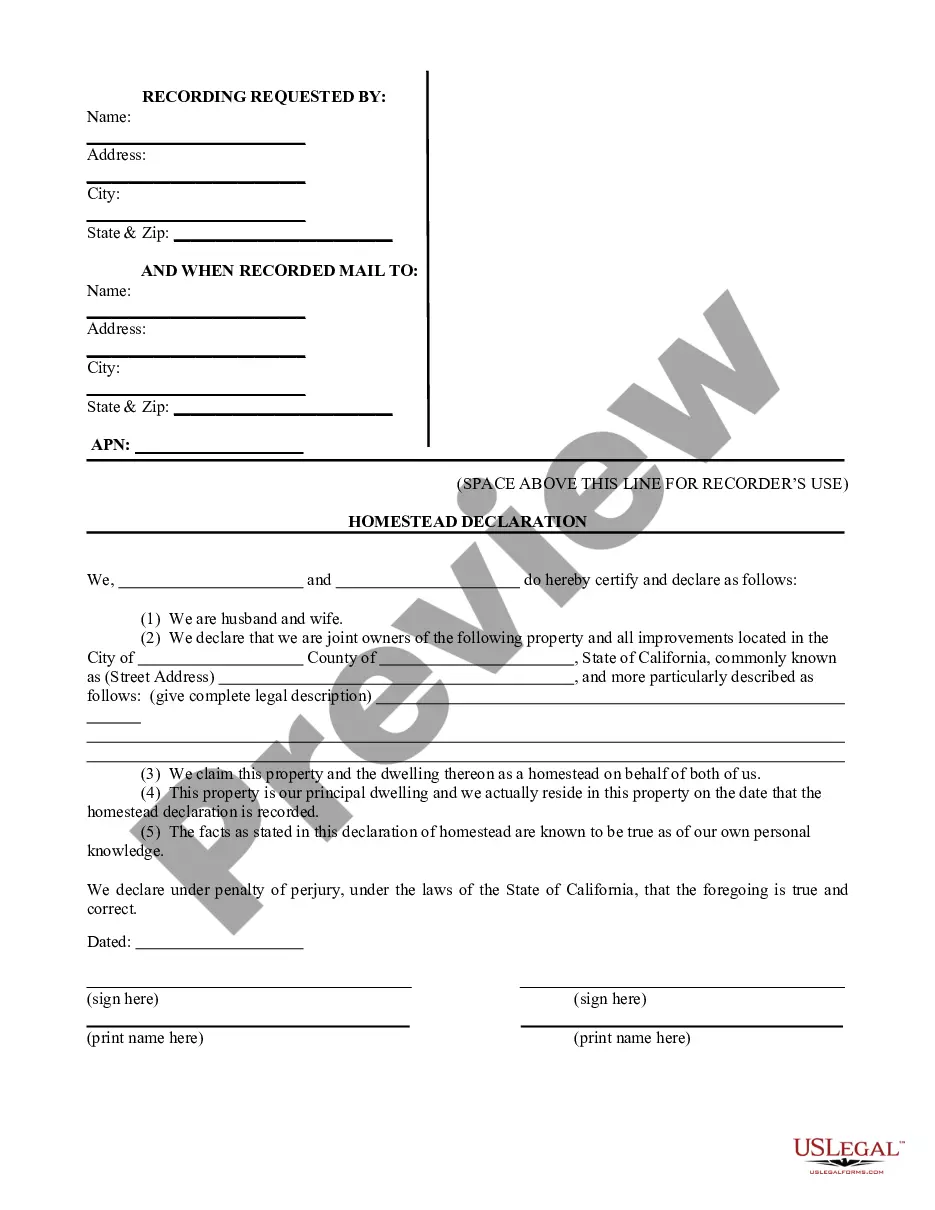

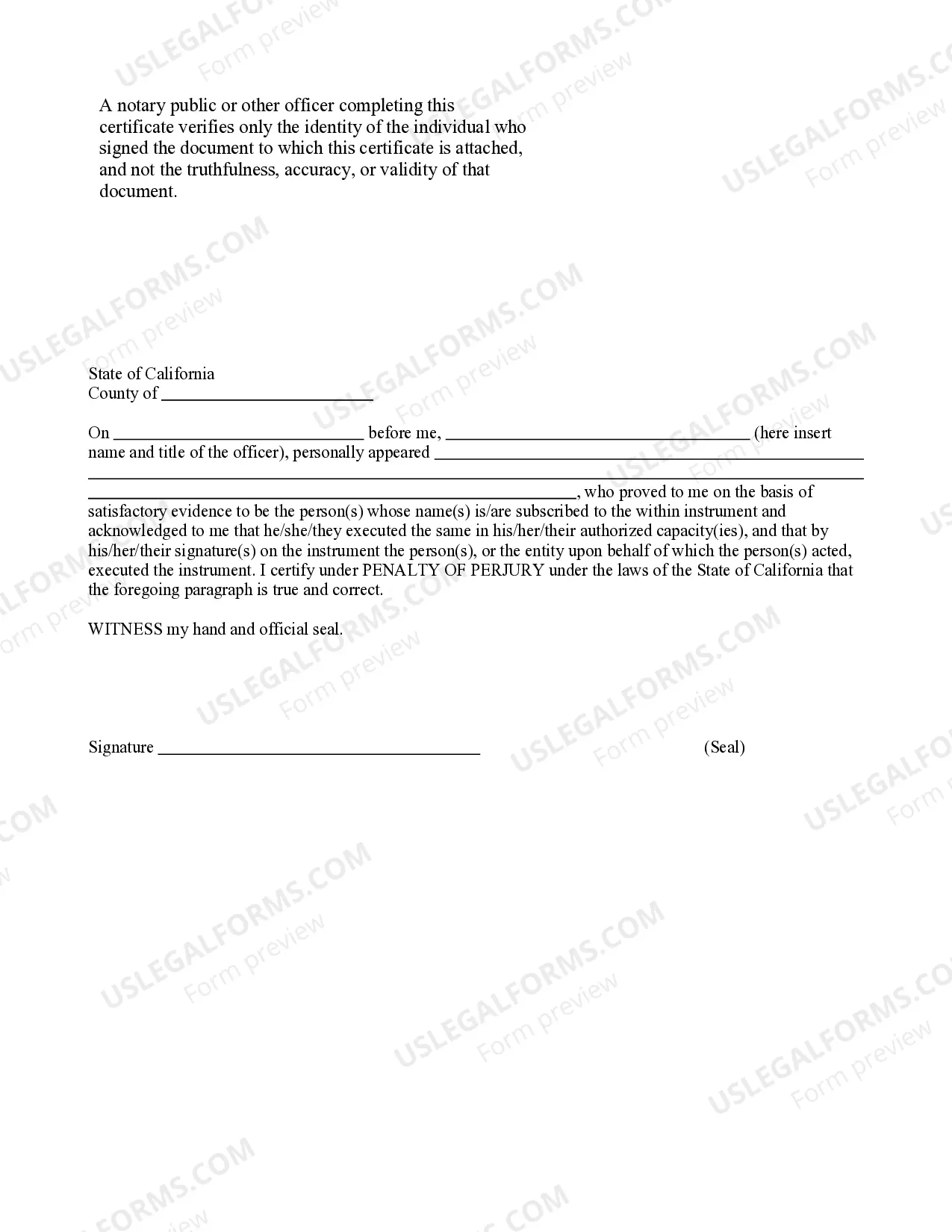

Use this form to file a declared homestead as a married couple at the County Recorder's Office in the county where the property is located.

San Jose California Homestead Declaration for Husband and Wife

Description

How to fill out California Homestead Declaration For Husband And Wife?

If you are looking for an authentic document, it’s unfeasible to pick a more suitable platform than the US Legal Forms website – one of the most comprehensive online collections.

Here you can obtain thousands of form examples for corporate and personal purposes sorted by categories and states, or keywords.

With our top-notch search feature, locating the latest San Jose California Homestead Declaration for Husband and Wife is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the document. Select the file format and save it on your device. Edit. Fill out, alter, print, and sign the acquired San Jose California Homestead Declaration for Husband and Wife.

