This Living Trust form is a living trust prepared for your State. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Carlsbad California Living Trust for Husband and Wife with No Children

Description

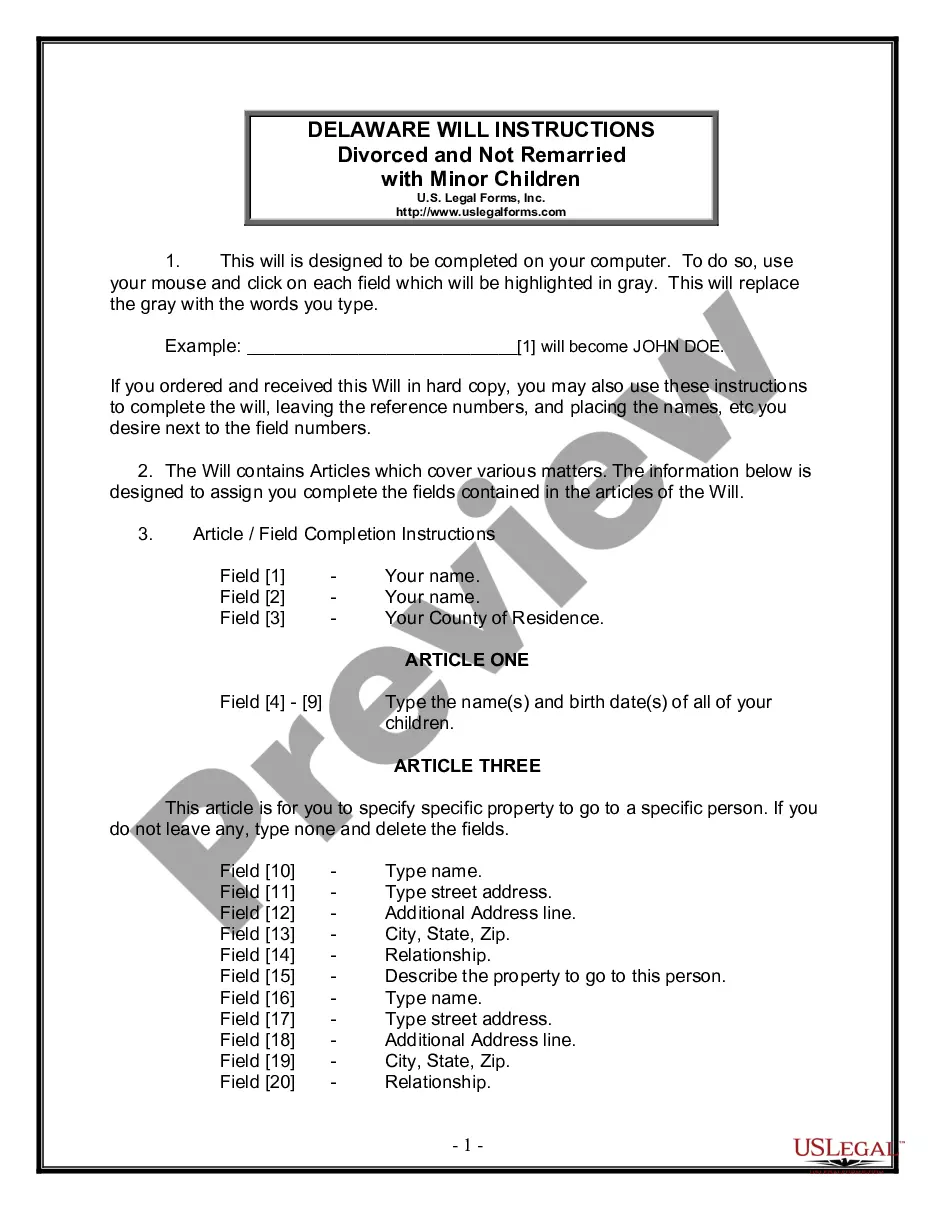

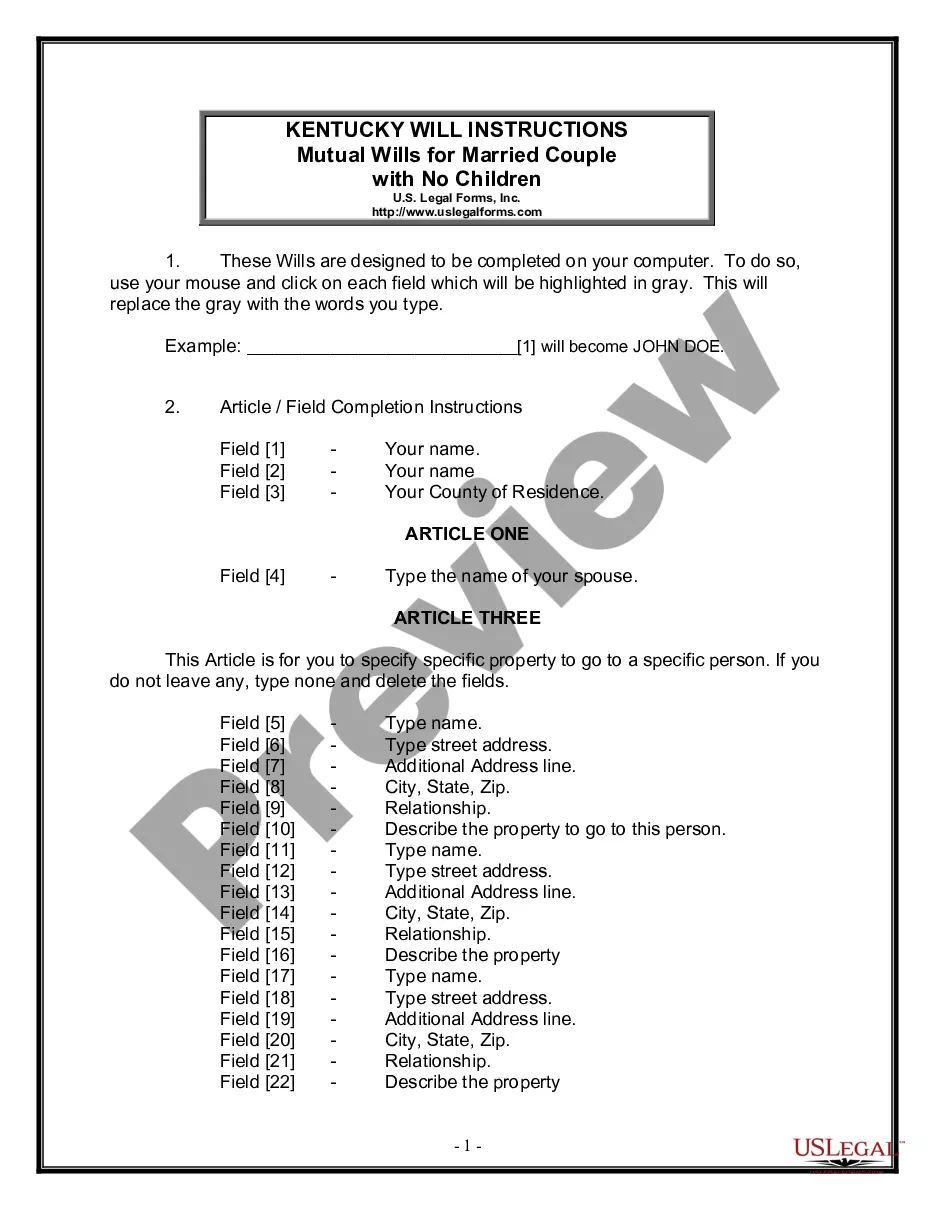

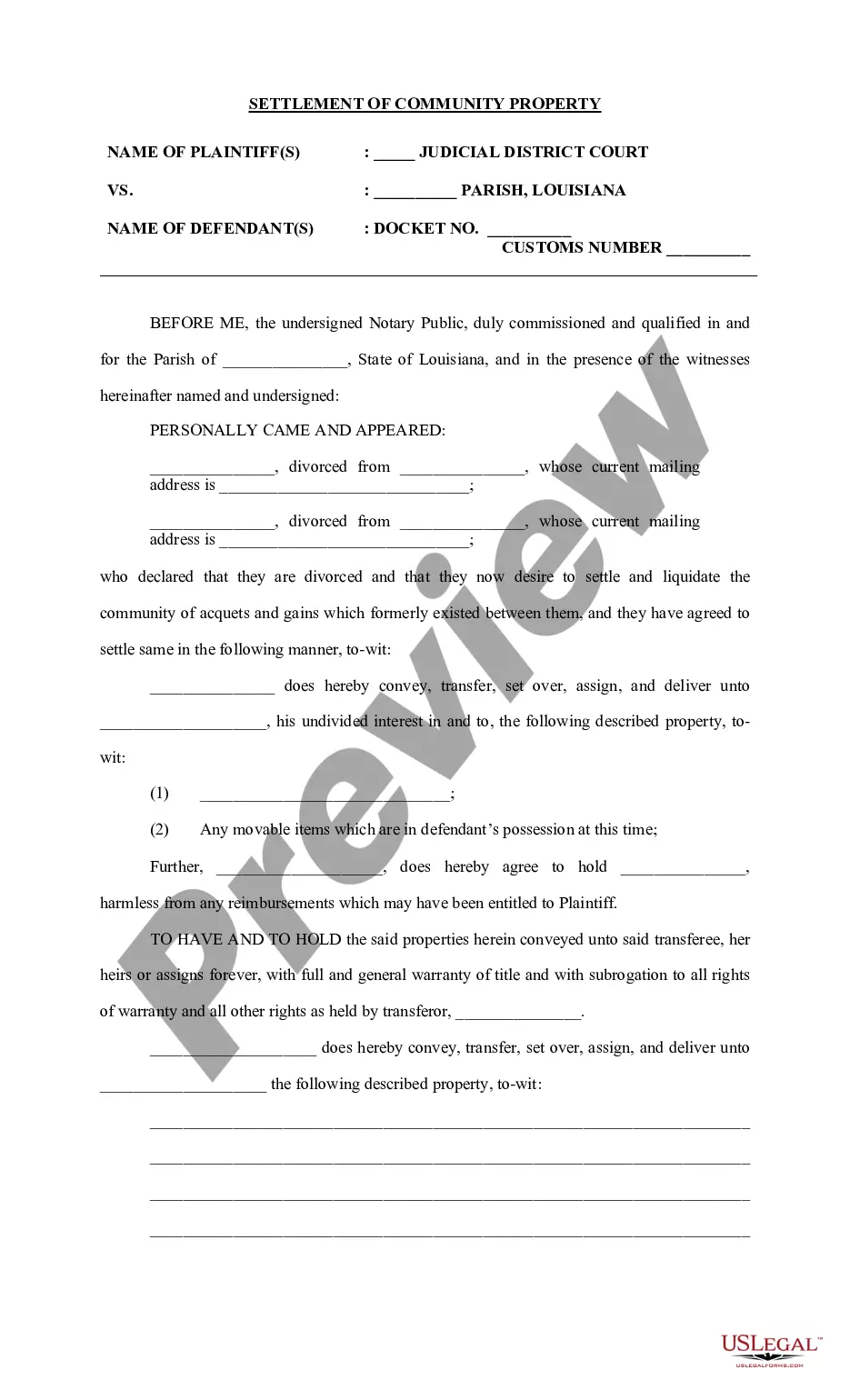

How to fill out California Living Trust For Husband And Wife With No Children?

If you have previously utilized our service, Log In to your account and download the Carlsbad California Living Trust for Husband and Wife with No Children to your device by selecting the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your first encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to each document you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or business requirements!

- Confirm you’ve found the right document. Review the description and use the Preview function, if available, to determine if it fulfills your needs. If it does not meet your expectations, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Carlsbad California Living Trust for Husband and Wife with No Children. Select the file type for your document and save it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it in and sign electronically.

Form popularity

FAQ

One disadvantage of a family trust is the complexity involved in asset management. Family dynamics can also complicate the trust’s effectiveness if not properly addressed. Regular communication and updates are essential to maintain clarity. Choosing a Carlsbad California Living Trust for Husband and Wife with No Children can streamline this process and provide peace of mind.

