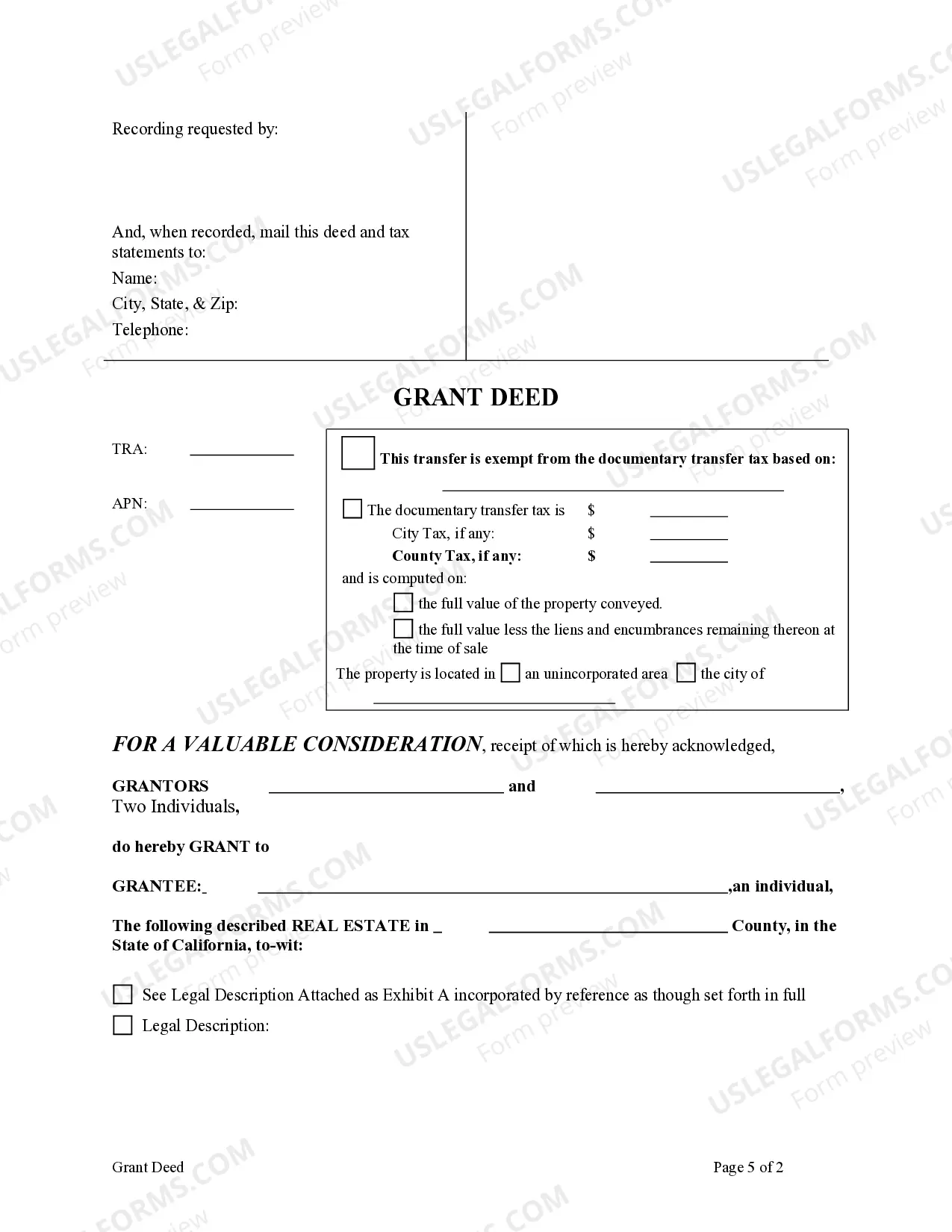

This form is a Grant Deed where the Grantors are two individuals and the Grantee is an individual. Grantors convey the property to Grantee. This deed complies with all state statutory laws.

Contra Costa California Grant Deed

Description

How to fill out California Grant Deed?

If you have previously employed our service, Log In to your account and store the Contra Costa California Grant Deed on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile in the My documents section whenever you need to use it again. Utilize the US Legal Forms service to quickly locate and store any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if available, to verify if it suits your requirements. If it doesn’t, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Obtain your Contra Costa California Grant Deed. Select the file format for your document and download it to your device.

- Fill out your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

1. Where can I get recorded documents, such as birth, death or marriage certificates, or deeds and liens? A wide variety of vital records may be obtained by visiting the Clerk-Recorder's office at 555 Escobar Street in downtown Martinez, near the Amtrak station.

