This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Irvine California Living Trust for Husband and Wife with One Child

Description

How to fill out California Living Trust For Husband And Wife With One Child?

If you have previously made use of our service, Log In to your account and download the Irvine California Living Trust for Husband and Wife with One Child onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Make use of the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

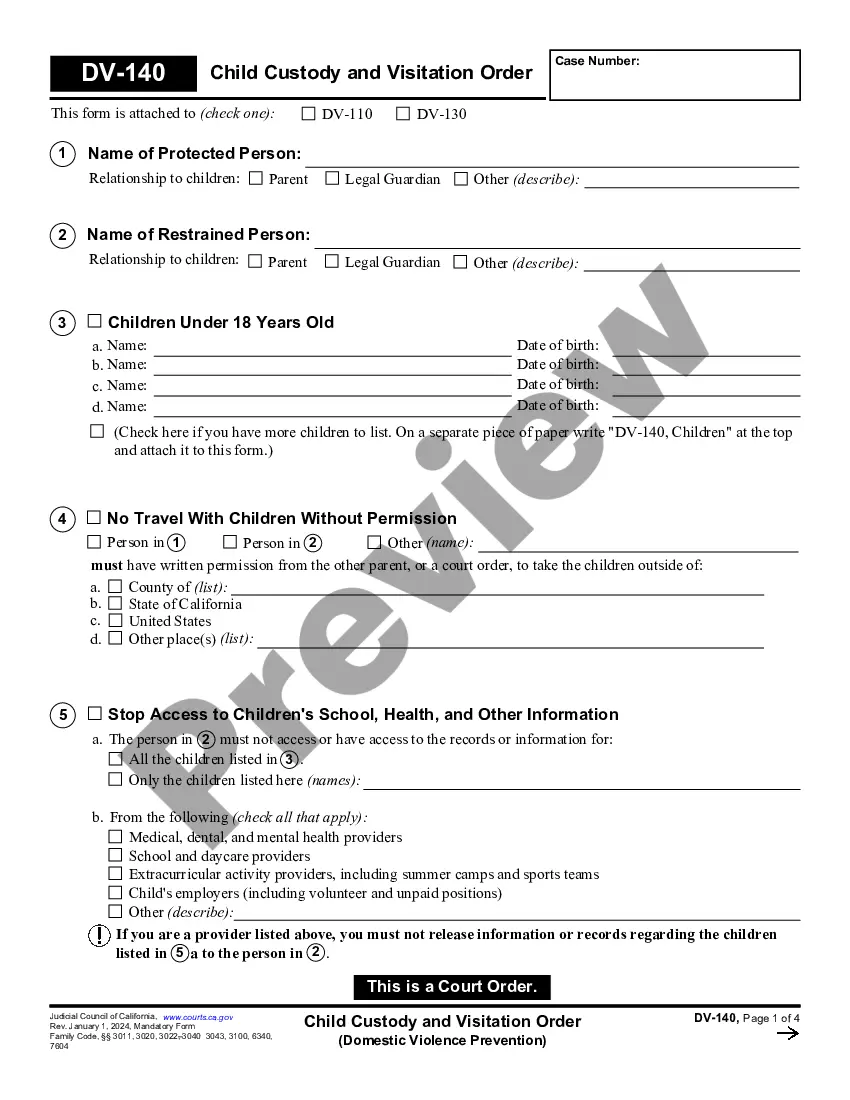

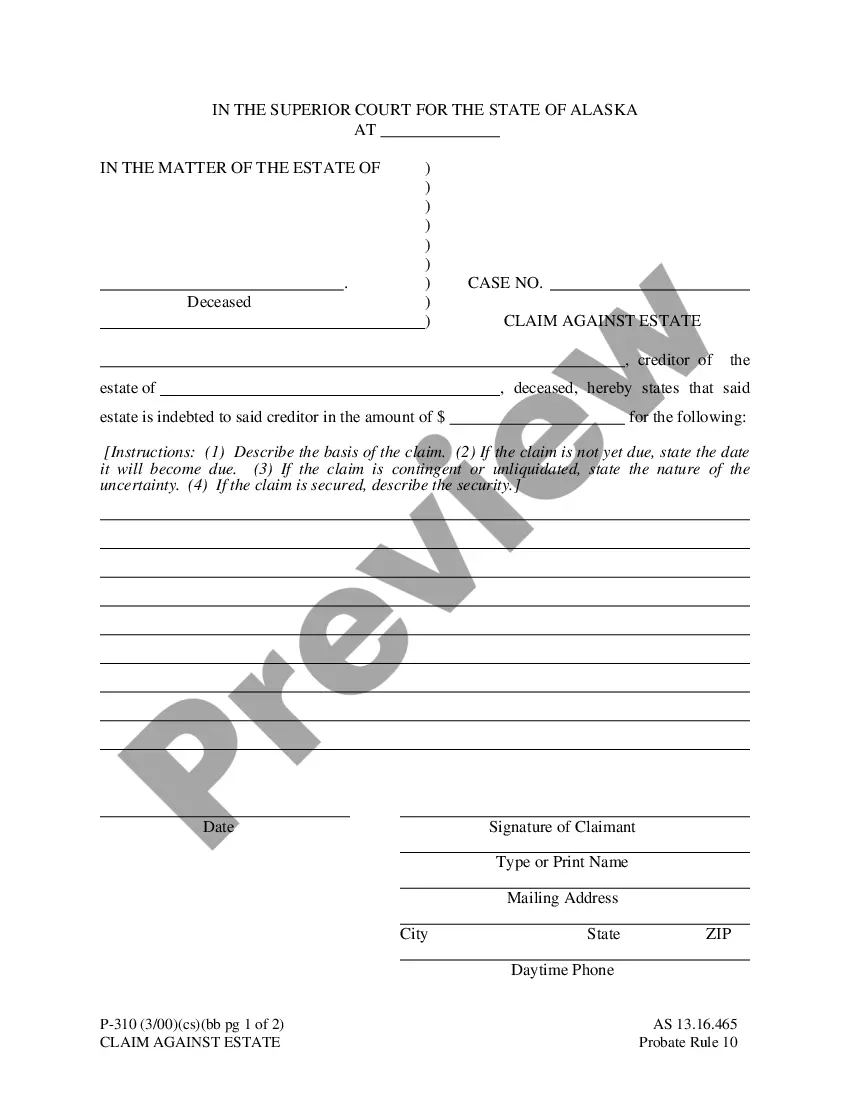

- Ensure you’ve found the correct document. Review the description and use the Preview feature, if available, to verify if it satisfies your requirements. If it doesn’t fit your needs, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Obtain your Irvine California Living Trust for Husband and Wife with One Child. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is failing to fund the trust adequately. An Irvine California Living Trust for Husband and Wife with One Child needs to be funded with the right assets for it to serve its purpose. Inadequate funding can lead to unintended tax consequences and may not provide the financial security intended for beneficiaries.

Yes, you can write your own living trust in California, but it requires careful attention to legal guidelines. An Irvine California Living Trust for Husband and Wife with One Child can be created using templates or online services, but it is wise to consult an attorney to ensure all legal requirements are met. This ensures that the trust is valid and that your wishes will be honored.

The downfall of having a trust can include the complexity of managing it. An Irvine California Living Trust for Husband and Wife with One Child requires careful documentation and compliance with state laws. If the trust is not updated regularly, it may lead to confusion or conflicts among beneficiaries, making it essential to have regular reviews and consultations.

One downside of putting assets in a trust, such as an Irvine California Living Trust for Husband and Wife with One Child, is the loss of direct ownership. Once assets are transferred, the granters may lose some control over the assets, which could be unsettling for some individuals. Furthermore, maintaining the trust requires ongoing attention and may incur fees for management and legal services.

