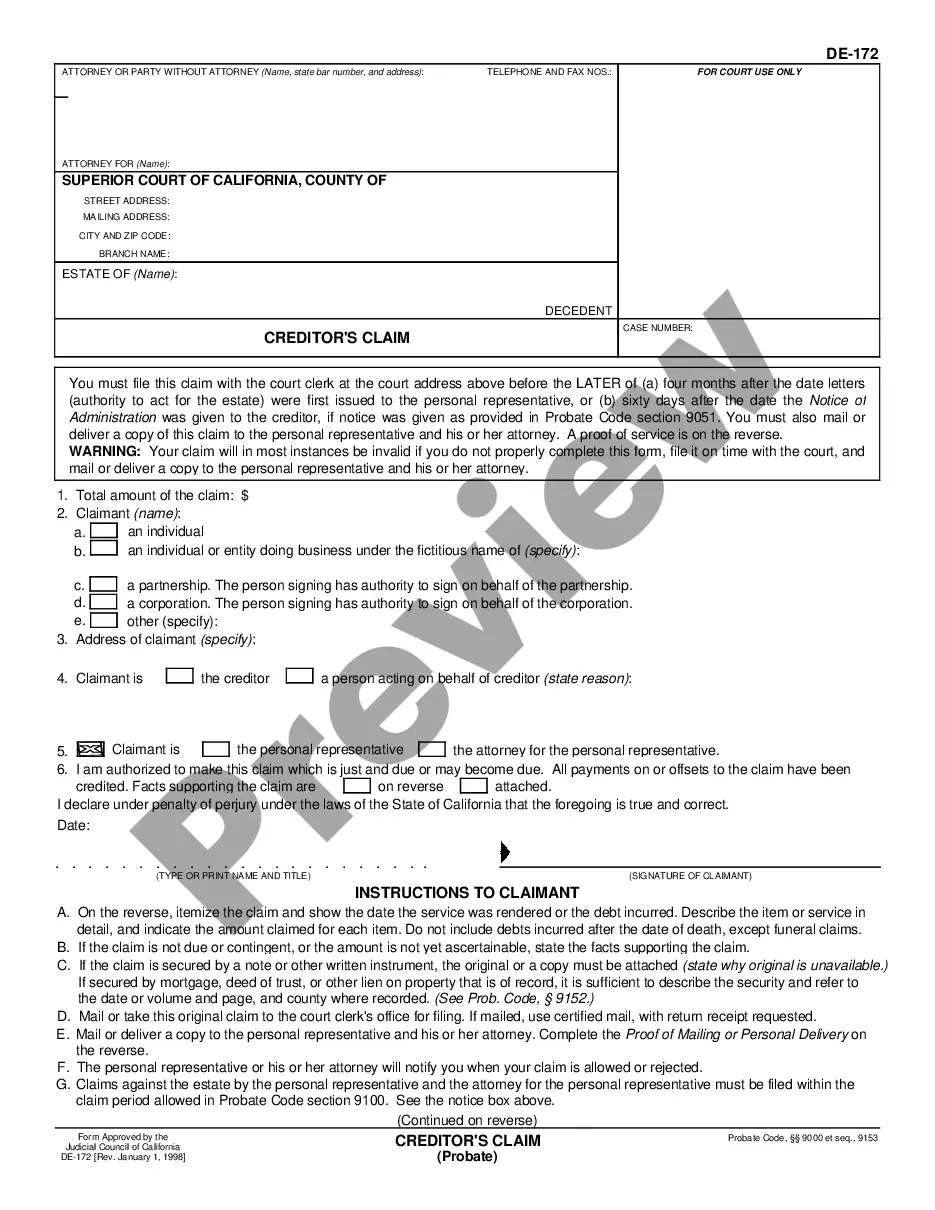

This form, Allowance or Rejection of Creditor's Claim - for estates filed after June 30, 1988, is an official form from the California Judicial Counsel, which complies with all applicable laws and statutes. USLF amends and updates the Judicial Counsel forms as is required by California statutes and law. This form sets forth whether a particular creditor's claim(s) is allowed or rejected and includes information such as the name of the creditor, date the claim was filed, date letters were first issued, date of notice of administration, date of decedent's death, estimated value of estate and total amount of claim(s).

Thousand Oaks California Allowance or Rejection of Creditor's Claim

Description

How to fill out California Allowance Or Rejection Of Creditor's Claim?

We consistently aim to reduce or avert legal complications when addressing intricate legal or financial concerns.

To achieve this, we engage legal services that are generally quite costly.

However, not every legal issue is as complicated.

Many of them can be resolved by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Thousand Oaks California Allowance or Rejection of Creditor's Claim or any other form with ease and security.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to manage your affairs independently without relying on an attorney's services.

- We offer access to legal form templates that are not always publicly accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Generally, in California creditors of a decedent's estate have up to one year (365 days) from the decedent's death to file a timely creditor claim.

You can get a creditor's claim form at the Forms Window in Room 112 on the first floor of the Los Angeles Superior Court at 111 North Hill Street, or any other Superior Court location. The form is also available at the Judicial Council website: . It is form number DE-172.

Q: How do I claim against an estate? Step 1: Establish grounds to make a claim.Step 2: Check the time limits.Step 3: Consider entering a caveat.Step 4: Consider Alternative Dispute Resolution.Step 5: Follow the Pre Action Protocol.Step 6: Commence court proceedings.

The statute of limitations for filing a claim against an estate is a strict one year from the date of the debtor's death (pursuant to California Code of Civil Procedure Section 366.2). This limitation period applies regardless of whether the judgment creditor knew the judgment debtor had died!

There is a strict time limit within which an eligible individual can make a claim on the estate. This is six months from the date that the grant of probate was issued. For this reason, executors are advised to wait until this period has lapsed before distributing any of the estate to the beneficiaries.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

Creditor's claim (sometimes referred to as a proof of claim) is a filing with a bankruptcy or probate court to establish a debt owed to that individual or organization.

Generally, in California creditors of a decedent's estate have up to one year (365 days) from the decedent's death to file a timely creditor claim.