Simi Valley California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less

Description

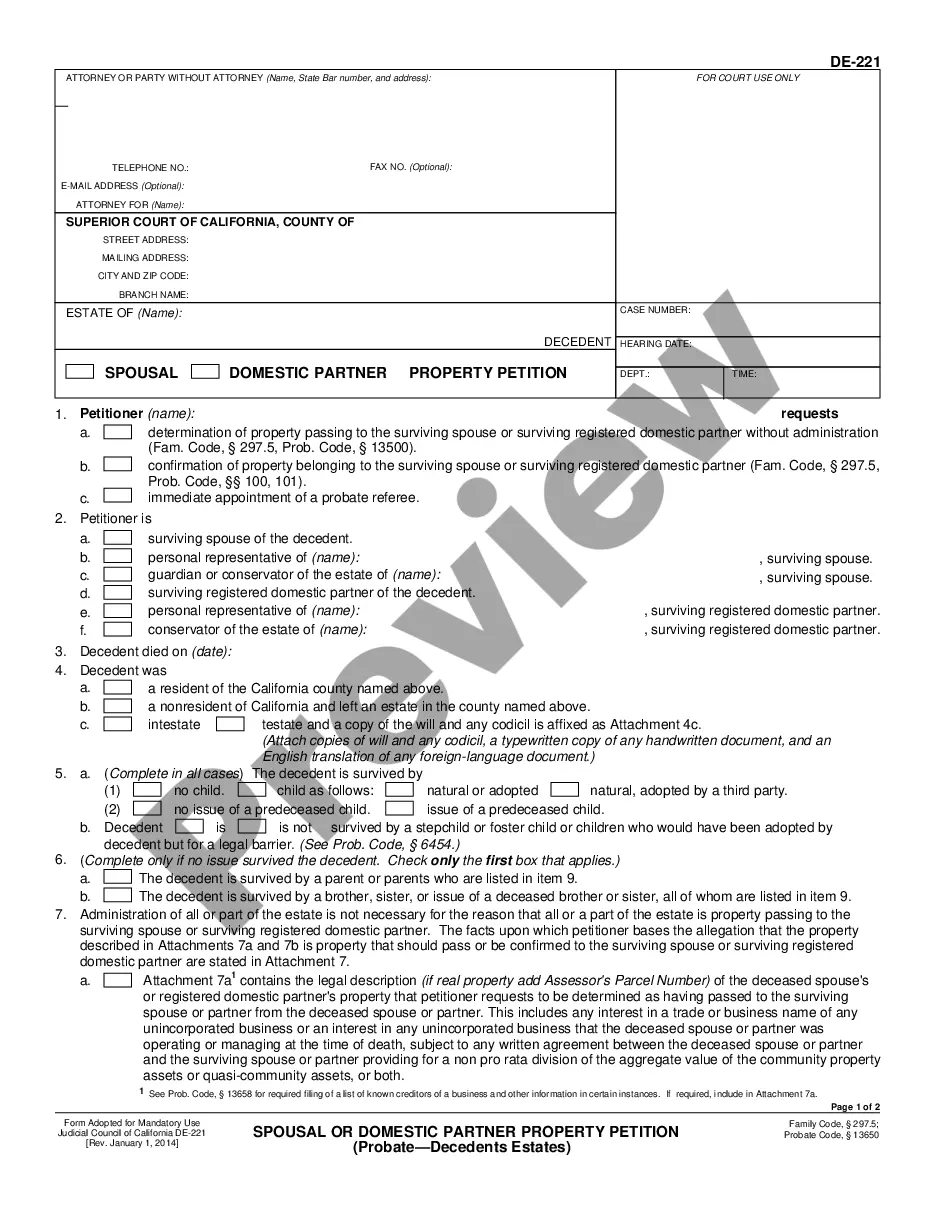

How to fill out California Petition To Determine Succession To Real And Personal Property - Small Estates - Estates $184,500 Or Less?

Utilize the US Legal Forms and gain immediate access to any form sample you require.

Our advantageous website with a multitude of templates facilitates easy discovery and retrieval of nearly any document sample you need.

You can download, complete, and validate the Simi Valley California Petition to Establish Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less within minutes, instead of scouring the internet for hours in search of the correct template.

Leveraging our repository is an excellent method to enhance the security of your record submission. Our knowledgeable attorneys routinely assess all documents to guarantee that the templates are applicable for a specific area and adhere to updated laws and regulations.

If you have not yet created an account, adhere to the steps below.

Locate the form you need. Verify that it is the form you sought: confirm its title and description, and utilize the Preview option if available. If not, employ the Search field to find the necessary one.

