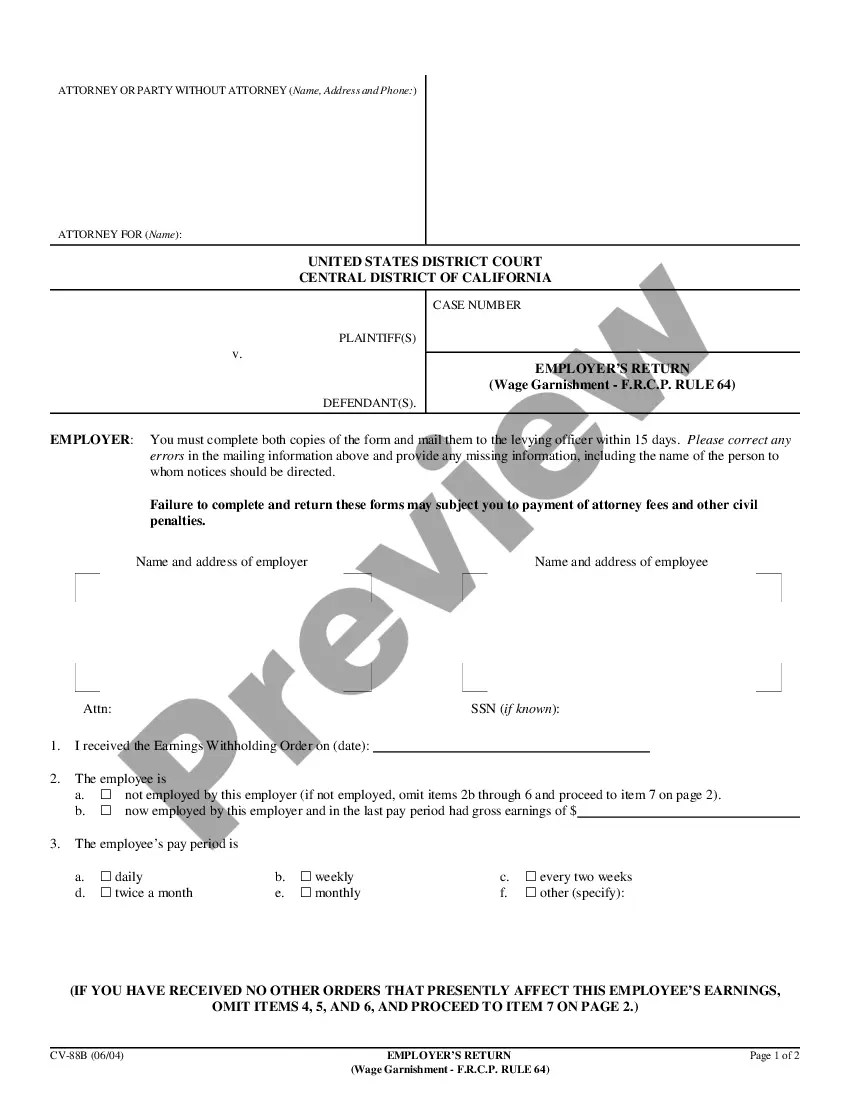

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

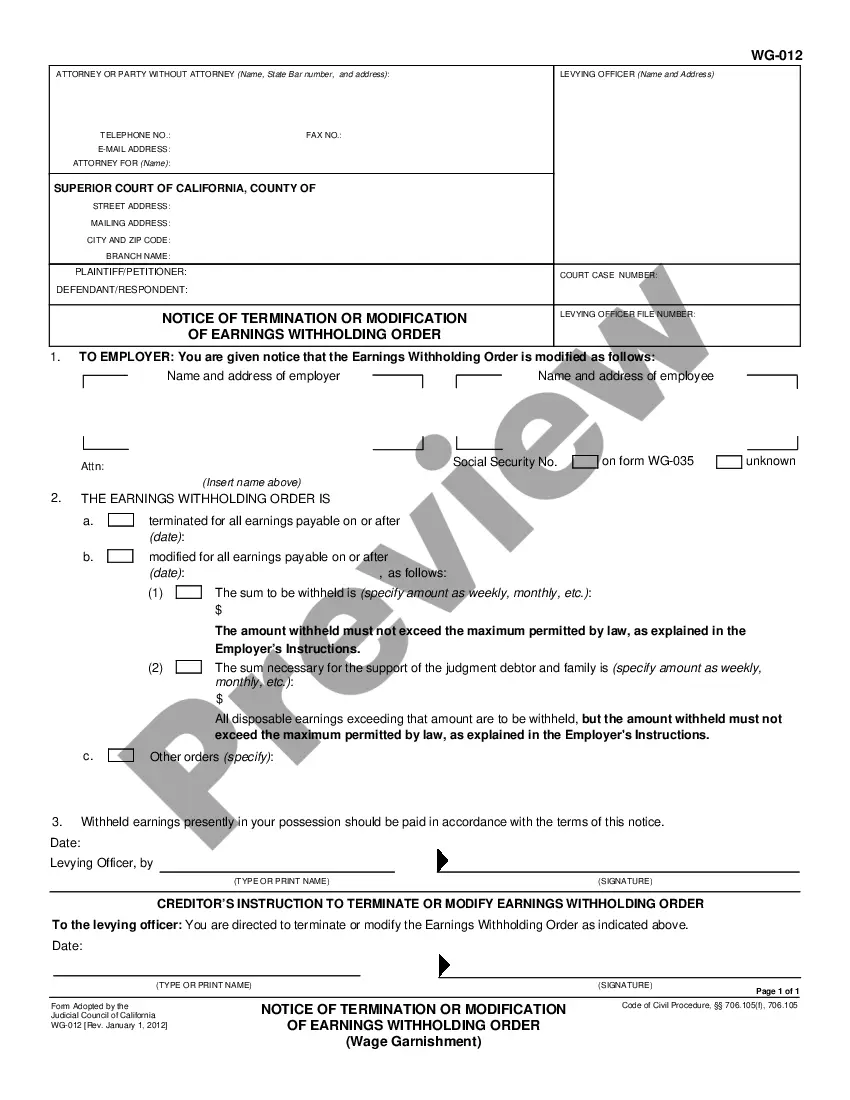

El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Notice Of Termination Or Modification Of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64?

Finding approved templates that align with your local regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All the papers are systematically organized by area of application and jurisdictional boundaries, making it as swift and simple as ABC to find the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64.

Maintaining paperwork organized and compliant with legal standards is of utmost importance. Utilize the US Legal Forms library to have vital document templates for any requirements readily accessible!

- For those already acquainted with our service and have used it previously, acquiring the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 requires just a few clicks.

- Simply Log In to your account, select the document, and hit Download to save it onto your device.

- This procedure will involve only a few additional steps for new users.

- Adhere to the instructions below to begin with the most comprehensive online form catalog.

- Examine the Preview mode and form description. Ensure you have selected the correct document that fulfills your needs and fully corresponds to your local jurisdiction requirements.

Form popularity

FAQ

To stop wage garnishment, you have several options, including negotiating a settlement with your creditor, filing for bankruptcy, or obtaining a court order to modify or terminate the garnishment. Taking action promptly is crucial, as wage garnishments can significantly impact your finances. Consider utilizing the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64, as it can guide you in legally adjusting or halting garnishments. Using a reliable platform like USLegalForms can simplify this process by providing the necessary forms and guidance.

In the United States, states such as North Carolina and at times, Texas, have legal frameworks that limit or prohibit wage garnishment for certain types of debts. However, regulations can vary, so it's always wise to check the specific laws applicable to your situation. If you're considering the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64, understanding your state's garnishment rules can help you navigate this issue effectively.

To write a letter to stop wage garnishment, first reference the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 in your introduction. Clearly state your request to stop the garnishment, along with the reasons for your request, such as a change in your financial situation. Remember to include your contact information for any follow-up. If you need additional help, uslegalforms offers templates to streamline the process, ensuring you address all required elements.

