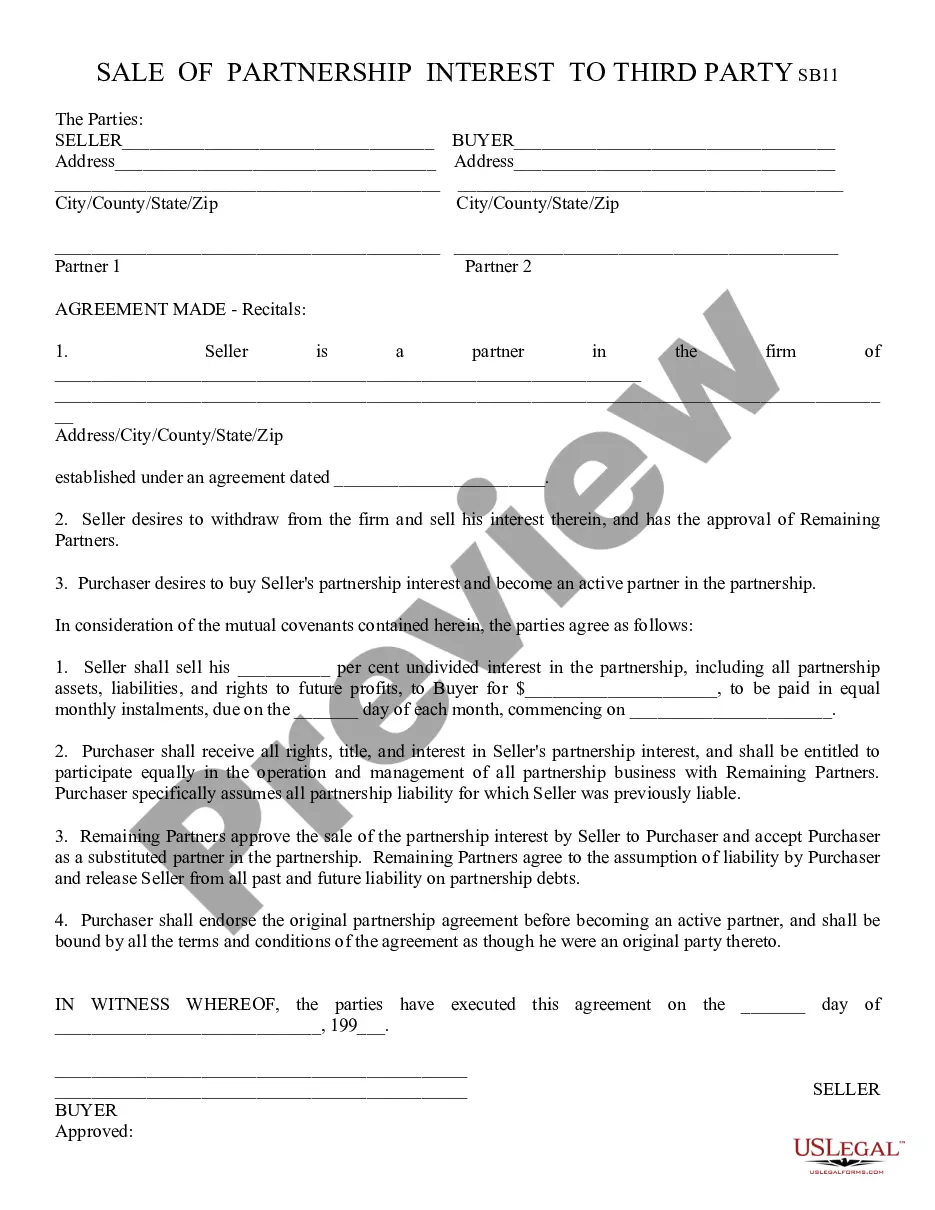

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Glendale Arizona Sale of Partnership Interest to Third Party

