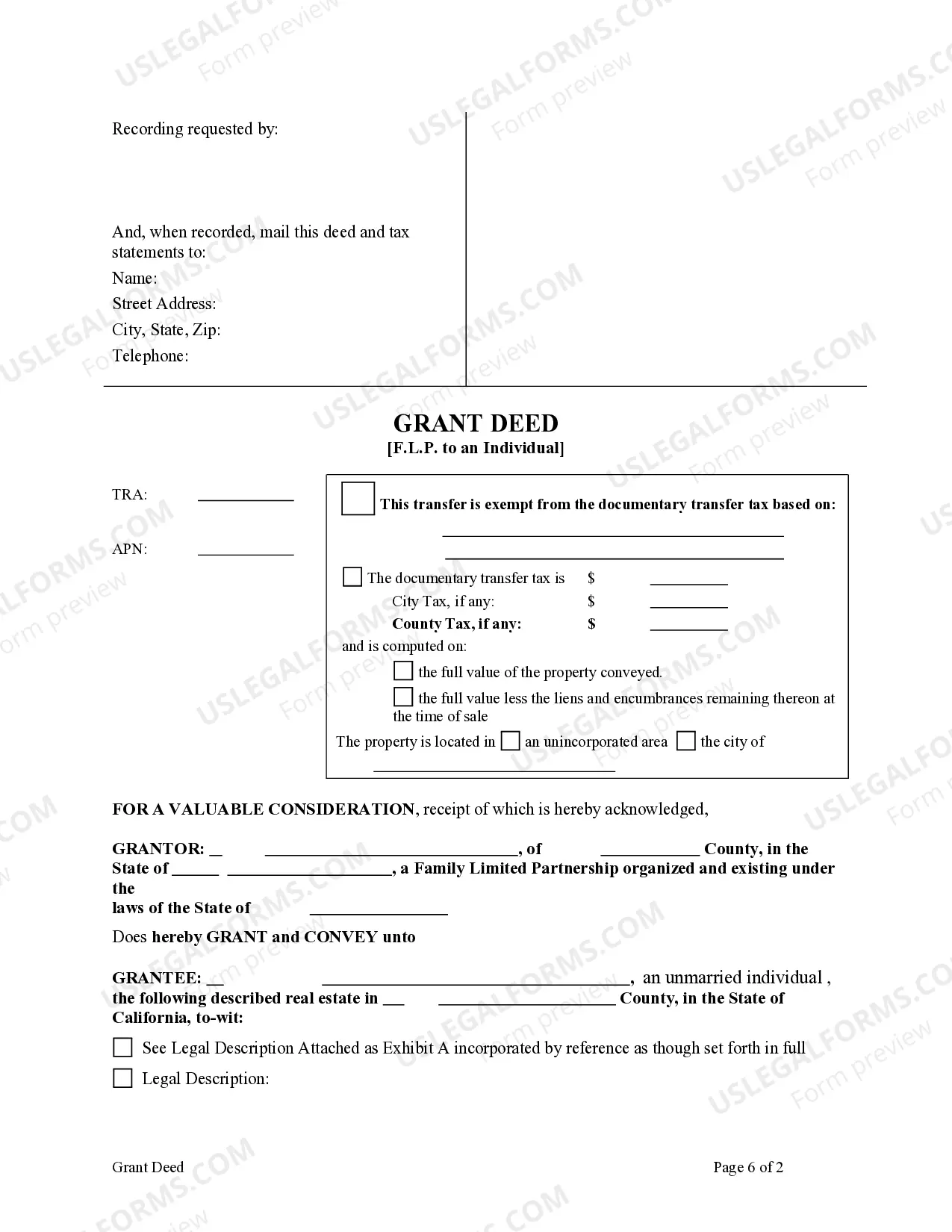

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the

Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Carlsbad California Grant Deed from Family Limited Partnership to an Individual.

Description

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

Leverage the US Legal Forms and gain immediate access to any form you need.

Our advantageous website featuring thousands of document templates makes it easy to locate and obtain nearly any document sample you desire.

