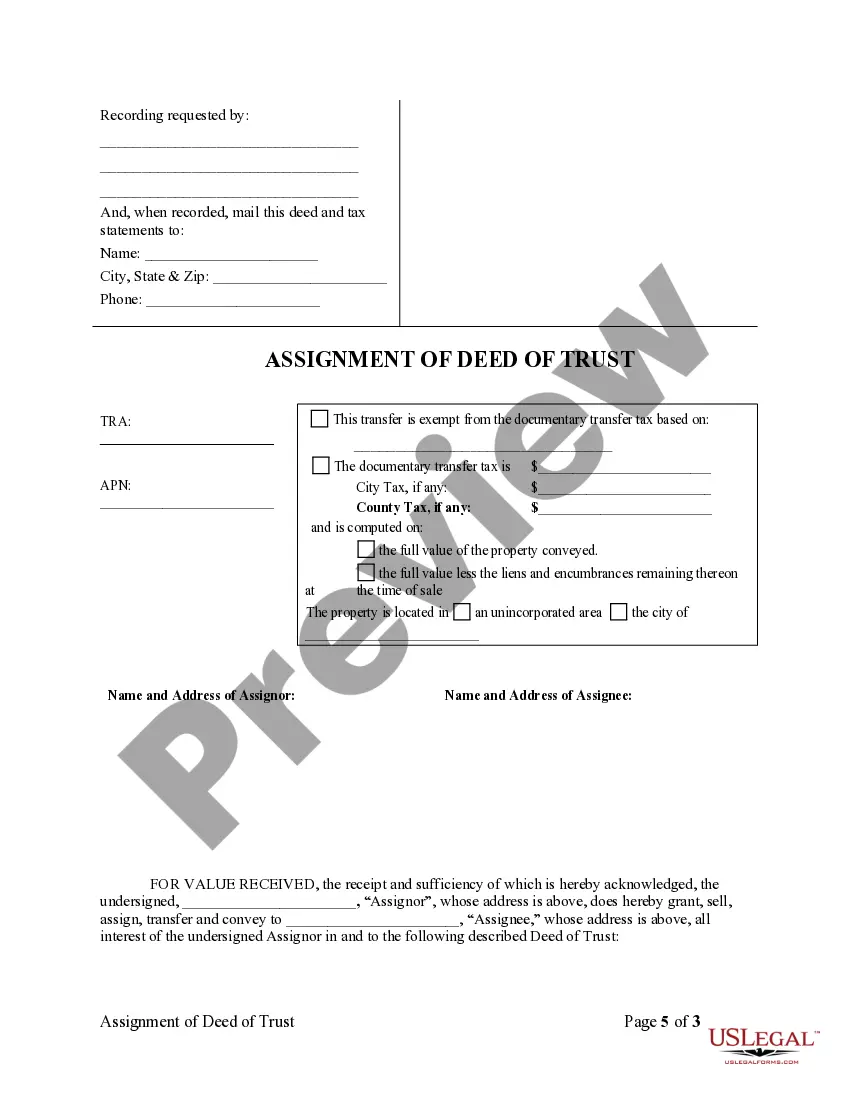

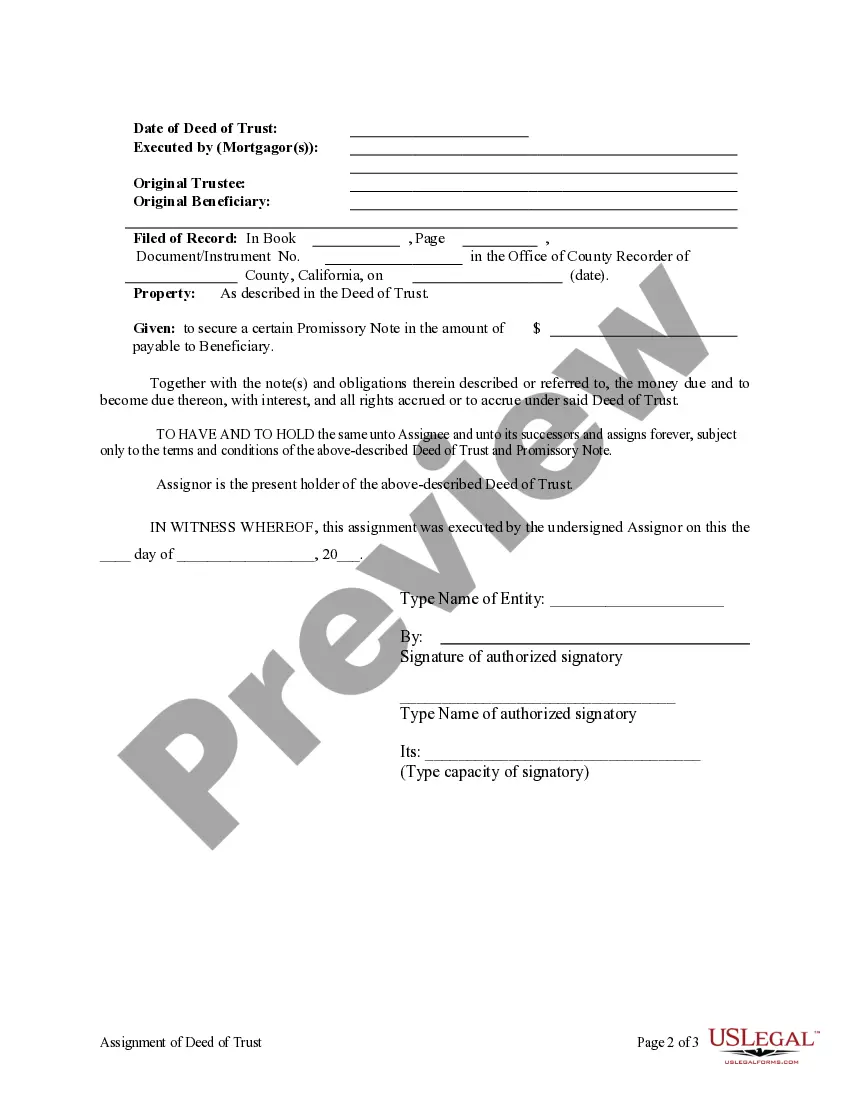

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out California Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Are you in search of a trustworthy and affordable provider of legal forms to purchase the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder? US Legal Forms is your ideal option.

Whether you require a straightforward agreement to establish rules for living together with your partner or a bundle of documents to facilitate your separation or divorce through the court system, we have you covered. Our website offers more than 85,000 current legal document templates for personal and business use. All templates we provide access to are tailored and designed based on the needs of specific states and regions.

To obtain the form, you need to Log In to your account, find the desired form, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired form templates at any time from the My documents tab.

Are you a newcomer to our platform? No problem. You can establish an account with great ease, but before that, make sure to do the following.

Now you can create your account. Then select the subscription plan and continue to payment. Once the payment is processed, download the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder in any offered format. You can return to the website at any moment and redownload the form at no extra cost.

Acquiring current legal documents has never been simpler. Give US Legal Forms a try now, and stop wasting your precious time learning about legal papers online for good.

- Ensure the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder aligns with the regulations of your state and local area.

- Review the form’s specifics (if available) to discover who and what the form is suitable for.

- Start the search anew if the form doesn’t meet your particular needs.

Form popularity

FAQ