- Moreover, the validity of each and every document is assured by a team of experienced attorneys who routinely examine the templates on our site and refresh them according to the latest state and county laws.

- If you are already acquainted with our platform and possess a registered account, all you need to do to acquire the San Jose California Homestead Declaration for Husband and Wife is to sign in to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have located the sample you are after. Review its description and utilize the Preview feature (if accessible) to examine its content. If it doesn’t fulfill your requirements, use the Search bar at the top of the screen to find the appropriate document.

- Confirm your selection. Choose the Buy now button. Subsequently, select your desired subscription plan and submit your information to register for an account.

Form popularity

FAQ

If you are sued in court and lose, the person who sued you may try to force the sale of your home to collect their money. A homestead makes it harder for them to do this. A homestead protects some of the equity in your home.

However, to be eligible for the homestead exemption, the owner must be a permanent resident of Florida and have a present intent of living at the property. Additionally, the owner must apply for the exemption. Generally, a married couple is entitled to only one homestead exemption.

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

In California, everyone who owns a home and lives in it is allowed to claim a homestead exemption, as SFGate reports: Single homeowners receive a $75,000 equity exemption. A head of household receives a $100,000 equity exemption.

A person can only have one permanent homestead. Therefore, a person who still lives primarily in another state or country cannot form the required intent to qualify for the Florida homestead protection. A person may maintain a second residence in another state as long as the Florida house is their primary home.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

The homestead estate is designed to protect home ownership from execution and forced sale, so long as the owner or covered family member occupies or intends to occupy the property as his or her principal place of residence.