You can download, fill out, and sign the Carlsbad California Grant Deed from Family Limited Partnership to an Individual in just a few minutes instead of searching the internet for hours for a suitable template.

Utilizing our library is an excellent method to enhance the security of your record submission. Our experienced lawyers consistently review all the documents to ensure that the templates are relevant for a specific area and adhere to updated laws and regulations.

Initiate the downloading process. Click Buy Now and choose the pricing plan that works best for you. Then, create an account and complete your order using a credit card or PayPal.

Download the file. Select the format to acquire the Carlsbad California Grant Deed from Family Limited Partnership to an Individual and modify, complete, or sign it according to your specifications.

- How can you acquire the Carlsbad California Grant Deed from Family Limited Partnership to an Individual.

- If you possess a subscription, simply Log In to your account. The Download button will be available on all the documents you examine.

- Moreover, you can find all your previously saved documents in the My documents section.

- If you do not yet have an account, follow the steps outlined below.

- Locate the template you need. Make sure it is the template you desired: verify its title and description, and use the Preview feature when it is available. Otherwise, use the Search box to find the required one.

Form popularity

FAQ

Adding someone to a deed in California can have significant tax implications. It may trigger a reassessment of property value, which could lead to an increase in property taxes. Additionally, if the transfer is considered a gift, it may impact your gift tax obligations. When you consider transferring a Carlsbad California Grant Deed from Family Limited Partnership to an Individual, it's wise to consult with a tax professional to fully understand the consequences.