The deed of trust is usually signed by the borrower and the trustee, who acts on behalf of the lender. This document provides a legal claim over the property in case of default. In the context of Clovis California, having clear and properly executed documentation is crucial, especially with the Assignment of Deed of Trust by Corporate Mortgage Holder, ensuring that all parties are protected.

A corporation Assignment of deed of trust mortgage involves a corporate entity transferring its rights and responsibilities as a lender to another organization or individual. This transfer is essential for maintaining the integrity of financial transactions within real estate. Understanding the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder can streamline this process and clarify the borrower’s obligations.

Typically, the Assignment of deed of trust is signed by the original mortgage holder and the new lender. This agreement establishes the new lender's rights over the property. In Clovis California, it is essential for both parties to ensure that the document is executed correctly to avoid any future disputes regarding the Assignment of Deed of Trust by Corporate Mortgage Holder.

The Assignment of mortgage or deed of trust is a legal document that transfers the rights of the original lender to another party. This process ensures that the new holder has the authority to collect payments and enforce the terms of the original agreement. In Clovis California, the Assignment of Deed of Trust by Corporate Mortgage Holder follows established legal protocols to maintain clarity in property ownership.

Typically, the lender or mortgage holder files the deed of trust. This process may also involve the borrower, particularly if they need to ensure the recording aligns with their financial agreements. It's important for stakeholders to know the roles and responsibilities in the filing process. Using platforms like US Legal Forms can aid in the correct submission of the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder.

