This Living Trust form is a living trust prepared for your State. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Santa Clarita California Living Trust for Husband and Wife with No Children

Description

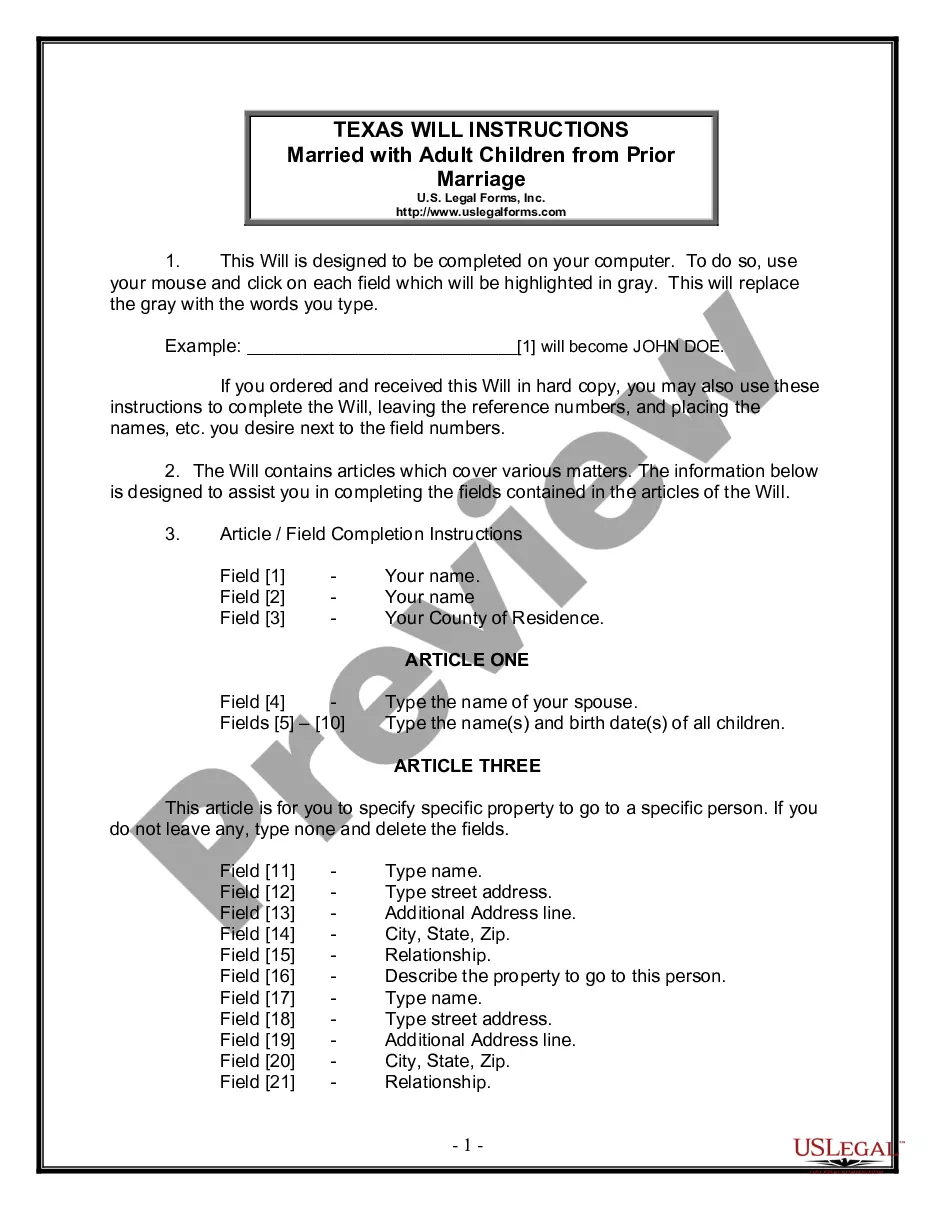

How to fill out California Living Trust For Husband And Wife With No Children?

