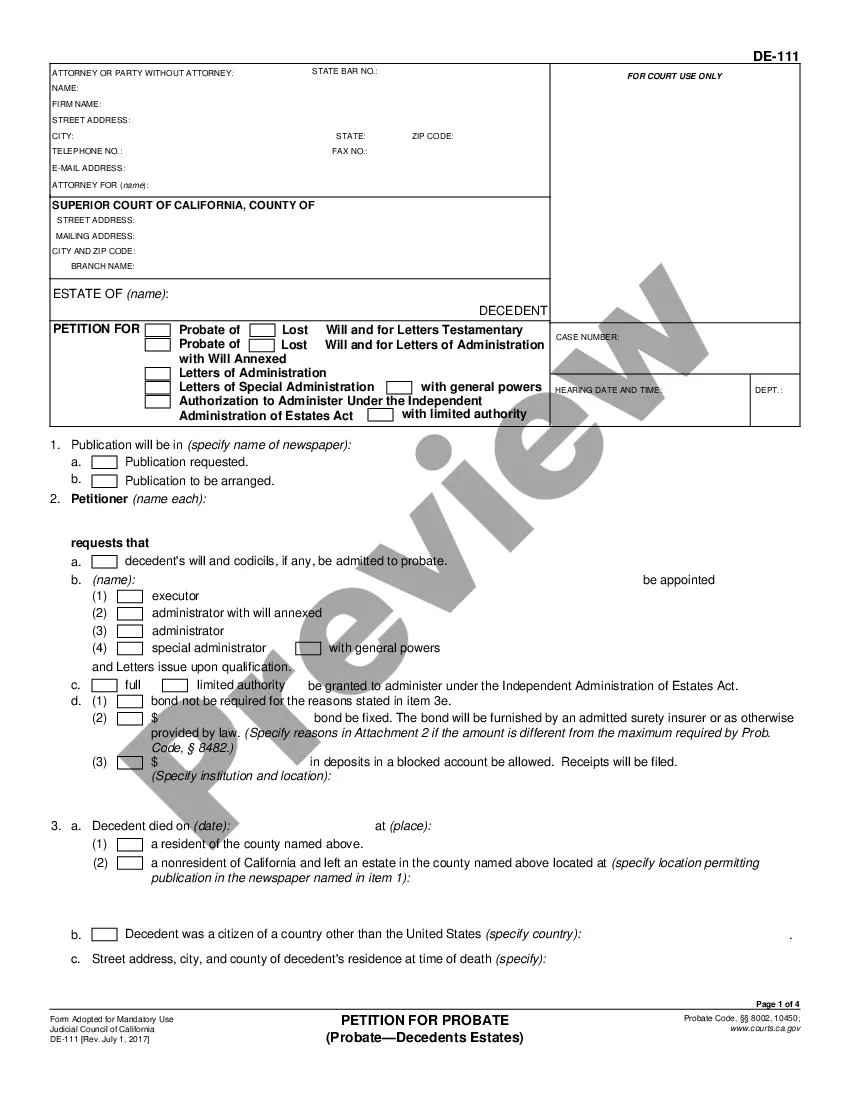

This form, Spousal Property Petition, is an official form from the California Judicial Counsel, which complies with all applicable laws and statutes. USLF amends and updates the Judicial Counsel forms as is required by California statutes and law. This form is a request for either determination of property passing to a surviving spouse or a surviving registered domestic partner without administration, confirmation of property belonging to a surviving spouse or surviving registered domestic partner or immediate appointment of a probate.

Anaheim California Spousal Property Petition

Description

How to fill out California Spousal Property Petition?

If you are searching for a legitimate form, it’s incredibly challenging to select a superior location than the US Legal Forms website – one of the largest collections online.

Here you can locate a vast array of document templates for business and personal needs categorized by types and regions, or keywords.

With the top-notch search feature, finding the latest Anaheim California Spousal Property Petition is as simple as 1-2-3.

Validate your choice. Select the Buy now option. Then, pick your preferred subscription plan and enter your details to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the relevance of every document is confirmed by a team of professional attorneys who consistently evaluate the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and hold an account, all you need to obtain the Anaheim California Spousal Property Petition is to Log In to your profile and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply adhere to the steps listed below.

