Use this form to file a declared homestead as a married couple at the County Recorder's Office in the county where the property is located.

Pomona California Homestead Declaration for Husband and Wife

Description

How to fill out California Homestead Declaration For Husband And Wife?

Obtaining authenticated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both personal and professional requirements and various real-life situations.

Every document is systematically organized by usage area and jurisdiction, making it as straightforward as pie to find the Pomona California Homestead Declaration for Husband and Wife.

Submit your credit card information or utilize your PayPal account to finalize the payment for the service.

- Review the Preview mode and form details.

- Ensure you have selected the correct one that fulfills your requirements and completely aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your criteria, proceed to the next step.

- Obtain the document.

Form popularity

FAQ

Waiving homestead rights involves giving up the legal protections offered by a homestead declaration. This could happen through legal agreements or certain financial arrangements that prevent the homeowner from claiming exemption benefits. It's crucial to understand how this might affect your Pomona California Homestead Declaration for Husband and Wife, especially if you're considering joint ownership.

In Massachusetts, the homestead exemption allows homeowners to protect up to $500,000 of home equity from creditors. However, this exemption can vary depending on specifics and may be higher for seniors or disabled individuals. While this may not directly relate to the Pomona California Homestead Declaration for Husband and Wife, knowing how exemptions work can inform your decisions.

Homestead refers to a legal designation that offers property protections to homeowners against creditors. It often involves the residence used by a family, and it secures their home from being sold to satisfy debts. Understanding the Pomona California Homestead Declaration for Husband and Wife can help solidify your rights to your family home.

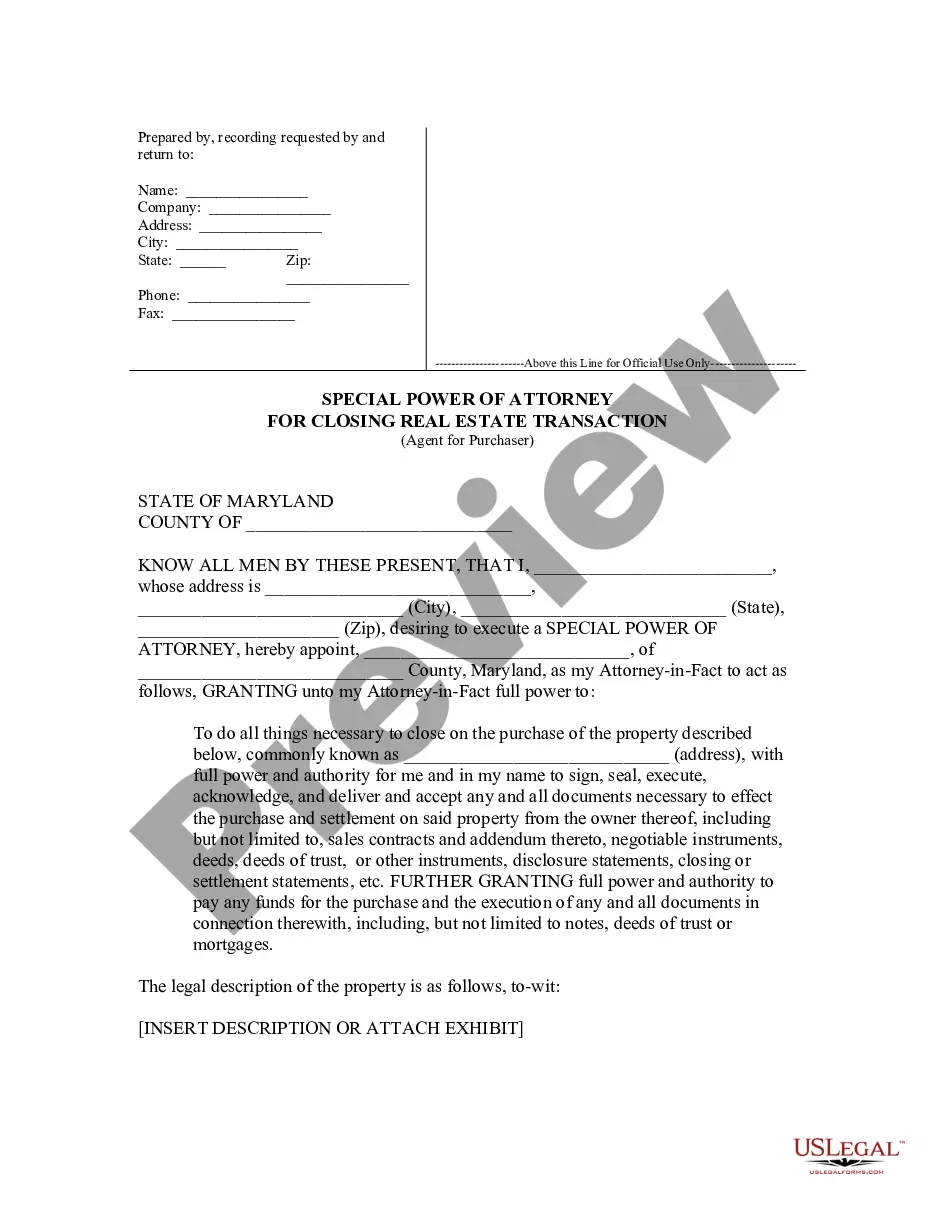

To declare homestead in California, you need to file a homestead declaration form with your local county recorder's office. This process is straightforward and can typically be completed online or in person at the office. By filing the Pomona California Homestead Declaration for Husband and Wife, you can ensure that both partners benefit from the protections offered.

Homestead exemptions can be highly beneficial as they protect a portion of the homeowner's equity from creditors. They provide peace of mind for homeowners, ensuring that you and your spouse can maintain your home despite financial challenges. In the context of the Pomona California Homestead Declaration for Husband and Wife, these exemptions help safeguard your joint property investment.

To qualify for a homestead exemption in California, you need to be the owner of the property and reside there as your main home. The Pomona California Homestead Declaration for Husband and Wife is essential for married couples wishing to secure these protections together. Filing the declaration with the county ensures that your property is recognized and protected. Taking the time to understand the qualification process helps you make informed decisions.

In California, property taxes do not automatically stop at a specific age; rather, a senior citizen exemption offers significant savings. Homeowners aged 62 or older may qualify for this exemption, which can reduce their property tax burden. Additionally, the Pomona California Homestead Declaration for Husband and Wife can provide further financial relief. Staying informed on these age-related benefits can help you plan for your future.

Eligibility for a homestead exemption in California includes homeowners who reside in the property as their primary residence. For couples, filing a Pomona California Homestead Declaration for Husband and Wife ensures both parties benefit from the exemption. Those who meet certain criteria, such as age or disability status, may also qualify for additional protections. Understanding these criteria helps you maximize your home's safety.

In California, homestead protection is not automatic. To secure the benefits of a Pomona California Homestead Declaration for Husband and Wife, couples must file a declaration with their county. This declaration protects a portion of their home's equity from creditors. Knowing this allows couples to take the necessary steps to secure their assets.

The second type of homestead exemption in California, alongside the automatic homestead exemption, is the declared homestead exemption. This option requires you to file the appropriate paperwork, like the Pomona California Homestead Declaration for Husband and Wife, to receive enhanced protection for your home equity. Understanding both types helps couples decide which is best suited for their unique situation.