The dissolution of a corporation package contains all forms to dissolve a corporation in California, step by step instructions, addresses, transmittal letters, and other information.

Irvine California Dissolution Package to Dissolve Corporation

Description

How to fill out California Dissolution Package To Dissolve Corporation?

Do you require a trustworthy and affordable provider of legal documents to obtain the Irvine California Dissolution Package for Dissolving a Corporation? US Legal Forms is your ideal choice.

Whether you seek a simple agreement to establish rules for living together with your partner or a collection of forms to facilitate your divorce proceedings, we've got you covered. Our platform features over 85,000 current legal document templates for both personal and business purposes. All the templates we provide are not generic; they are tailored to the specific needs of various states and regions.

To access the document, you must Log In, find the requisite template, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired document templates anytime in the My documents section.

Is this your first time on our platform? No problem. You can create an account swiftly, but before you proceed, ensure you do the following.

You can now establish your account. After that, choose a subscription plan and move on to payment. Once the payment is finalized, download the Irvine California Dissolution Package for Dissolving a Corporation in any supported file format. You can return to the website anytime and redownload the document at no extra cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and put an end to wasting your precious time searching for legal documentation online once and for all.

- Check if the Irvine California Dissolution Package for Dissolving a Corporation complies with the laws of your state and locality.

- Review the form's description (if available) to determine its intended use and suitability.

- Initiate the search process again if the template is not appropriate for your unique situation.

