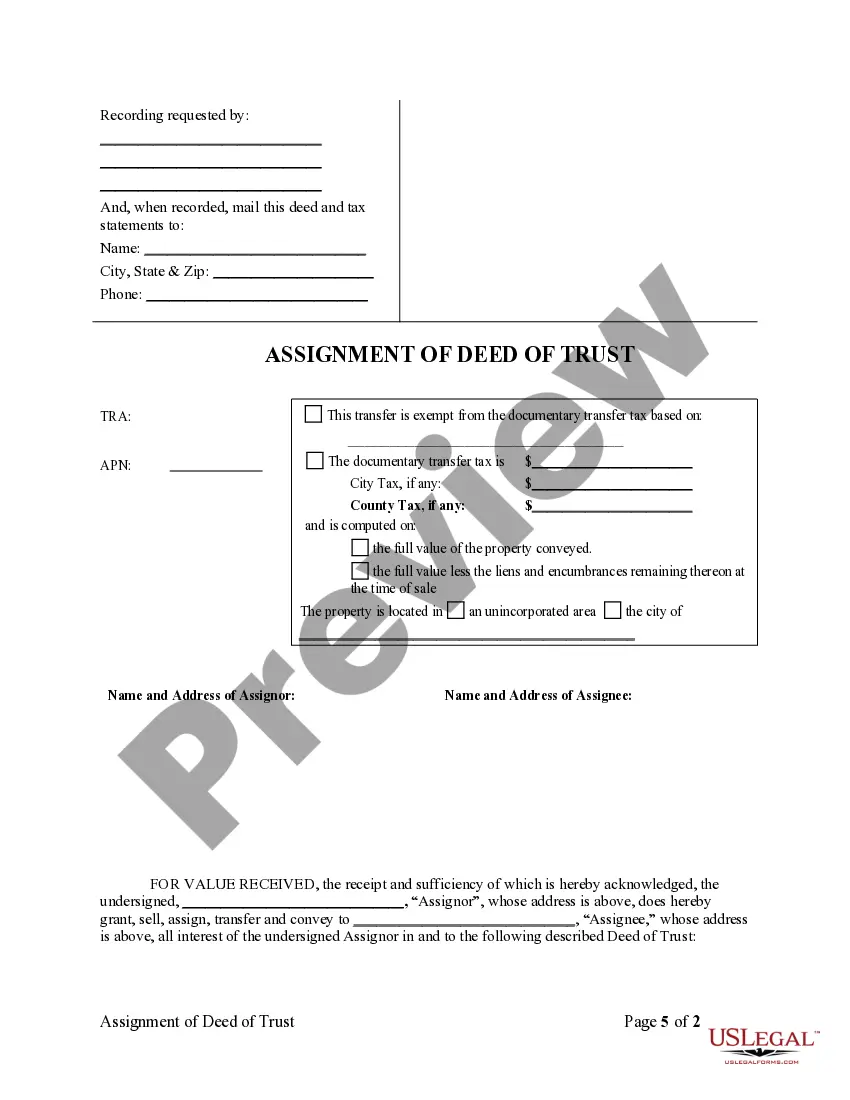

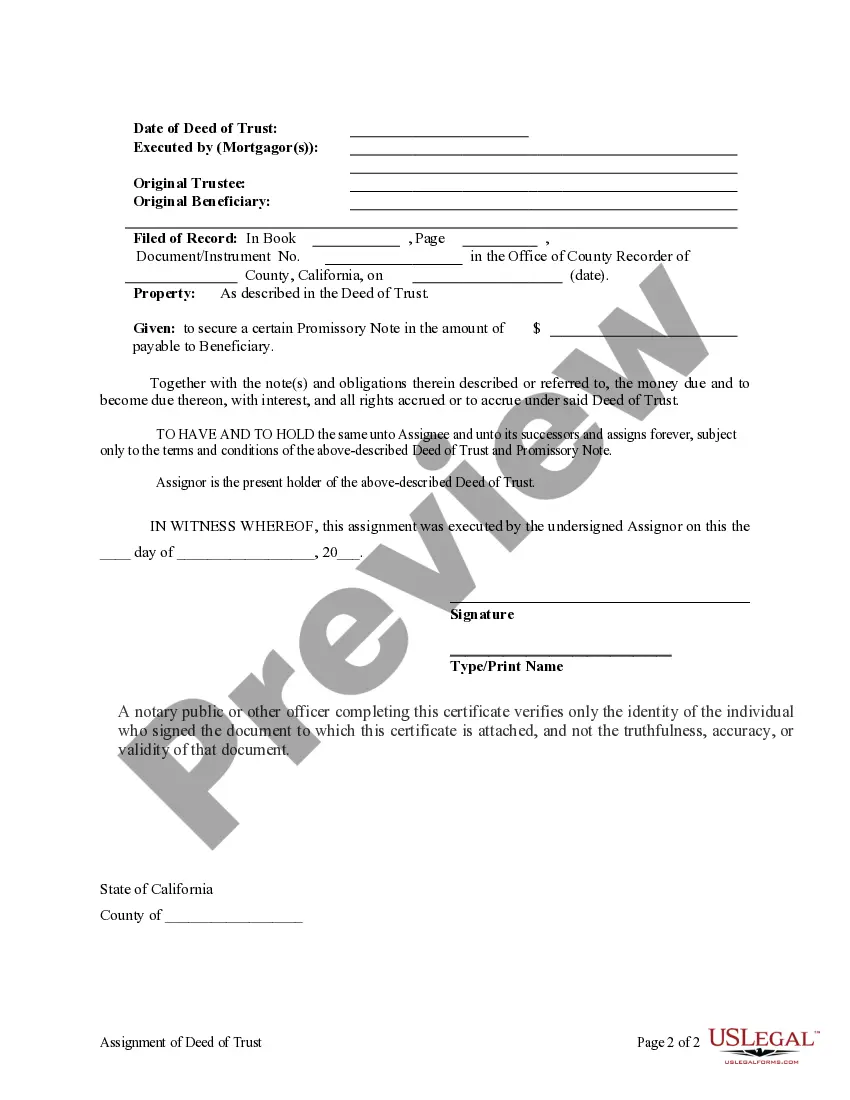

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder

Description

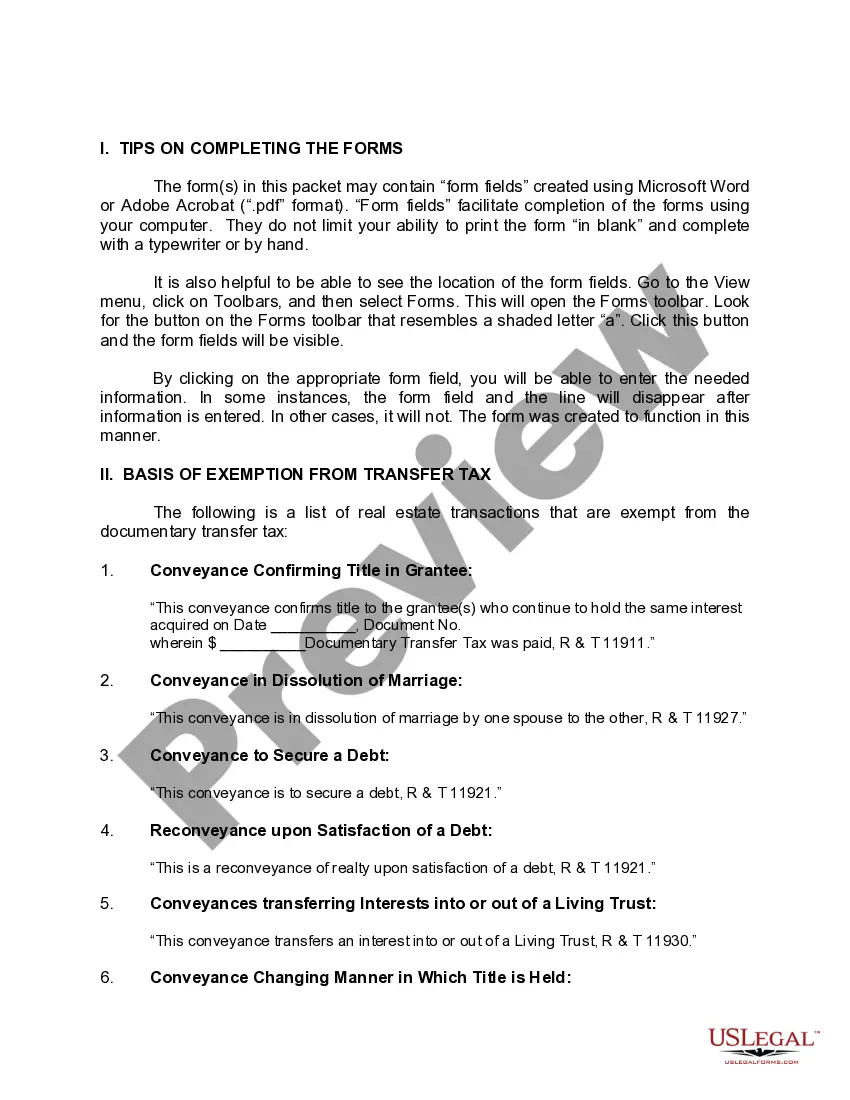

How to fill out California Assignment Of Deed Of Trust By Individual Mortgage Holder?

Irrespective of societal or occupational standing, completing legal paperwork is a regrettable requirement in the contemporary world.

Frequently, it is nearly unfeasible for an individual lacking any legal expertise to create such documents from scratch, primarily because of the intricate vocabulary and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Verify that the form selected is applicable to your locality, as the laws of one state or county may not apply to another.

Review the form and examine a brief summary (if available) of circumstances in which the document can be utilized. If the chosen form does not satisfy your needs, you may start anew and look for the required document.

