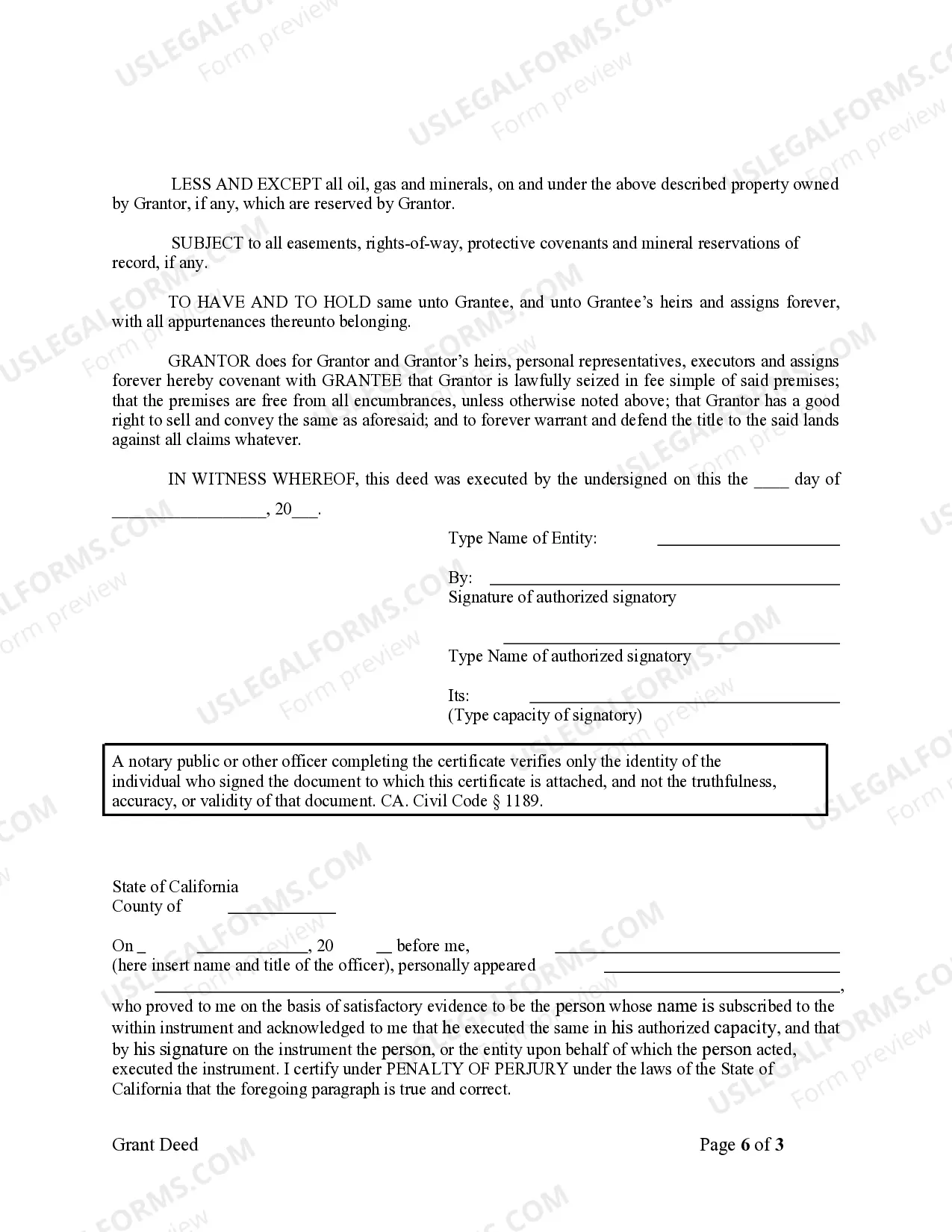

This Warranty Deed from Corporation to Individual form is a Warranty Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

