This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

Santa Maria California Request for Income and Benefit Information From Employer

Description

How to fill out California Request For Income And Benefit Information From Employer?

If you have previously utilized our service, Log In to your account and download the Santa Maria California Request for Income and Benefit Information From Employer onto your device by clicking the Download button. Ensure that your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial experience with our service, adhere to these straightforward instructions to obtain your document.

You have perpetual access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to reference it again. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or professional necessities!

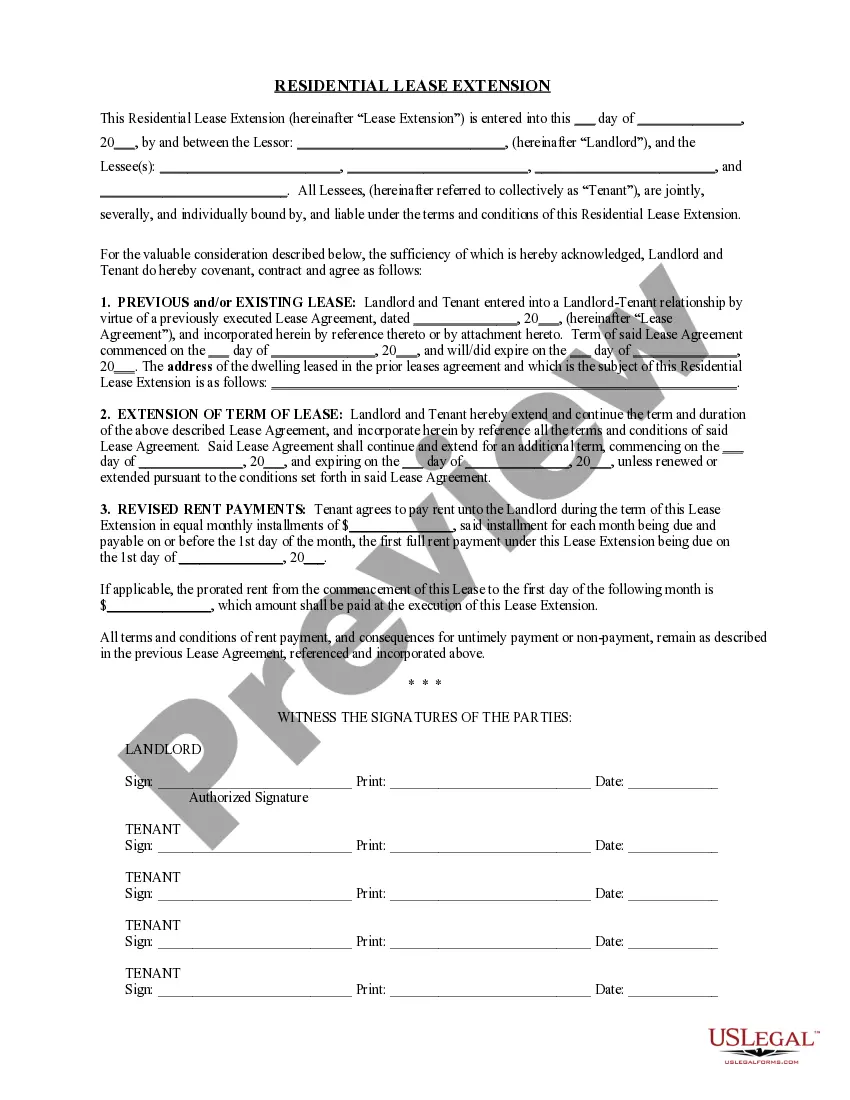

- Ensure you’ve located the correct document. Review the description and utilize the Preview feature, if accessible, to verify if it suits your requirements. If it’s not suitable, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or select the PayPal option to finalize the purchase.

- Obtain your Santa Maria California Request for Income and Benefit Information From Employer. Select the file format for your document and store it on your device.

- Complete your sample. Print it or use professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Employers in California have several obligations, including providing safe working conditions, offering mandated benefits, and paying appropriate wages. They are also required to respect employee rights and maintain compliance with state and federal labor laws. If you're navigating these obligations, a Santa Maria California Request for Income and Benefit Information From Employer can assist you in understanding your rights and the responsibilities of your employer.

Indeed, California law mandates that employers provide various benefits to their employees. This includes health insurance and other specific benefits intended to improve employee welfare. If you are unsure of your rights, a Santa Maria California Request for Income and Benefit Information From Employer could provide you with the clarity you need.

While having health insurance is strongly encouraged in California, there is a mandate that can result in penalties for those who choose to go without. This is part of an effort to ensure more residents have access to necessary healthcare services. For individuals wishing to understand the implications, a Santa Maria California Request for Income and Benefit Information From Employer is a helpful resource.

Under the California employee benefits, an employee can get various benefits from the employer according to the state rule. He can avail these benefits for multiple reasons such as unemployment, paid sick leave, health insurance, childcare insurance and even retirement.

Unemployment Insurance (UI) The 2022 taxable wage limit is $7,000 per employee. The UI maximum weekly benefit amount is $450. The UI tax rate for new employers is 3.4 percent (.

The Employment Development Department (EDD) offers a wide variety of services to millions of Californians under Unemployment Insurance (UI), State Disability Insurance (SDI), workforce investment (Jobs and Training), and Labor Market Information programs.

The EDD issues benefit payments for Disability Insurance, Paid Family Leave, and Unemployment Insurance claims using a visa debit card. This prepaid debit card is a fast, convenient, and secure way to get your benefit payments and is not subject to a credit check or monitoring by the EDD.

We automatically added the federal unemployment compensation to each week of benefits that you were eligible to receive. Any unemployment benefits through the end of the program are still eligible for the extra $300, even if you are paid later.

It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim start date and up to the maximum WBA.

$167 per week for each week you were unemployed due to COVID-19. $167 plus $600 per week for each week you are unemployed due to COVID-19. $167 per week, for each week that you are unemployed due to COVID-19.