When filling out a wage garnishment exemption related to the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64, start by collecting your financial information. Clearly state your income, necessary expenses, and any dependents that may qualify you for an exemption. Be truthful and precise when entering this information, as inaccuracies can delay the process. If you're unsure, consider using resources like uslegalforms, which can guide you through the necessary steps.

Stopping a state tax garnishment online typically involves contesting the garnishment through your tax authority's website. Most state agencies offer resources and guidelines for addressing garnishment status. Utilizing services like USLegalForms can assist you in preparing documents, such as the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64, to facilitate this process efficiently.

To cease franchised tax board garnishments, you can contest the underlying debt or arrange a payment plan with the tax board. Individuals often find success by seeking professional assistance to manage their options effectively. The El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 can serve as an essential tool in this process.

Indeed, employers are required to inform employees about garnishments related to their wages. The legislation behind the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 specifies that employees must receive this notification to understand their circumstances appropriately. It's important for transparency and fairness.

Yes, it is possible to receive a wage garnishment without your prior knowledge. Legal notices may be sent to your employer before reaching you. However, once a garnishment is in effect, the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 ensures you will receive notification about the proceedings.

To prevent your tax refund from being garnished, you may need to address any outstanding debts or disputes with the relevant authorities. Consulting a professional can help navigate this process. Consider utilizing platforms like USLegalForms to obtain the necessary forms—such as the El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64—to take action.

In California, employers must comply with state-specific regulations regarding wages and garnishments. The El Monte California Notice of Termination or Modification of Earnings Withholding Order - Wage Garnishment - F.R.C.P. Rule 64 outlines exact steps and forms needed for lawful garnishment. Employers should follow these requirements to ensure fair treatment of employees.