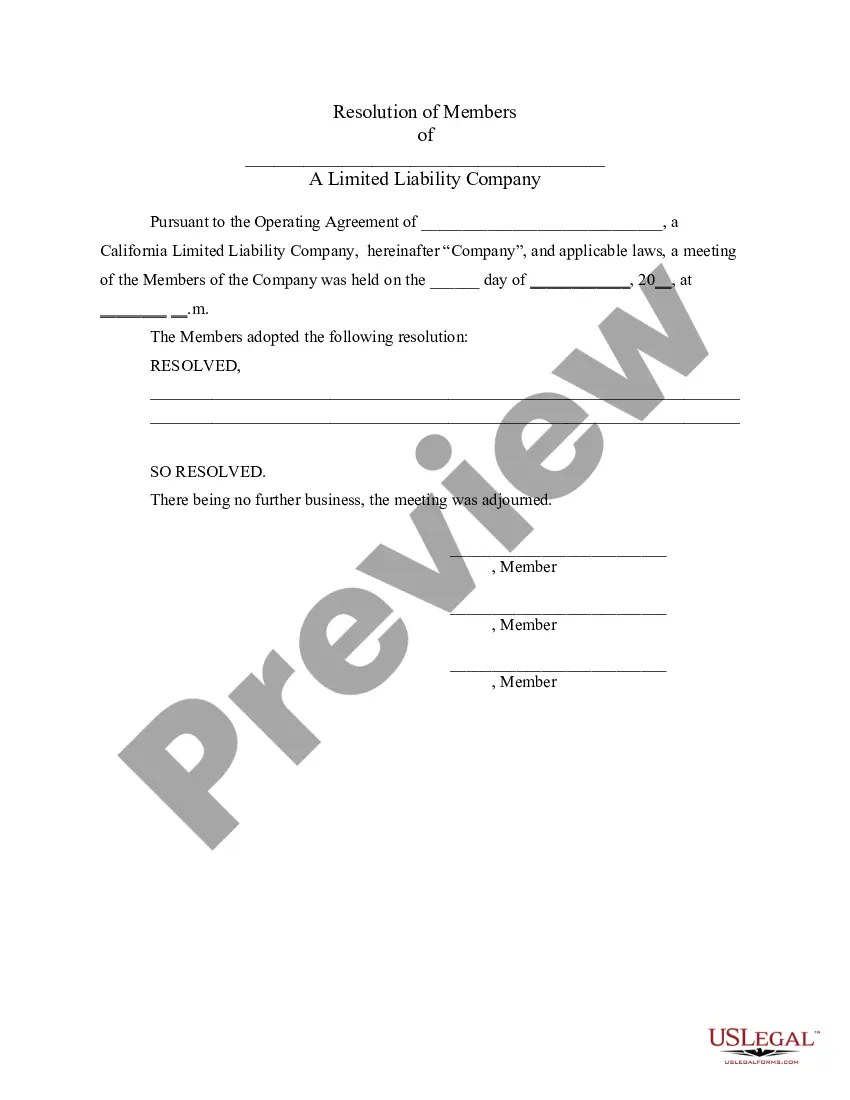

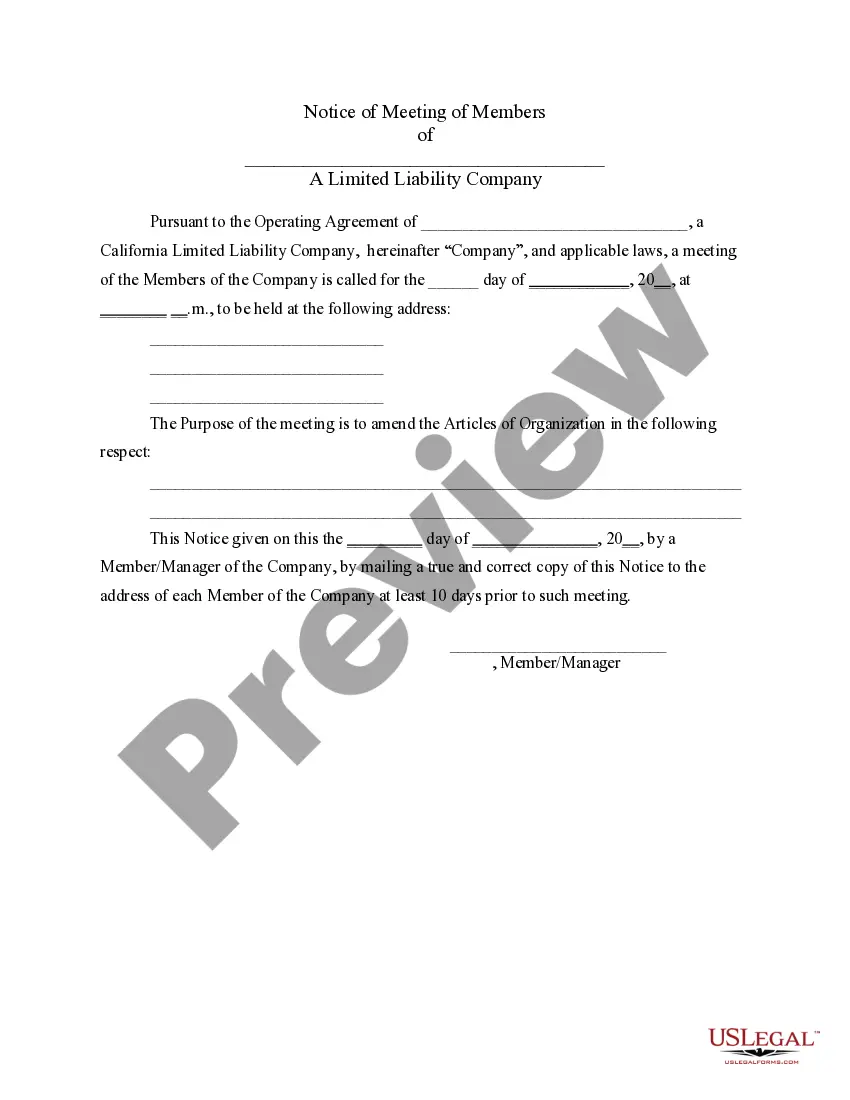

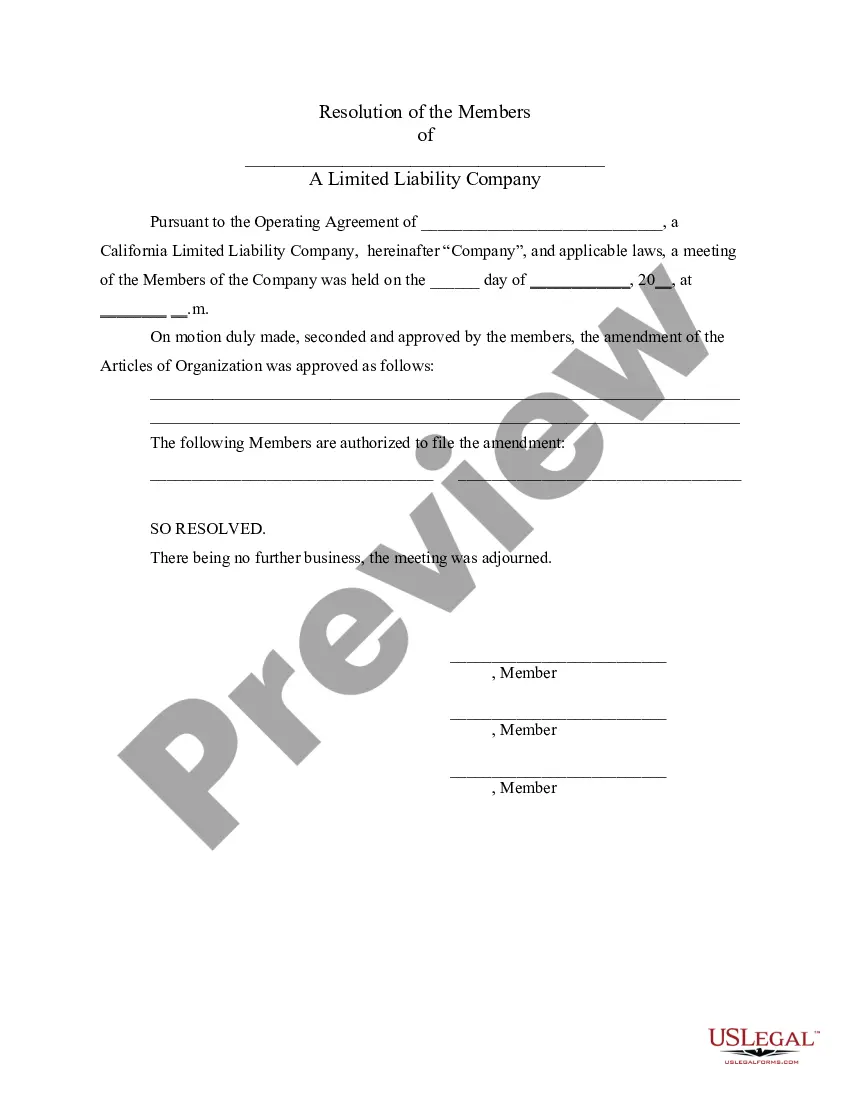

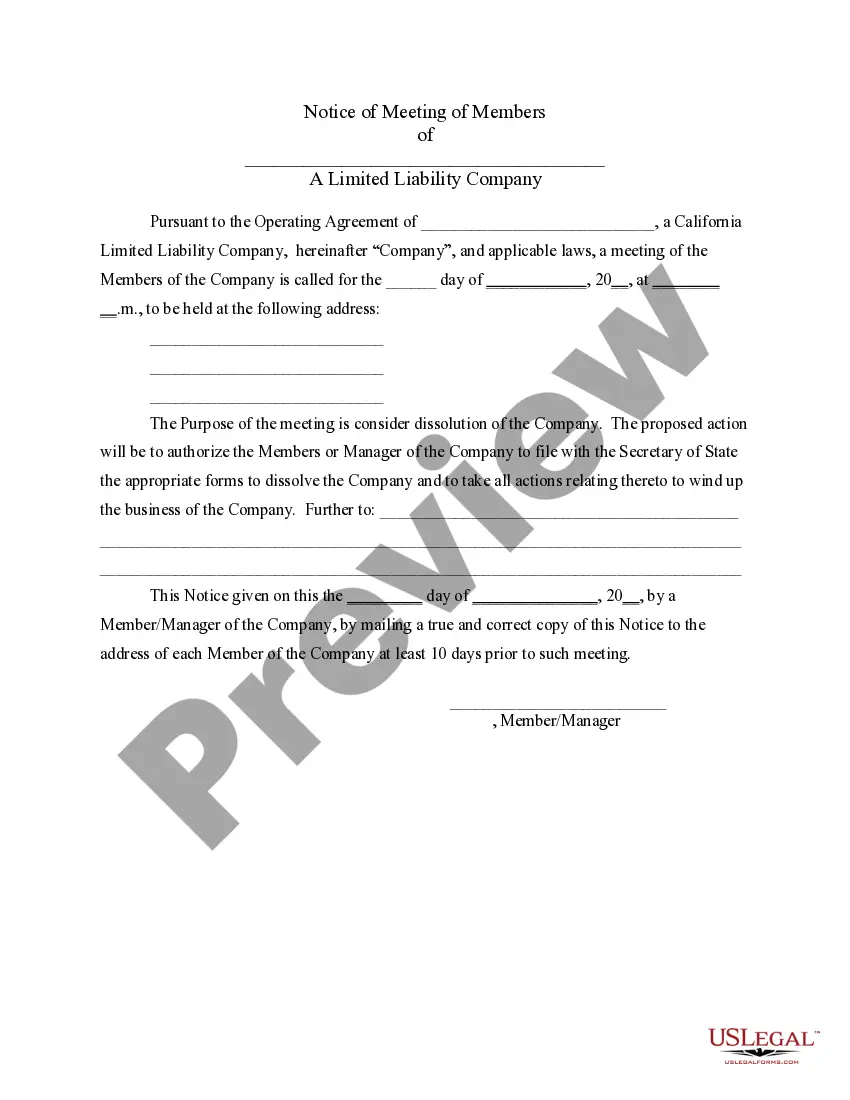

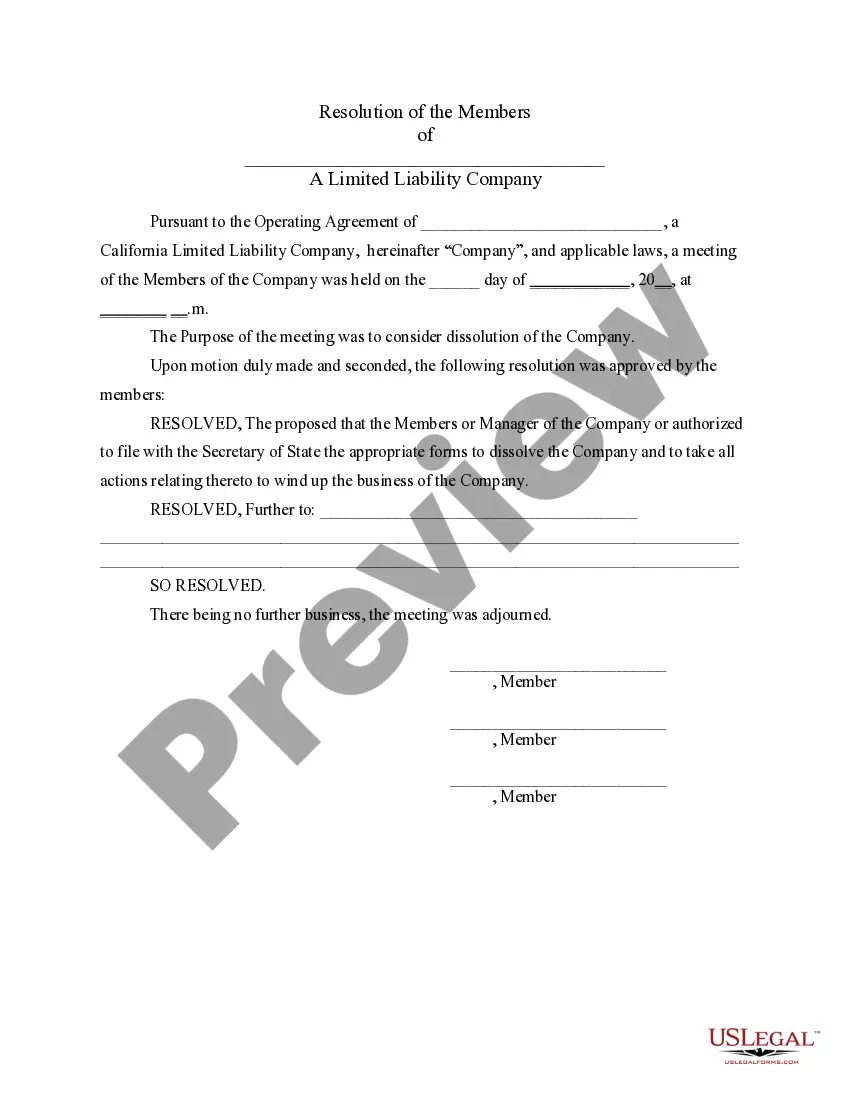

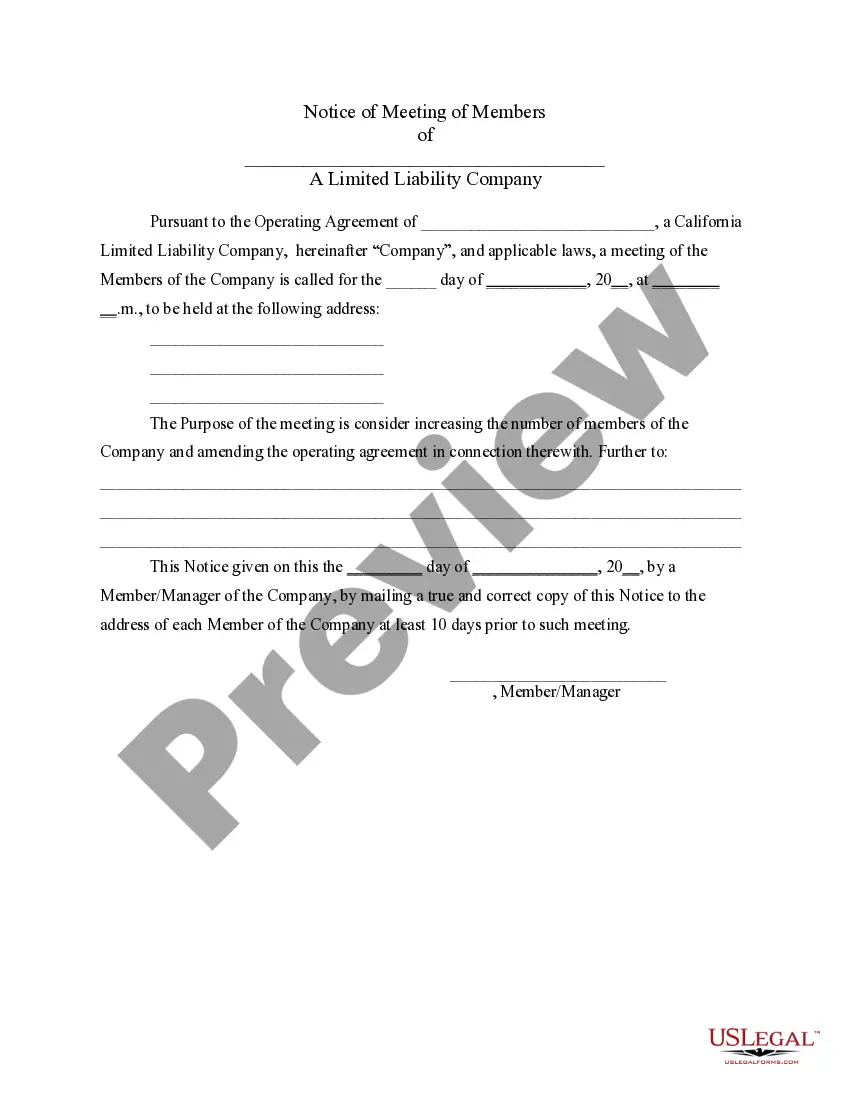

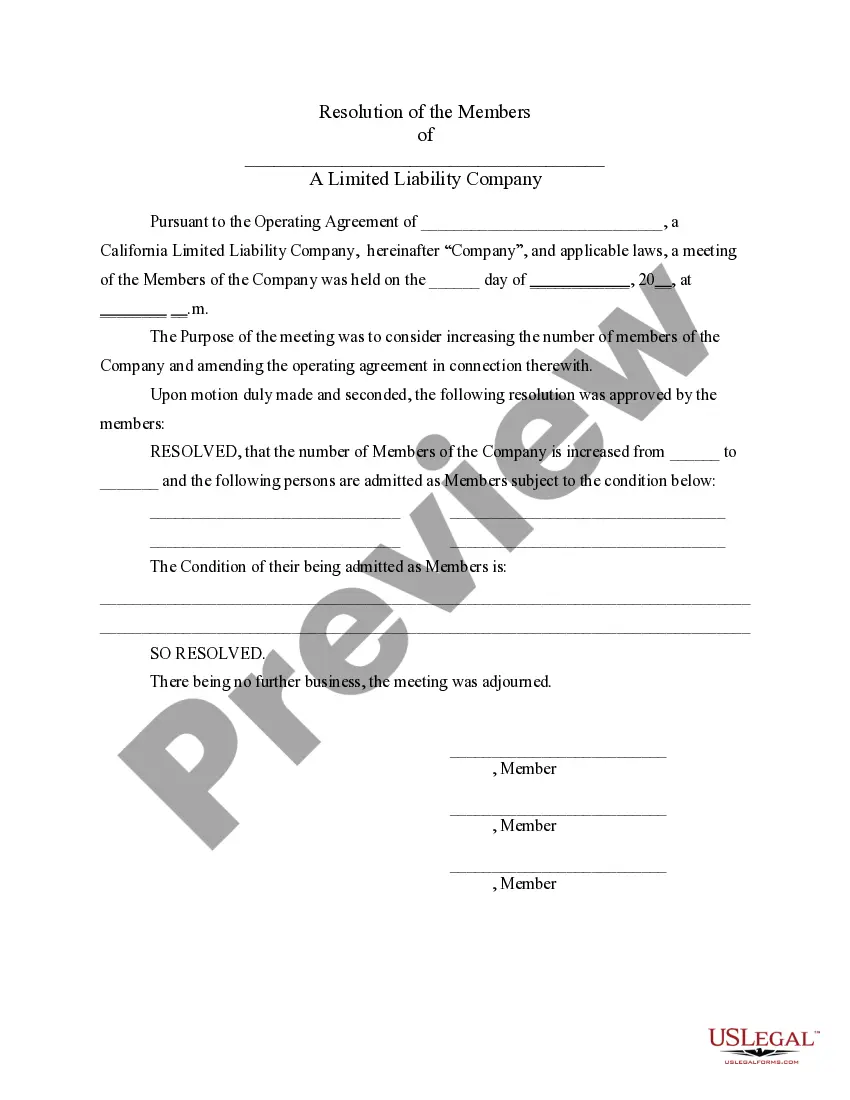

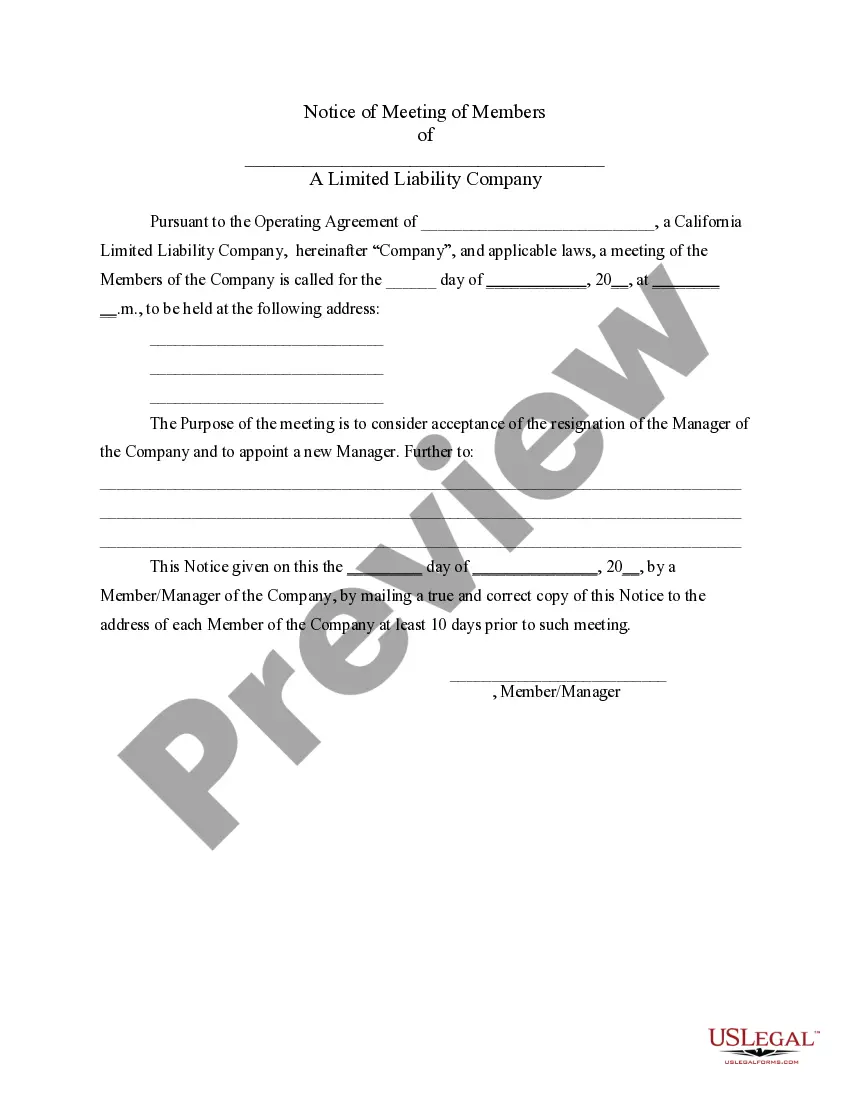

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Simi Valley California LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out California LLC Notices, Resolutions And Other Operations Forms Package?