Putting assets in a trust can greatly benefit your parents, especially if they have an Irvine California Living Trust for Husband and Wife with One Child. This type of trust can streamline the transfer of assets and potentially reduce estate taxes. However, it is crucial to evaluate their specific financial situation and future needs before making this decision.

For married couples, an Irvine California Living Trust for Husband and Wife with One Child typically provides an ideal solution for estate planning. This type of trust allows spouses to manage and distribute their assets smoothly while accommodating their child’s needs. It can help to avoid probate, providing peace of mind. To navigate the specific requirements and benefits of your situation, consider using platforms like USLegalForms to streamline the establishment of your trust.

Married couples often wonder if they need separate living trusts. For many, establishing an Irvine California Living Trust for Husband and Wife with One Child can simplify estate planning by consolidating assets. However, separate trusts might be beneficial in certain situations, such as protecting individual assets or ensuring specific distributions. Ultimately, it’s wise to consult a legal professional to weigh the benefits of joint versus separate trusts tailored to your family’s unique needs.

The best living trust for a married couple typically depends on specific family circumstances and goals. An Irvine California Living Trust for Husband and Wife with One Child is highly effective, as it provides for both spouses and ensures seamless transfer of assets to your child. Choosing a reputable platform like uslegalforms can help you create a comprehensive living trust tailored to your needs.

Husbands and wives might choose separate trusts for various reasons, including individual financial situations or estate objectives. Separate trusts can enable one spouse to designate specific beneficiaries, handle debts, or protect assets in case of unforeseen circumstances. This strategy can complement an Irvine California Living Trust for Husband and Wife with One Child by providing additional flexibility.

In many cases, it is beneficial for a husband and wife to have separate living trusts. This approach allows you to tailor each trust to meet specific needs, such as differing asset management strategies or estate planning goals. However, an Irvine California Living Trust for Husband and Wife with One Child can also serve well for joint needs, simplifying management while addressing both partners' wishes.