Description

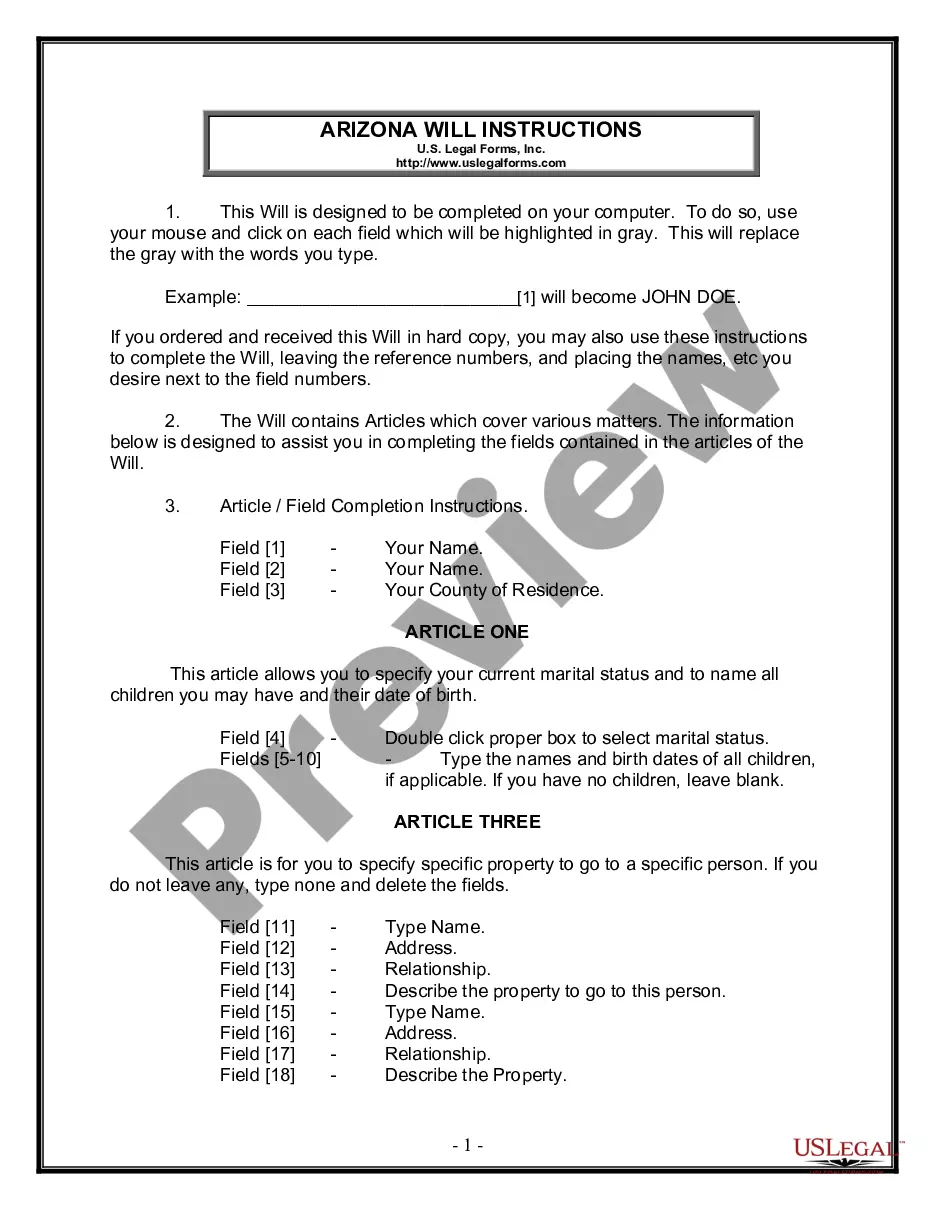

How to fill out Arizona Sale Of Partnership Interest To Third Party?

Regardless of one’s social or occupational rank, completing law-related documents is a regrettable requirement in today’s workplace.

It is often nearly impossible for an individual without legal training to create such documents independently, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms can be a game changer.

