This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

Fontana California Revocable Transfer on Death Deed - Individual to Individual

Description

How to fill out California Revocable Transfer On Death Deed - Individual To Individual?

Irrespective of social or occupational position, filling out legal documents is an unfortunate requirement in today’s society.

Frequently, it’s nearly impossible for someone lacking legal education to create these types of documents from scratch, primarily due to the intricate vocabulary and legal nuances they entail.

This is where US Legal Forms becomes beneficial.

Verify the form you’ve selected is appropriate for your jurisdiction since the regulations of one state or county may not apply to another.

Review the form and read a brief summary (if available) of situations for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent source for associates or legal advisors who aim to enhance their time efficiency with our DIY documents.

- Whether you need the Fontana California Revocable Transfer on Death Deed - Individual to Individual or any other document that is appropriate for your state or county, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the Fontana California Revocable Transfer on Death Deed - Individual to Individual in minutes using our reliable platform.

- If you are already a registered user, feel free to Log In to your account to access the correct form.

- However, if you’re new to our library, make sure to follow these steps before acquiring the Fontana California Revocable Transfer on Death Deed - Individual to Individual.

Form popularity

FAQ

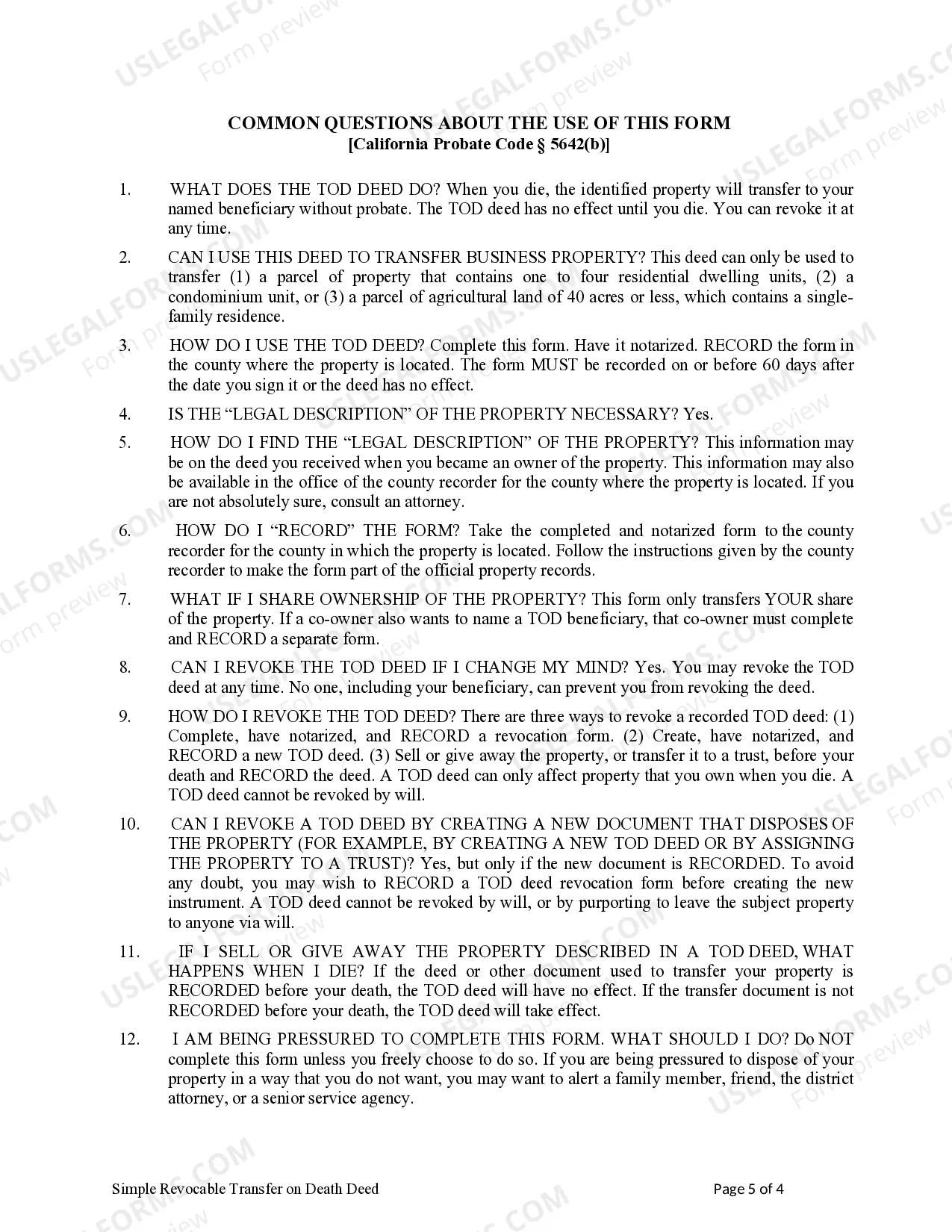

