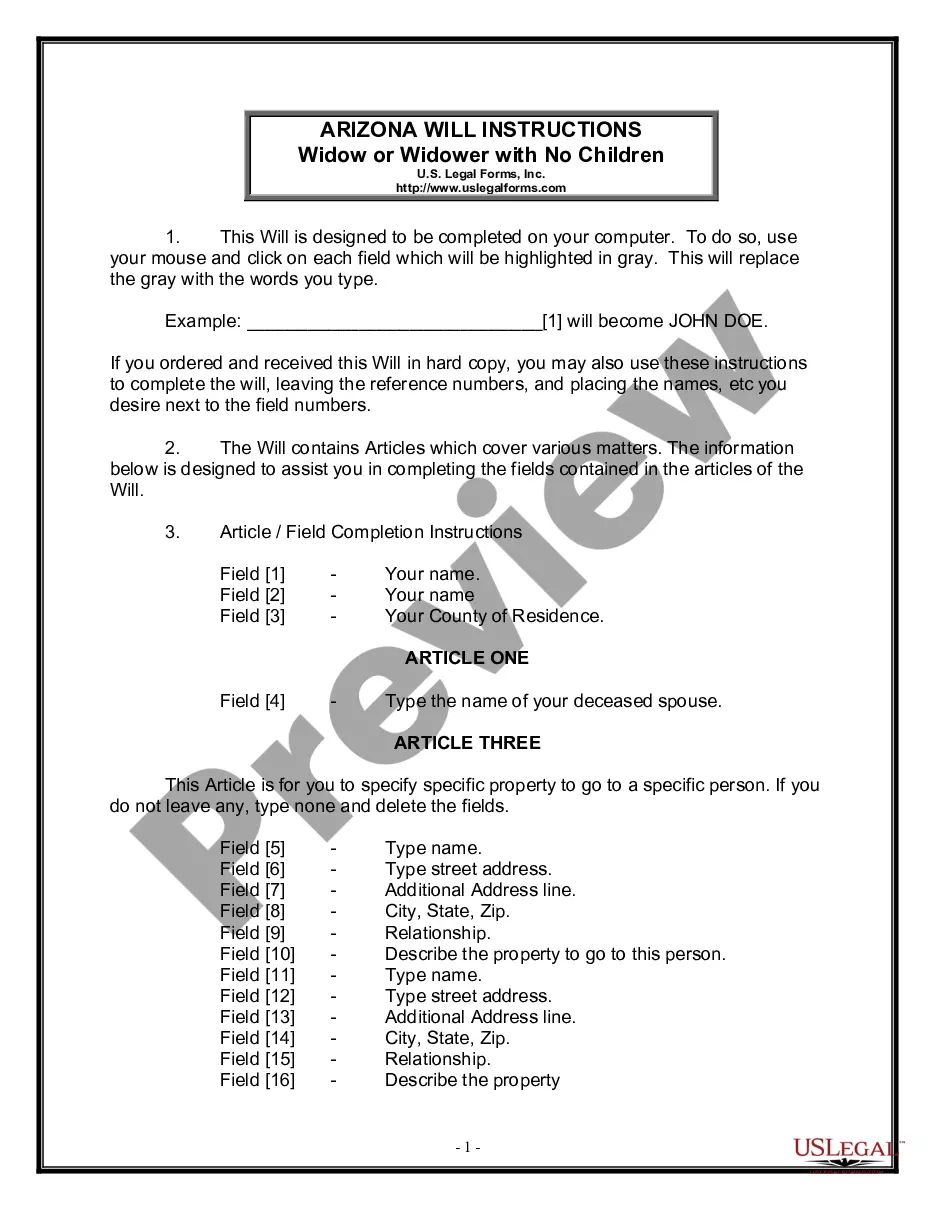

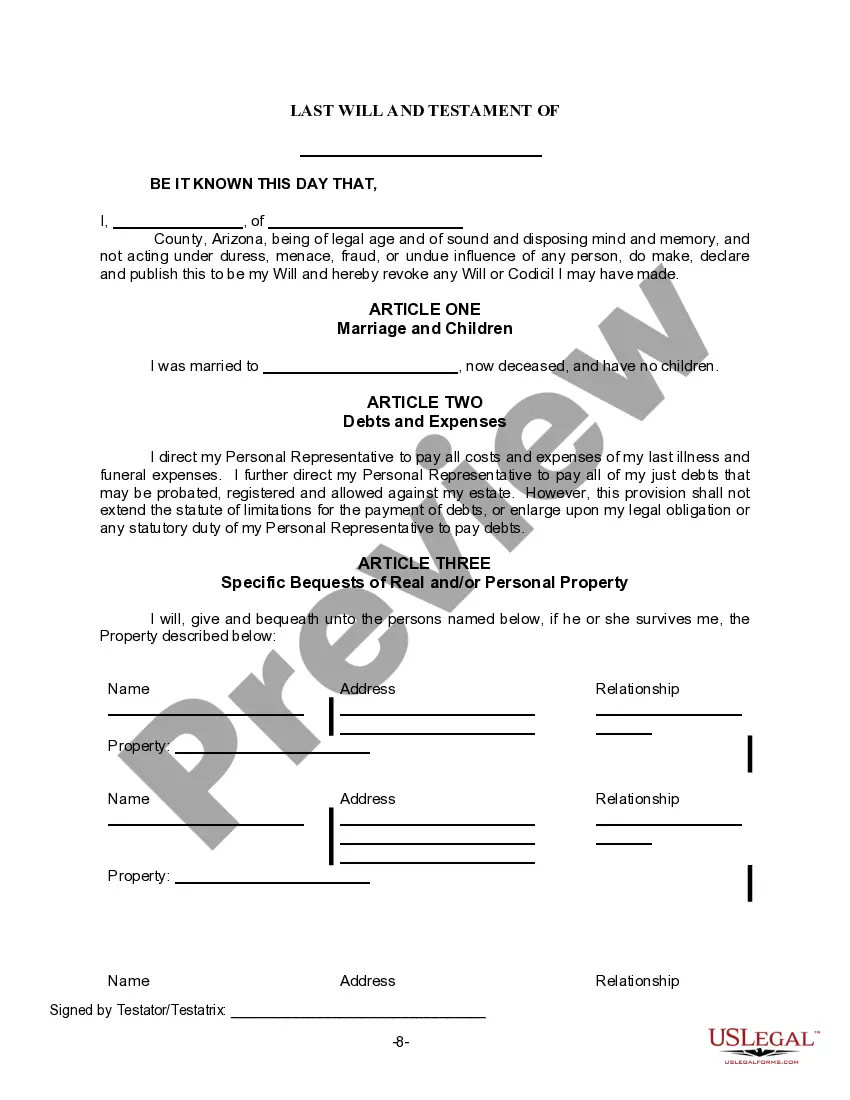

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

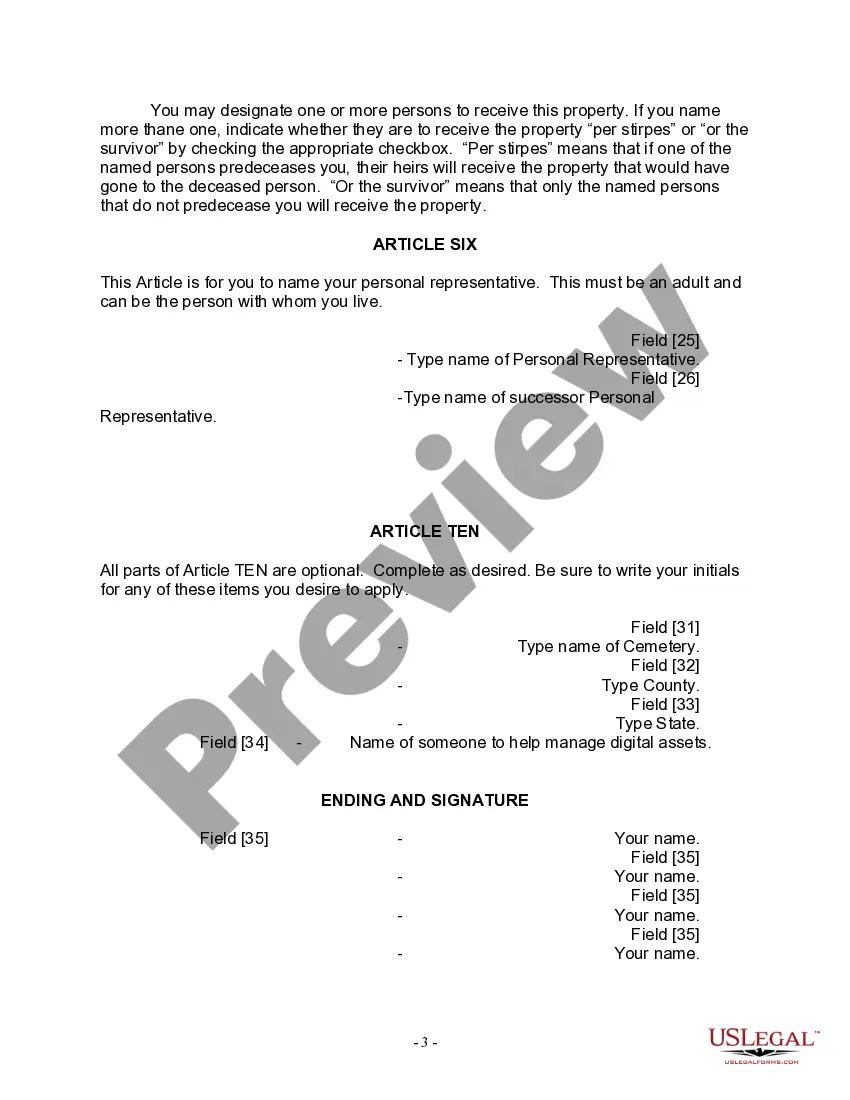

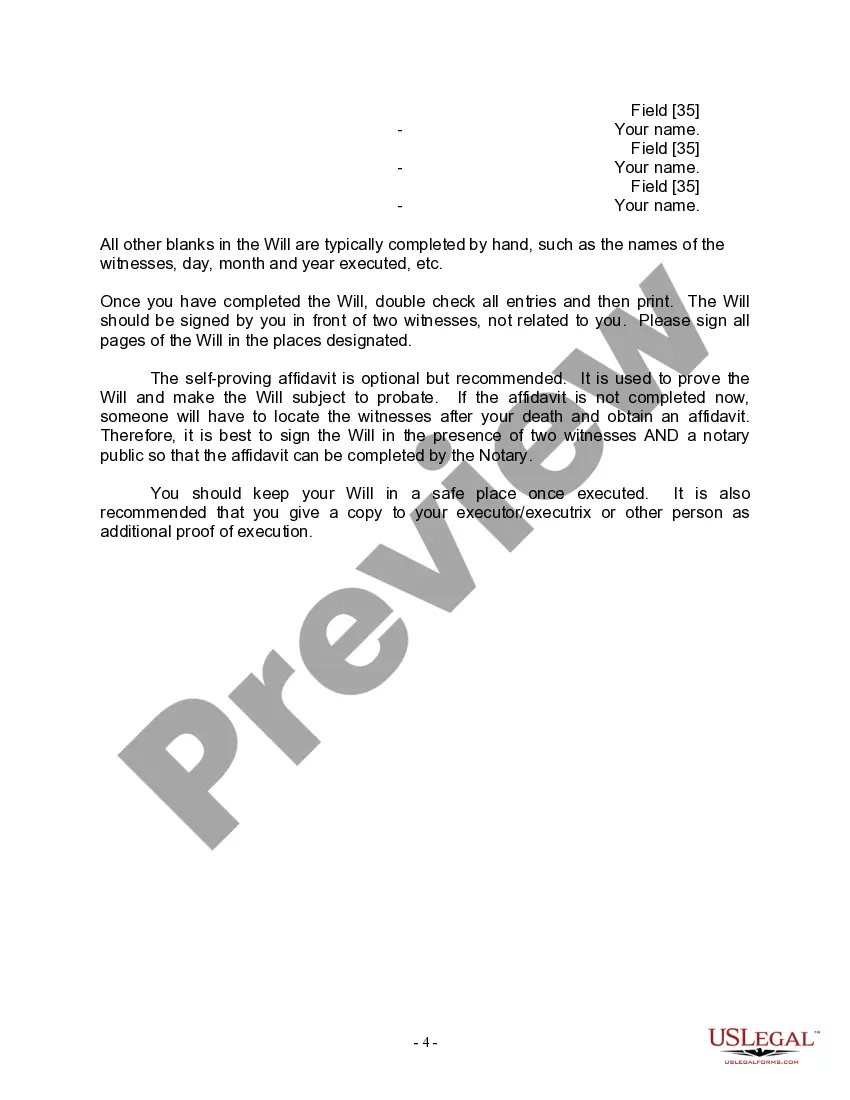

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

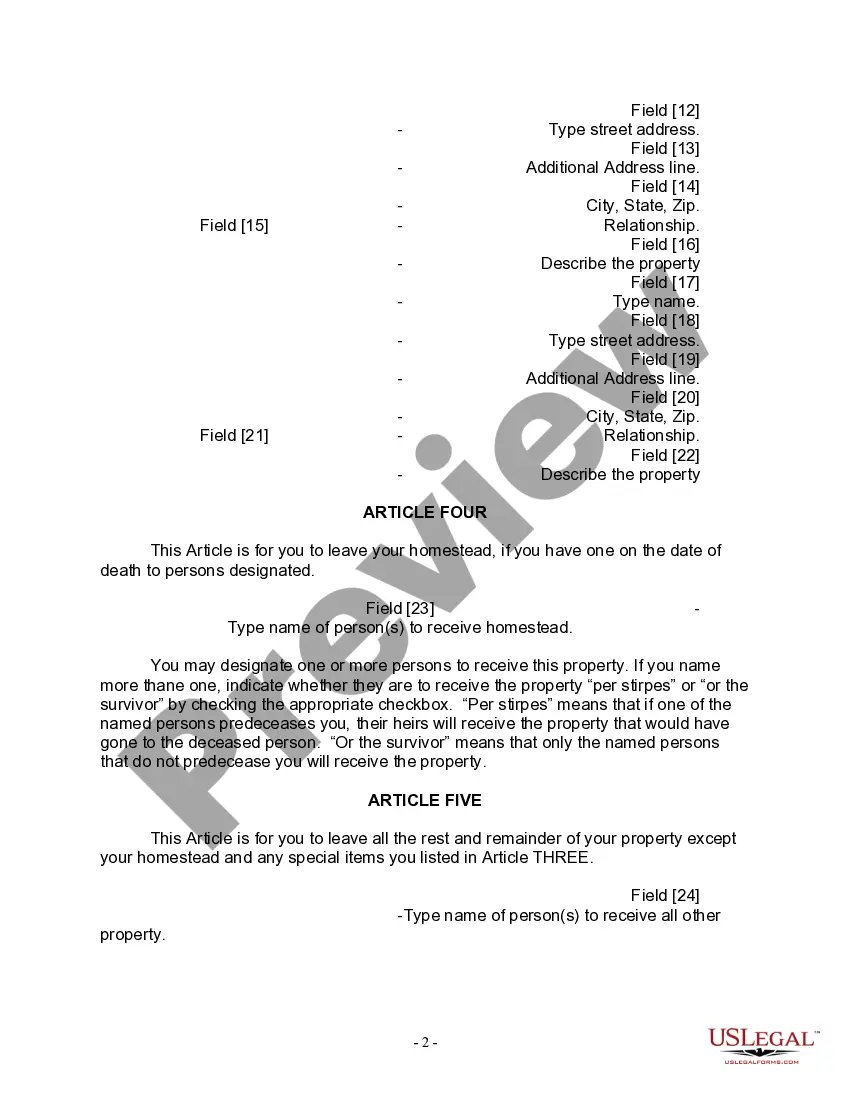

The Phoenix Arizona Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows an individual to outline their final wishes and ensure that their property and assets are distributed according to their desires after their passing. This form is specifically designed for widows or widowers who do not have any children. This Last Will Form provides a comprehensive and detailed structure to encompass various aspects such as designating