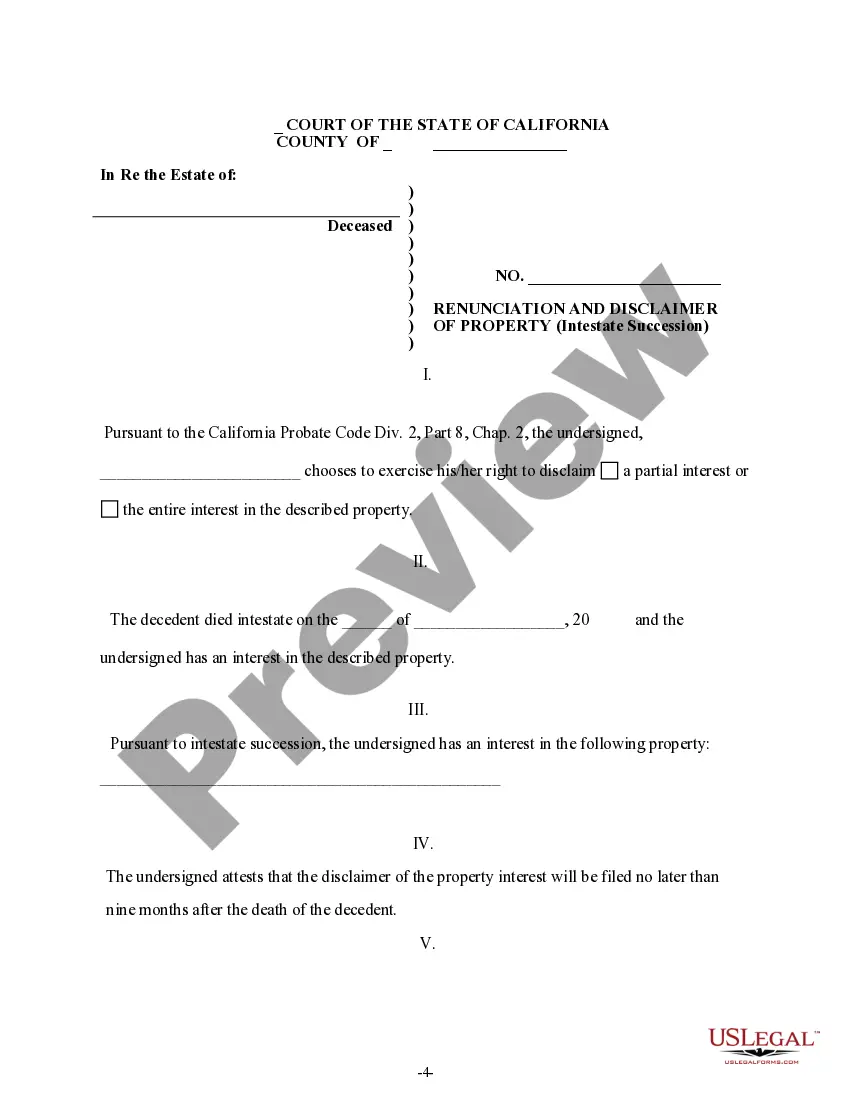

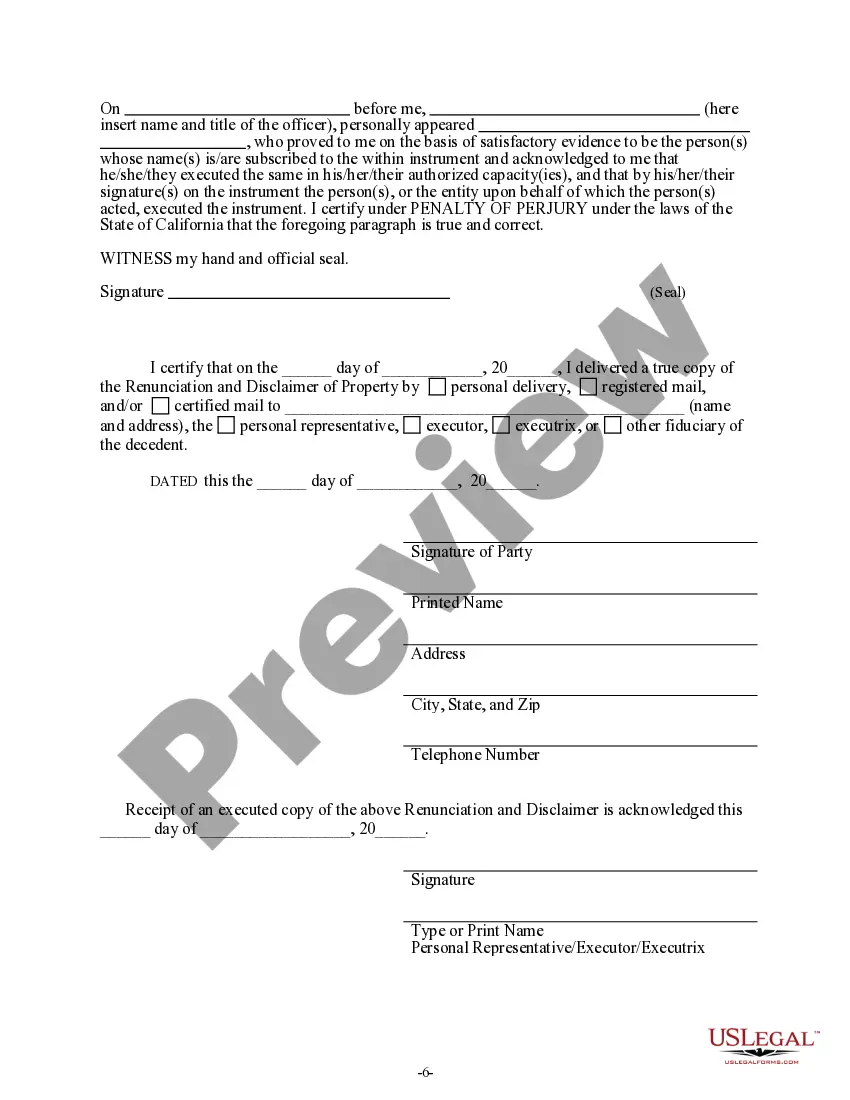

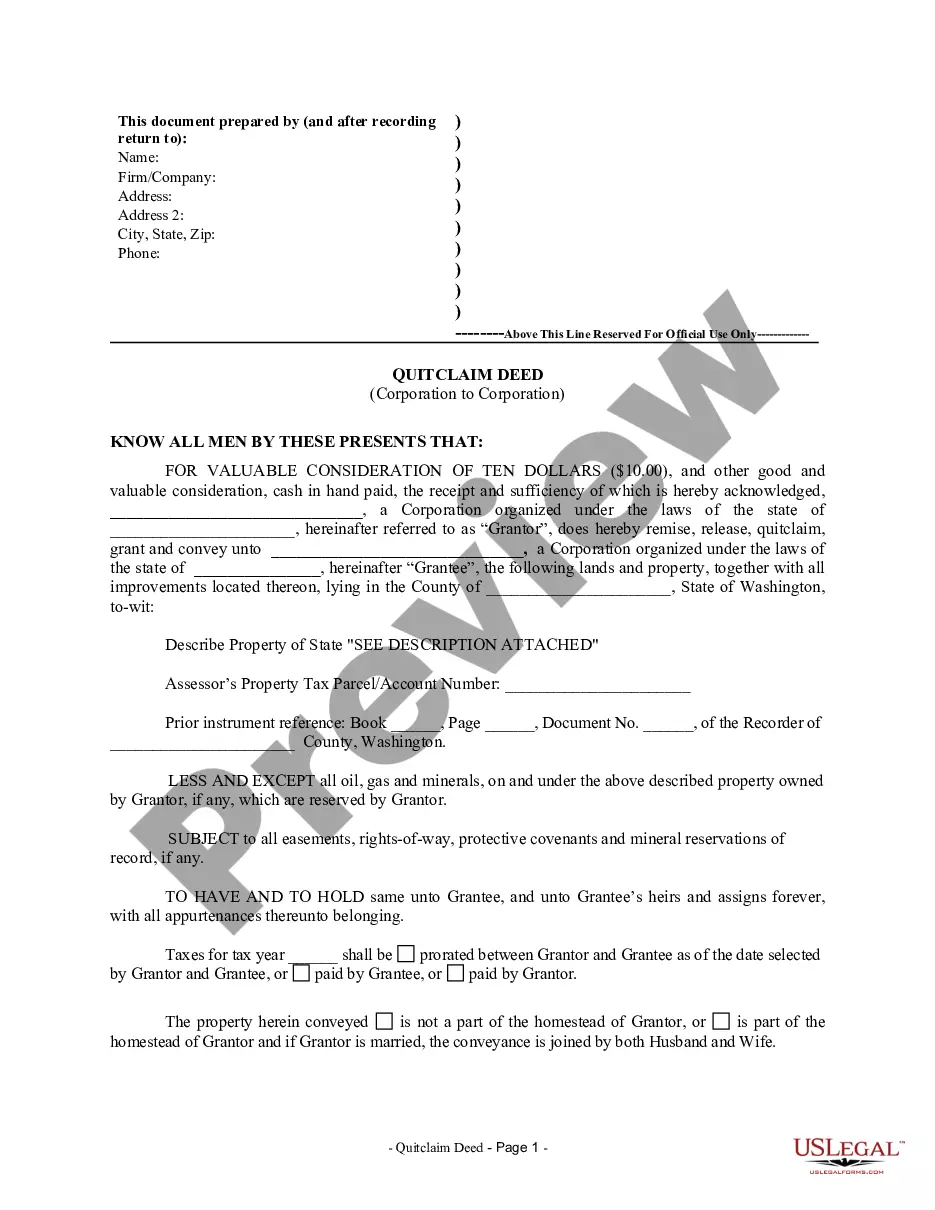

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Roseville California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

Regardless of one’s social or professional rank, completing legal documents has become a regrettable requirement in the current business landscape.

Frequently, it’s nearly unfeasible for individuals lacking any legal knowledge to create such documents from the ground up, primarily due to the intricate language and legal nuances they contain.

This is where US Legal Forms proves to be useful.

Make sure the document you select is tailored to your area since the laws of one state or region do not apply to another.

Preview the document and review a brief description (if available) of scenarios for which the document may be applicable.

- Our platform features an extensive collection of over 85,000 state-specific documents that cater to nearly any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors looking to maximize their efficiency with our DIY forms.

- Whether you require the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession or any other documents that are applicable to your state or locality, US Legal Forms has everything readily available.

- Here’s a guide to quickly obtain the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession using our reliable platform.