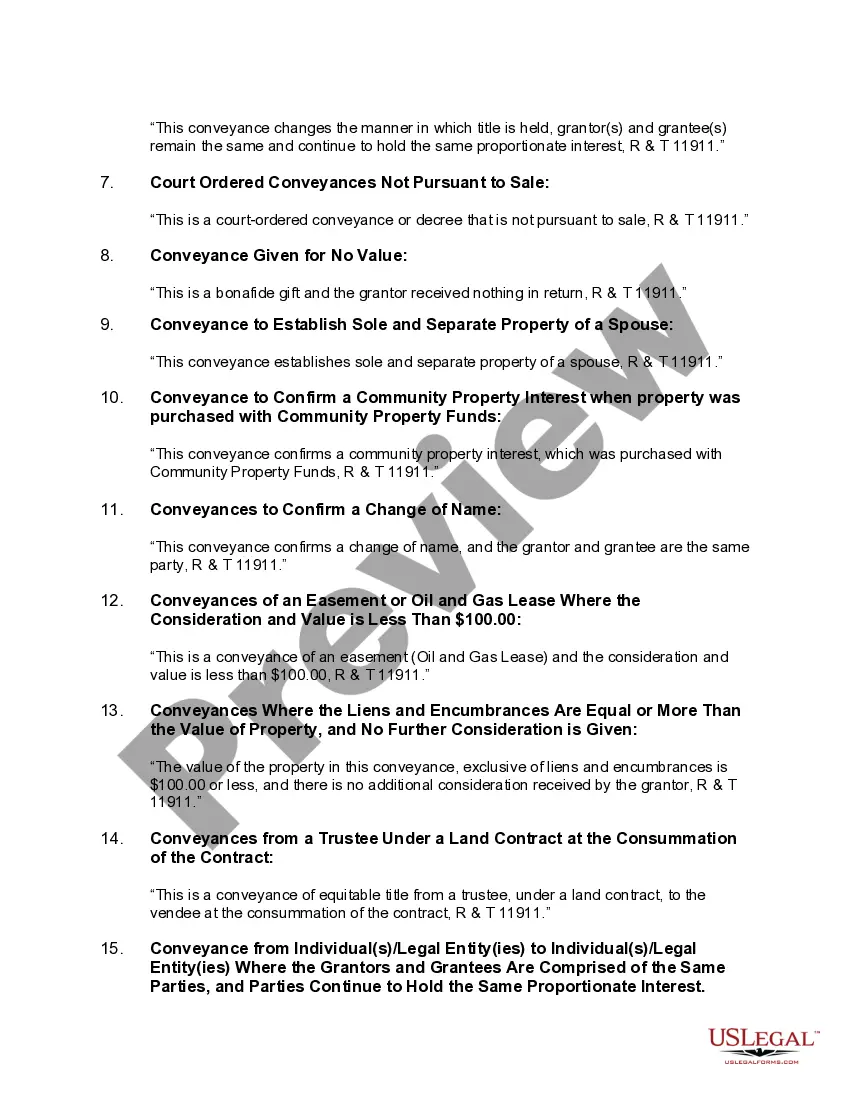

- Our platform provides an extensive collection with over 85,000 ready-to-use state-specific forms suited for nearly every legal situation.

- US Legal Forms also acts as a valuable tool for associates or legal advisors aiming to enhance their time efficiency with our DIY documents.

- Whether you are in need of the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder or any other form applicable in your jurisdiction, US Legal Forms has everything readily available.

- Here’s how you can swiftly obtain the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder using our reliable service.

- If you are already a member, simply Log In to your account to access the required form.

- However, if you are new to our site, make sure to follow these instructions before acquiring the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder.

Form popularity

FAQ

One of the biggest mistakes parents make is failing to communicate their intentions clearly with their beneficiaries. This lack of clarity can lead to misunderstandings and disputes down the line. To avoid issues, consider utilizing a well-documented approach like the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder to ensure that all parties understand their roles and responsibilities.

The property in a trust is owned by the trust itself, managed by a trustee for the benefit of the beneficiaries. The trustee has a fiduciary duty to manage the property according to the trust's terms. Understanding the dynamics of the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder can help clarify ownership and responsibilities associated with trust properties.

