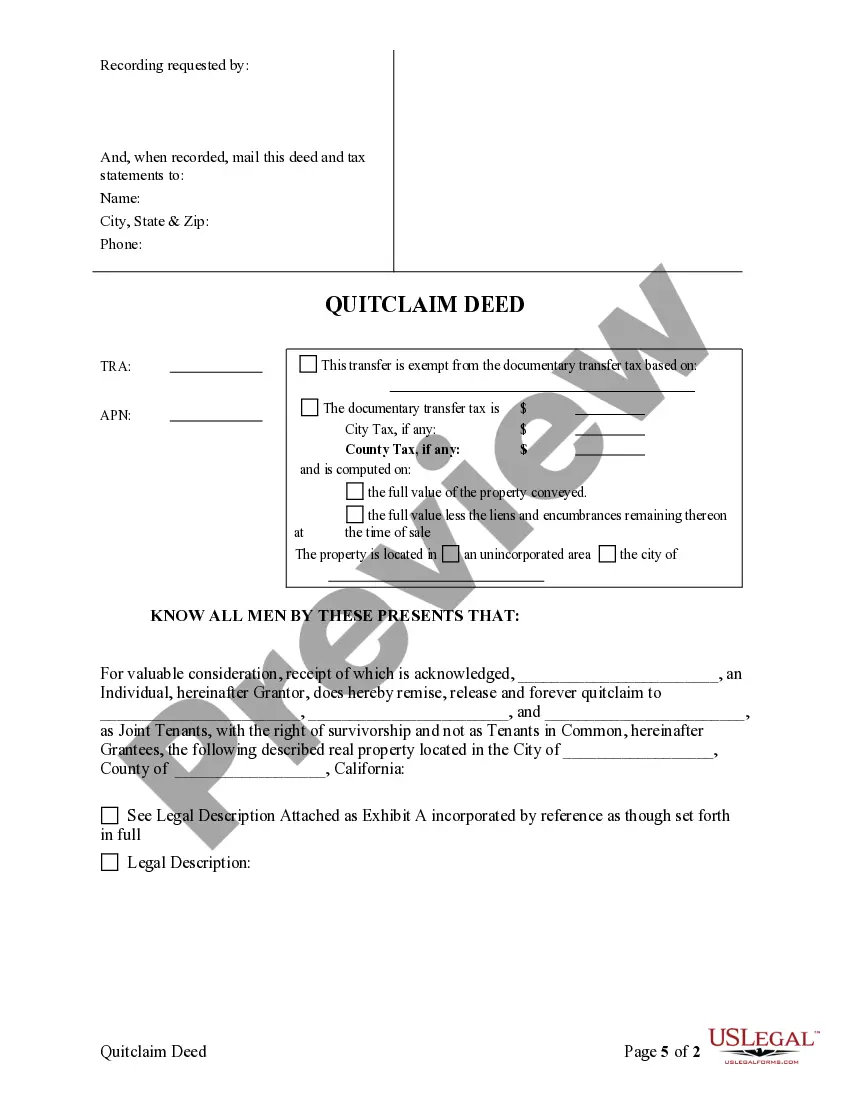

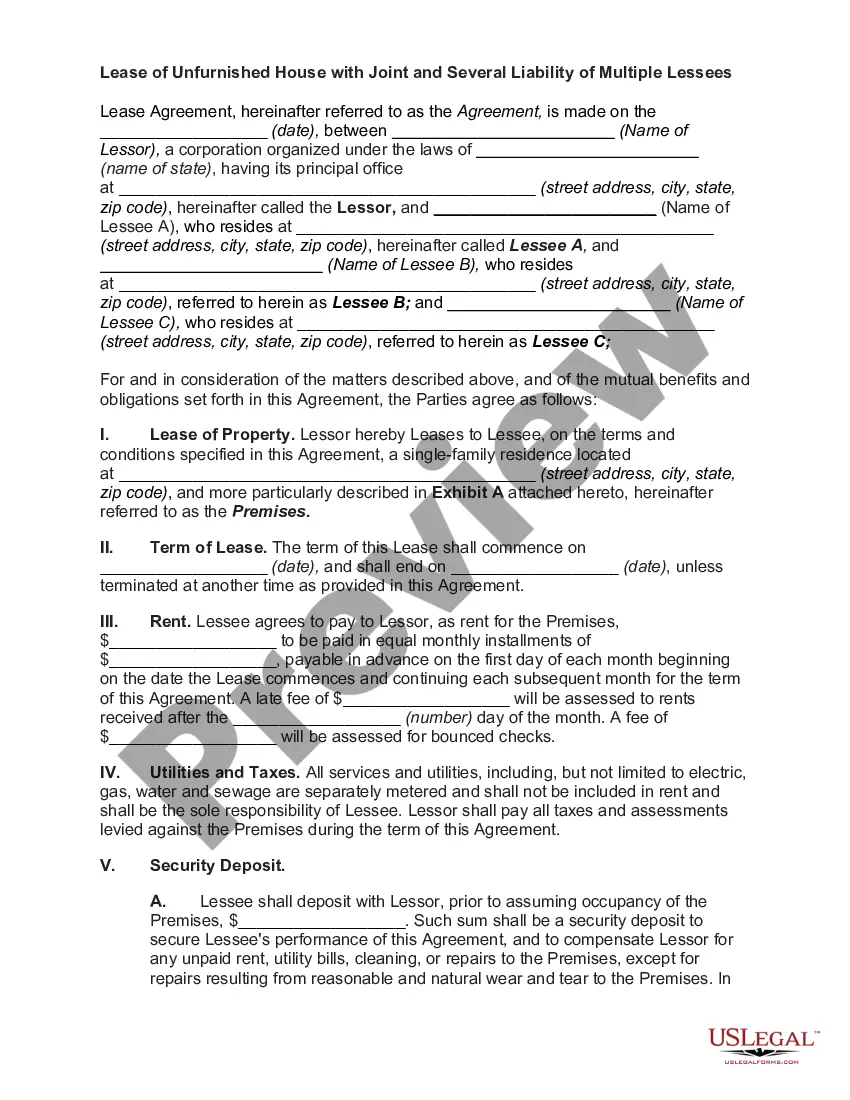

This form is a Quitclaim Deed where the grantor is one individual and the grantees are three individuals holding title as joint tenants.

Anaheim California Quitclaim Deed from one Individual to Three Individuals as Joint Tenants

Description

