This purpose of this document is to release one of the owners of the property form the obligation of the loan which was used to purchase the property. The party being released will transfer his or her interest in the property to the other owner.

Simi Valley California Assumption of Deed of Trust, and Release of One of Original Borrowers

Description

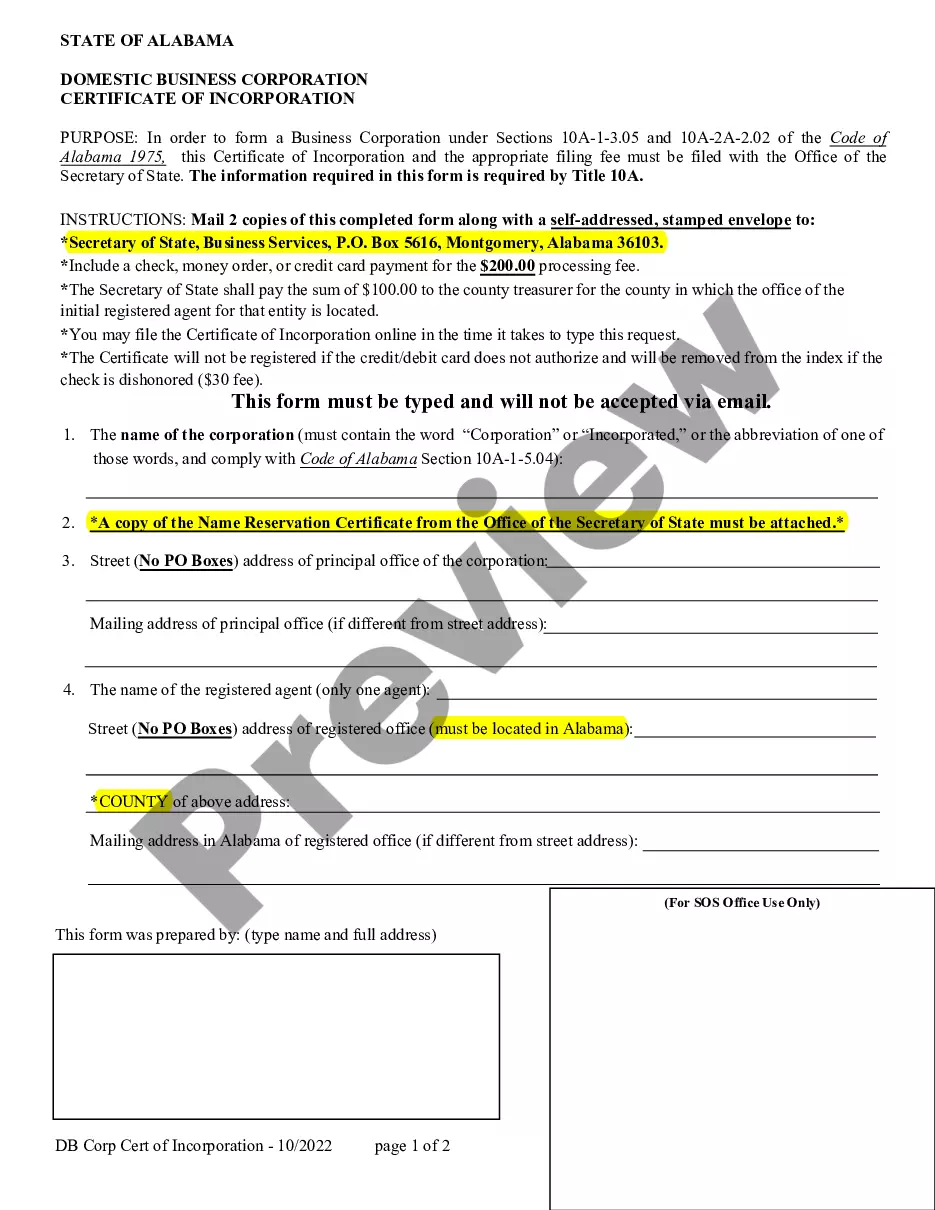

How to fill out California Assumption Of Deed Of Trust, And Release Of One Of Original Borrowers?

Obtaining validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal forms for both personal and professional requirements and various real-life situations.

All the documents are accurately categorized by usage area and jurisdiction, enabling your search for the Simi Valley California Assumption of Deed of Trust, and Release of One of Original Borrowers to be as simple as possible.

Maintaining documentation organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have essential document templates readily available for any requirement!

