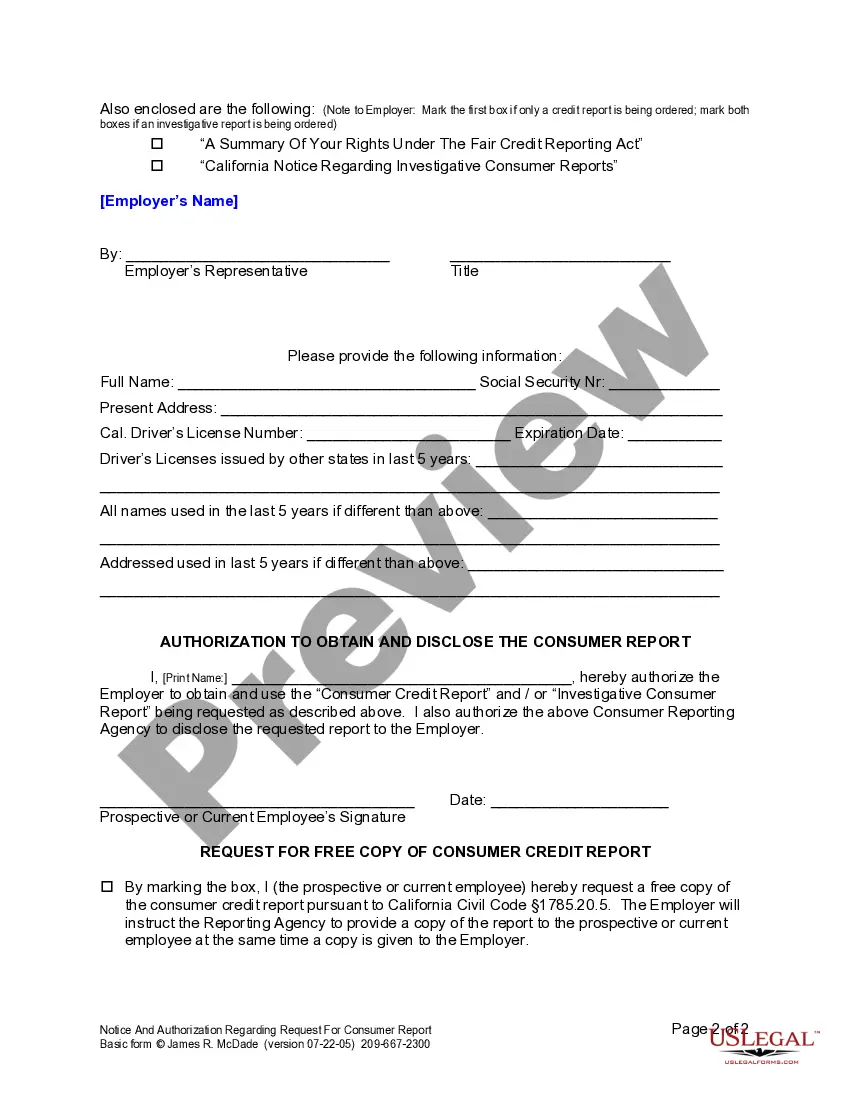

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

Long Beach California Notice and Authorization Regarding Consumer Report

Description

How to fill out California Notice And Authorization Regarding Consumer Report?

If you have previously employed our service, Log In to your account and retrieve the Long Beach California Notice and Authorization Regarding Consumer Report onto your device by selecting the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: it can be found in your profile within the My documents section whenever you need to access it again. Take advantage of the US Legal Forms service to efficiently find and store any template for your personal or business requirements!

- Confirm you have found the appropriate document. Review the description and utilize the Preview feature, if available, to verify if it suits your needs. If it does not suit you, employ the Search tab above to discover the suitable one.

- Purchase the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Establish an account and make a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Long Beach California Notice and Authorization Regarding Consumer Report. Select the file format for your document and store it on your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

The FCRA specifies those with a valid need for access. You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer.

Generally speaking, a background check for employment may show identity verification, employment verification, credit history, driver's history, criminal records, education confirmation, and more.

Employment background checks also are known as consumer reports. They can include information from a variety of sources, including credit reports and criminal records.

Hundreds of companies provide employment background checks and qualify as consumer reporting agencies. Employment reports often include credit checks, criminal background checks, public records?such as bankruptcy filings and other court documents?and information related to your employment history.

A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments. Increasingly, these records also include your activity on social media, such as Twitter and Facebook.

What Can Be Disqualifying on a Background Check? Criminal History.Inconsistencies.Poor Credit History.Poor Employment History.Bad Driving Record.Review the Background Check Policy.Talk to the Candidate.Make a Decision.

You should fact-check your specialty consumer reports during important life events and situations, such as when applying for a job, rental home, or at other times like when applying for a new bank account or insurance policy.

Hundreds of companies provide employment background checks and qualify as consumer reporting agencies. Employment reports often include credit checks, criminal background checks, public records?such as bankruptcy filings and other court documents?and information related to your employment history.

You are also entitled to a free credit report every 12 months from each of the three nationwide consumer reporting companies?Equifax, TransUnion, and Experian. You can request a copy through AnnualCreditReport.com .