This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

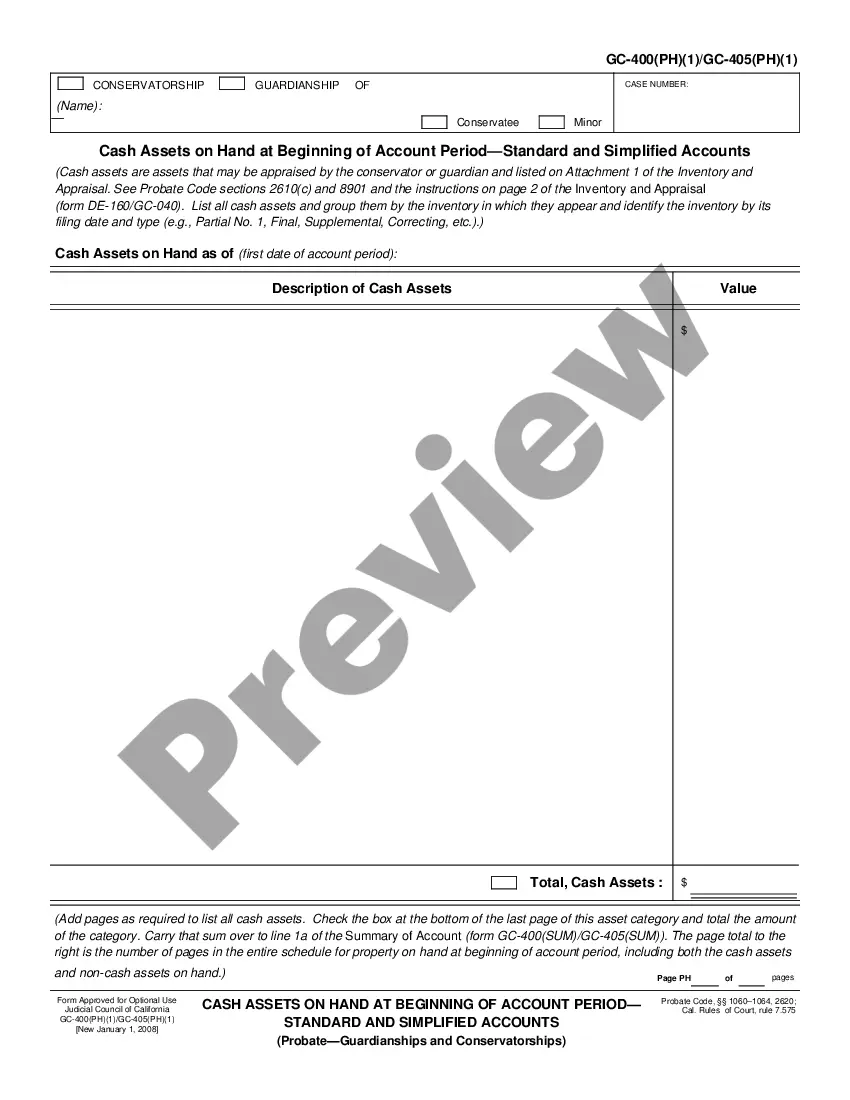

Garden Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts

Description

How to fill out California Cash Assets On Hand At End Of Account Period-Standard And Simplified Accounts?

Locating validated templates that conform to your regional legislation can be challenging unless you utilize the US Legal Forms archive.

It’s a web-based repository of over 85,000 legal documents for both individual and business requirements as well as various real-world situations.

All the forms are correctly sorted by usage area and jurisdiction categories, so finding the Garden Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts becomes as simple as one, two, three.

Submit your credit card information or utilize your PayPal account to complete the payment. Download the Garden Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts. Store the template on your device to continue with its completion and access it in the My documents section of your profile whenever necessary. Maintaining documentation organized and compliant with legal stipulations is critically important. Take advantage of the US Legal Forms library to always have essential document templates available at your fingertips!

- Familiarize yourself with the Preview mode and form details.

- Ensure you’ve selected the accurate one that fulfills your requirements and aligns with your local jurisdictional standards.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next stage.

- Purchase the document.

Form popularity

FAQ

Estate Executors Must Provide Beneficiaries With Proper Accounting. Under California law, executors of a will must file an accounting of all of the transactions they have conducted while administering the estate. The executor must file this accounting with the probate court.

The Law of Probate Accounting in California For starters, California Probate Code section 16060 provides that the trustee has a duty to keep the beneficiaries of the trust reasonably informed of the trust and its administration by providing an accounting at least once a year.

Some times beneficiaries want to see more detailed documents such as a Deceased's bank statement or pension documentation. Strictly speaking a beneficiary has no entitlement as of right to such documentation and it is your discretion as Executor whether or not to disclose it.

Legal proceedings against the deceased If there are any legal proceedings or claims against the deceased, at the date of death, which are set to continue despite the deceased's death, the Executor must inform the beneficiaries of these proceedings.

There are certain kinds of information executors are generally required to provide to beneficiaries, including an inventory and appraisal of estate assets and an estate accounting, which should include such information as: An inventory of estate assets and their value at the time of the decedent's death.

In California, any form of property that is not individually owned by the deceased is considered a non-probate property by operation of California probate law. These assets are common. They can be anything from cars, belongings, life insurance policies, real property, and transfers on death accounts.

Residuary beneficiaries are additionally entitled to receive a copy of the estate accounts, once these have been prepared, so that they can see how their share of the inheritance has been calculated.

Assets Subject to the California Probate Court Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

Executors and other personal representatives do not have to provide the estate accounts until the process of administration is complete. This can take a long time, especially in more complex estates, so residuary beneficiaries may have to wait for some time in order to receive the final accounts they are entitled to.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.