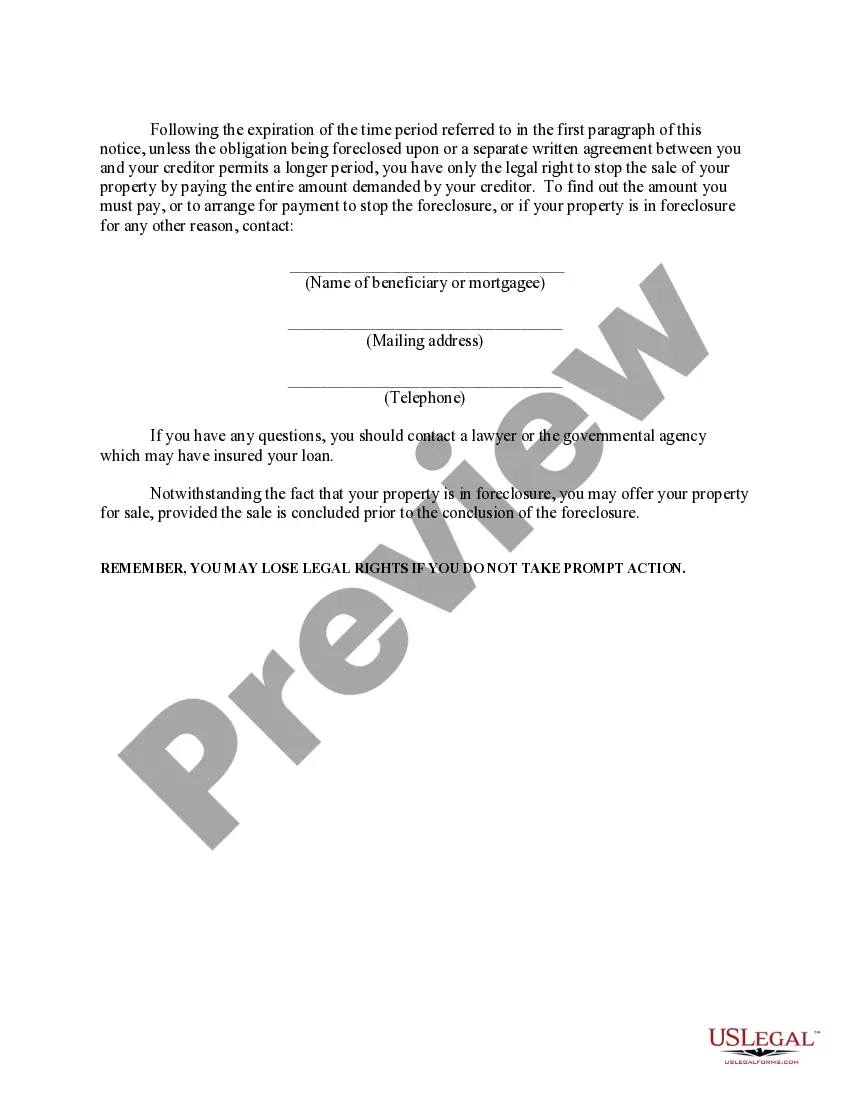

This form serves as a notice of default to the mortgagor for payments that are past due. The default notice states that while the property is in foreclosure, the mortgagor is still responsible for paying other obligations required by the note and the deed of trust. If the mortgagor fails to make future payments on the loan or other financial obligations, the beneficiary or the mortgagee may insist that he/she do so in order to reinstate the account into good standing. The form also emphasizes that the mortgagor could lose his/her rights in the property if prompt action is not taken.

San Jose California Notice of Default And Election to Sell Under Deed of Trust

Description

How to fill out California Notice Of Default And Election To Sell Under Deed Of Trust?

Locating authenticated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to individual and professional requirements as well as various real-world situations.

All the forms are correctly categorized by usage area and jurisdiction, making it as simple as pie to search for the San Jose California Notice of Default And Election to Sell Under Deed of Trust.

Maintaining paperwork organized and adhering to legal standards is of significant importance. Take advantage of the US Legal Forms library to have essential document templates for any requirements readily available!

- Check the Preview mode and form description.

- Ensure you've selected the right one that fulfills your needs and fully aligns with your local jurisdiction requirements.

- Search for another template, if necessary.

- If you notice any discrepancies, make use of the Search tab above to find the correct one.

- Once it fits your criteria, proceed to the next step.

Form popularity

FAQ

If real property is utilized to secure a loan, it is usually achieved by executing a mortgage or, in California, a Deed of Trust. A mortgage is a document that allows the creditor, who is unpaid, to proceed to court to force the sale of the property to pay off the debt.

When a deed of trust is foreclosed by court sale, the action: Would allow the trustor a redemption period; A trustee has legally begun the process to sell property secured by a trust deed.

In California, lenders can foreclose on deeds of trust or mortgages using a nonjudicial foreclosure process (outside of court) or a judicial foreclosure process (through the courts). The nonjudicial foreclosure process is used most commonly in our state.

In states that allow the use of a deed of trust as opposed to a mortgage agreement, most homes are foreclosed through a process called non-judicial foreclosure. Non-judicial foreclosure, as the name implies, occurs outside of the court system, and is usually much faster and cheaper than judicial foreclosure.

1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right notices (Notice of Default and Notice of Sale) the process will go to sale without court involvement at all.

Saclaw.org/deed-of-trust. A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan.

How to Foreclose on a Deed of Trust Step 1 ? Notice of Default. Record a Notice of Default with the county recorder.Step 2 ? Notice of Sale.Step 3 ? Auction.Step 4 ? Obtain Possession of Property.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

Prior to payment of the debt, the lender was entitled to possession of the property. Use of the deed of trust with power of sale was developed to get around some of the restrictions of the mortgage and the required judicial foreclosure, a time consuming lawsuit.

The Trustee in a Deed of Trust is the party who holds legal title to the property during the life of the loan. Trustees will most often have one of two jobs. If the property is sold before the loan is paid off, the Trustee will use the proceeds from the sale to pay the lender any outstanding portion of the loan.