Fontana California Assignment to Living Trust

Description

How to fill out Fontana California Assignment To Living Trust?

If you’ve previously utilized our service, Log In to your account and download the Fontana California Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it as per your payment structure.

If this is your initial encounter with our service, execute these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to reuse it. Leverage the US Legal Forms service to quickly locate and save any template for your personal or professional necessities!

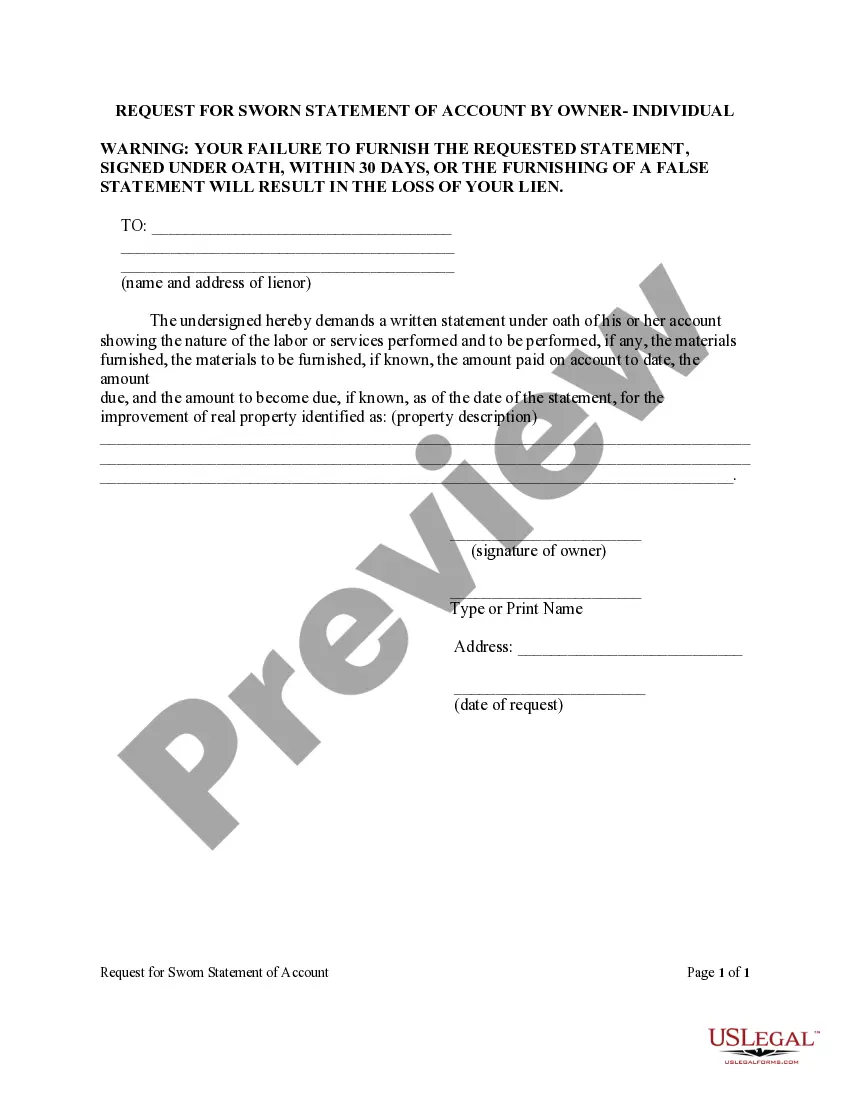

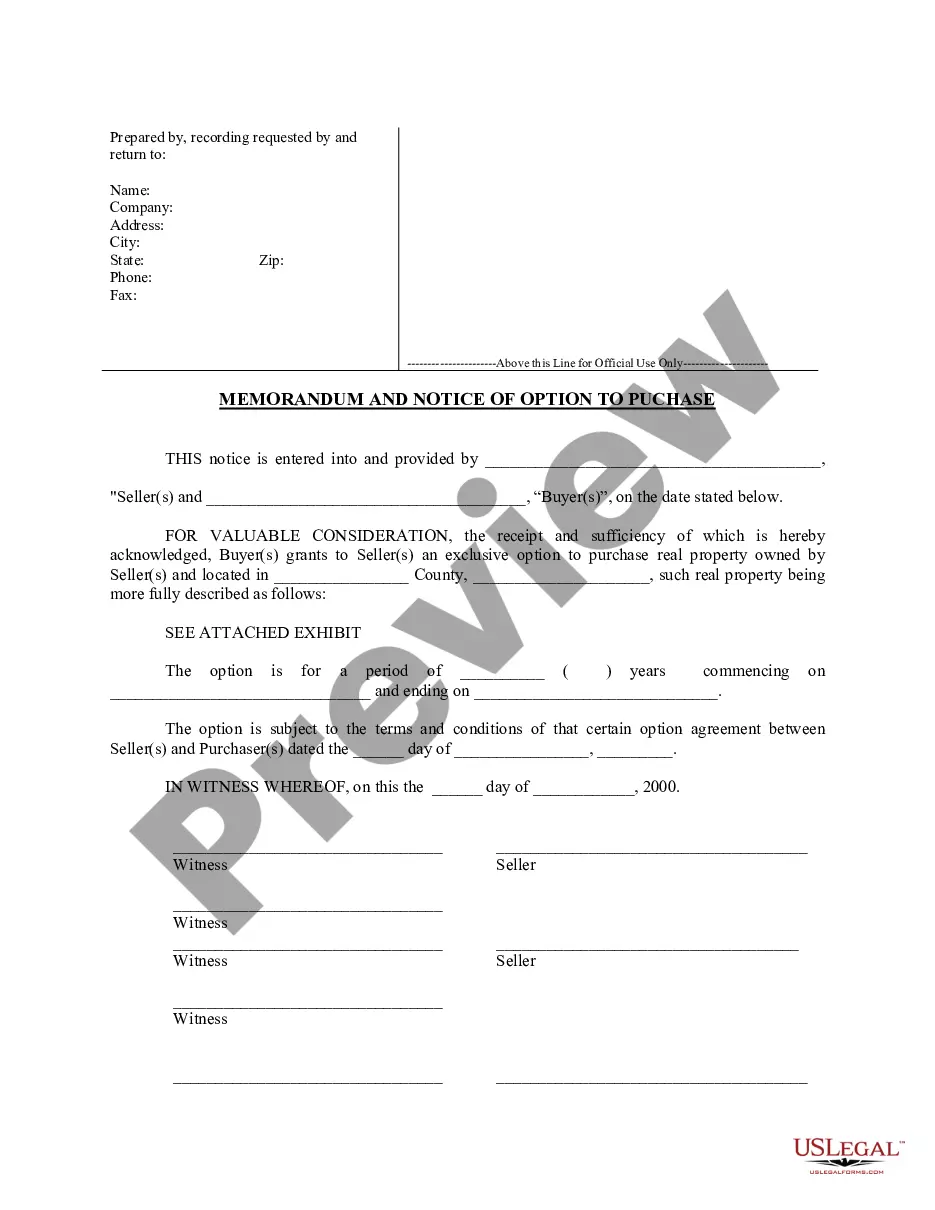

- Ensure you’ve located an appropriate document. Browse the description and utilize the Preview feature, if available, to verify if it satisfies your needs. If it is unsuitable, employ the Search tab above to find the correct one.

- Buy the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process payment. Enter your credit card information or use the PayPal option to finalize the purchase.

- Acquire your Fontana California Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

Transferring property into a trust in California generally does not trigger immediate tax implications, as the property remains subject to your ownership. However, it's important to consider potential estate and gift tax consequences. Moreover, the Fontana California Assignment to Living Trust may help in streamlining the management of these assets, making tax handling more efficient. For personalized advice, consulting a tax professional can provide clarity on your specific situation.

To set up a living trust in California, begin by determining which assets you want to include in the trust. Next, you should create a trust document outlining the terms and conditions of the trust. After that, transfer ownership of your assets into the trust, which is often referred to as Fontana California Assignment to Living Trust. Consider using a platform like uslegalforms for easy templates and legal guidance that simplify the entire process.

Dangers of trust funds can include disputes among beneficiaries over asset distribution and the potential mismanagement of funds by trustees. Additionally, if the trust is not properly structured, it may lead to tax implications or a lack of access to the funds when needed. To minimize these risks, it's advisable to work with professionals who understand Fontana California Assignment to Living Trust regulations and can offer sound guidance.

The negative side of a trust often includes the initial costs involved in setting one up, including legal fees and potential ongoing management expenses. Additionally, trusts can sometimes restrict access to funds, which may frustrate beneficiaries who require immediate financial support. Therefore, it's essential to consider these implications while planning your Fontana California Assignment to Living Trust.

