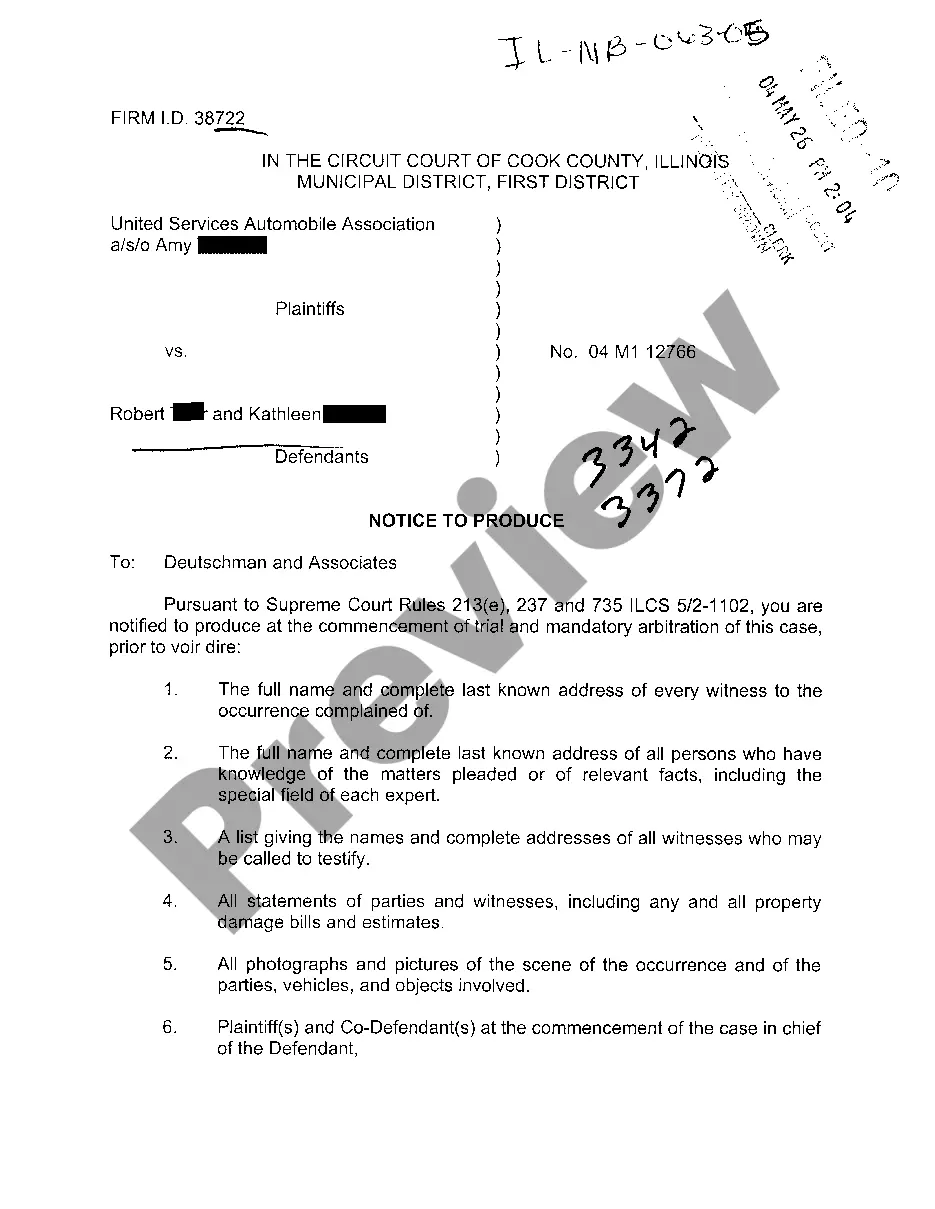

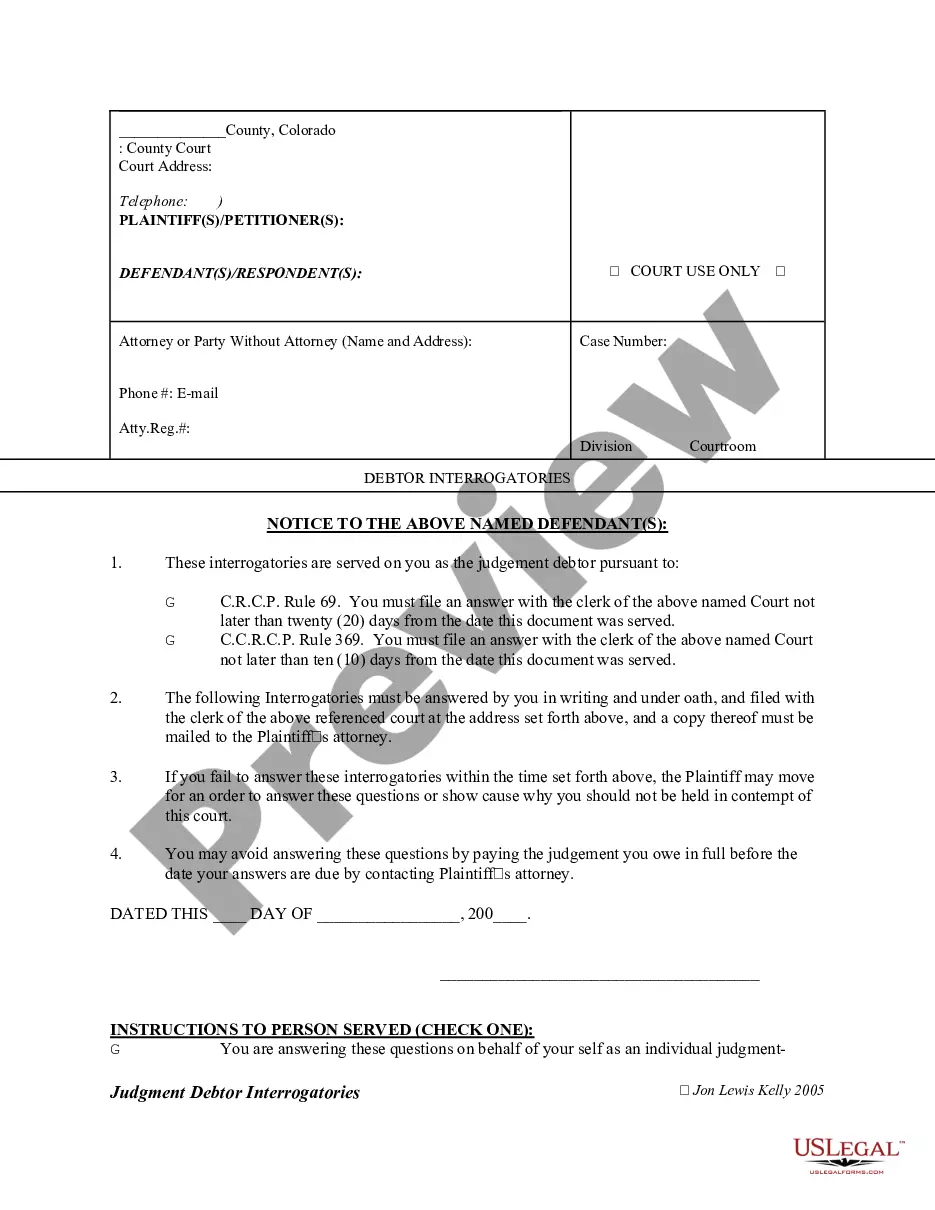

Long Beach California Certificate of Lien for Unsecured Property Taxes

Description

How to fill out California Certificate Of Lien For Unsecured Property Taxes?

Are you searching for a trustworthy and affordable legal forms provider to acquire the Long Beach California Certificate of Lien for Unsecured Property Taxes? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for both personal and business use.

All templates that we offer are not generic and are designed in accordance with the regulations of individual states and counties.

To obtain the document, you need to Log In to your account, find the required template, and click the Download button next to it. Please keep in mind that you can retrieve your previously purchased document templates at any time from the My documents tab.

Now you can set up your account. After that, select the subscription plan and proceed with the payment.

Once the payment is complete, download the Long Beach California Certificate of Lien for Unsecured Property Taxes in any available format. You can return to the website at any moment and redownload the document without any additional fees.

- Is this your first time visiting our platform? No problem.

- You can create an account in minutes, but before you do that, ensure to follow these steps.

- Check if the Long Beach California Certificate of Lien for Unsecured Property Taxes aligns with the rules of your state and local area.

- Review the form’s description (if available) to understand who and what the document is meant for.

- Restart the search if the template does not match your specific needs.

Form popularity

FAQ

Under the adverse possession doctrine, someone could legally take possession of the property if they live there long enough. In California, adverse possession laws allow for a person to legally claim ownership over a property by paying taxes and staying there for a certain amount of time.