- If you are currently a subscriber, you can simply Log In to your account and download the correct form.

- If you are not familiar with our platform, please follow these instructions before downloading the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession.

Form popularity

FAQ

In Roseville, California, a beneficiary has up to nine months to submit a formal renunciation and disclaimer of property received through intestate succession. This time frame starts from the date of the decedent's death. However, if the beneficiary is aware of the inheritance, it's advisable to act promptly and not wait for the entire period. By utilizing the uslegalforms platform, you can access the necessary documents and guidance to navigate the Roseville California Renunciation and Disclaimer of Property received by Intestate Succession effectively.

To disclaim an inheritance in California, you must draft a formal disclaimer letter stating your intent to renounce the property. Make sure to submit the disclaimer within nine months of the deceased's passing. This process is essential for beneficiaries engaging with the renunciation and disclaimer of property received by intestate succession in Roseville, California, and allows for a smooth transition of assets.

A beneficiary might choose to disclaim property for various reasons. They may wish to avoid potential tax implications, protect their own financial interests, or agree that the inheritance should go to another family member. This decision aligns with the concept of renunciation and disclaimer of property, especially in Roseville, California, where individuals can make strategic financial choices.

To write a Disclaimer of inheritance sample, start with a formal letter format, including names and addresses. Clearly articulate your intent to disclaim, providing relevant information about the deceased and the specific inheritance. For additional clarity and structure, consider using templates available on platforms like USLegalForms, which can assist in demonstrating the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession effectively.

Disclaiming inheritance in California involves specific rules, such as the requirement for a written disclaimer and adherence to deadlines set by law. You should also ensure that you are relinquishing your right to the inheritance without any conditions. Familiarizing yourself with these guidelines can make the process of Roseville California Renunciation And Disclaimer of Property received by Intestate Succession smoother.

Inheritance generally does not need to be declared on tax returns in California unless the property generates income. However, it's crucial to be aware of any potential tax liabilities that could arise from inherited assets. Understanding these aspects will help you effectively manage the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession.