The best way to transfer property title between family members often includes using a Fontana California Revocable Transfer on Death Deed - Individual to Individual. This method avoids probate and ensures a smooth transfer upon passing. Additionally, it allows for easy designation of beneficiaries, making it less complicated for everyone involved. For those unfamiliar with the process, platforms like uslegalforms can offer essential guidance and templates.

To transfer property from a deceased relative in California, first ensure that a Fontana California Revocable Transfer on Death Deed - Individual to Individual was in place. If such a deed exists, you will need to present a death certificate and any required identification to the county recorder’s office. Assuming all paperwork is proper, the property can be directly transferred to you without the lengthy probate process. Legal advice might be beneficial throughout this process.

The step up in basis refers to the adjustment of property value for tax purposes when inherited through a Fontana California Revocable Transfer on Death Deed - Individual to Individual. Generally, the property's tax basis is stepped up to its fair market value at the date of the owner's death. This feature protects beneficiaries from capital gains tax on any appreciation that occurred during the original owner's lifetime. Understanding this can significantly impact your tax obligations and estate planning.

To transfer a deed after death in California using a Fontana California Revocable Transfer on Death Deed - Individual to Individual, access the recorded TOD deed if one exists. Provide the necessary documentation, such as a death certificate, to prove the owner's passing. You may then directly transfer the property title to the designated beneficiary without going through probate. It is advisable to consult with legal professionals to ensure all steps are properly followed.