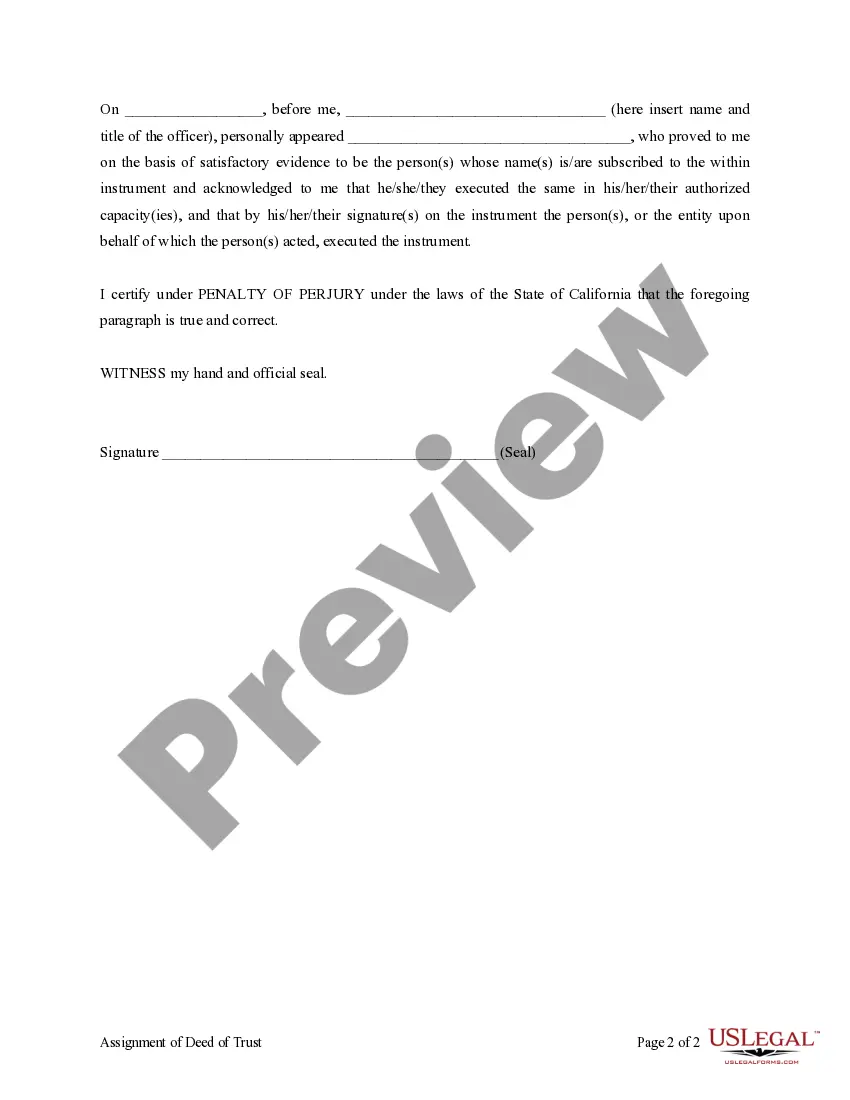

Transferring property out of a trust in California involves executing a deed that specifies the details of the transfer. The trustee must sign this deed, which is then recorded with the appropriate county office. For a smooth process, consider exploring US Legal Forms for the documentation required for the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder.

To transfer property from a trust to an individual in California, you generally need to prepare a deed that specifies the transfer. This deed should be signed by the trustee and recorded with the county recorder's office. If you have questions about the process or need documents, consider using resources like US Legal Forms for guidance on the Thousand Oaks California Assignment of Deed of Trust by Individual Mortgage Holder.

The filing of a deed of trust is generally done by the lender or their agent, who submits the document to the county recorder's office. In Thousand Oaks, California, this filing gives public notice of the lender's interest in the property. It is vital for individual mortgage holders to comply with these regulations to protect their rights and investment.

Typically, a deed of trust is created by the borrower, also known as the trustor, who needs financing for a home. This document is then prepared and signed with the lender, creating the trust relationship. In Thousand Oaks, California, individual mortgage holders can easily navigate this process with platforms like USLegalForms, ensuring all necessary legal steps are correctly followed.

An assignment of a mortgage signifies the transfer of the mortgage rights from one party to another. In Thousand Oaks, California, this process often involves an assignment of deed of trust by individual mortgage holder, allowing lenders to delegate the management of the mortgage. This ensures that payments and obligations remain clear, simplifying the process for those involved. Utilizing platforms like US Legal Forms can streamline this process and provide necessary legal documentation.

A deed of assignment involves transferring rights and interests in an asset, while a deed of transfer typically refers to the transfer of ownership. In the context of Thousand Oaks, California, an assignment of deed of trust by individual mortgage holder can involve assigning the right to collect payments, rather than changing ownership of the property itself. Understanding these distinctions helps parties navigate legal transactions more effectively.

California primarily uses a deed of trust instead of a traditional mortgage. This legal instrument allows for a more streamlined process, especially beneficial for the assignment of deed of trust by individual mortgage holder. It is essential for buyers and sellers in Thousand Oaks to understand this distinction, as it impacts their rights and obligations in property transactions. Familiarity with deeds of trust ensures smoother dealings in California's real estate market.

Lenders often prefer a deed of trust because it provides a quicker and more efficient foreclosure process. In Thousand Oaks, California, an assignment of deed of trust by individual mortgage holder allows lenders to expedite the recovery of their funds in case of default. This efficiency attracts lenders, making it a common choice in real estate financing. As a result, both borrowers and lenders benefit from the clarity and speed involved.