If you are in search of a pertinent form template, it’s unattainable to locate a more suitable service than the US Legal Forms site – one of the largest collections on the web.

With this collection, you can access thousands of templates for professional and personal uses categorized by themes and regions, or specific phrases.

Utilizing our sophisticated search feature, locating the latest Simi Valley California LLC Notices, Resolutions and other Operations Forms Package is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Specify the file type and download it to your device.

- Furthermore, the relevance of every document is confirmed by a team of experienced attorneys who routinely review the templates on our site and refresh them to align with the most recent state and county stipulations.

- If you are already familiar with our platform and possess an account, all you need to do to acquire the Simi Valley California LLC Notices, Resolutions and other Operations Forms Package is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have found the sample you need. Review its description and utilize the Preview function to examine its content. If it doesn’t fulfill your requirements, leverage the Search option at the top of the page to find the appropriate document.

- Confirm your choice. Select the Buy now button. Afterward, choose your desired subscription plan and provide the information needed to create an account.

Form popularity

FAQ

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

A Statement of Information must be filed either every year for California stock, cooperative, credit union, and all qualified out-of-state corporations or every two years (only in odd years or only in even years based on year of initial registration) for California nonprofit corporations and all California and

The Statement of Information form shows a company's owners/officers, business address(es), and business description. A corporation/LLC must file a Statement of Information within 90 days of their Articles of Incorporation/Organization to do business in the state of California.

Important details that you must include in your Statement of information are: Name and address of the company. Name and address of the officers. Description of your work. Name and address of your California agent for service of process.

Every California and registered foreign limited liability company must file a Statement of Information with the California Secretary of State, within 90 days of registering with the California Secretary of State, and every two years thereafter during a specific 6-month filing period based on the original registration

The purpose of an SOI is to keep up-to-date information about an LLC and alert the state to any changes in the LLC's CEO, Registered Agent, address, and officers', members', and managers' addresses and names.

California LLCs must also file a Statement of Information. Required information includes: The name of your LLC and the Secretary of State's file number (foreign LLCs must use the name under which they're authorized to contact intrastate business) Name and address of the LLC's registered agent.

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

A Statement of Information is filed to divulge your company's activities over the prior year. This information is often most important to shareholders or other parties that have an interest in your company.

Every corporation that is incorporated, registered, or doing business in California must pay the $800 minimum franchise tax.