This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

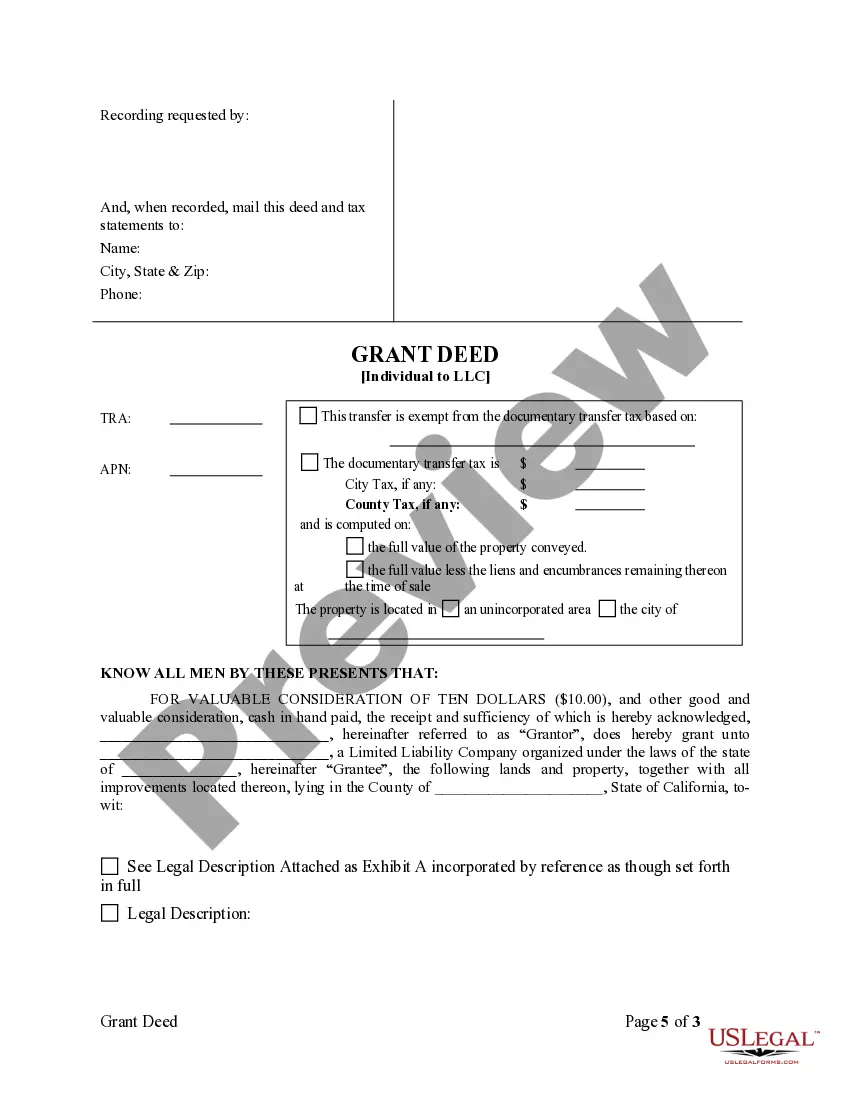

San Jose California Grant Deed from Individual to LLC

Description

How to fill out California Grant Deed From Individual To LLC?

We consistently aim to minimize or avert legal complications when engaging with intricate law-related or financial issues.

To achieve this, we seek legal services that are typically quite costly.

However, not every legal situation is as complicated.

Many of them can be managed by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the San Jose California Grant Deed from Individual to LLC or any other document swiftly and securely.

- US Legal Forms is a digital collection of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository enables you to handle your issues independently without the need for an attorney.

- We provide access to legal document templates that aren't always accessible to the public.

- Our templates are tailored to specific states and regions, making the search process considerably easier.

Form popularity

FAQ

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Other Grant Deed Requirements The deed is effective even without them. For example, it is not necessary to enter the date the deed was made or the amount of money paid. And a grant deed will be valid if the grantor's signature on the grant deed is not notarized and even if it's not recorded in the local land records.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

Both types of legal documents serve the same function of transferring ownership of real property. The fundamental difference between quitclaim deeds and grant deeds is the level of protection and warranty provided to the grantee.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

California uses two types of deeds to change ownership of real property: grant deeds and quitclaim deeds. Further names such as warranty deed, interspousal deed, or trust transfer deed are simply special identification given to grant deeds or quitclaim deeds based on specific circumstances.

Transferring your property to an LLC is usually achieved by filing a quitclaim deed, a general warranty deed, or some other kind of deed to facilitate a transfer of the property from you to your LLC. Otherwise, as you acquire property, it can be directly purchased in the name of your LLC.