California counties that allow intercounty base value transfers: Alameda, Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Mateo, Santa Clara, Tuolumne, and Ventura. Since these counties are subject to change, we recommend you contact the county to which you wish to move to verify eligibility.

You can obtain a copy of your Grant Deed directly from the Los Angeles County Registrar-Recorder/County Clerk. No third party assistance is needed. The County Registrar-Recorder mails the original Grant Deed document to the homeowner after it is recorded. Therefore, you should already have your original Grant Deed.

Purchasers of property at the tax sale must also pay a Documentary Transfer Tax on the amount of the bid. The tax is based on the rate of $. 55 for each $500 or fractional part of each $500 when the bid exceeds $100.

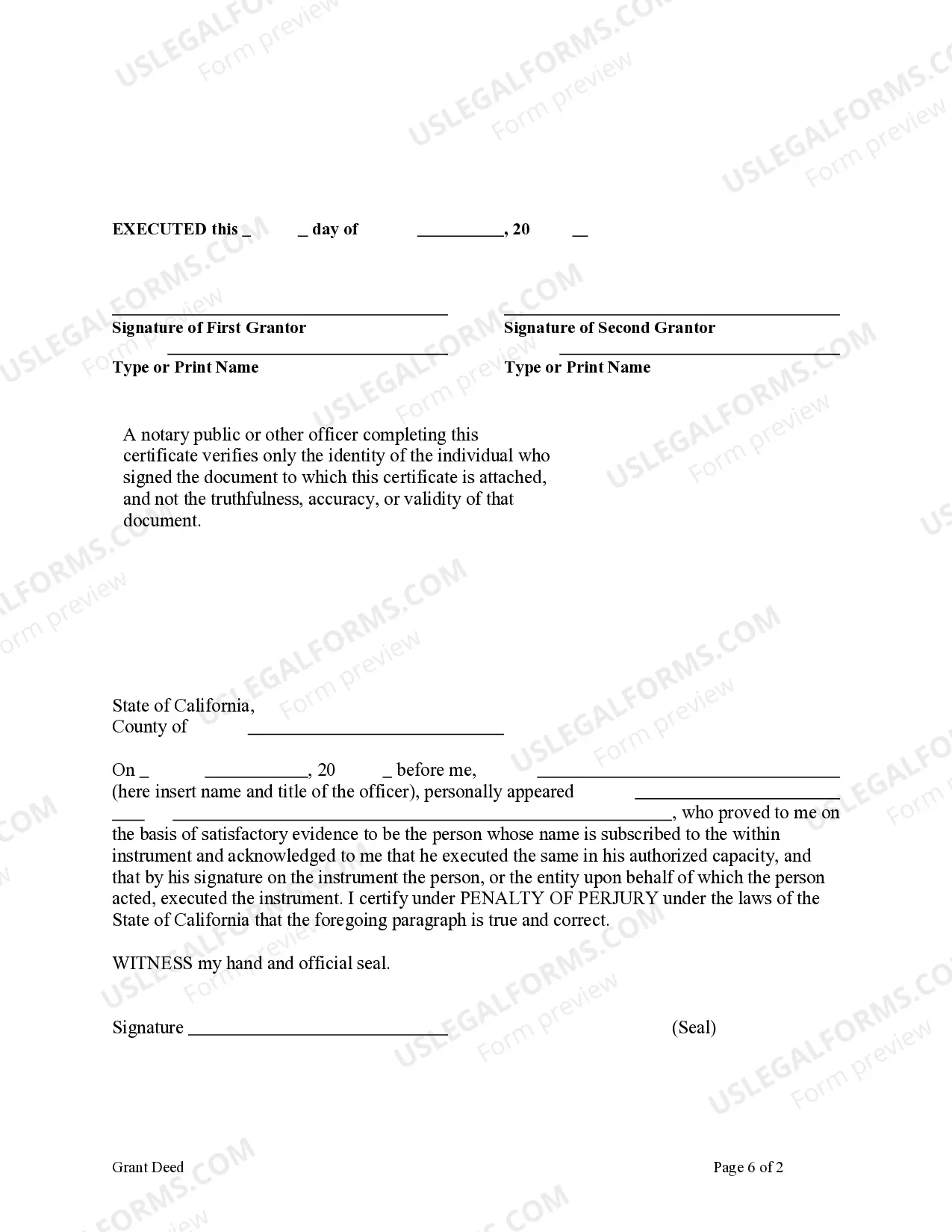

Recording Fees First Page: $14; $3 for each additional page. Combined documents: $14 per title. Non-standard page: $3 per page.

Real Estate Transfer Tax: Total: $1.10/per $1,000 property value (comprised of City Rate: $0.55/per $1,000 property value plus County Rate: $0.55/per $1,000 property value).