This document outlines the federal and state legal standards an employer must follow when requesting a consumer credit report or a background investigation on an employee or potential employee.

Chico California Employer's Summary of FCRA Investigation Reports

Description

How to fill out California Employer's Summary Of FCRA Investigation Reports?

Take advantage of the US Legal Forms and gain immediate access to any form template you require.

Our helpful website with countless documents simplifies the process of locating and acquiring nearly any document sample you will need.

You can export, complete, and endorse the Chico California Employer's Summary of FCRA Investigation Reports in just a few minutes rather than spending hours online searching for an appropriate template.

Using our collection is an outstanding method to enhance the security of your document submissions.

If you haven't created an account yet, follow the steps below.

Ensure you make the most of our form repository and optimize your document experience!

- Our qualified attorneys frequently examine all records to confirm that the templates are suitable for a specific state and comply with current laws and regulations.

- How can you access the Chico California Employer's Summary of FCRA Investigation Reports? If you have a subscription, simply Log In to your account.

- The Download button will appear on every sample you explore. Additionally, you can retrieve all your previously saved documents from the My documents section.

Form popularity

FAQ

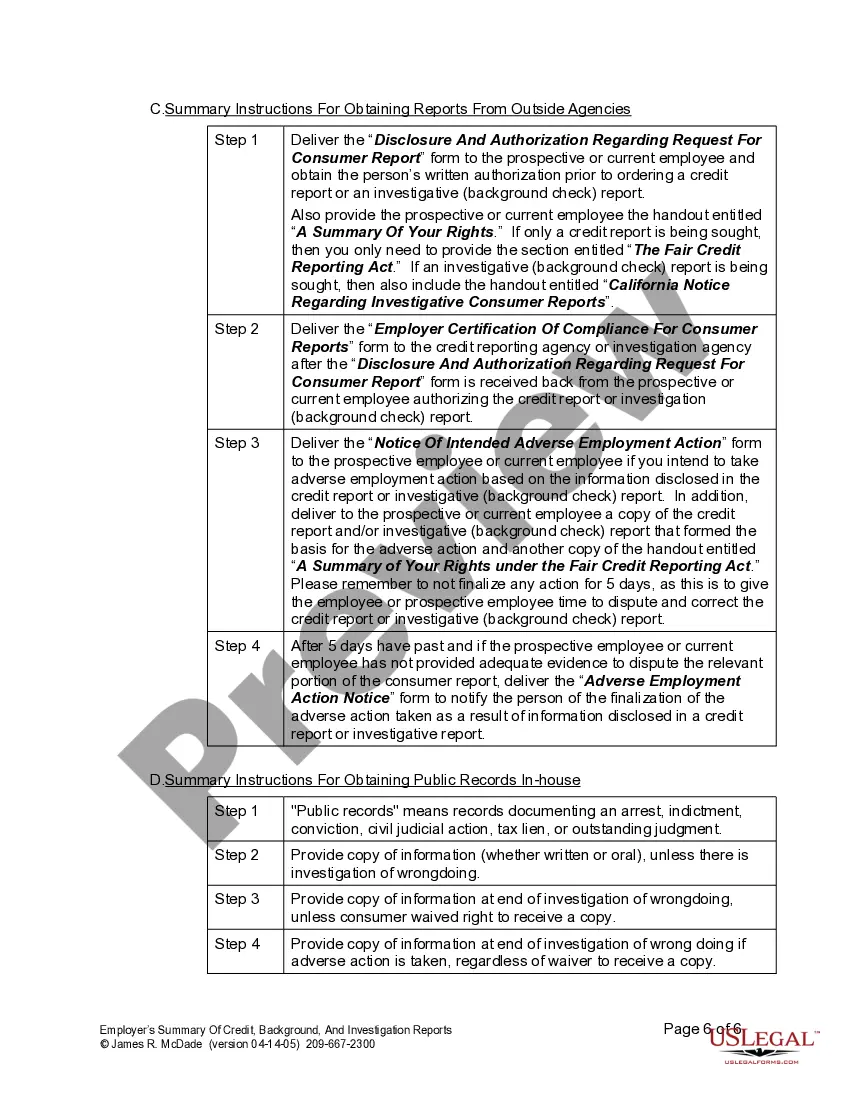

The FCRA For ?Employment Purposes? Employers are required to both disclose their intention to obtain a consumer report and obtain written consent from applicants or current employees prior to requesting a consumer report.

Investigative consumer reports are reports credit agencies prepare about someone's character, general reputation, personal characteristics or mode of living that are obtained through personal interviews with such people as neighbors, friends and associates and reviewing records and public records, including but not

In general, when employers use a third party to conduct background checks on applicants or employees, the federal Fair Credit Reporting Act (FCRA) will apply. The FCRA governs how employers obtain and handle consumer reports, which include standard background checks.

An investigative consumer report offers insight employers use to gain a better understanding of a person's character through interviews. These are often in the form of personal and/or professional references. When deciding which might be best, ask what information are you trying to gain.

The FCRA regulates the collection, distribution and use of consumer information, which includes Consumer Reports, also known as employment background checks. Background checks can contain information from a variety of sources, including credit reports, employment verifications and criminal record searches.

Employment background checks also are known as consumer reports. They can include information from a variety of sources, including credit reports and criminal records.

California Civil Code Section 1786.2 defines an ?investigative consumer report? as ?a consumer report in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through any means.

Issuers of credit cards. Employers. Generally, the FCRA does not apply to commercial transactions, including those involving agricultural credit. It does not give any federal agency authority to issue rules or regulations having the force and effect of law.

Compliance with the FCRA is the responsibility of both the employer and the background screening company. Employers must make sure they disclose that they are going to conduct a background check and get written authorization.

Hundreds of companies provide employment background checks and qualify as consumer reporting agencies. Employment reports often include credit checks, criminal background checks, public records?such as bankruptcy filings and other court documents?and information related to your employment history.