A handwritten living trust can be legal in California, provided it meets specific legal criteria. However, challenges may arise regarding its validity if not executed properly. For added security and clarity, consider using a professionally designed framework like the Carlsbad California Living Trust for Husband and Wife with No Children.

Yes, individuals can write their own living trust in California. The process is straightforward with the right resources at hand. Just be sure to follow the legal requirements to ensure validity and enforceability. A Carlsbad California Living Trust for Husband and Wife with No Children can help simplify the process and ensure your intentions are clear.

It may be beneficial for your parents to consider putting their assets in a trust. This can help manage their estate, avoid probate, and provide clear directives for asset distribution. Each situation varies, so it’s advisable to consult with a professional for tailored advice. A Carlsbad California Living Trust for Husband and Wife with No Children is a great option to consider.

While trusts offer many benefits, one downside is the potential loss of control over assets. Once assets are placed in a trust, they are managed by the trustee, making personal access more complicated. Furthermore, setting up a trust can incur costs and legal fees. However, a well-structured Carlsbad California Living Trust for Husband and Wife with No Children can mitigate many concerns.

One of the biggest mistakes is failing to communicate the details of the trust with family members. Clear communication helps prevent misunderstandings and conflicts. Additionally, not updating the trust regularly can create issues when circumstances change. To ensure peace of mind, consider exploring options like the Carlsbad California Living Trust for Husband and Wife with No Children.

Placing your home in a Carlsbad California Living Trust for Husband and Wife with No Children can provide several benefits. It helps avoid probate, ensuring a smoother transfer of property upon death. This action can also provide privacy, as trusts are not public records like wills. By doing this, you ensure that your wishes regarding your home are respected without delay.

A Carlsbad California Living Trust for Husband and Wife with No Children offers many advantages, but it’s important to recognize some downsides. Establishing a living trust can involve initial costs for creation and funding. Additionally, trust assets may still be subject to certain taxes upon death. Understanding these factors will help you make informed decisions.

When considering a Carlsbad California Living Trust for Husband and Wife with No Children, it is essential to evaluate your individual needs. A joint trust can simplify management and distribution of assets. However, separate trusts might offer more tailored control over personal assets and specific wishes. Consulting a legal expert can help you decide the best approach.

A significant downside of a living trust in California, specifically a Carlsbad California Living Trust for Husband and Wife with No Children, is that it does not protect assets from creditors. While a living trust bypasses probate, it does not offer the same level of protection as other asset management strategies may provide. Moreover, the creation and maintenance of the trust require attention to detail, which can be cumbersome for some. Seeking guidance from platforms like uslegalforms can simplify this process.