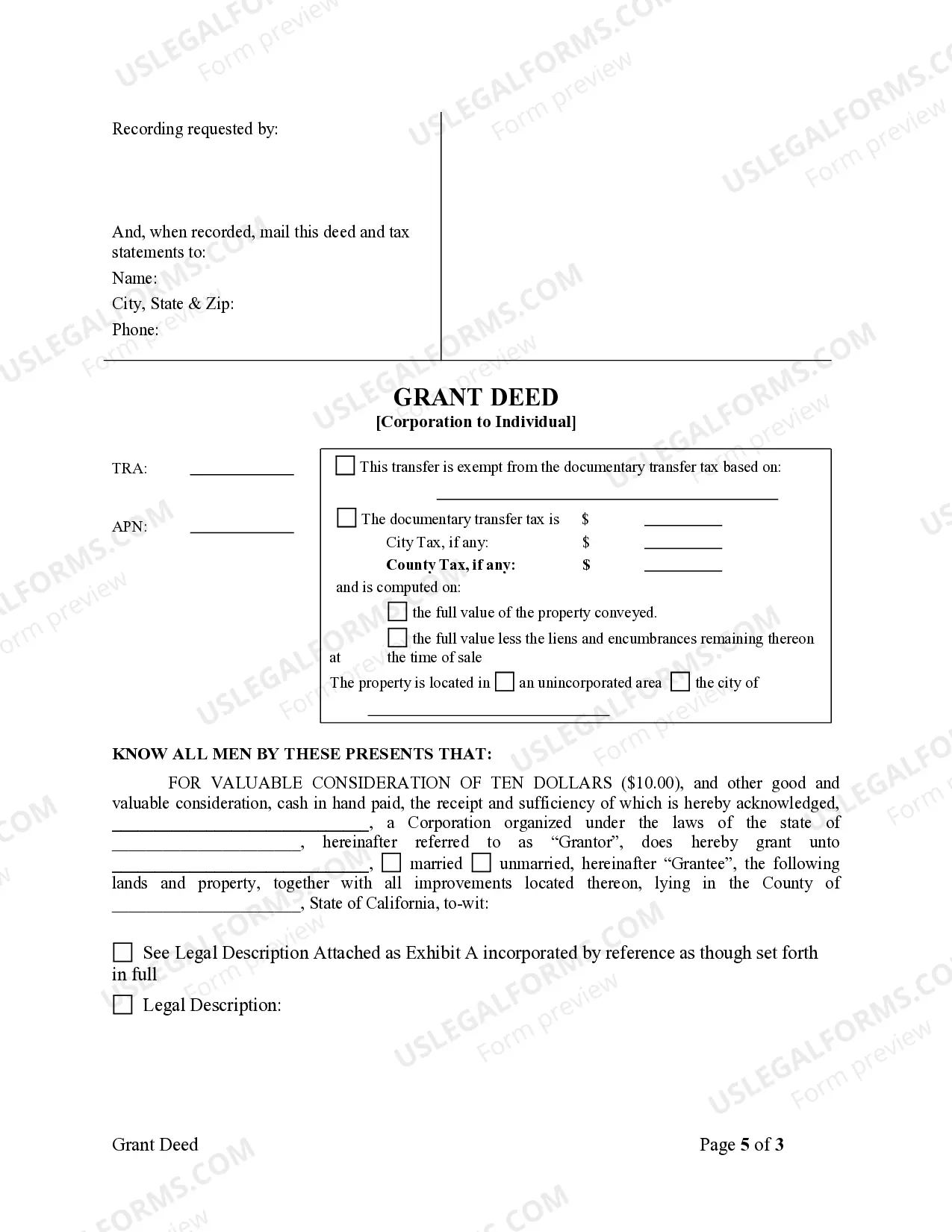

Bakersfield California Grant Deed from Corporation to Individual

Description

How to fill out California Grant Deed From Corporation To Individual?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms archive.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the forms are accurately sorted by usage category and jurisdiction, making it as quick and straightforward as one-two-three to find the Bakersfield California Grant Deed from Corporation to Individual.

Download the Bakersfield California Grant Deed from Corporation to Individual. Save the template on your device to continue with its completion and access it in the My documents menu of your profile whenever you require it again. Maintaining organized paperwork and ensuring compliance with legal standards is critically significant. Utilize the US Legal Forms library to always have crucial document templates for all your needs right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the appropriate one that fulfills your needs and completely aligns with your local jurisdiction's requirements.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to discover the correct one. If it fits your needs, proceed to the next step.

- Purchase the document.

- Click on the Buy Now button and select your preferred subscription plan. You will need to create an account to gain access to the library’s resources.

Form popularity

FAQ

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Both types of legal documents serve the same function of transferring ownership of real property. The fundamental difference between quitclaim deeds and grant deeds is the level of protection and warranty provided to the grantee.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.

California uses two types of deeds to change ownership of real property: grant deeds and quitclaim deeds. Further names such as warranty deed, interspousal deed, or trust transfer deed are simply special identification given to grant deeds or quitclaim deeds based on specific circumstances.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

Updated June 24, 2022. A California grant deed is used to convey property from a seller (also known as a grantor) to a buyer (also known as the grantee). Similar to a warranty deed, the grantor asserts that he or she has clear title to the property and is transferring his or her interest to the buyer.