Ensure that the template you’ve located is appropriate for your region, as the laws in one state aren’t applicable to another.

Examine the form and read a brief overview (if provided) of the situations for which the document may be applicable.

- Our platform provides an extensive collection of over 85,000 ready-to-use, state-specific forms suitable for almost any legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors looking to conserve time by using our DIY templates.

- Whether you need the Glendale Arizona Sale of Partnership Interest to Third Party or any other document applicable in your jurisdiction, US Legal Forms has everything readily accessible.

- Here’s a guide on acquiring the Glendale Arizona Sale of Partnership Interest to Third Party in moments through our reputable service.

- If you’re already part of our clientele, feel free to Log In to access your desired document.

- If you’re new to our collection, please follow these steps before obtaining the Glendale Arizona Sale of Partnership Interest to Third Party.

Form popularity

FAQ

To record the sale of a partnership interest, follow these steps: document the sale in the partnership's financial records, adjust the ownership percentages in the partnership agreement, and ensure all partners are informed of the change. In the context of Glendale Arizona Sale of Partnership Interest to Third Party, clear records will facilitate tax reporting and prevent misunderstandings. Using platforms like USLegalForms can streamline this recording process and ensure compliance with legal requirements.

To record the sale of partnership interest, start by documenting the sale in your partnership's books. Include details such as the sale date, buyer’s name, and transaction amount, which is crucial for the Glendale Arizona Sale of Partnership Interest to Third Party. After that, update the partnership agreement to reflect the change in ownership. This documentation ensures transparency and maintains an accurate record of ownership.

Yes, if your partnership operates in Arizona, you must file an Arizona Partnership Return (Form 165). This return includes information about income, deductions, and distributions, pertinent to the Glendale Arizona Sale of Partnership Interest to Third Party. Each partner must also report their respective share of the partnership income on their individual state returns. Timely filing helps maintain compliance with state regulations.

To report a sale of a partnership, you should file Form 1065, U.S. Return of Partnership Income, with the Internal Revenue Service (IRS). This is important for the Glendale Arizona Sale of Partnership Interest to Third Party, as it ensures proper reporting of gains or losses. Additionally, you may need to issue Schedule K-1 forms to each partner, detailing their share of income or loss. Accurate reporting helps avoid future tax issues.

Yes, you can gift an interest in a partnership, but specific tax implications may arise from such a gift. It’s important to document the gift properly and consult with a tax advisor to avoid any potential issues. Understanding the details of a Glendale Arizona Sale of Partnership Interest to Third Party can aid you in making informed decisions about gifting ownership.

To transfer a partnership interest, the transferring partner must draft a transfer agreement and provide proper notice to the other partners. After that, the partnership must update its records to reflect the new ownership. Facilitating this process effectively is crucial, especially during a Glendale Arizona Sale of Partnership Interest to Third Party.

The common form used for the transfer of partnership interest is the Partnership Interest Transfer Agreement. This document outlines the terms and conditions of the transfer, ensuring that all parties are on the same page. Utilizing resources like US Legal Forms can simplify this process, particularly in the context of Glendale Arizona Sale of Partnership Interest to Third Party.

A partner can transfer their interest in a partnership, but the terms must comply with the partnership agreement. Often, this transfer requires the consent of other partners to protect their interests. This aspect is particularly relevant in a Glendale Arizona Sale of Partnership Interest to Third Party.

Yes, you can exchange a partnership interest under certain conditions. However, it is essential to consult a legal advisor to understand the implications of such an exchange. Engaging in a Glendale Arizona Sale of Partnership Interest to Third Party might create specific tax consequences that require careful planning.

Yes, you can transfer your partnership interest to another person, but this typically requires the consent of the other partners, depending on the partnership agreement. Engaging in Glendale Arizona Sale of Partnership Interest to Third Party may involve specific procedures that ensure the transfer complies with state laws. Working with legal experts can facilitate a smooth and proper transfer process.