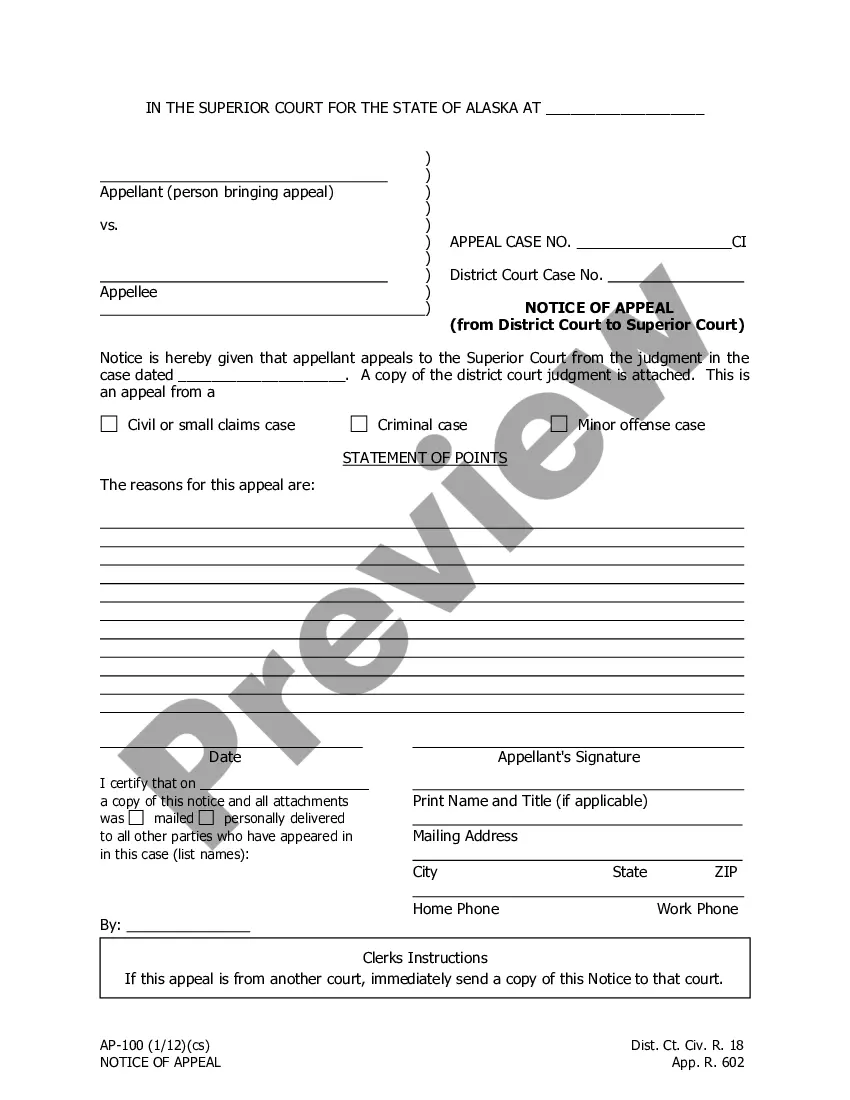

How to fill out California Quitclaim Deed From One Individual To Three Individuals As Joint Tenants?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online compilation of over 85,000 legal documents catering to both personal and professional requirements across various real-life situations.

