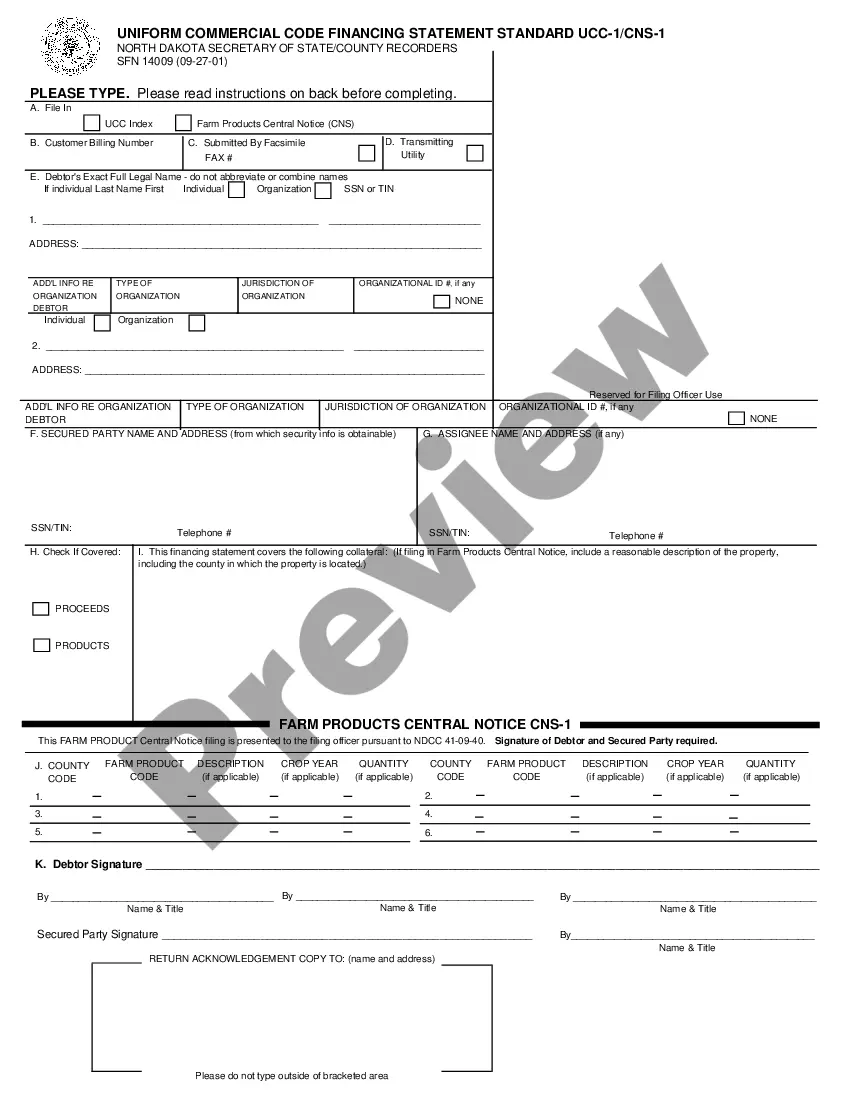

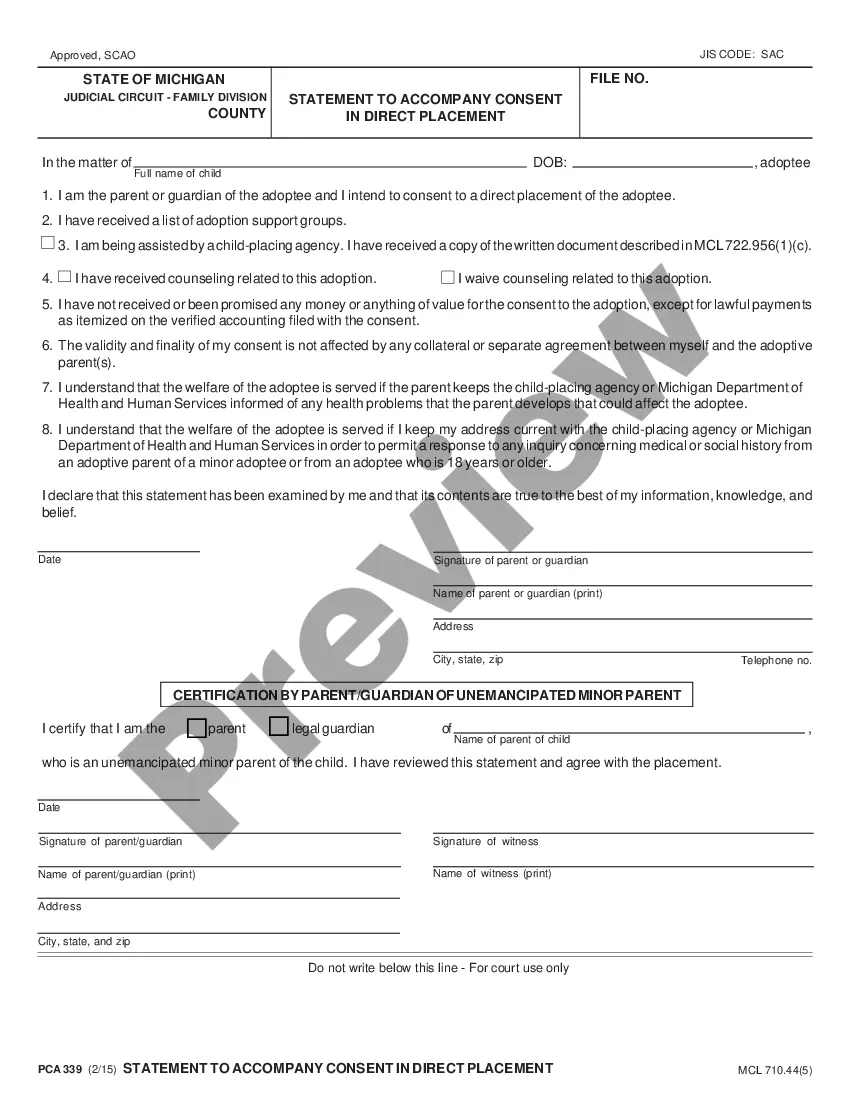

This form is a generic example that may be referred to when preparing such a form.

Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out California Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

If you are looking for a pertinent form, it’s incredibly challenging to select a more suitable location than the US Legal Forms website – likely the most extensive online database.

Here you can obtain a vast number of document templates for organizational and personal needs categorized by types and states, or keywords.

With our sophisticated search feature, locating the most up-to-date Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the format and download it onto your device. Edit. Fill out, revise, print, and sign the acquired Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually.

- Moreover, the relevance of each document is validated by a team of professional attorneys who routinely examine the templates on our site and update them to comply with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the initial time, simply adhere to the instructions below.

- Ensure you have selected the form you need. Review its description and utilize the Preview function (if available) to examine its content. If it doesn’t fulfill your criteria, use the Search option located at the top of the page to locate the correct document.

- Verify your selection. Click the Buy now button. After that, select the desired pricing plan and provide the necessary information to register for an account.

Form popularity

FAQ

The four main types of promissory notes include secured, unsecured, demand, and installment notes. A secured note uses collateral to back the agreement, while an unsecured note does not. Demand notes allow payment to be requested at any time, and installment notes require payments over a specific period. Understanding these types will enhance your knowledge about creating an Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually.

Yes, a promissory note can indeed be created without interest. This means that the borrower agrees to repay the principal amount only, without any additional fees. This type of arrangement can be especially beneficial for both parties, as it simplifies repayment. If you're considering an Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, ensure that the terms are clearly documented.

Filling out a promissory note involves writing the key information needed for both parties to understand the agreement fully. Include the borrower’s and lender’s details, the principal amount, and the interest rate calculation method. In the case of an Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, make it clear that no payments are required until maturity, and the interest will accumulate over the term, making this option straightforward and beneficial.