You cannot buy a tax lien in California. A lien pays the delinquent tax for the homeowner and you receive interest for it. California sells tax deeds on properties with taxes delinquent for five or more years, or if the owner has not enrolled in the county's Five Year Payment Plan.

?Buying tax delinquent property in California is a straightforward process. California does not create tax lien certificates. Instead, it issues tax deeds on properties with taxes delinquent for five or more years, or if the owner has not enrolled in the county's Five Year Payment Plan.

A lien secures our interest in your property when you don't pay your tax debt. Once a Notice of State Tax Lien is recorded or filed against you, the lien: Becomes public record. Attaches to any California real or personal property you currently own or may acquire in the future.

California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122? Employment Development Department (916) 464-2669.

California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122? Employment Development Department (916) 464-2669.

No law prohibits someone from paying the property taxes due on another person's property, after all. But just because you pay back taxes on someone else's property doesn't mean you'll gain any sort of legal interest or ownership right to that property.

In California, adverse possession occurs when a person who wants to claim someone else's land must not only use it for at least five years, but they must also pay property taxes on it.

In order to assert a claim of adverse possession in California, the claimant (party seeking to gain title to the property) must demonstrate: possession under a claim of right or color of title; actual, open, notorious occupation (protected by a substantial enclosure such as a fence and usually cultivated or improved);

Unsecured (Personal) Property Taxes are ad-valorem (value based) property taxes that the Office of the Los Angeles County Assessor assesses to the owner of record as of January 1 of each year. Because the taxes are not secured by real property such as land, these taxes are called ?Unsecured.?