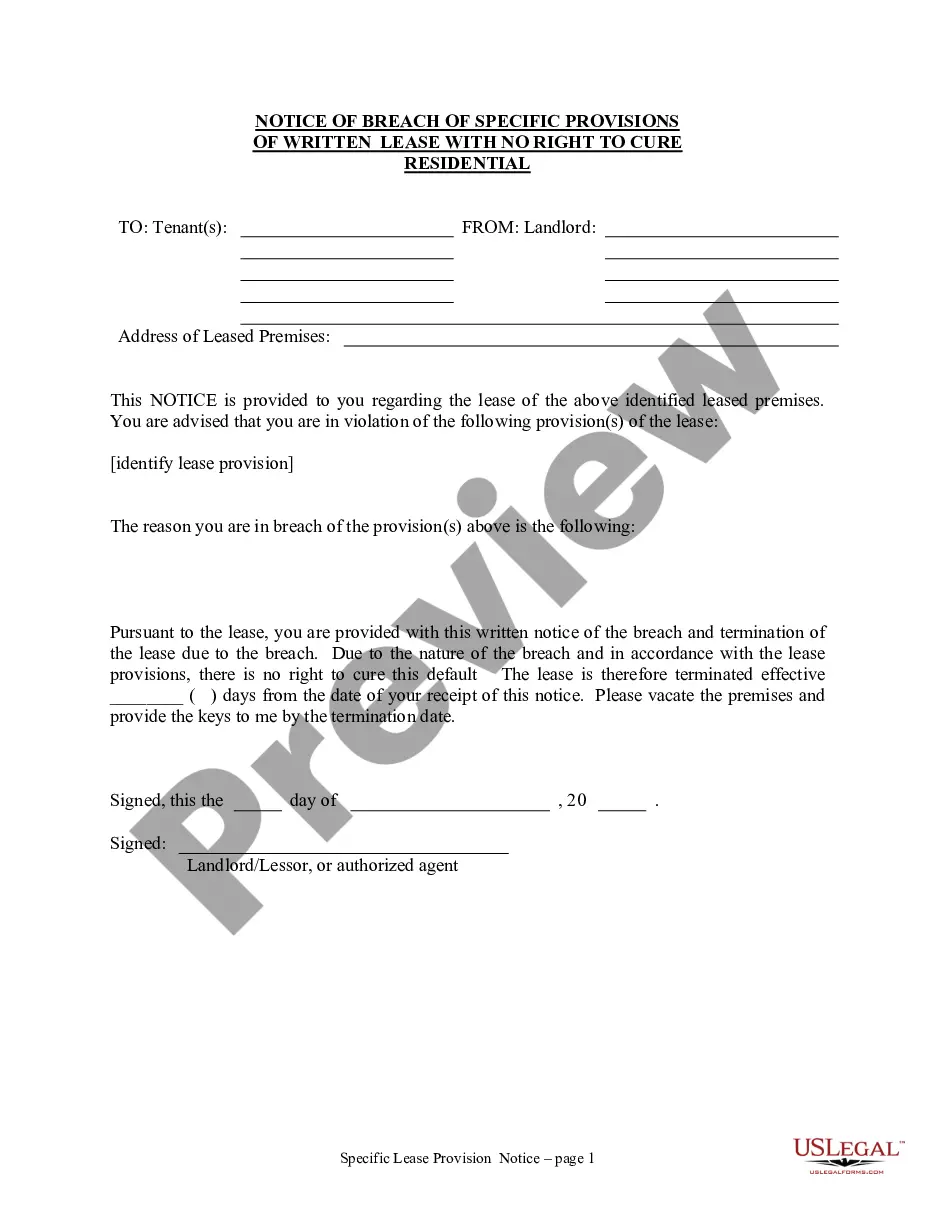

To file a Fontana California Revocable Transfer on Death Deed - Individual to Individual, complete the specific form available through the county recorder's office. After filling out the form, you need to sign it in the presence of a notary. Once signed, file it with the appropriate county recorder where the property is located to make the transfer legally binding. This process ensures your intentions are clearly documented.

A common problem with Transfer on Death (TOD) deeds in California is the potential for confusion among beneficiaries. Sometimes, beneficiaries might not be aware of the deed or their rights under it, which could lead to disputes. Moreover, if the property owner changes their mind but fails to revoke the deed properly, it complicates the situation further. Using tools like uslegalforms can help clarify these issues and ensure proper execution.

Yes, property can be transferred without probate in California using a Fontana California Revocable Transfer on Death Deed - Individual to Individual. This process allows the property owner to designate beneficiaries, avoiding the probate process entirely upon their death. Consequently, the transfer occurs automatically, simplifying the transition of assets. Ensure all paperwork is accurate and properly recorded to harness these benefits.

To fill out a death certificate in California, you need to gather pertinent information such as the deceased person's full name, date of birth, date of death, and place of residence. Family members, physicians, or funeral directors can help complete the form, which may also require signatures. After completing the document, submit it to the local vital records office for filing. For additional guidance, US Legal Forms offers resources that can simplify this process.

To fill out a Transfer on Death deed in California, start by obtaining the appropriate form from a reliable source, such as the US Legal Forms platform. Ensure you provide accurate information about the grantor and the beneficiaries, as the deed transfers property upon the owner's death. After completing the document, sign it in the presence of a notary public. Lastly, record the deed with your county's recorder's office to make it effective in accordance with Fontana California Revocable Transfer on Death Deed - Individual to Individual regulations.

Filing a Transfer on Death Deed in California requires you to complete the deed and have it notarized. Next, you must record the signed deed with your local county's recorder office. With precise instructions available on uslegalforms, you can easily navigate the process of filing a Fontana California Revocable Transfer on Death Deed - Individual to Individual, ensuring compliance with all legal requirements.