We consistently endeavor to minimize or evade legal repercussions when managing subtle law-related or fiscal matters.

To achieve this, we seek legal remedies that are often quite costly.

However, not all legal issues are similarly intricate; the majority can be handled by ourselves.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorneys to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button next to it. Should you misplace the form, you can always download it again from within the My documents tab.

- Our platform enables you to manage your issues independently without the necessity of hiring an attorney.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Leverage US Legal Forms whenever you need to obtain and download the Santa Clarita California Living Trust for Husband and Wife with No Children or any other form quickly and securely.

Form popularity

FAQ

You do not need to file a living trust in California with the court. Instead, you should create the trust document and properly fund it by transferring your assets into the trust. It is vital to maintain records of the assets owned by the trust for clarity. If you need assistance, platforms like US Legal Forms can help you navigate the process of establishing a Santa Clarita California living trust for husband and wife with no children.

Yes, you can write your own living trust in California. Many individuals choose this route to save costs and tailor the document to their specific needs. However, it is crucial to ensure that the trust complies with California laws to avoid complications. For peace of mind, consider using platforms like US Legal Forms, which can provide guidance in creating a Santa Clarita California living trust for husband and wife with no children.

In California, a living trust does not need to be recorded. However, it is essential to fund the trust by transferring assets into it. While you do not file the trust with the county recorder, you must keep it in a safe place and provide copies to any involved parties. This ensures that your Santa Clarita California living trust for husband and wife with no children is effective and accessible when needed.

The best living trust for a married couple in Santa Clarita, California, is typically a revocable living trust. This type of trust allows both spouses to manage their assets during their lifetimes and specify how assets will be distributed after death. With a living trust, you can avoid probate, ensuring a smoother transition of property. It's designed to meet the unique needs of husbands and wives, especially those without children.

Even if you are married with no children, a trust can be a valuable tool for managing and protecting your assets. A Santa Clarita California Living Trust for Husband and Wife with No Children can simplify the transfer of property and minimize estate taxes. Additionally, it allows you to specify how you want your assets distributed if something happens to both of you. This strategy can safeguard your estate and provide clarity for your spouse.

In California, a trust can last for a very long time, often up to 21 years after the death of the last surviving beneficiary. This means that if you create a Santa Clarita California Living Trust for Husband and Wife with No Children, you can ensure your assets are managed and distributed according to your wishes for decades. It offers peace of mind knowing that your estate will be handled even in the distant future. With careful planning, you can set terms that fit your needs.

The time to set up a living trust in California can vary based on your situation. On average, establishing a Santa Clarita California Living Trust for Husband and Wife with No Children may take a few weeks from start to finish. This includes drafting the documents, funding the trust, and ensuring that all legal requirements are met. To streamline the process, consider using platforms like uslegalforms, which can help guide you through the necessary steps efficiently.

While a living trust offers benefits like avoiding probate, there are some downsides. Setting up a Santa Clarita California Living Trust for Husband and Wife with No Children can involve upfront costs and paperwork. Additionally, if you do not fund your trust properly or keep it updated, it may not provide the intended benefits. Always weigh these factors and seek guidance to navigate the process effectively.

In California, marriage does not automatically override a trust. If you create a Santa Clarita California Living Trust for Husband and Wife with No Children, this trust remains valid despite your marriage. However, it is wise to review and possibly amend your trust after marriage to reflect your new circumstances. Always consider consulting a legal professional to ensure your trust aligns with your current wishes.

A handwritten living trust, also known as a holographic trust, can be legal in California if it meets certain criteria. The handwriting must be that of the trust's creator, and the document must clearly express the intent to create a trust. However, relying solely on a handwritten document can lead to complications and disputes among beneficiaries. For a dependable solution, consider using uslegalforms to set up your Santa Clarita California Living Trust for Husband and Wife with No Children correctly.