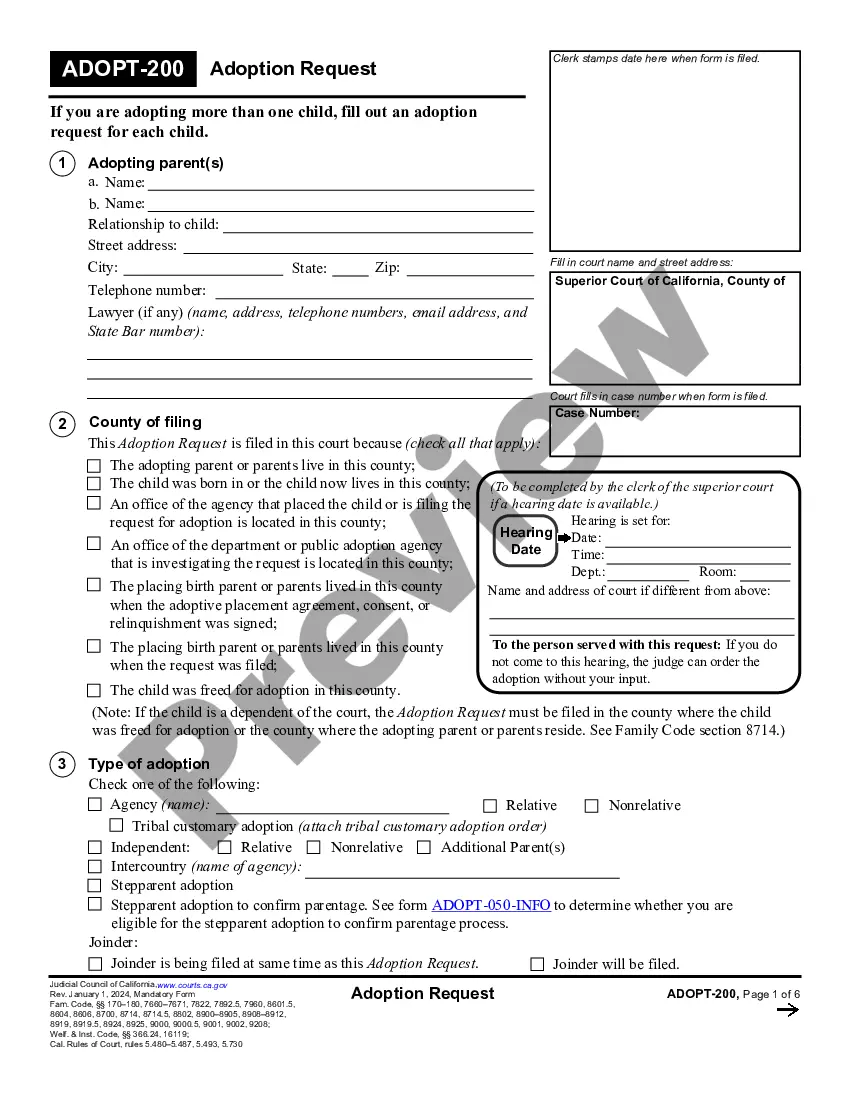

Accounting Report-Adoptions: This report lists all of the expenses incurred from adopting your child. This form is not necessary if one is adopting as a step-parent and/or domestic partner.

Orange California Adoption Expenses

Description

How to fill out California Adoption Expenses?

If you are looking for a pertinent form, it’s incredibly challenging to find a more suitable location than the US Legal Forms website – arguably the largest online repositories.

With this repository, you can access thousands of templates for business and personal use categorized by type and state, or keywords. Utilizing our sophisticated search feature, obtaining the latest Orange California Adoption Expenses is as simple as 1-2-3.

Moreover, the relevance of each document is validated by a team of experienced attorneys who regularly review the templates on our platform and update them according to the latest state and county regulations.

Receive the template. Choose the file format and download it to your device.

Edit. Fill out, modify, print, and sign the acquired Orange California Adoption Expenses.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Orange California Adoption Expenses is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the guidelines mentioned below.

- Ensure you have selected the template you require. Review its details and utilize the Preview option to view its content. If it does not meet your criteria, use the Search feature at the top of the page to find the desired document.

- Confirm your choice. Click the Buy now button. Then, select the desired pricing plan and provide the necessary information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The US government provides funding through various programs aimed at supporting adoption. Many states offer subsidies that can help with Orange California adoption expenses, especially for children in foster care. Additionally, federal tax credits exist to ease the financial burden of adoption, making it more accessible for families.

Yes, in some instances, you may claim expenses from a failed adoption on your taxes. The IRS allows you to deduct certain Orange California adoption expenses if the adoption was legal and had begun before it fell through. Consult with a tax professional to understand how to properly file these deductions.

Funding your adoption can involve various strategies, such as applying for grants and scholarships specifically designed for adoption. You can also look into fundraising options and adopt a crowdfunding strategy to engage your community. Remember to explore resources that can assist with Orange California adoption expenses throughout the process.

When filing your tax return, you can often claim adoption expenses under the Adoption Tax Credit. This credit can help offset Orange California adoption expenses. Be sure to keep detailed records of all eligible costs and consult a tax professional for guidance specific to your situation.

In most cases, those who are adopted do not receive financial aid specifically for being adopted. However, adoptive parents may qualify for subsidies or financial assistance programs that help with Orange California adoption expenses. It's essential to research local and state resources that can provide support.

Funding adoptions can vary greatly, but many people utilize personal savings, grants, and loans. You might also consider crowdfunding through online platforms that support families adopting. Additionally, some employers offer adoption assistance benefits, which can help cover Orange California adoption expenses.

Qualified adoption expenses involve costs directly related to the adoption process. In the context of Orange California Adoption Expenses, these can include adoption fees, legal fees, and travel costs associated with the adoption. It's essential to track these expenses accurately, as they can be important for tax implications and financial aid. For a comprehensive overview, you may want to explore legal resources like uslegalforms that specialize in adoption-related documentation.

Receiving financial aid can vary based on individual circumstances, but many adopted children qualify for additional support. For families navigating Orange California Adoption Expenses, understanding state aid and federal programs can make a significant difference. Many agencies and resources provide guidance on how adoption status can influence financial aid opportunities. Consulting with a legal professional or adoption agency can also help clarify available benefits.

Qualified expenses for the adoption credit include various costs such as adoption fees, court costs, and even attorney fees related to the adoption process. It's crucial to keep track of these expenses since they can significantly lower the taxable amount. By understanding what counts as qualified expenses, you can better plan your Orange California adoption expenses.

An adopted child may receive various benefits, including access to healthcare, education grants, and even some monthly stipends based on state programs. These benefits aim to provide financial support to the family and ensure that the adopted child has a stable upbringing. Knowing these advantages can help ease your Orange California adoption expenses.