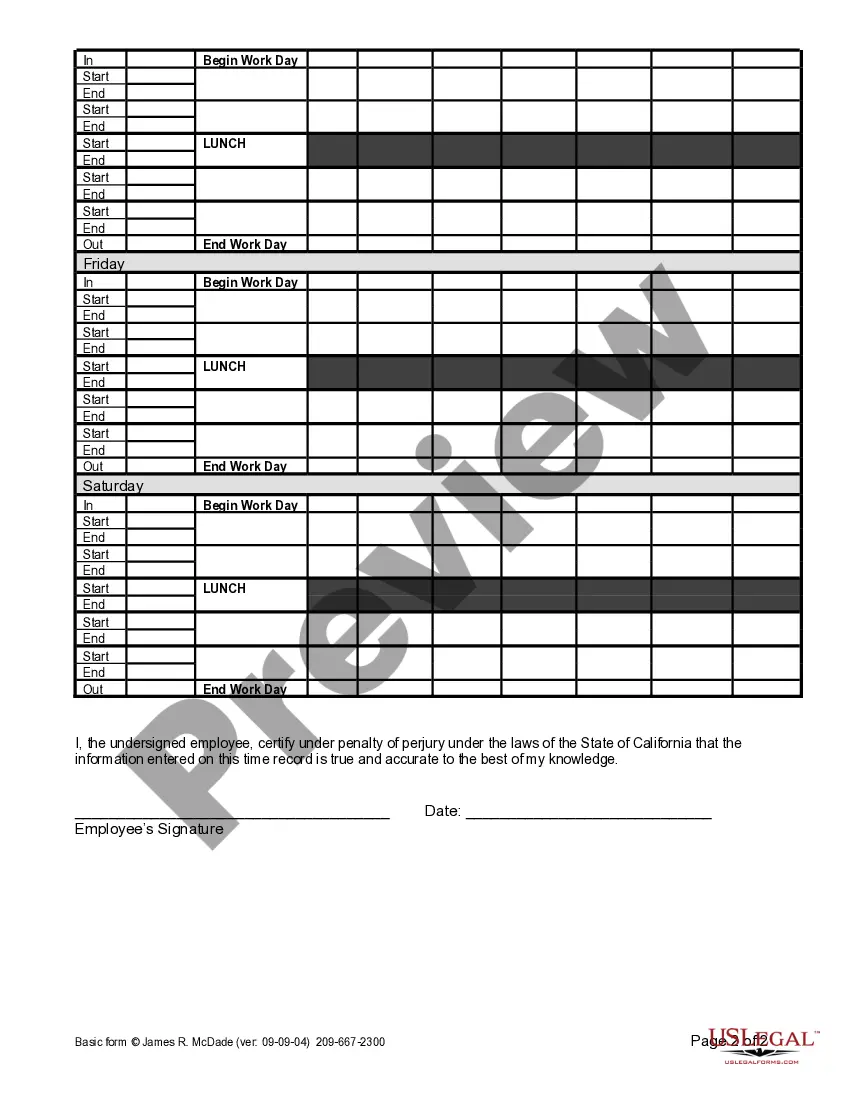

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

Rancho Cucamonga California Weekly Time Sheet for Multiple Pay Rate

Description

How to fill out California Weekly Time Sheet For Multiple Pay Rate?

If you are seeking a legitimate form template, it’s unfeasible to select a more user-friendly service than the US Legal Forms website – one of the most extensive online repositories.

With this repository, you can obtain numerous document samples for business and personal purposes categorized by type and location, or keywords.

Thanks to the efficient search feature, acquiring the latest Rancho Cucamonga California Weekly Time Sheet for Multiple Pay Rate is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and download it to your device.

- Moreover, the relevance of every document is validated by a team of qualified attorneys who consistently review the templates on our website and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Rancho Cucamonga California Weekly Time Sheet for Multiple Pay Rate is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview feature to examine its contents. If it does not meet your requirements, employ the Search function at the top of the page to find the right document.

- Confirm your choice. Click the Buy now option. After this, select your preferred payment plan and submit your details to register for an account.

Form popularity

FAQ

The Rule for Most Employees Any wages that are earned between the 1 st and 15 th day of any month must be paid on or before the 26 th of the same month, at the very latest. Any wages earned in last half of the month must be paid on or before the 10 th day of the following month.

1. What is the minimum wage? Effective January 1, 2021, the minimum wage increases to $14 per hour for employers with 26 or more employees and $13 per hour for employees with 25 or fewer employees.

1.1. How long does an employer have to pay you after payday in California? Most California workers are required to be on a semi-monthly payroll. This means their California employers have to pay them twice a month.

Due to the enactment of Senate Bill (SB) 3, the California minimum wage will increase to $15.00 per hour, effective January 1, 2022, for employers with 26 or more employees, and to $14.00 per hour for employers with 25 or fewer employees.

In California, wages, with some exceptions, must be paid at least twice during each calendar month on the days designated in advance as regular paydays.

In some states, including California, the time limit depends on whether the employee quit or was fired. California's law is the strictest in the nation. An employee who is fired (or laid off) is entitled to a final paycheck immediately, meaning at the time of termination or layoff.

If you are paid a salary, the regular rate is determined as follows: Multiply the monthly remuneration by 12 (months) to get the annual salary. Divide the annual salary by 52 (weeks) to get the weekly salary. Divide the weekly salary by the number of legal maximum regular hours (40) to get the regular hourly rate.

What Is California's Minimum Wage Today? For the remainder of 2022, the current minimum wage in the state will stay at $14 per hour for California employers with 25 employees or less. If your business employs 26 or more people, you've already been subject to a $15 per hour minimum wage rate as of January 1, 2022.

What Is California's Minimum Wage Today? For the remainder of 2022, the current minimum wage in the state will stay at $14 per hour for California employers with 25 employees or less. If your business employs 26 or more people, you've already been subject to a $15 per hour minimum wage rate as of January 1, 2022.

Regular rate of pay in California is an employee's total earnings divided by the total number of hours worked in a workweek....Hourly Pay Workers meal break, rest break, or. recovery period.