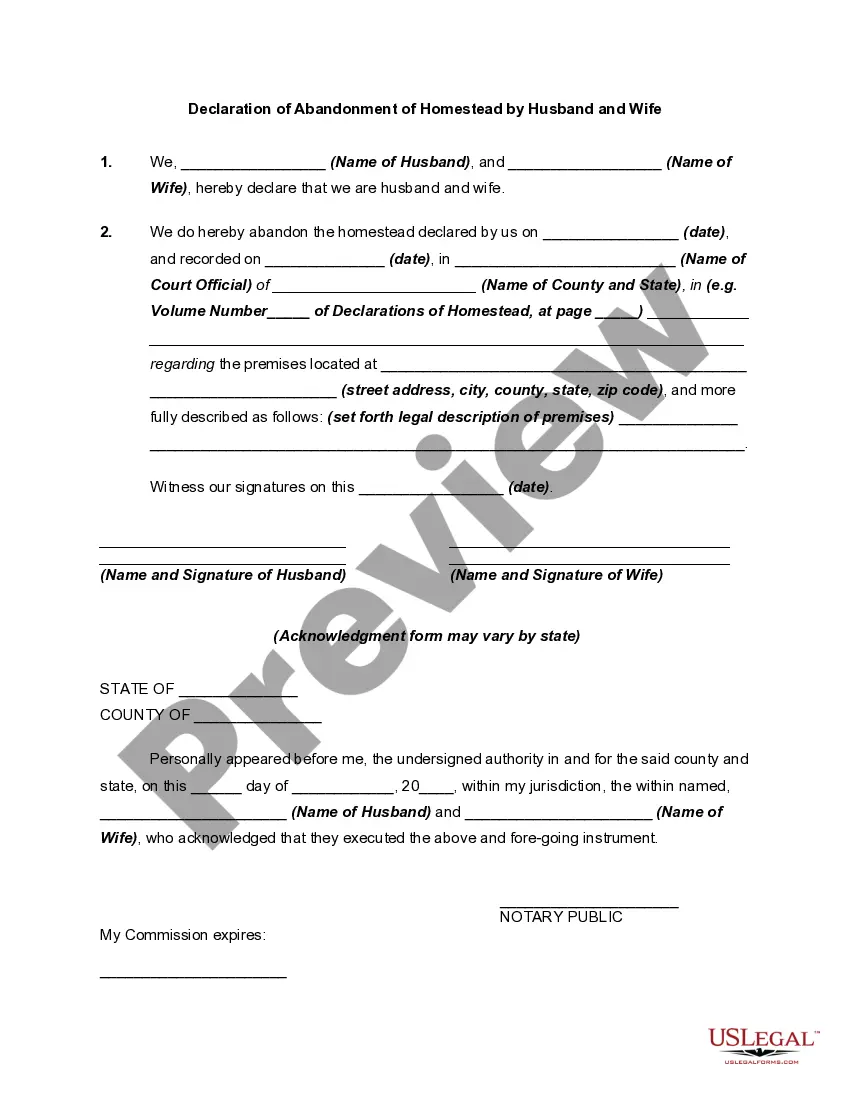

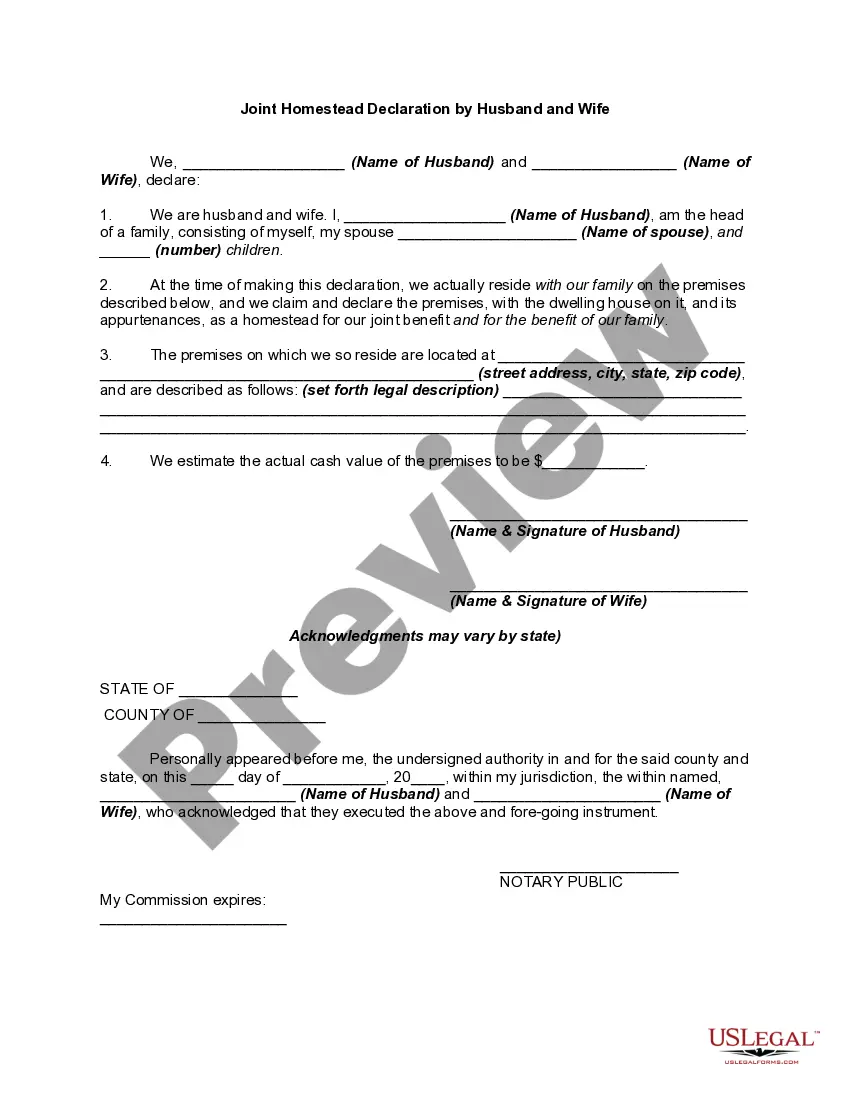

Now, in case you're wondering how you can ensure a homestead exemption applies to your home, you should know that there are two types: automatic and declared homestead exemptions.

A homestead exemption protects home equity from a homeowner's creditors, up to a certain dollar amount. Collectors cannot acquire any funds within this amount to settle past-due debt. This applies if you file for bankruptcy or you experience financial difficulties after a divorce or your spouse passes away.

A homestead declaration is a legal document that claims and registers a particular house as the owner's homestead or principle dwelling. This document helps to protect the house against loss to creditors.