All papers are accurately classified by function and jurisdiction areas, making the search for the Anaheim California Quitclaim Deed from one Individual to Three Individuals as Joint Tenants as straightforward as A-B-C.

Maintain organized paperwork in accordance with legal standards is crucial. Leverage the US Legal Forms library to always have necessary document templates readily available for any requirements at your fingertips!

- Review the Preview mode and form description.

- Ensure you've selected the right option that fits your requirements and fully aligns with your local jurisdiction regulations.

- Search for another template if necessary.

- If you identify any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

File the forms. The recording fee will vary by county, but you can expect as a range to pay between $6 and $21 for the first page and $3 for any additional page. In Sacramento County, for example, the Recorder charges $21 for the first page and $3 for each additional page for recording.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

When owning a home together is no longer an option, you can remove him from your mortgage by refinancing. You do not need his consent to refinance. However, the co-owner must agree to relinquish ownership rights. By completing a quit claim deed, the owner quits his interest in the home.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

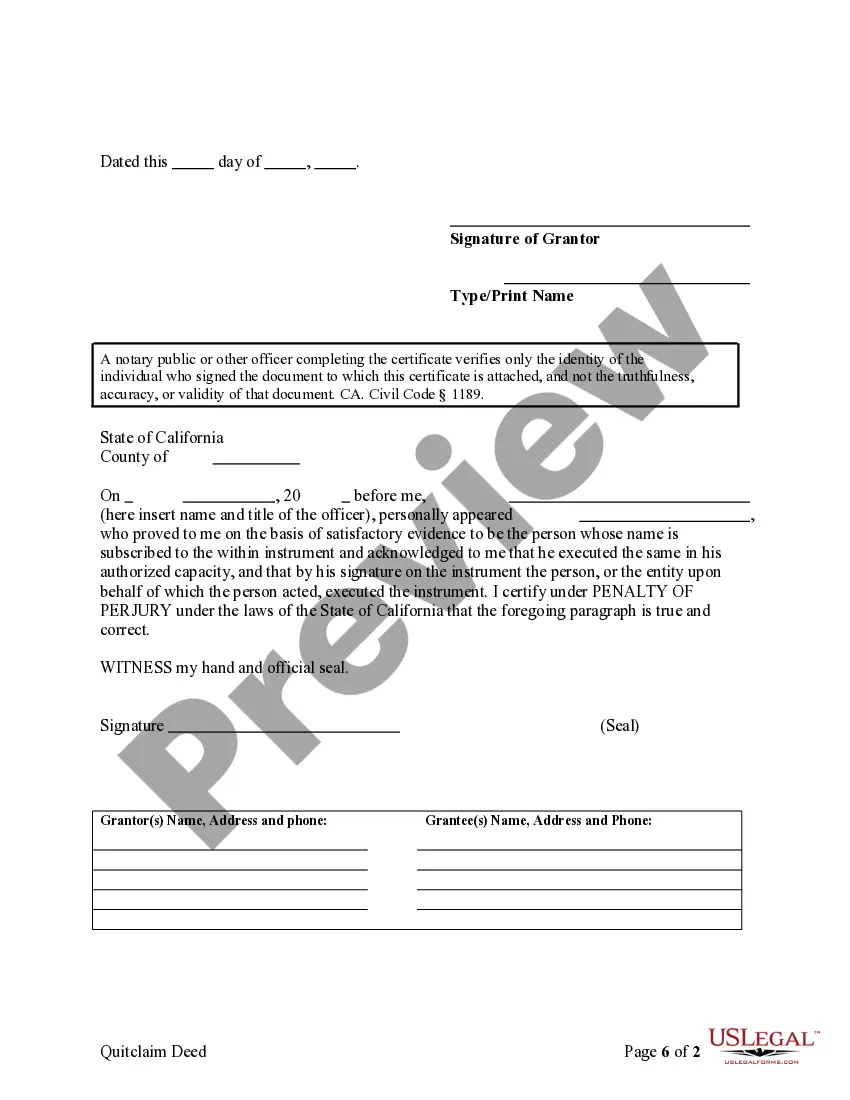

Once you have filled out a California quitclaim deed, you will need to get it notarized. Next, you will need to need to visit your appropriate local government office to file some paperwork. Depending on your county of sale, that may be a Recorder's office, a County Clerk's Office, or an Assessor's office.

Adding a name to the deeds Equity transfer is not just about removing a name from the deeds. It also includes adding a name. For example, parents may want to add their children to the deeds of the family home. When someone marries their partner, they may want to add them to the deeds of the property they already owned.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office. There are a few types of deeds that accomplish this in California, including a quitclaim deed, grant deed and transfer on death deed.

Recording Fee for Quitclaim DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.004 more rows

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).