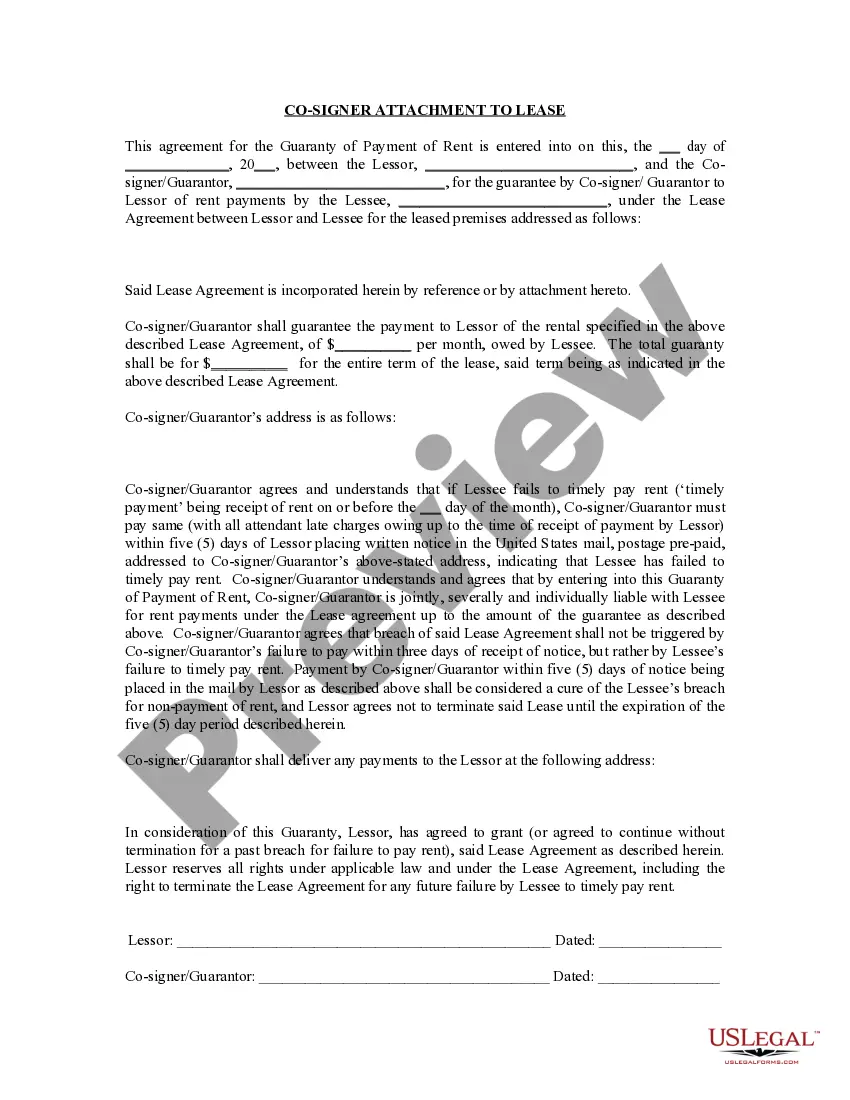

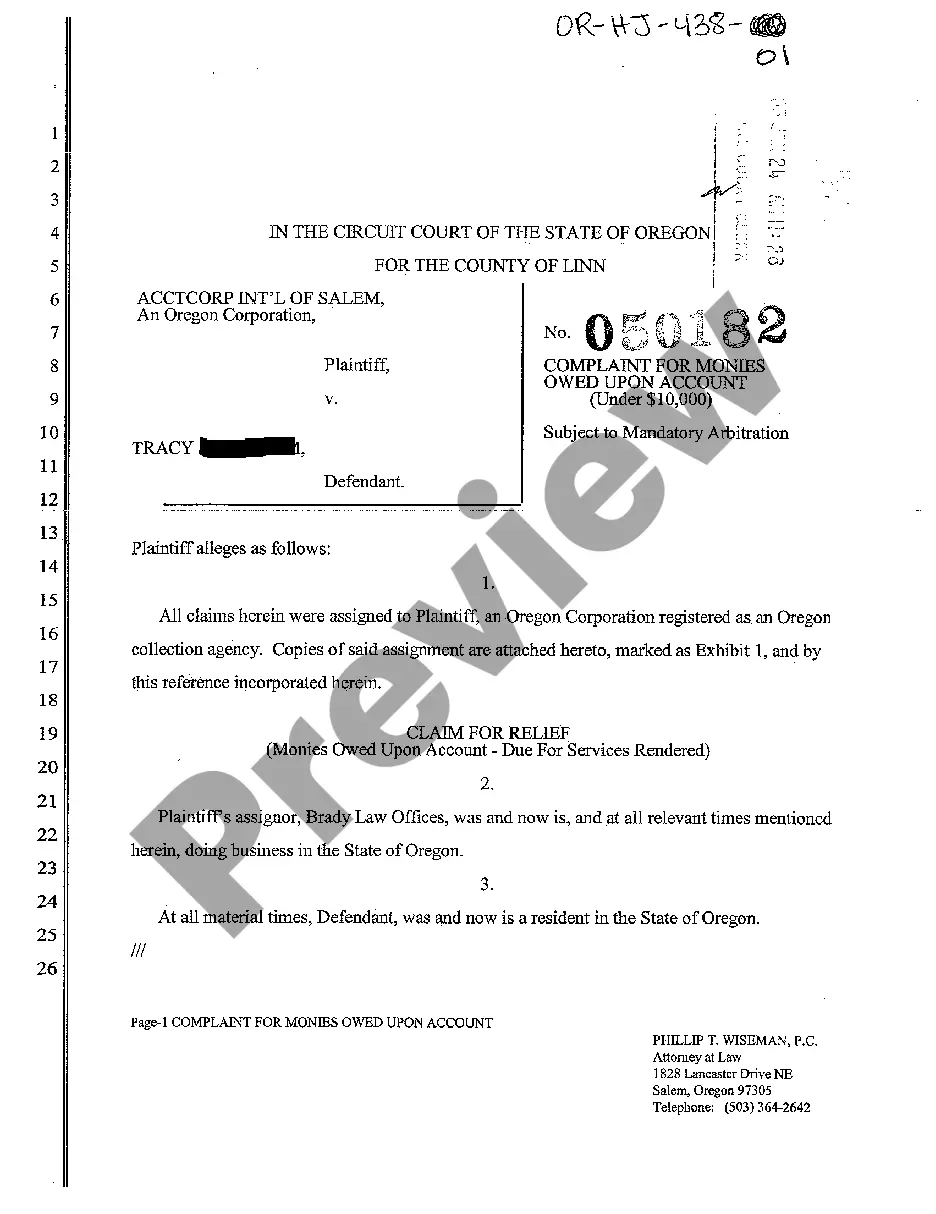

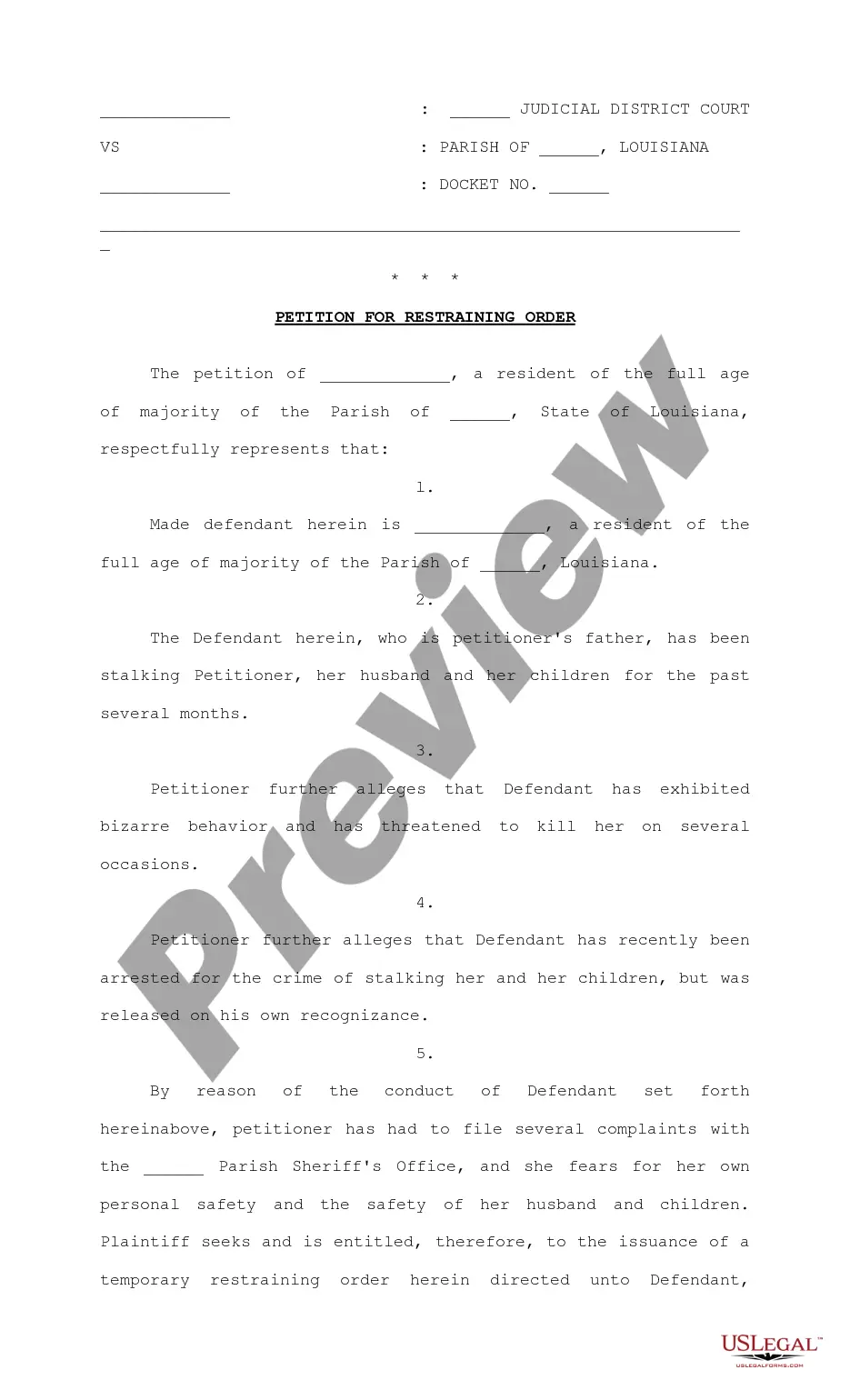

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Simi Valley California Revocation of Living Trust

Description

How to fill out California Revocation Of Living Trust?

If you have previously utilized our service, Log In to your account and retrieve the Simi Valley California Revocation of Living Trust on your device by clicking the Download option.

Ensure your subscription is active. If it is not, renew it based on your payment schedule.

Complete your document. Print it or use professional online editors to fill it in and sign it electronically. You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business purposes!

- Verify you have found a suitable document. Review the description and use the Preview feature, if available, to determine if it fulfills your requirements.

- If it does not meet your needs, utilize the Search tab above to find the right one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Simi Valley California Revocation of Living Trust. Select the file format for your document and store it on your device.

Form popularity

FAQ

The payout rule for trusts varies based on the type of trust and its specific provisions. Generally, it determines when and how beneficiaries receive distributions from the trust assets. For trusts in Simi Valley California, understanding these rules ensures compliance and fair distribution among beneficiaries. Utilizing resources like uslegalforms can provide guidance and templates to help clarify payout rules in your specific situation.

Reversing a living trust primarily involves revoking it, as living trusts are generally revocable. You need to draft a solid revocation document that outlines your wishes to nullify the trust. Additionally, it is wise to inform your beneficiaries and any trustees of this change to avoid confusion moving forward. Considering the implications of Simi Valley California Revocation of Living Trust, you might want to seek assistance from a legal professional.