beneficiaries, appointing an executor, specifying specific bequests, and ensuring the smooth transfer of property and assets. It allows the creator of the will, also known as the testator, to name individuals or organizations to whom they wish to leave their property upon their death. Some relevant keywords associated with this form include: 1. Last Will and Testament: This refers to the legal document that outlines the testator's final wishes regarding the distribution of their property and the appointment of an executor. 2. Executor: This is the individual appointed by the testator to oversee the administration of their estate and ensure that their final wishes are carried out. 3. Beneficiary: These are the individuals or organizations named by the testator to receive specific property or assets from their estate. 4. Bequests: These are specific gifts or items of property that the testator designates to be given to specific individuals or organizations. 5. Estate: This term refers to the collective sum of a person's property, assets, and debts at the time of their death. Different types of Phoenix Arizona Legal Last Will Forms for a Widow or Widower with no Children may include variations specific to the testator's needs and preferences. For example: 1. Simple Last Will and Testament: This form is a straightforward document that covers the basic elements of a will, including the appointment of an executor and the distribution of assets to chosen beneficiaries. 2. Living Will: Also known as an advance directive, this document allows individuals to outline their medical treatment preferences and end-of-life decisions, ensuring their wishes are respected if they become incapacitated. 3. Pour-Over Will: This form is used in conjunction with a trust and allows the testator to transfer any assets not already included in the trust to the trust upon their death, ensuring that everything is managed according to their estate plan. It is important to consult with a qualified attorney or legal professional familiar with Arizona state laws to ensure the accuracy and validity of any legal documents, including the specific Last Will Form that meets the needs of a Widow or Widower with no Children in Phoenix, Arizona.