- Ensure you have accessed the sample you require. Review its description and use the Preview function (if available) to inspect its content.

- If it doesn’t fulfill your requirements, employ the Search box located at the top of the screen to find the suitable document.

Form popularity

FAQ

On the death of your spouse you are automatically entitled to an undivided half of the property by virtue of your marriage in community of property in terms of the Matrimonial Property Act 88 of 1984. Your spouse's share will be transferred in accordance the provisions of the Act.

You don't have to do full formal probate if you find out there is a community property interest.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

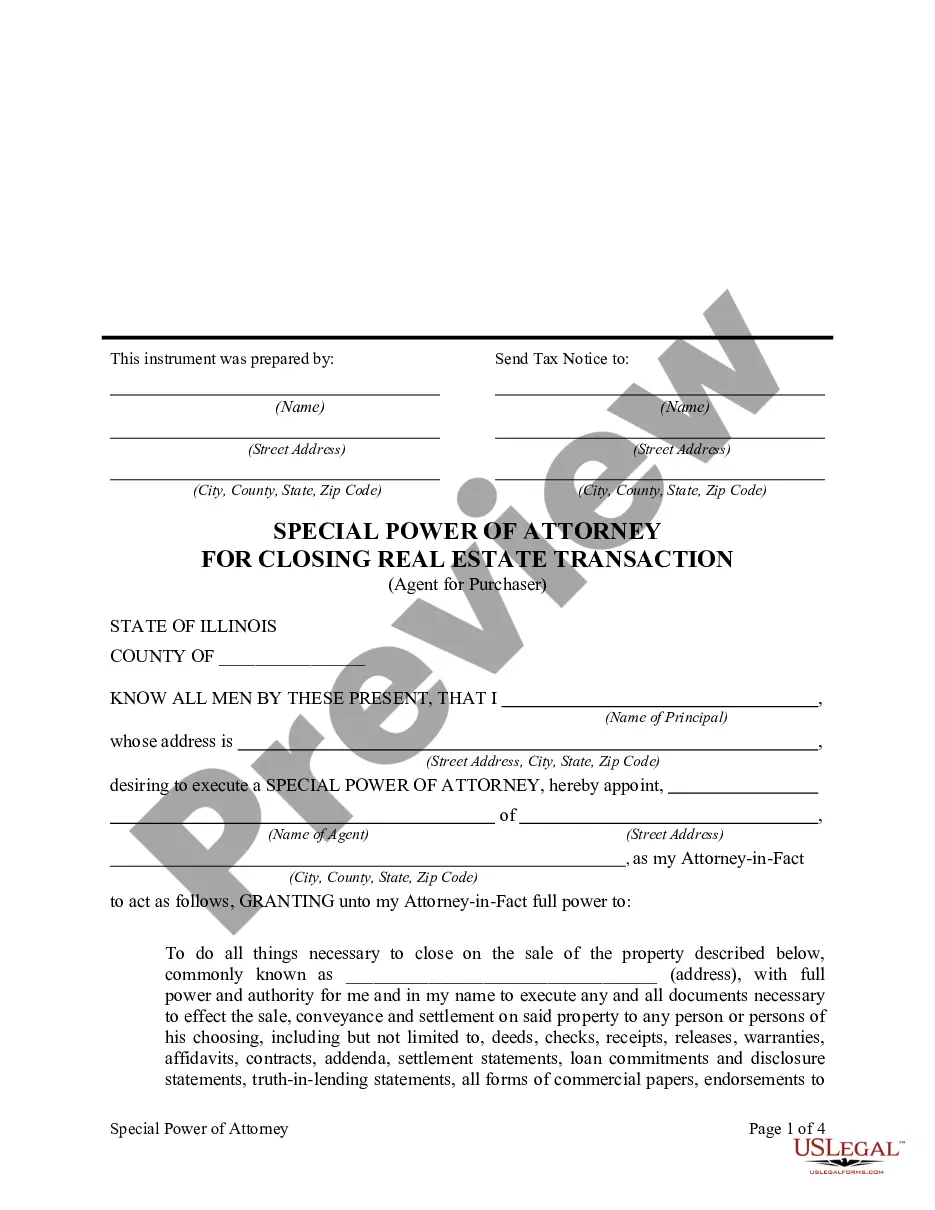

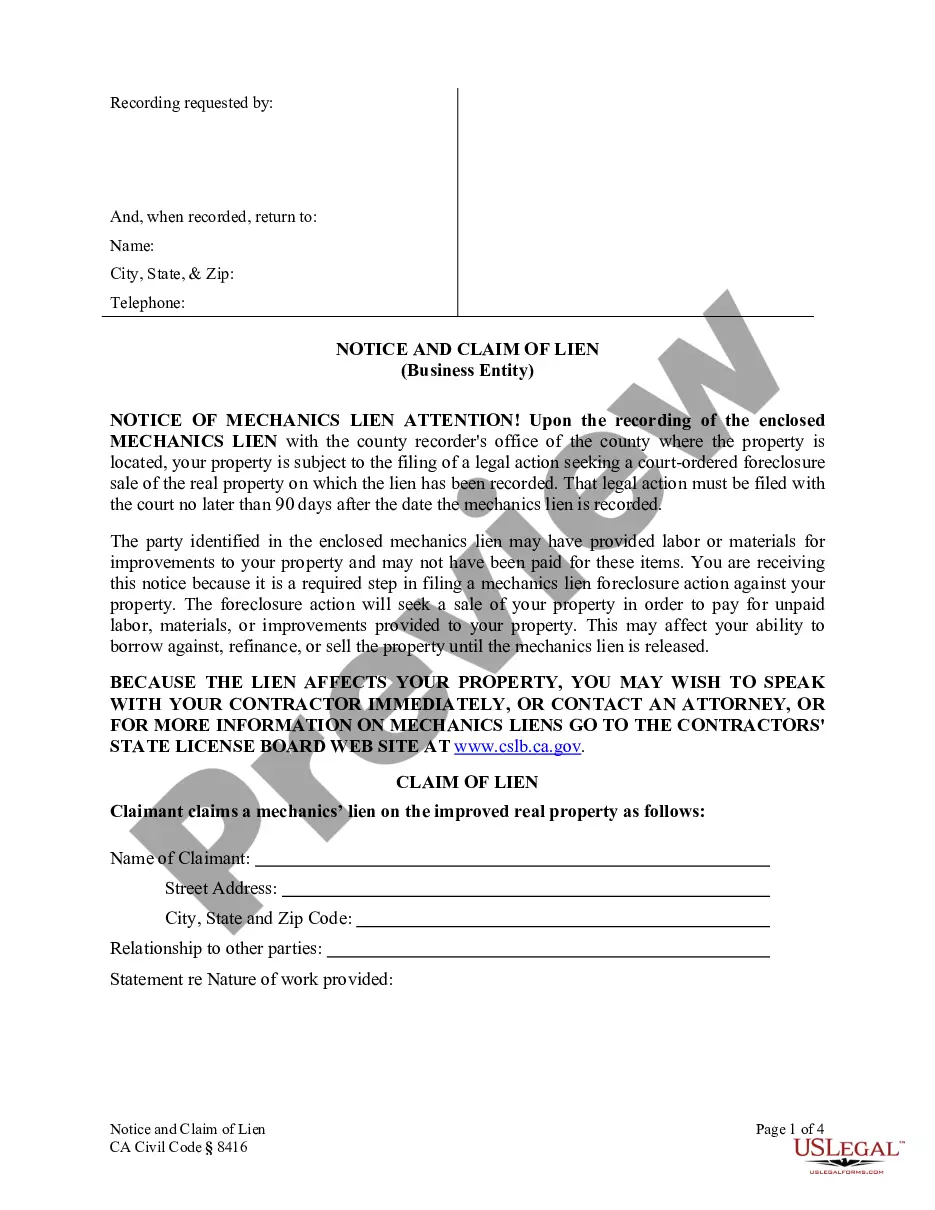

Without opening probate, any assets titled in the decedent's name, including real estate and vehicles, will remain in the decedent's name for an indefinite period of time. This prevents you from selling them to pay off debts, distributing them to the beneficiaries, or keeping registration current.