Promissory notes are legally binding documents in California, including the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. These notes create a formal agreement between the borrower and lender, ensuring that both parties meet their responsibilities. Using a trusted platform like uslegalforms can help you create a legally sound document that protects your interests.

Yes, interest can compound on a promissory note, particularly on the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. Compounding means that the interest accrues on both the principal and the accumulated interest over time. Understanding how compounding works can help you better manage your finances and obligations.

In most cases, a promissory note, like the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, will stand up in court if it is properly executed. If the terms are clear and the parties involved have fulfilled their obligations, the court is likely to enforce the note. However, having a reliable platform like uslegalforms can help you draft a note that minimizes any potential legal complications.

Yes, promissory notes are enforceable in California, including the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. These documents hold legal weight as long as they meet certain requirements, such as being in writing and signed by the borrower. Compliance with state laws and proper documentation ensures that your note can be upheld in a court of law.

Payments made on a promissory note are generally not considered taxable income for the lender, as they merely represent a return of principal. However, any interest portion of the payment must be reported as taxable income. If you are dealing with an Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it's essential to keep accurate records to differentiate between principal and interest payments for tax purposes.

Yes, a promissory note can be created without interest, often referred to as a 'zero-interest' note. In the case of an Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, such a note might be less common, but it is possible. However, consider the implications on your financial planning and tax responsibilities when choosing this option.

To record interest on a promissory note, maintain a simple ledger where you note the date, the amount of interest accrued, and any payments received. For an Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, you will record interest periodically, usually annually, to reflect the compounding nature of its terms. Proper documentation ensures clarity for both parties involved.