This document outlines the federal and state legal standards an employer must follow when requesting a consumer credit report or a background investigation on an employee or potential employee.

San Diego California Employer's Summary of FCRA Investigation Reports

Description

How to fill out California Employer's Summary Of FCRA Investigation Reports?

Are you in search of a reliable and budget-friendly provider of legal documents to purchase the San Diego California Employer's Summary of FCRA Investigation Reports? US Legal Forms is your ideal source.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce proceedings in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic but tailored based on the regulations of specific states and counties.

To obtain the document, you must Log In to your account, find the necessary form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any moment from the My documents section.

Is this your first visit to our site? No problem. You can set up an account within minutes, but before doing that, ensure to take the following steps.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the San Diego California Employer's Summary of FCRA Investigation Reports in any format available. You can revisit the website anytime and redownload the document at no extra cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and put an end to spending hours deciphering legal documents online.

- Verify whether the San Diego California Employer's Summary of FCRA Investigation Reports aligns with the regulations of your state and locality.

- Review the form’s details (if available) to understand who the document is designed for and its intended use.

- Initiate your search again if the form does not suit your legal needs.

Form popularity

FAQ

The FCRA applies to any company that collects and sells data about you to third parties. Such companies, known as consumer reporting agencies, must follow the stipulations of the FCRA. The three most well-known consumer reporting agencies in the U.S. are Equifax, TransUnion and Experian.

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report.

The FCRA regulates the collection, distribution and use of consumer information, which includes Consumer Reports, also known as employment background checks. Background checks can contain information from a variety of sources, including credit reports, employment verifications and criminal record searches.

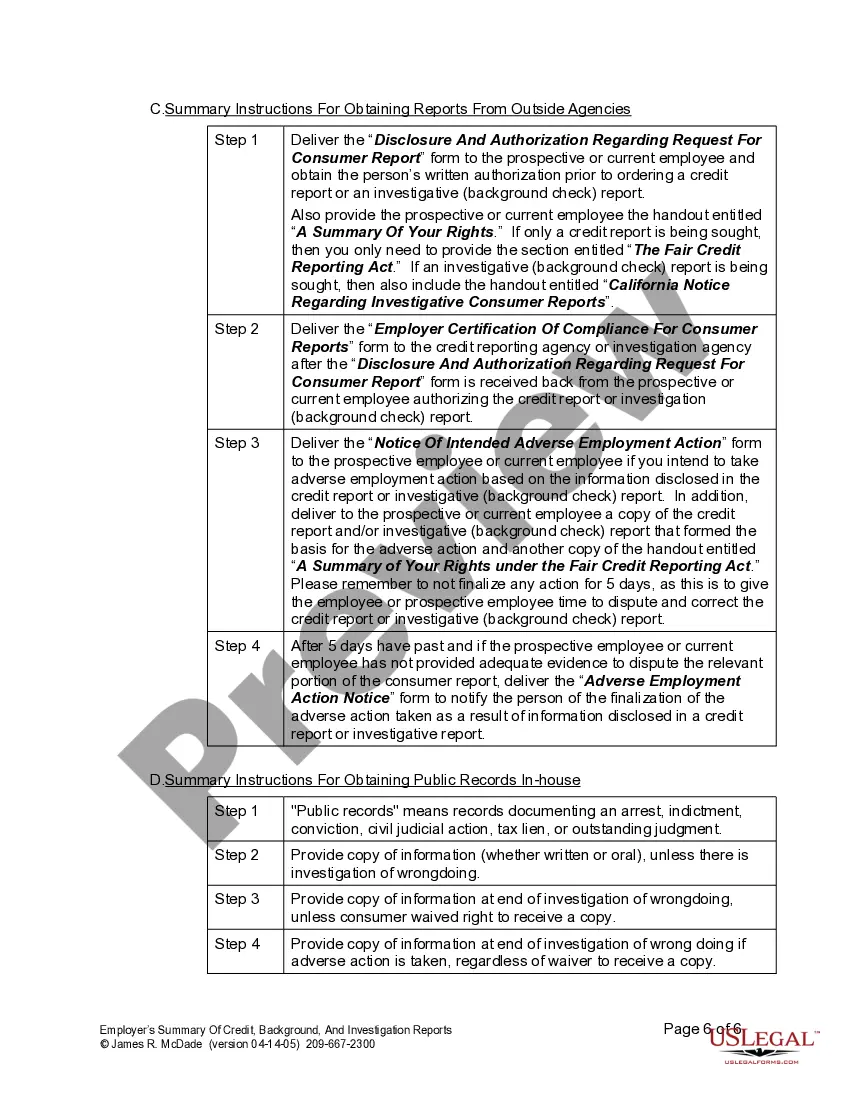

The FCRA For ?Employment Purposes? Employers are required to both disclose their intention to obtain a consumer report and obtain written consent from applicants or current employees prior to requesting a consumer report.

In general, when employers use a third party to conduct background checks on applicants or employees, the federal Fair Credit Reporting Act (FCRA) will apply. The FCRA governs how employers obtain and handle consumer reports, which include standard background checks.

A background investigation generally involves determining whether an applicant may be unqualified for a position due to a record of criminal conviction, motor vehicle violations, poor credit history, or misrepresentation regarding education or work history.

Issuers of credit cards. Employers. Generally, the FCRA does not apply to commercial transactions, including those involving agricultural credit. It does not give any federal agency authority to issue rules or regulations having the force and effect of law.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.