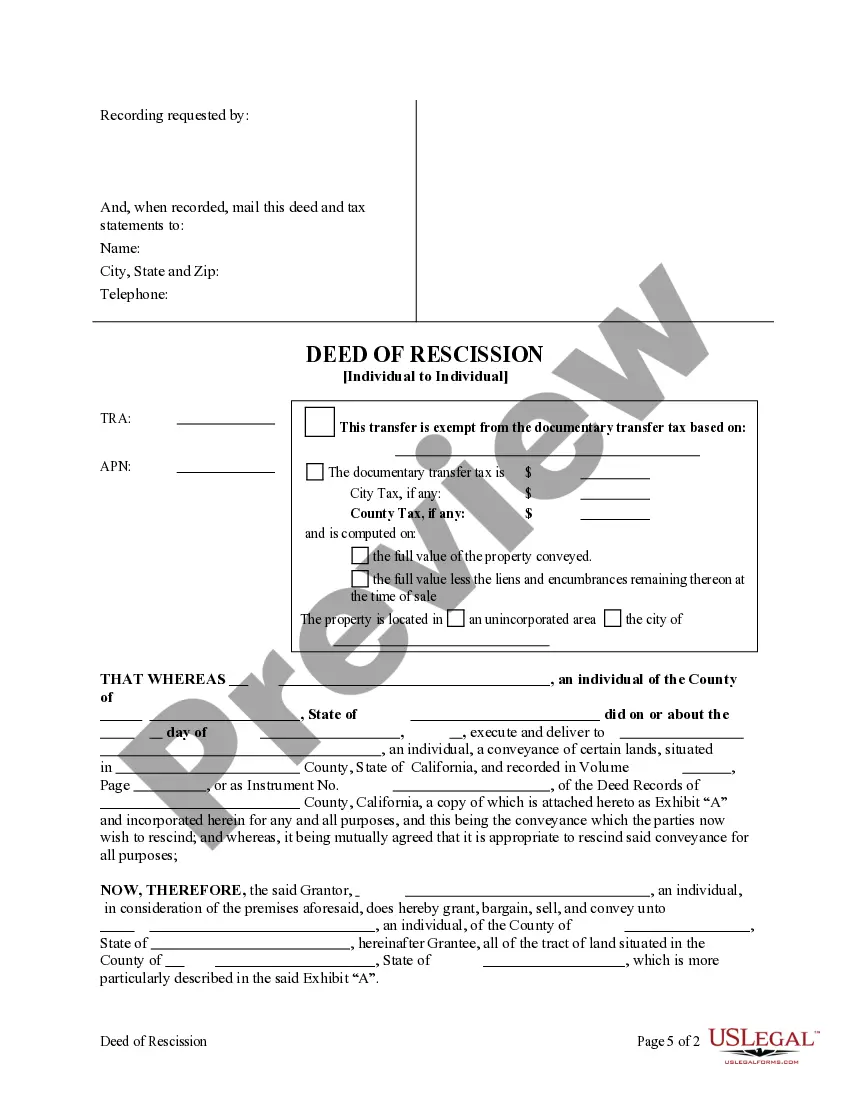

This form is a Deed of Rescission where the Grantor is an individual and the Grantee is an individual. The parties are rescinding or unwinding a prior transfer of the subject property. Grantor conveys and grants the described property to the Grantee. Grantor will defend and warrant the property only as to those claiming by through and under him and not otherwise. This deed complies with all state statutory laws.

San Jose California Deed of Rescission - Individual to Individual

Description

How to fill out California Deed Of Rescission - Individual To Individual?

If you have previously employed our service, Log In to your account and retrieve the San Jose California Deed of Rescission - Individual to Individual onto your device by selecting the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have uninterrupted access to all documents you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to effortlessly find and download any template for your personal or commercial requirements!