To disclaim an inheritance in California, you must provide a written disclaimer that meets the qualifications outlined by state law. This document should clearly express your intent to refuse the inheritance and include necessary details about the property and your relationship to the deceased. Utilizing resources like USLegalForms can help you navigate the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession effectively.

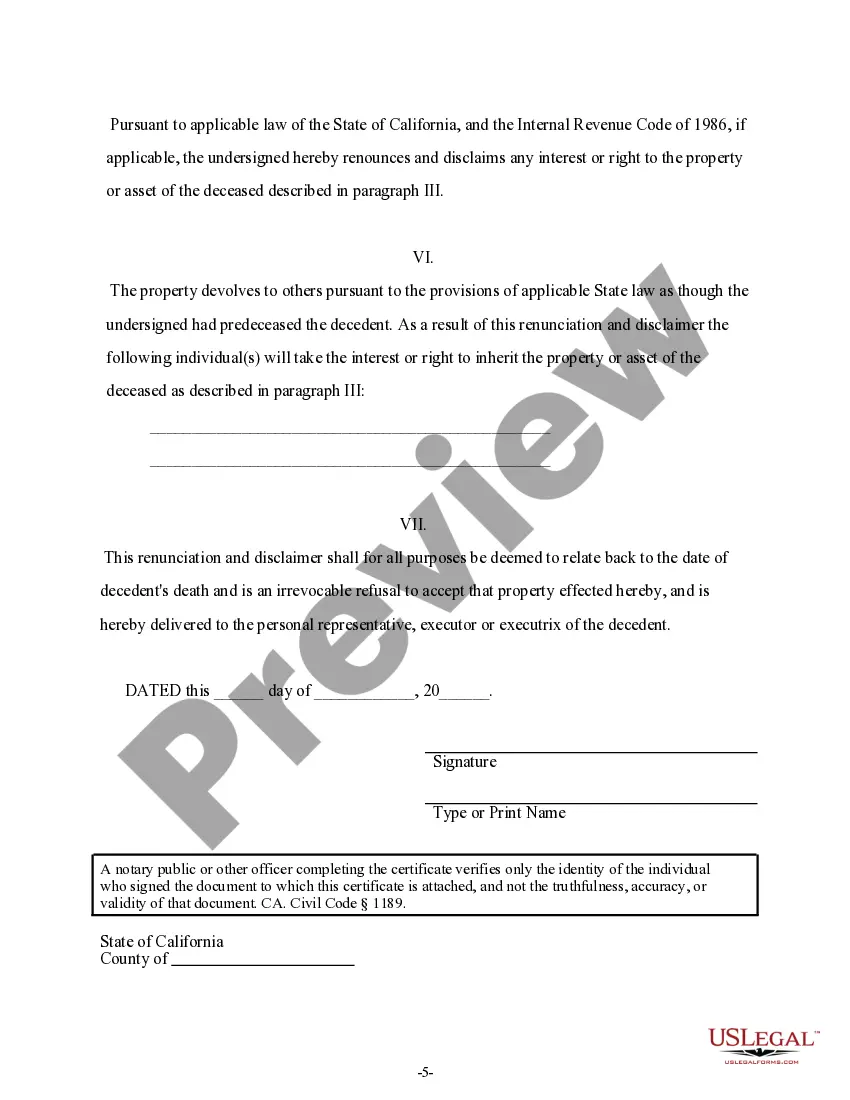

To write an inheritance Disclaimer letter, begin with your name and contact information, followed by a clear statement of your intent to disclaim the property. Include details about the deceased, the property in question, and reference the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession. Ensure the letter is signed and dated, and consider seeking legal advice for additional guidance.

A Disclaimer is considered qualified when it meets specific legal criteria set by California law. These criteria include the necessity for the disclaimer to be in writing and executed within a certain timeframe after the inheritance is received. By ensuring these conditions are met, you can effectively pursue the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession.

In Roseville California, a Disclaimer of inheritance does not legally require notarization. However, having it notarized can provide extra security and ensure your intent is clearly documented. It is always a good idea to consult with a legal professional to ensure adherence to local laws and to streamline the Roseville California Renunciation And Disclaimer of Property received by Intestate Succession.