This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We continually endeavor to reduce or avert legal complications when engaging with intricate legal or financial issues.

To achieve this, we enlist the services of attorneys, which are typically quite expensive.

However, not every legal problem is equally complicated.

Many can be resolved by ourselves.

Take advantage of US Legal Forms whenever you need to locate and download the Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document easily and securely. Simply Log In to your account and click the Get button next to it. In case you misplace the form, you can always re-download it in the My documents tab.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our platform enables you to take charge of your affairs without requiring legal counsel services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are specific to states and areas, which greatly eases the search process.

Form popularity

FAQ

To ensure a promissory note is valid, it must contain the names of the borrower and lender, the amount being borrowed, repayment terms, and signatures from both parties. It should also comply with state laws, particularly California’s regulations. When creating a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, always review these requirements. Utilizing platforms like US Legal Forms can guide you through this process.

The conditions for a promissory note typically involve specifying repayment terms, including due dates and interest rates. The note must also state what happens in the event of non-payment or default. Crafting a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate with clear conditions helps protect both parties. Resources like US Legal Forms can assist you in understanding and outlining these conditions effectively.

A promissory note is valid when it includes essential elements, such as the parties involved, the amount borrowed, interest rate, and payment schedule. Both parties should sign the note, and it should specify any conditions or consequences for default. Providing a clear and concise Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is vital for its validity. For assistance, consider using services like US Legal Forms.

Yes, promissory notes are enforceable in California as long as they meet specific legal requirements. The terms must be clear, and both parties should sign the document. If you draft a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure you include all essential details to support enforceability. Consulting a legal expert can also provide peace of mind regarding compliance with state laws.

Yes, you can write your own promissory note, but it’s crucial to include specific elements such as the principal amount, interest rate, and repayment terms. Utilizing resources like US Legal Forms can provide you with helpful templates to ensure you meet all legal requirements. Crafting a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate on your own gives you control, but be cautious to cover all necessary components for enforceability.

For a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you typically file the note with your county's recorder's office. This office manages public records and documents related to real estate. Filing the note there helps establish its validity and protects your rights as a holder. USLegalForms can assist you with templates and guidance to ensure your note is filed correctly.

When it comes to a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, recording the note is essential for protecting your interests. Recording the note provides public notice of your claim against the property. This action strengthens your legal rights and helps prevent potential disputes. Consider using USLegalForms to easily navigate the recording process and ensure all necessary steps are completed.

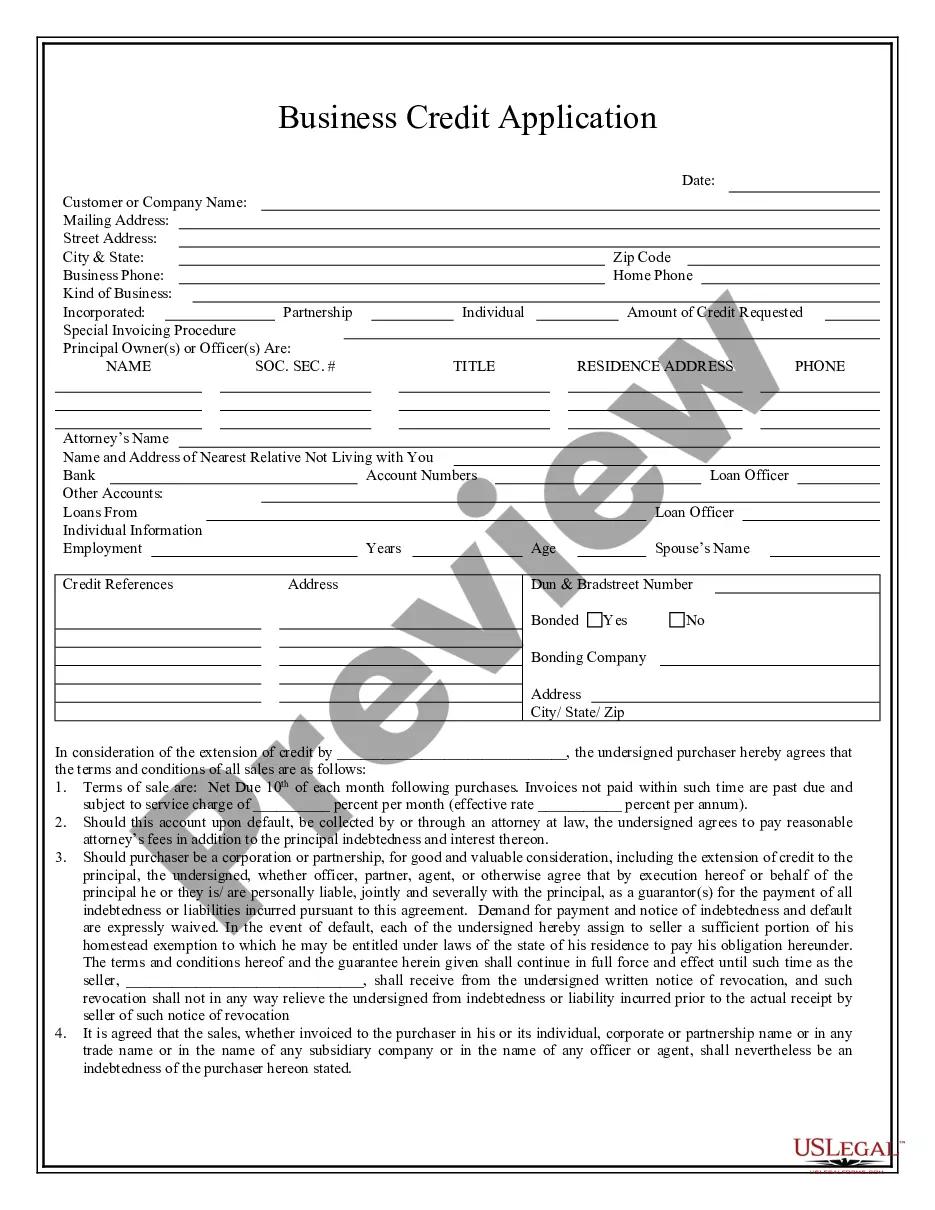

Filling out a promissory note involves outlining essential components such as the principal amount, interest rate, and repayment terms. Provide clear details on the borrower's identity, along with any items used as collateral. For guidance on creating a compliant Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, consider using platforms like uslegalforms.

The document that secures a promissory note to real property is known as a mortgage or deed of trust. This document provides legal assurance that the lender has a claim against the property if the borrower defaults. Therefore, when you establish a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is crucial to properly record this securing document.

To secure a promissory note with real property, you must attach the note to a mortgage or deed of trust. This document serves as a legal claim on the property in case of default. When you utilize a Fullerton California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure that all documents are properly recorded in the local county office for full protection.