Irrevocable trusts generally do not fall under the same 5-year rule as revocable trusts. Once an irrevocable trust is established, the grantor typically cannot modify or revoke it, making it less flexible. However, assets transferred into an irrevocable trust may still be considered for estate tax purposes after a certain time period. Checking with estate planning professionals can help you navigate these complex rules, especially related to Simi Valley California Revocation of Living Trust.

To revoke a living trust in California, you must follow specific legal steps to ensure the trust is effectively canceled. First, you need to create a written revocation document that clearly states your intent to revoke the trust. After drafting this document, you should notify all relevant parties, including your trustee and beneficiaries. This process is crucial when dealing with Simi Valley California Revocation of Living Trust to prevent future legal complications.

The 5 year rule for trusts refers to a legal guideline determining the period in which certain assets transferred into a trust may be exempt from estate taxes. In the context of Simi Valley California Revocation of Living Trust, understanding this rule can significantly influence your estate planning decisions. If a trust is revoked within five years of its creation, it may still affect your tax obligations at the time of your death. Consulting with a professional can clarify how this rule pertains to your living trust.

Terminating a trust in California involves either reaching an agreement among the beneficiaries or petitioning the court for termination. You must follow the specific legal framework set out in the state’s trust laws. Taking careful steps ensures a smooth termination process. If you're in Simi Valley, consider accessing resources from USLegalForms to assist you in the termination of a living trust correctly.

To invalidate a trust in California, you need to present evidence proving that the trust does not meet legal requirements. This may involve demonstrating lack of capacity, undue influence, or fraud. Consulting with a legal professional can provide clarity on your options. Using tools from USLegalForms can also help streamline this process during the revocation of living trust in Simi Valley, California.

A revocation of a living trust refers to the legal process of canceling the trust, thereby nullifying any previous arrangements made under that trust. This step allows you to redistribute your assets as needed. Understanding this concept is crucial, especially in Simi Valley, California, where specific local regulations apply. Platforms like USLegalForms can provide guidance and resources to help you navigate this process effectively.

Revoking a living trust in California involves creating a formal revocation document that clearly states your intention to cancel the trust. You must sign this document in front of a notary to ensure its validity. If you established the trust, this task is generally straightforward. For assistance, you can use USLegalForms to obtain templates that simplify the Simi Valley, California revocation of living trust process.

To discharge a trust, you must follow specific steps according to the laws relevant to the trust's terms. You typically need a written agreement from all beneficiaries, along with any required court approval. In Simi Valley, California, working with a legal expert can ensure you follow the proper protocols for the revocation of living trusts. Utilizing platforms like USLegalForms can guide you through this process efficiently.