One significant mistake parents make when setting up a trust fund is not clearly defining their goals and the purpose of the trust. Parents may assume their children understand the terms or the reasoning behind the trust, leading to confusion and potential conflicts later. To avoid this, it's vital to communicate openly with beneficiaries and carefully outline the trust's objectives, even if it pertains to Fontana California Assignment to Living Trust considerations.

One common pitfall of setting up a trust is failing to transfer assets into it, which can lead to unintended consequences during estate distribution. Another issue is not updating the trust as life circumstances change, such as marriage, divorce, or the birth of children. It's crucial to regularly review and adjust your trust to align with your wishes, especially when dealing with Fontana California Assignment to Living Trust.

To file a living trust in California, start by drafting the trust document according to state laws. You can use resources from platforms like US Legal Forms for templates and guidance. Next, fund the trust by transferring your assets into it, ensuring that all documentation is complete and correctly signed. Finally, it's advisable to consult an attorney to ensure compliance with all legal requirements relating to Fontana California Assignment to Living Trust.

Yes, you can draft your own living trust in California, but it requires careful attention to details and compliance with state laws. Without proper language and execution, your trust might not serve its intended purpose or could face legal challenges. Utilizing resources like uslegalforms can help ensure that your Fontana California Assignment to Living Trust is correctly written and legally binding.

Another consideration regarding a living trust in California is the lack of certain protections available with a will, such as guardianship for minor children. Furthermore, if you’re not diligent with funding your trust, your assets may remain outside of it, leading to unintended outcomes. To overcome these challenges, working with platforms like uslegalforms can assist you in maintaining a well-organized Fontana California Assignment to Living Trust.

Setting up a living trust in California can typically be completed within a few weeks, depending on your specific situation and the complexity of your assets. The document preparation and the property transfer processes are the main activities that require time. You may find that using uslegalforms accelerates the paperwork, helping you swiftly establish your Fontana California Assignment to Living Trust.