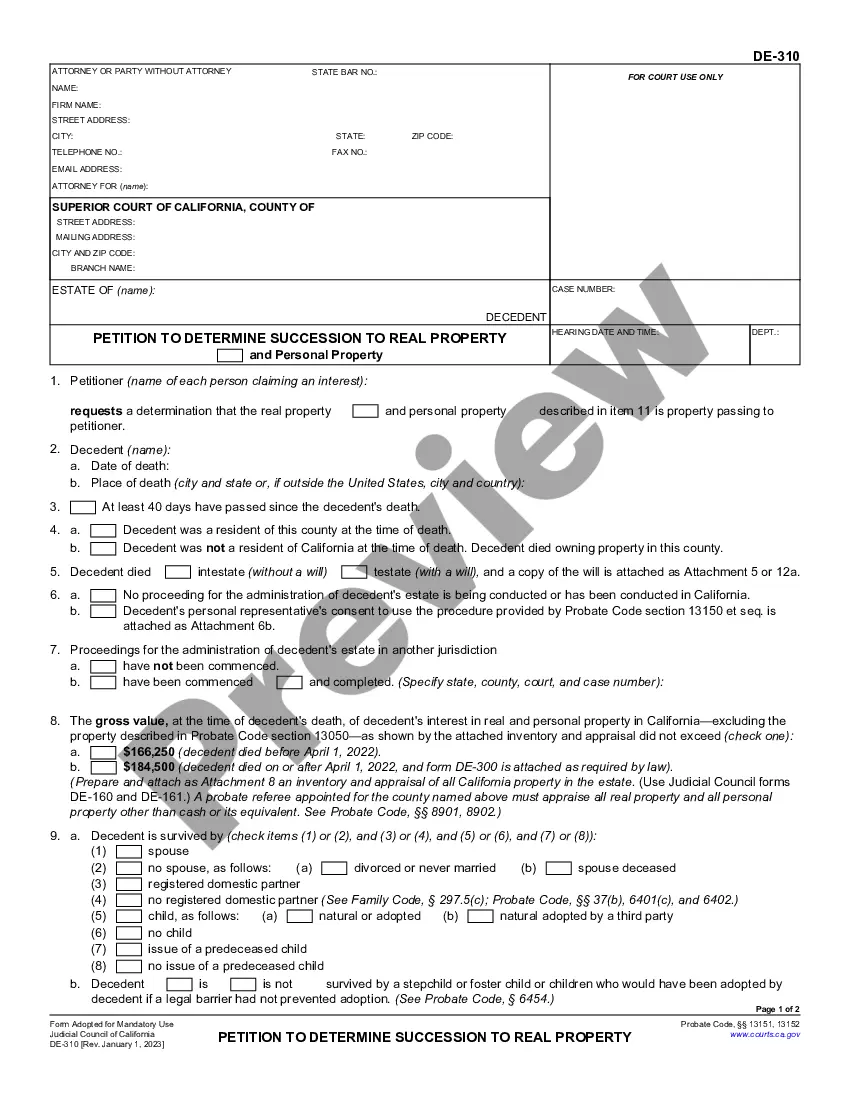

As of April 1, 2022, the California Probate Code has been updated to increase the gross value of a deceased person's property from $166,250 to $184,500.

California Spousal Property Petition Form DE-221 - YouTube YouTube Start of suggested clip End of suggested clip And they were a resident of California. And they were testate. And they had a surviving spouse. AndMoreAnd they were a resident of California. And they were testate. And they had a surviving spouse. And the name of the surviving spouse is Nancy Smith.

Assets Subject to the California Probate Court Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

If your spouse passed away in California without a Trust, you may think you'll need to go through probate. However, in many cases, the surviving spouse does not need to probate the estate of their loved one to gain access to his or her assets. Instead, you may only need to file a Spousal Property Petition.

A Spousal Property petition is a way to transfer or confirm property to a surviving spouse without a full probate proceeding. It can usually be done with only one hearing in the court. If the decedent's estate is not complicated, the petition can settle questions about title or ownership of property.

Spousal or Domestic Partner Property Petition (Probate?Decedents Estates) (DE-221) Ask the court to decide that all or part of a deceased person's estate does not have to go through the probate process because it belongs to the deceased person's spouse or domestic partner.