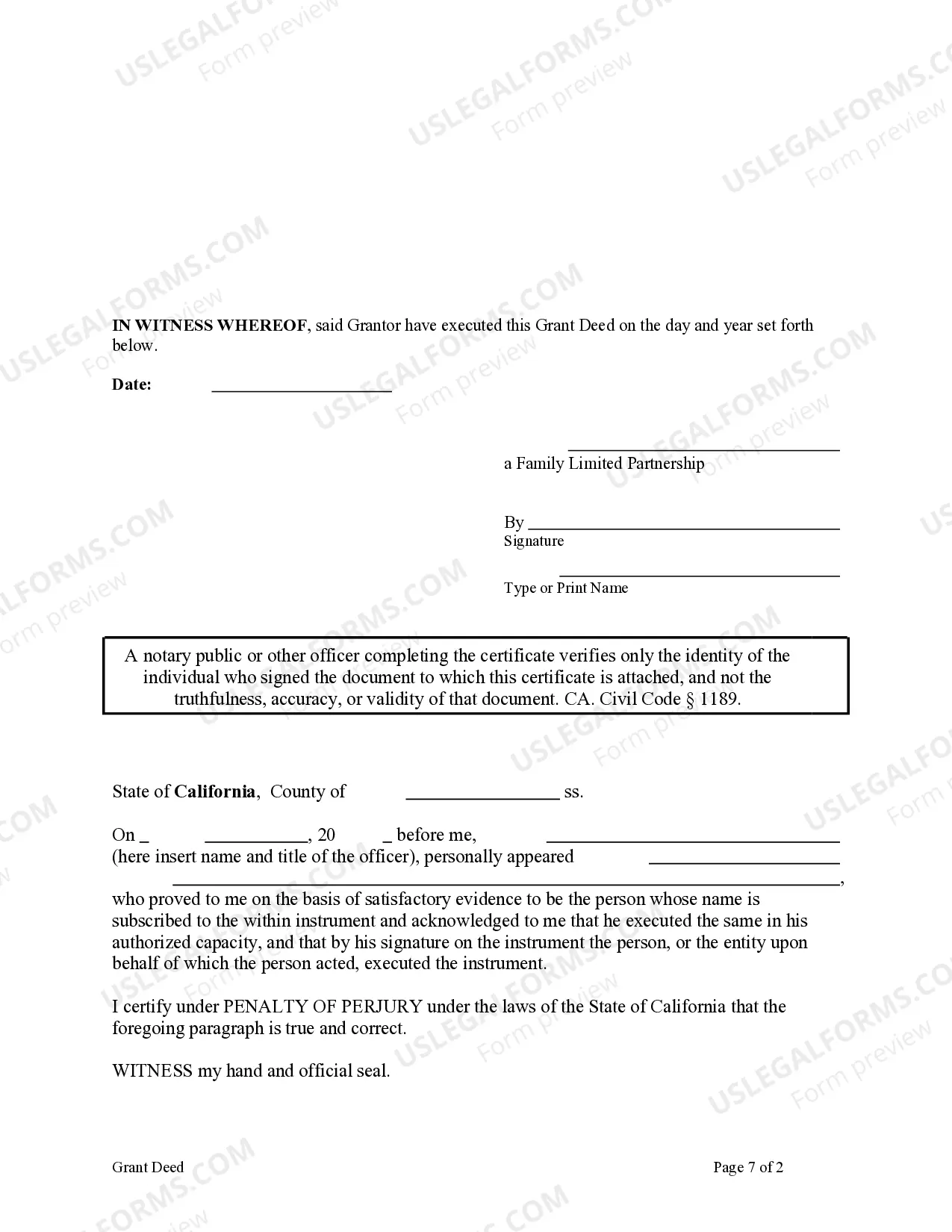

To add someone to a grant deed, start by drafting a new deed that reflects the addition along with the names of all current owners. Ensure the new deed complies with California law by including adequate property descriptions and signatures. Once signed and notarized, submit the new deed to the county recorder. Using the process of transferring a Carlsbad California Grant Deed from Family Limited Partnership to an Individual can clarify the transfer and simplify the addition of new names.

While it is not strictly necessary to hire a lawyer to add someone to a deed, it is often recommended. A legal professional can help ensure that the deed is correctly drafted and that all legal requirements are met. This becomes particularly important when dealing with complex situations, such as transferring a Carlsbad California Grant Deed from Family Limited Partnership to an Individual. Consulting a lawyer can help protect your interests and avoid future disputes.

To add a name to a grant deed in California, you will need to create a new deed that includes all the current owners and the new individual you wish to add. This deed must clearly identify the property and indicate the new ownership rights. After completing the deed, it must be signed, notarized, and recorded with the county. By using a Carlsbad California Grant Deed from Family Limited Partnership to an Individual, the process becomes smoother when all parties are in agreement.

Typically, a family limited partnership does not go through probate, as the assets are held within the partnership. These assets can transfer directly to the designated individuals according to the partnership agreement upon the death of the partner. However, understanding the specific dynamics of your partnership is crucial. If you plan to transition a Carlsbad California Grant Deed from Family Limited Partnership to an Individual, clear documentation is essential to avoid any complications.

To amend a grant deed in California, you need to create a new deed that reflects the changes you want to make. This amended deed must include essential information, such as the names of the parties involved and a clear description of the property. Once you complete the new grant deed, you should have it signed and notarized. Finally, you must file the amended deed with the county recorder for it to be legally effective, especially if you are transferring a Carlsbad California Grant Deed from Family Limited Partnership to an Individual.

Yes, family limited partnerships must file an annual return with the IRS, even if they do not owe any tax. This ensures transparency and proper reporting of income and distributions. Understanding your obligations is crucial, especially if engaging in a Carlsbad California Grant Deed from Family Limited Partnership to an Individual.

Family limited partnerships must adhere to specific guidelines, such as clearly defined roles for general and limited partners. Proper documentation and adherence to state laws are vital for maintaining the partnership's validity. When executing a Carlsbad California Grant Deed from Family Limited Partnership to an Individual, these rules become particularly important.

The IRS views family limited partnerships as legitimate entities but scrutinizes them for tax avoidance. It's essential to ensure compliance with all IRS guidelines to prevent penalties. Understanding these regulations is critical, especially when considering a Carlsbad California Grant Deed from Family Limited Partnership to an Individual.

Yes, distributions from a family limited partnership are generally taxable. The tax treatment can vary depending on the partner's overall income and the partnership's profits. Consulting with a tax professional can clarify how this relates to the Carlsbad California Grant Deed from Family Limited Partnership to an Individual.