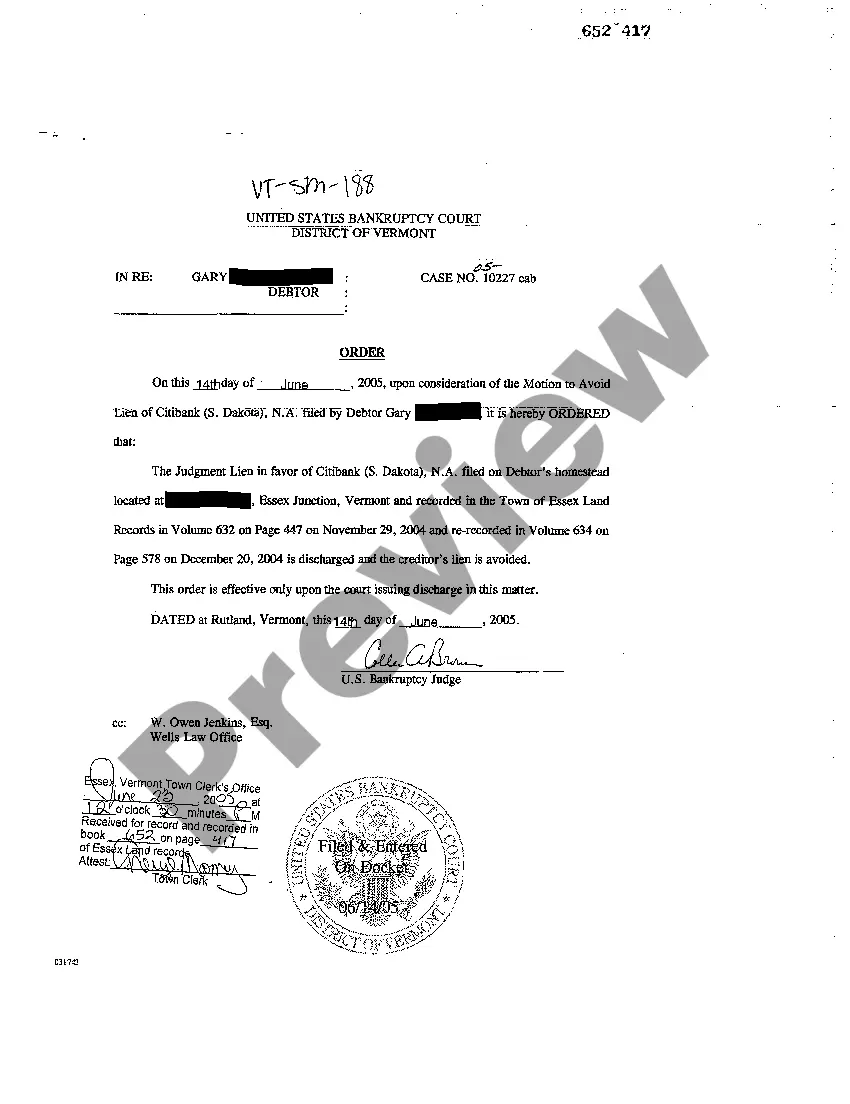

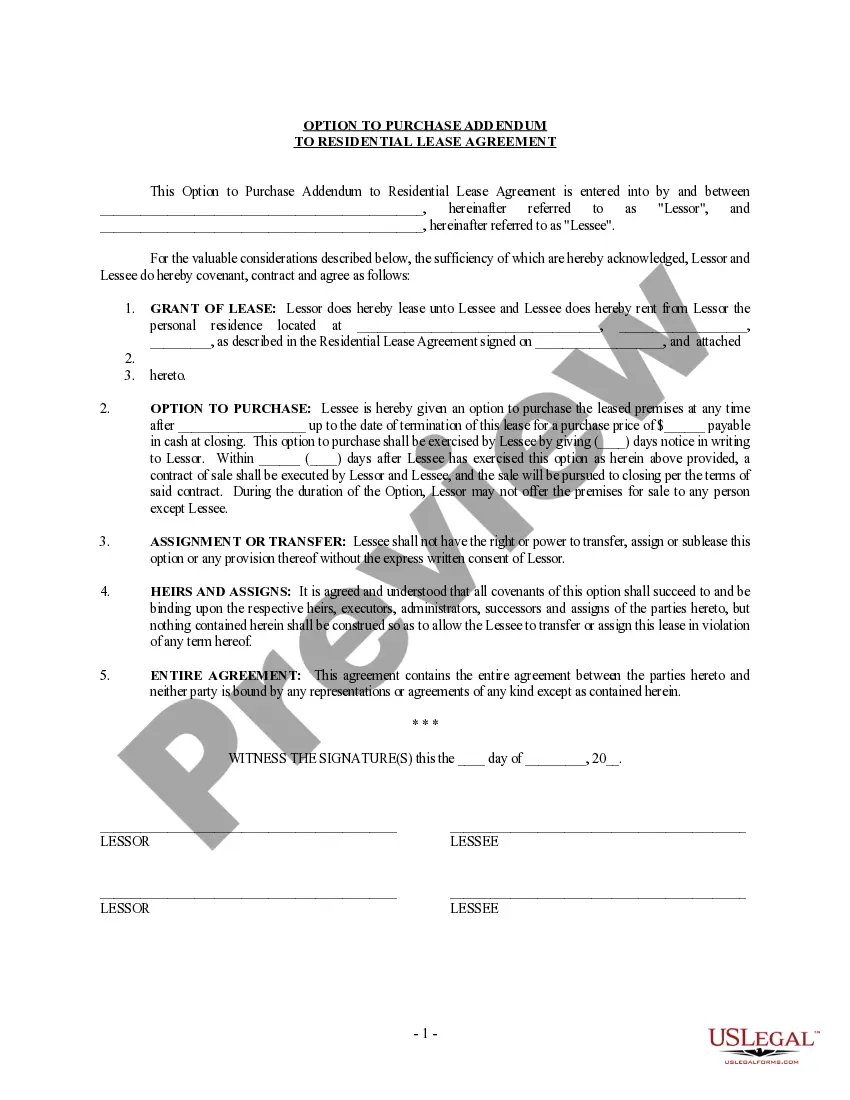

- Confirm you’ve found the correct document. Browse through the description and utilize the Preview feature, if available, to determine if it suits your requirements. If it's unsuitable, employ the Search tab above to locate the right one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your San Jose California Deed of Rescission - Individual to Individual. Choose the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Ideally, we want the deed recorded but how long it takes depends on the county and how well staffed they are. In Southern California, San Bernardino, Los Angeles where we do most of or work, Orange County, Riverside, San Diego, Central Valley, and Northern California it usually takes two to three weeks.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

Requirements for Deed Rescission A deed rescission will return ownership of property to the previous owner as if the sale or transfer of property had never occurred. To be legally valid, a deed rescission must be mutual, meaning that all parties involved in the transaction must consent to the rescission.

Follow these quick steps to edit the PDF santa clara county transfer tax affidavit online for free: Sign up and log in to your account.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office. There are a few types of deeds that accomplish this in California, including a quitclaim deed, grant deed and transfer on death deed.

Preliminary Change of Ownership Forms are available online at the Assessor web site or can be mailed to you upon request by calling the Assessor's office at (408) 299-5500.