- For those already familiar with our catalog and have used it previously, acquiring the Simi Valley California Assumption of Deed of Trust, and Release of One of Original Borrowers requires just a few clicks.

- You only need to Log In to your account, choose the document, and click Download to store it on your device.

- This process involves only a few additional steps for new users.

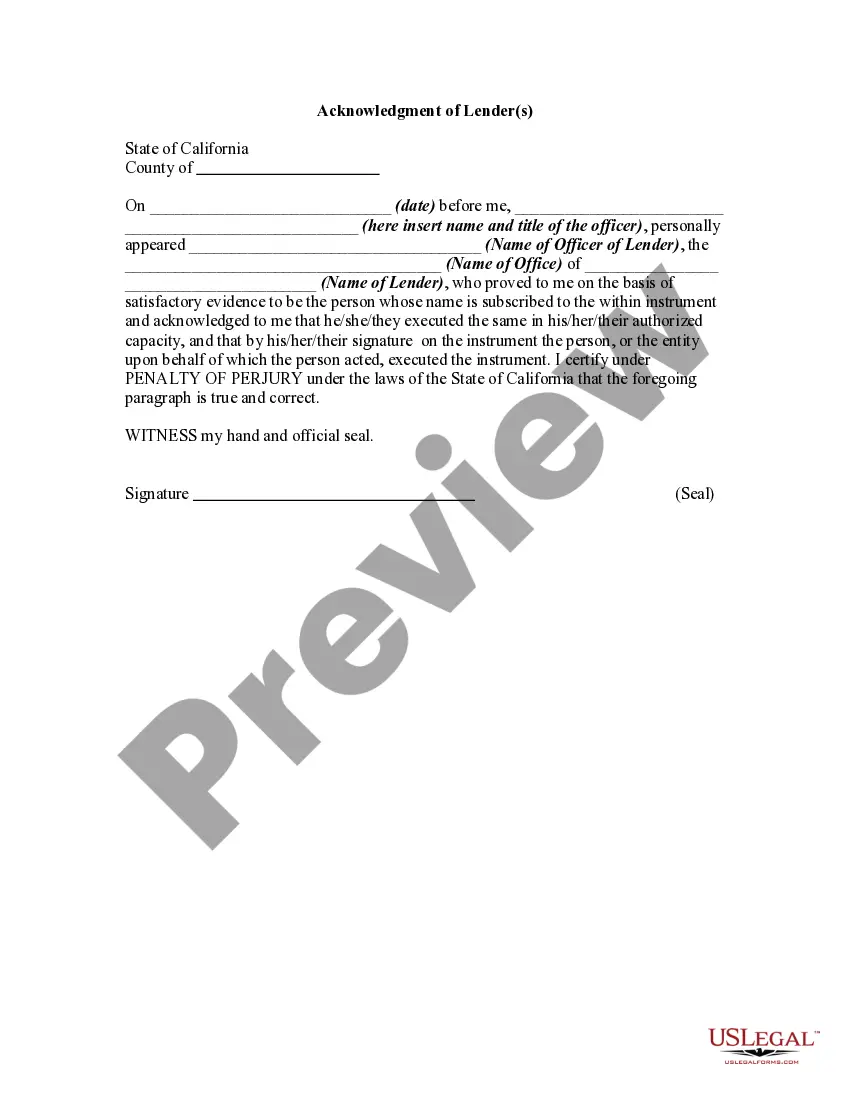

- Review the Preview mode and form description. Ensure you've selected the correct one that fulfills your needs and fully aligns with your local legal requirements.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

You can transfer a mortgage to another person if the terms of your mortgage say that it is ?assumable.? If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

FHA, VA and USDA loans can all be assumable. Conventional loans, such as the ever popular 30-year-loans, are not assumable. However, Addy states there are some non-conforming conventional loans that are assumable such as adjustable rate mortgages (ARMs) from Fannie Mae and Freddie Mac.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

You can transfer a mortgage to another person if the terms of your mortgage say that it is ?assumable.? If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

On an assumption, the funding fee is 0.5% of the existing mortgage balance and is paid by the new home buyer at closing.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

How much does a loan assumption cost? You'll have to pay closing costs on a loan assumption, which are typically 2-5% of the loan amount.

If you are the sole heir, you could reach out to the mortgage servicer and ask to assume the mortgage, or sell the property. You could also choose to let the lender foreclose. If you want to assume the loan, you can work with the servicer to transfer the loan to you.