A corporate assignment of deed of trust refers to the transfer of the beneficial interest and rights associated with a deed of trust from one corporate entity to another. This process is crucial in the real estate finance sector and serves to maintain the chain of title for the property. Understanding the implications of the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder can benefit anyone involved in property transactions or financing.

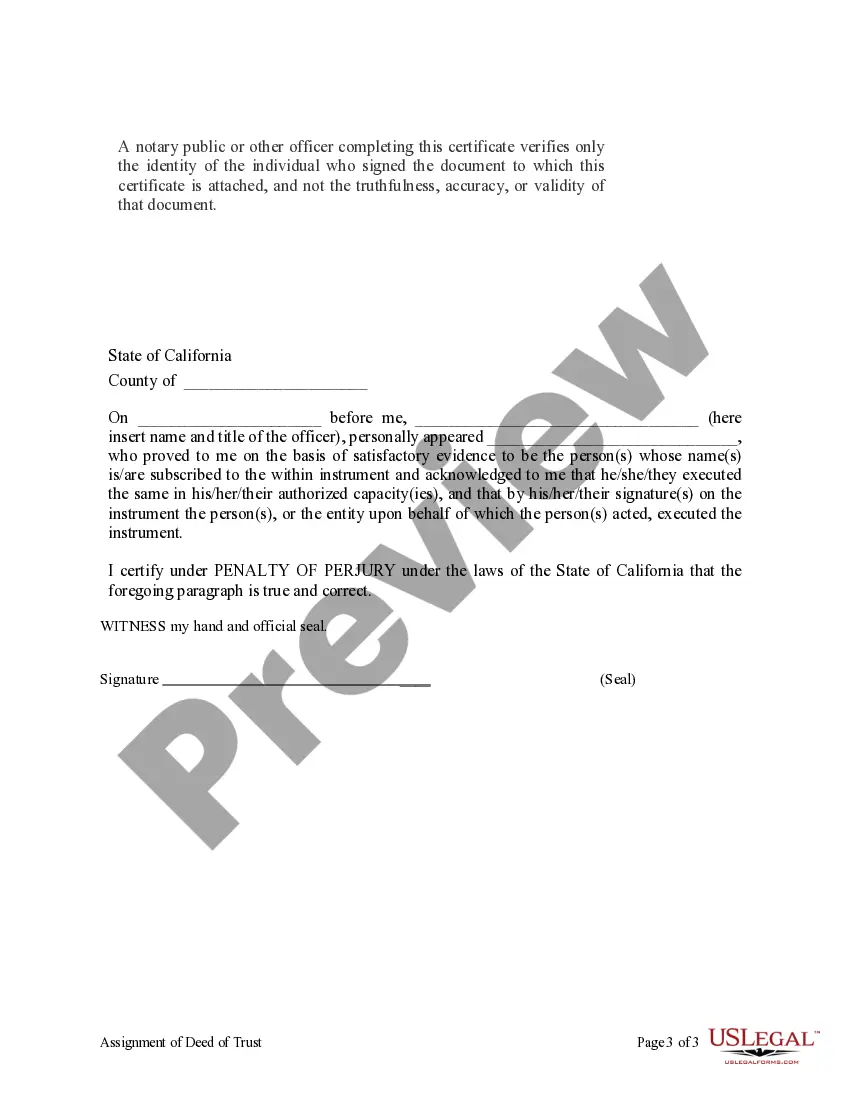

To file a deed of trust in California, begin by preparing the document according to legal guidelines. Once completed, you must submit the deed to the county recorder in which the property is located. After recording, ensure you obtain a copy of the filed deed for your records. Utilizing resources such as US Legal Forms can simplify this process for the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder.

Yes, a trust deed must be recorded in California to protect the interests of all parties involved. This recording ensures that the deed is public knowledge, which helps establish the priority of the mortgage. Failing to record can lead to complications, especially during the transfer of property. For those navigating the process, the Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder presents an essential step to secure your investment.

A deed of transfer officially conveys property ownership, while a deed of Assignment transfers an interest, like a mortgage or trust deed, from one party to another. In the situation of a Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder, this distinction is crucial since the focus is on the rights tied to the mortgage rather than ownership of the property itself. Understanding this difference can make navigating real estate transactions clearer.

Trust deeds may come with disadvantages such as limited borrower rights and potential high fees if foreclosure occurs. When you consider a Clovis California Assignment of Deed of Trust by Corporate Mortgage Holder, it's essential to understand that these deeds can result in quick foreclosure processes. Consequently, homeowners may feel at a disadvantage compared to traditional mortgages.