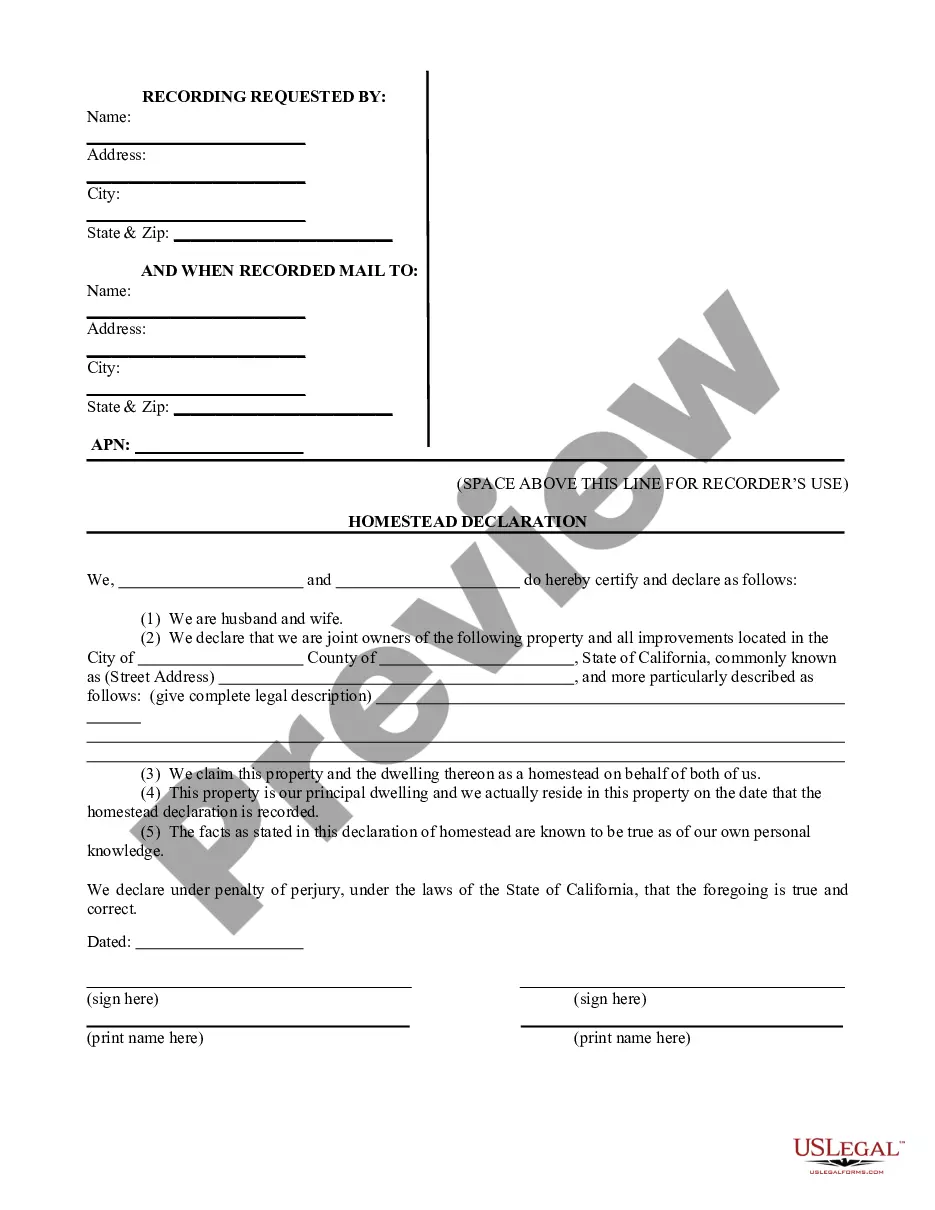

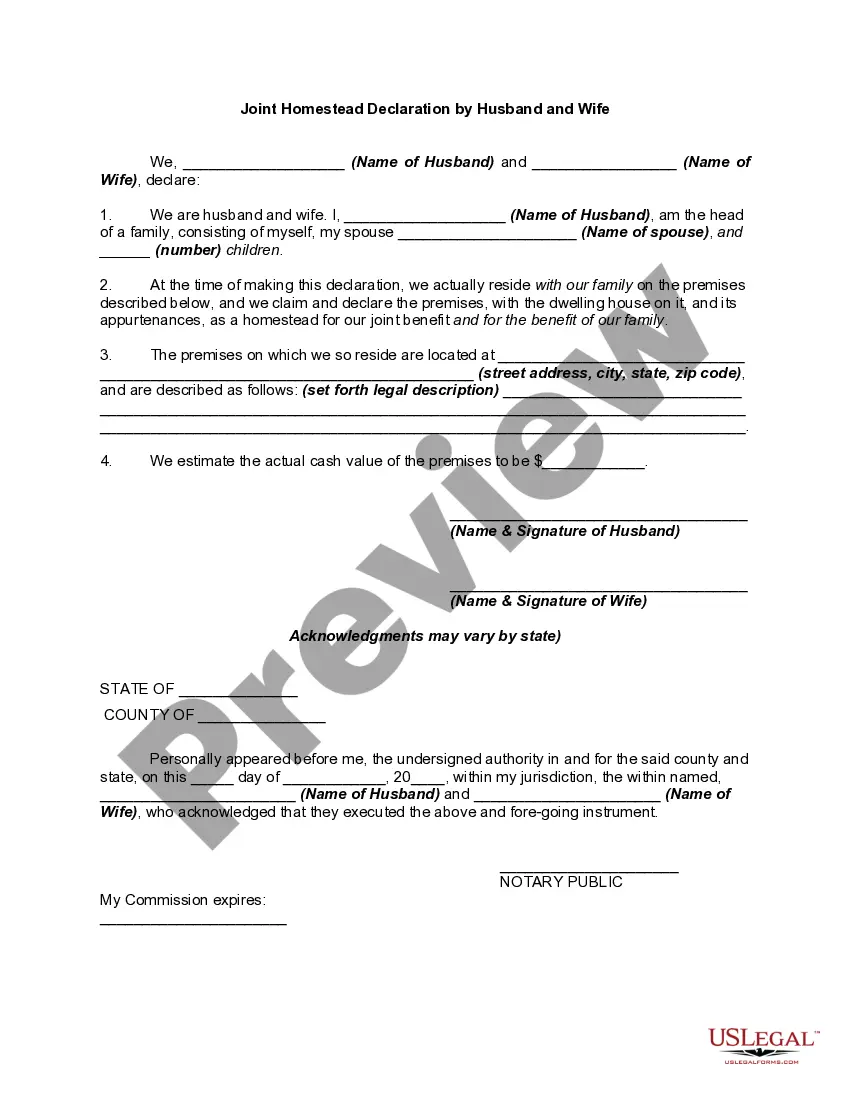

Use this form to file a declared homestead at the County Recorder's Office in the county where the property is located.

Santa Clarita California Homestead Declaration for Single Person

Description

How to fill out California Homestead Declaration For Single Person?

We consistently aim to minimize or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal counsel that is typically very expensive.

However, not every legal issue is of the same complexity.

Many can be handled independently by ourselves.

Leverage US Legal Forms whenever you need to locate and download the Santa Clarita California Homestead Declaration for a single person or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your affairs without relying on legal professionals.

- We offer access to legal document templates that are not always available to the general public.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

To avoid property tax reassessment in California, it's crucial to understand the exemption laws, especially regarding transfers of property. Keeping ownership records clear and detailed can help, as can consulting with experts. The Santa Clarita California Homestead Declaration for Single Person can offer guidance and protection, helping you avoid unnecessary reassessments and preserving your property's tax status.

In California, homestead laws can protect a portion of your home's equity, depending on your situation. For a single person, the protection can cover up to $300,000 in equity. Filing the Santa Clarita California Homestead Declaration for Single Person is essential to ensure you receive maximum protection and peace of mind regarding your property.

While the homestead exemption itself does not reduce property taxes, there are methods to lower them. For instance, you can appeal your property tax assessment if you believe your home is overvalued. Utilizing resources such as the Santa Clarita California Homestead Declaration for Single Person can assist you in understanding your rights and options, ultimately helping you navigate property tax concerns.

A homestead exemption in California offers various advantages, including protection from creditors and a shield against forced sale of your home to satisfy debts. Moreover, it allows you to maintain greater ownership stability, contributing to peace of mind. By completing the Santa Clarita California Homestead Declaration for Single Person, you can experience these benefits, ensuring your residence remains protected.

