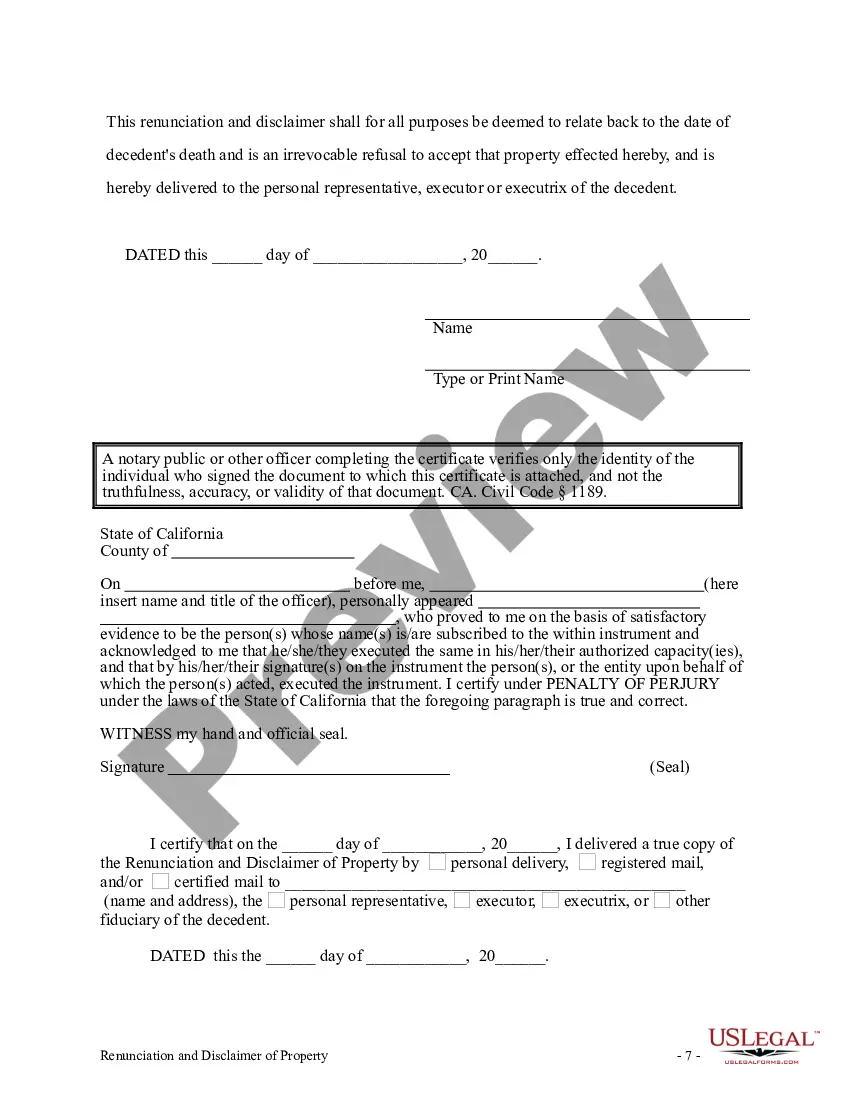

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond

Description

How to fill out California Renunciation And Disclaimer Of Individual Retirement Account, Annuity, Or Bond?

If you are looking for an authentic form, it’s unattainable to discover a more suitable platform than the US Legal Forms site – likely the most extensive online collections.

Here you can obtain a vast array of document examples for business and personal uses by categories and jurisdictions, or keywords.

With our top-notch search functionality, acquiring the latest Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is as straightforward as 1-2-3.

Acquire the form. Choose the format and save it to your device.

Make adjustments. Fill in, modify, print, and sign the procured Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond.

- If you are already familiar with our platform and possess an account, all you need to obtain the Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have opened the sample you need. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t fulfill your needs, employ the Search field at the top of the page to locate the suitable file.

- Confirm your selection. Hit the Buy now button. Subsequently, select the preferred subscription option and provide details to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Writing an inheritance letter involves clearly stating your intentions regarding the inheritance, including any renunciations or disclaimers. Begin with the date and your information, followed by the recipient’s details. Clearly express your desire to disclaim any rights to the inheritance, particularly if it involves an IRA, Annuity, or Bond, and reference your location in Elk Grove, California. For precise language and legal compliance, consider using uslegalforms to create a tailored letter.

In California, there is no state inheritance tax; however, federal tax rules apply. Generally, you can inherit any amount without incurring taxes at the state level. That said, if the estate exceeds certain thresholds, it may be subject to federal estate taxes. It’s wise to consult an estate planner or tax professional for specific guidance, especially when dealing with Individual Retirement Accounts, Annuities, or Bonds.

To disclaim an inheritance in California, you must provide a written statement that clearly indicates your intention to renounce your share of the inheritance. This is usually done by filing a Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond with the appropriate legal authorities. Ensure you complete this process within the required time frame, as there are deadlines associated with such disclaimers. Using uslegalforms can simplify the preparation of necessary documents and guide you through the steps.

To disclaim an inheritance in California, you must file a formal disclaimer with the probate court or the executor of the estate. This document should clearly state your refusal of the inheritance and comply with state laws regarding disclaimers. For a seamless process, consider using uslegalforms, which can guide you through the steps for an Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond.

Yes, you can refuse an inheritance in California through a legal process known as disclaimer. This can apply to various assets, including individual retirement accounts, annuities, and other financial instruments. By engaging in an Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, you can choose not to accept your inheritance while ensuring a smooth transition according to state laws.

To disclaim an inheritance in California, you should draft a written disclaimer outlining your intention not to accept the inheritance. This document needs to include your name, a description of the asset, and your signature. Using resources from platforms like uslegalforms can help you create a proper Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, ensuring legal compliance and effectiveness.

In California, you can inherit any amount from your parents without incurring estate taxes, as the state does not impose an inheritance tax. However, federal estate taxes may apply if the estate exceeds the threshold limit. When considering the Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, it’s wise to consult a tax professional to understand any tax implications.

Section 280 of the California Probate Code outlines the requirements for disclaiming an inheritance. This section specifies how beneficiaries can formally refuse assets, like retirement accounts and bonds. If you are considering the Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, this section is crucial to understand your rights and obligations.

If you refuse your inheritance, it typically goes to the next eligible beneficiary or back to the estate. This process can differ based on California law and the nature of the asset, like a retirement account or annuity. In the context of the Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, formally disclaiming your inheritance ensures it is distributed according to your wishes and state laws.

California probate codes govern the distribution of assets after someone passes away. They outline the legal process for handling estates, including wills and trusts. Understanding these codes is essential, especially for those considering an Elk Grove California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond. By knowing these laws, you can make informed decisions about your inheritance.