Form popularity

FAQ

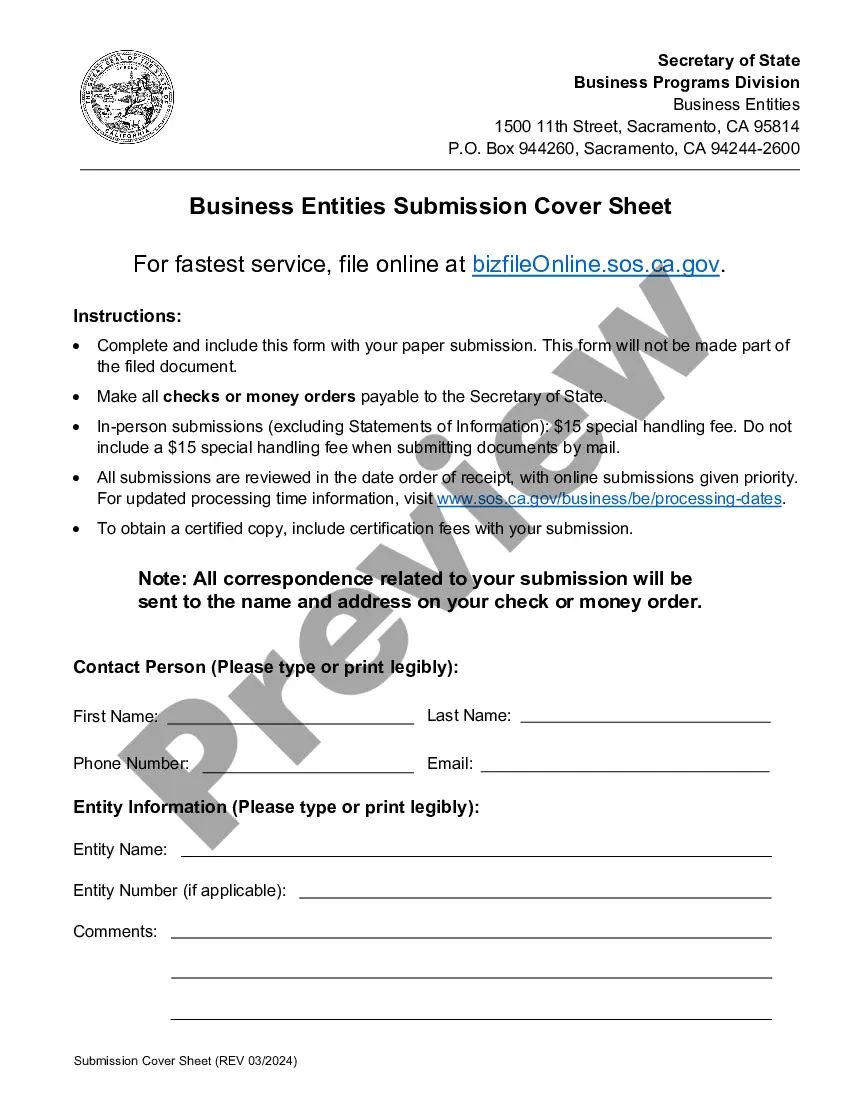

Filing for dissolution of a corporation in California requires you to prepare specific documents such as the Articles of Dissolution. After gathering these documents, file them with the California Secretary of State. To facilitate this process, you can utilize the Irvine California Dissolution Package to Dissolve Corporation from uslegalforms, which offers clear instructions and essential forms to help you navigate the dissolution smoothly.

To file for corporate dissolution in California, begin by completing the necessary paperwork, including the Certificate of Dissolution. The next step involves submitting this form to the California Secretary of State, along with any required fees. To simplify the process, consider using the Irvine California Dissolution Package to Dissolve Corporation provided by uslegalforms. This package serves as a comprehensive resource, guiding you through each step seamlessly.

The initial step to terminate a corporation in California involves obtaining and completing the Articles of Dissolution form from the Secretary of State. This document signals your intent to dissolve your corporation and must be filed correctly. Utilizing the Irvine California Dissolution Package to Dissolve Corporation can simplify this process by providing you with all the necessary forms and detailed instructions. Taking this step ensures a smooth transition during your corporation's dissolution.

To dissolve a California corporation, you need to start by filing the necessary paperwork with the California Secretary of State. You will also need to settle any outstanding debts and obligations before completing the process. Once you have submitted the required forms, you can obtain the Irvine California Dissolution Package to Dissolve Corporation for guidance. This package ensures you follow all legal steps and helps streamline your dissolution efficiently.

To dissolve your corporation in California, you need to file the appropriate forms with the Secretary of State. Begin by completing the forms included in the Irvine California Dissolution Package to Dissolve Corporation for a simplified process. This package also provides you with step-by-step instructions to assist you in fulfilling all requirements, ensuring a smooth dissolution.

You should mail your certificate of dissolution to the California Secretary of State's office. It is crucial to send your documents to the correct address to avoid any delays. The Irvine California Dissolution Package to Dissolve Corporation provides accurate mailing instructions to ensure your submission is handled promptly.

The timeframe to dissolve a company in California typically ranges from a few weeks to several months. Factors like the method of submission and any outstanding obligations can influence this duration. Using the Irvine California Dissolution Package to Dissolve Corporation can streamline the process and help you manage timelines more effectively.

Yes, you can dissolve a California corporation online. The process involves submitting the required forms to the California Secretary of State's website. By using the Irvine California Dissolution Package to Dissolve Corporation, you can easily navigate through this process and ensure all necessary documentation is correctly completed.

To terminate a corporation, the first step involves convening a meeting to seek approval from the board and shareholders on the decision to dissolve. This meeting should focus on discussing the reasons for the dissolution and the next steps required. Following this approval, it’s crucial to file the Irvine California Dissolution Package to Dissolve Corporation, which provides all the essential forms and guidance needed for a successful termination. Using this package simplifies the process and helps avoid any legal complications.

The first step in terminating a corporation is to hold a formal meeting with the board of directors and shareholders. This meeting will discuss the decision to dissolve the corporation and require a vote to approve the dissolution. After obtaining approval, the next step is to prepare and file the necessary documents, which often includes the Irvine California Dissolution Package to Dissolve Corporation. This package outlines all the legal requirements and helps ensure a smooth and compliant dissolution process.