The California homestead exemption does not directly reduce property taxes. Instead, it provides protection for your home’s equity against creditors and helps you retain ownership during financial hardship. By filing a Santa Clarita California Homestead Declaration for Single Person, you secure this protection, ensuring your property remains safe even in challenging times.

Eligibility for the homestead exemption in California includes homeowners who occupy their property as their primary residence. The exemption is available to individuals, including single persons listed on the property title. For those in Santa Clarita, completing the Santa Clarita California Homestead Declaration for Single Person can make claiming this exemption easier. Be sure to check local requirements for any additional criteria.

Yes, California does offer a property tax exemption for homeowners aged 55 or older when they sell their homes. This exemption allows qualifying individuals to transfer their property tax base to a new home, minimizing tax increases. Utilizing the Santa Clarita California Homestead Declaration for Single Person can help streamline this process. Speak with a local expert for guidance tailored to your situation.

In California, there is no age limit that entirely stops you from paying property taxes. However, if you are 62 years or older, you may be eligible for property tax postponement programs. The Santa Clarita California Homestead Declaration for Single Person can help you secure benefits that reduce your property tax burden. Therefore, it's wise to explore your options as you reach retirement age.

To qualify for the homestead exemption in California, you must own and occupy your home as your primary residence. Additionally, you need to file a Santa Clarita California Homestead Declaration for Single Person to receive this benefit. The state requires that your home’s assessed value does not exceed a certain limit for the exemption to apply. Remember, this exemption can protect a portion of your home equity from creditors.

No, both owners do not need to file for the homestead exemption in Texas. If one owner files and qualifies, the exemption can still apply to the property, benefiting all owners. Furthermore, those interested in the Santa Clarita California Homestead Declaration for Single Person can find similar options that allow one owner to secure beneficial tax exemptions, thus simplifying the filing process.