- How can one access the Simi Valley California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less.

- If you already possess an account, simply Log In. The Download option will be accessible on all documents you view.

- Furthermore, you can retrieve all your previously saved documents in the My documents section.

Form popularity

FAQ

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.

Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident. You can obtain it in person or by accessing your court's self-help center online and downloading the form there.

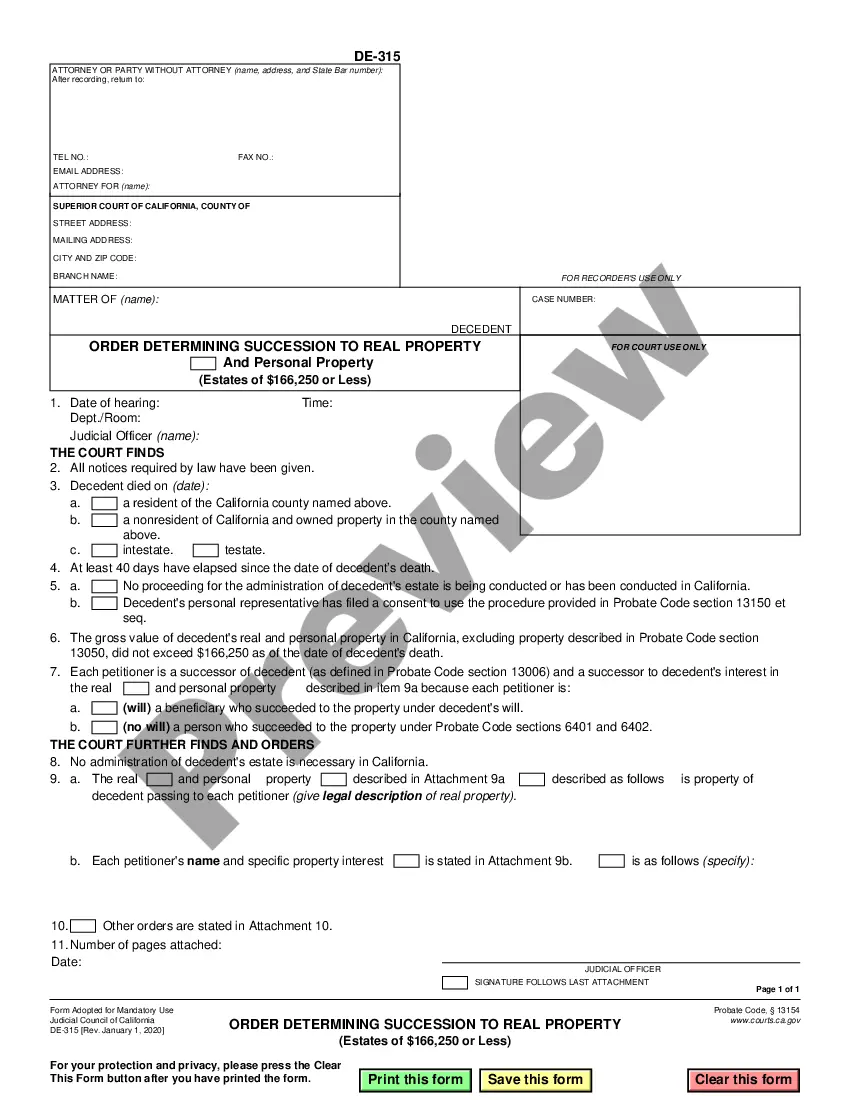

As of April 1, 2022, the California Probate Code has been updated to increase the gross value of a deceased person's property from $166,250 to $184,500.

For decedents who died prior to April 1, 2022 the California Probate Code provides that probate estates of $166,250 or less do not need to be probated. Deaths on or after April 1, 2022 the threshold amount is $184,500. If the estate consists of assets in excess of the prescribed amount a probate is necessary.

1. The Small Estate Affidavit. If the total probate estate does not exceed $184,500 (this is the maximum value for deaths occurring on or after April 1, 2022), you can use the small estate affidavit to collect all property other than real estate.

Maximum Value of Small Estate: $166,250?$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500. (For deaths prior to April 1, 2022, the maximum value of an estate that could use the small estate affidavit was $166,250.)

In California, if your assets are valued at $150,000 or more and they are not directed to beneficiaries through either a trust plan, beneficiary designation, or a surviving spouse, those assets are required to go through the probate process upon your incapacity or death.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

Real or personal property that the person who died owned with someone else (joint tenancy) Property (community, quasi-community, or separate) that passed directly to the surviving spouse or domestic partner. Life insurance, death benefits, or other assets not subject to probate that pass directly to the beneficiaries.