Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

If you are searching for a legitimate document, it’s exceptionally difficult to select a more suitable service than the US Legal Forms website – arguably the largest online repositories.

Here you can obtain a vast array of document samples for both business and personal uses categorized by types, regions, or keywords.

With the enhanced search capability, locating the latest Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is as straightforward as 1-2-3.

Verify your selection. Hit the Buy now button. Then, pick the preferred pricing option and enter details to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the accuracy of each record is confirmed by a team of qualified lawyers who routinely review the templates on our platform and update them according to the latest state and county statutes.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have opened the template you need. Review its details and use the Preview option (if available) to examine its content.

- If it doesn’t satisfy your requirements, utilize the Search bar at the top of the screen to find the correct file.

Form popularity

FAQ

A trust transfer deed in California is a legal document that transfers title of a property into a trust. This allows the property to be managed according to the trust's terms while typically avoiding probate. If you are involved in a Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, you may encounter trust transfer deeds as important components in property management and ownership.

A mortgage trust generally refers to a trust arrangement where mortgage loans are pooled together for investment purposes. It allows investors to gain returns from mortgage income while spreading risks associated with individual loans. In the realm of Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, mortgage trusts can play a vital role in funding or securing property transactions.

California largely uses deeds of trust for real estate transactions rather than standard mortgages. This legal choice supports more efficient handling of property transactions, including foreclosures and refinancing. If you're exploring the Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, understanding this preference for deeds of trust is beneficial.

The primary difference lies in the number of parties involved; a mortgage involves two parties—the borrower and the lender—while a deed of trust includes three parties: the borrower, the lender, and a trustee. Deeds of trust provide a quicker, less complicated means for lenders to recover the property if the borrower defaults. When dealing with a Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, knowing this difference can help in understanding the implications of your agreements.

California is primarily a deed of trust state, meaning that most property transactions in the state use deeds of trust instead of traditional mortgages. This system assists in streamlining the foreclosure process and allows for easier refinancing options. If you are involved in a Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, this distinction is significant.

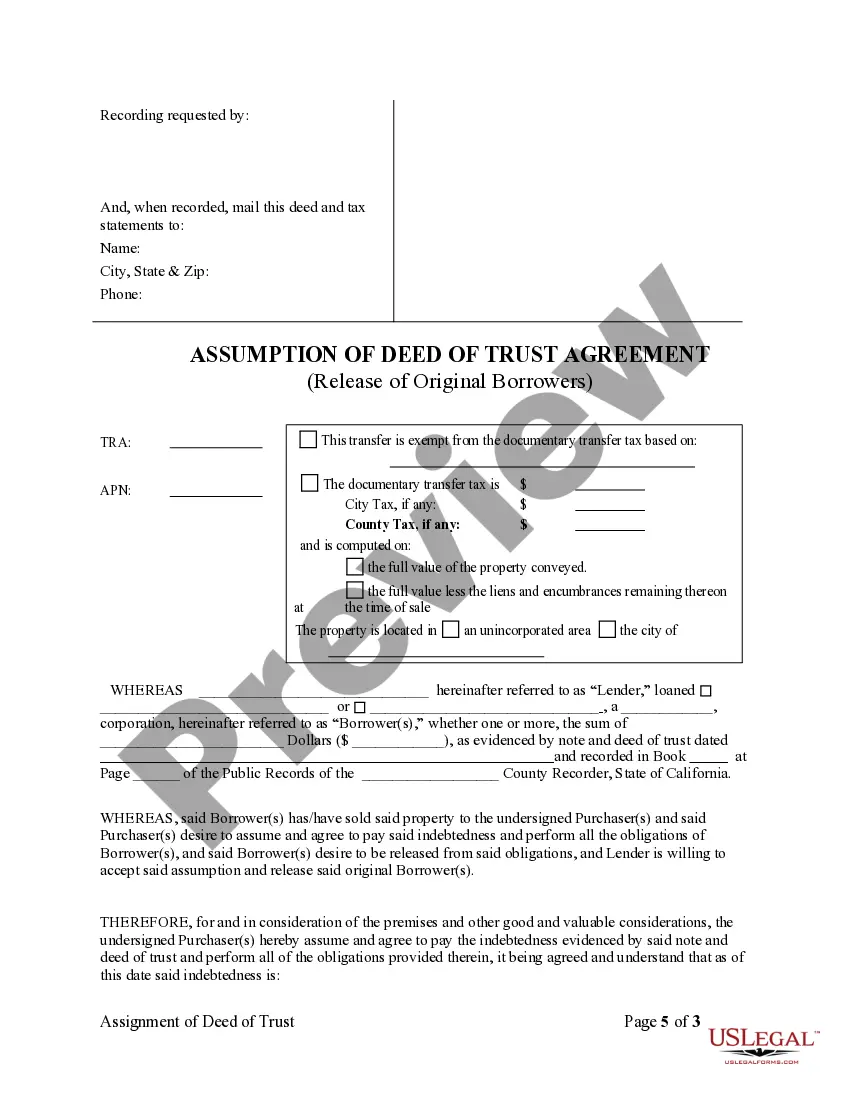

An assumption and release occur when a new borrower takes over the responsibility of an existing mortgage from the original borrower. This process effectively releases the original mortgagors from any liability related to the deed of trust. Understanding the terms of a Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is essential for both parties involved.

A deed of trust may be deemed invalid in California if it is not properly executed or if the necessary parties do not sign it. Additionally, any document that fails to follow the state's recording requirements can also be declared invalid. In the context of a Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, ensuring proper execution is crucial for maintaining the validity of the agreement.

To reconvey a deed of trust in California, you must request a reconveyance deed from the trustee. When dealing with the Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, ensure this document reflects the complete payment of the debt. The trustee will sign and record the reconveyance deed at the county recorder's office, clearing the title and removing the lien from your property. Completing this correctly is essential for your peace of mind.

Transferring a deed to a trust in California involves preparing a new deed that names the trust as the owner. When you're ready to implement the Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, be sure to follow local laws for completing this transfer. You will also need to sign the deed, and then record it with the county recorder’s office. This process protects your property under the trust's terms.

In California, a trust deed does need to be recorded to protect the interests of all parties involved. This recording ensures that the Huntington Beach California Assumption Agreement of Deed of Trust and Release of Original Mortgagors can be enforced, providing legal protection. Recording your trust deed helps maintain a clear chain of title, which is vital for future transactions. To secure your ownership, make sure to follow this important step.