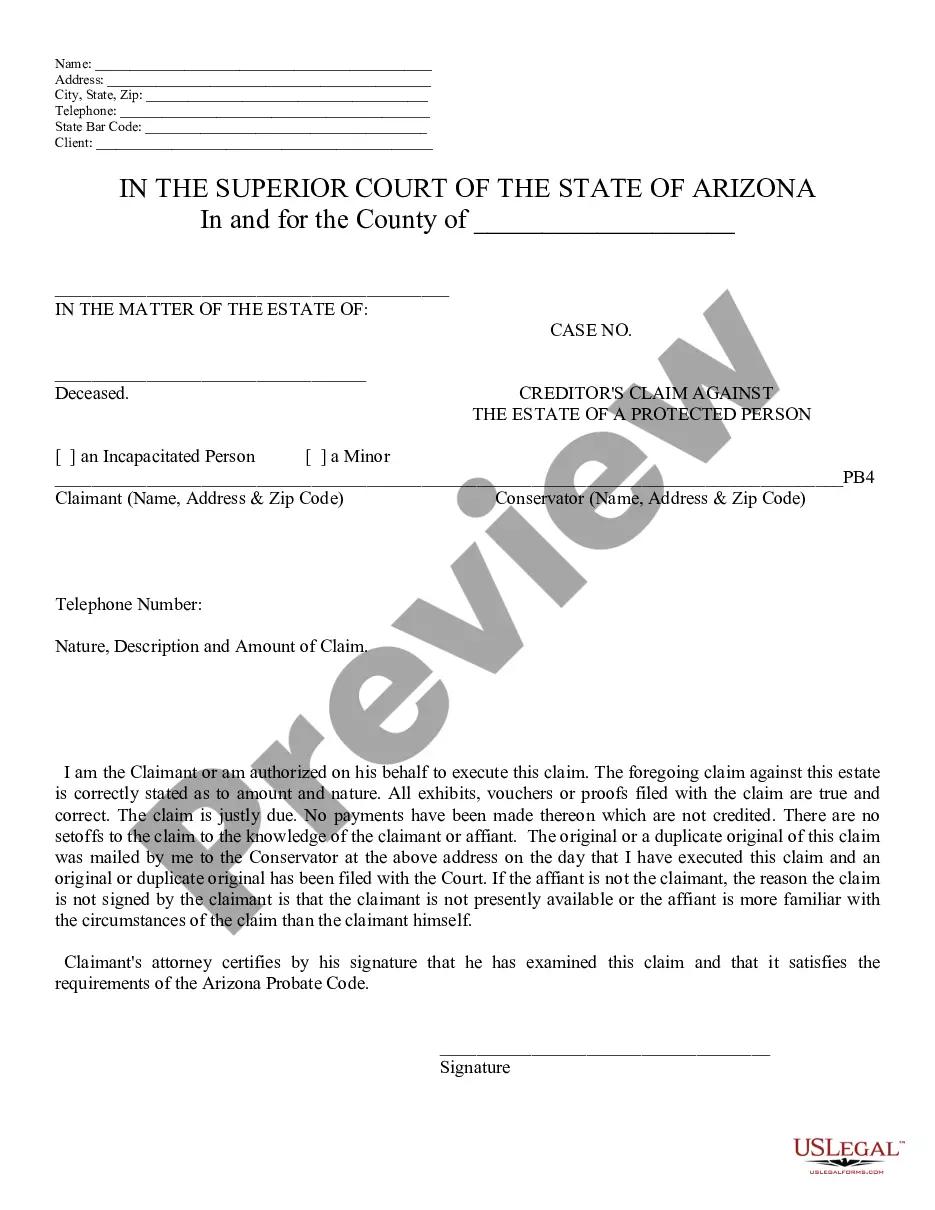

Creditors Claim in Probate - Arizona: This form is signed by a creditor, stating that he/she has a claim against the decedent's estate. The form further lists the claim, and the services performed for said claim. It is available for download in both Word and Rich Text formats.

Chandler Arizona Creditors Claim in Probate

Description

How to fill out Arizona Creditors Claim In Probate?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our advantageous website with a vast array of document templates makes it easy to locate and acquire nearly any document sample you require.

You can export, complete, and validate the Chandler Arizona Creditors Claim in Probate in just a few minutes rather than spending hours on the Internet trying to locate the right template.

Utilizing our catalog is an excellent method to enhance the security of your document submissions.

The Download option will be visible on all the samples you examine. Additionally, you can access all the previously saved documents in the My documents section.

If you haven’t created an account yet, follow the instructions below.

- Our skilled legal experts frequently examine all the documents to ensure that the templates are suitable for a specific area and adhere to current laws and regulations.

- How do you obtain the Chandler Arizona Creditors Claim in Probate.

- If you already possess a profile, simply Log In to your account.

Form popularity

FAQ

Certain assets are exempt from probate in Arizona, such as life insurance policies with designated beneficiaries, retirement accounts, and assets held in joint tenancy. Additionally, small estates under the specified value may also avoid probate altogether. Knowing what is exempt is key to navigating a Chandler Arizona creditors claim in probate and can streamline the estate settlement journey.

To avoid probate in Arizona, consider establishing a living trust or designating beneficiaries on accounts and assets. Properties titled in joint tenancy will also bypass probate. By utilizing these methods, you can more easily manage a Chandler Arizona creditors claim in probate, ensuring smooth transitions for your loved ones and simplifying the estate process.

Yes, you can inherit debt in Arizona, but only to the extent of the deceased's assets. Family members are not personally responsible for the deceased's debts unless they co-signed or are otherwise liable. When handling a Chandler Arizona creditors claim in probate, the estate handles debts before distributing assets. This is essential to ensure that creditors receive their due.

In Arizona, estates valued above $75,000 generally require probate proceedings. For real property, the threshold is $100,000. If you are dealing with a Chandler Arizona creditors claim in probate, knowing the estate's value helps determine whether it needs to enter probate. An estate planning professional can offer guidance on this matter.

In Arizona, bank accounts may go through probate depending on how they are structured. If the account is solely in the deceased person's name, it typically becomes part of the probate estate. However, accounts with designated beneficiaries can bypass probate. Understanding how Chandler Arizona creditors claim in probate affects these accounts is crucial for the estate settlement process.

In Arizona, the statute of limitations generally allows creditors to collect debts for a set period, which varies depending on the type of debt. Typically, unsecured debts have a three to six-year limit before they become uncollectible. If you are dealing with probate matters, a Chandler Arizona Creditors Claim in Probate must be filed within a specific timeframe to protect creditors’ rights. Understanding these timelines can help you manage your financial responsibilities effectively.

In Arizona, the responsibility for a deceased person's debts typically falls on their estate, not on family members or friends. This means that creditors can file a Chandler Arizona Creditors Claim in Probate to seek payment from the estate’s assets. If the estate does not have enough assets to cover the debts, the debts may go unpaid. It's essential to understand the probate process to navigate these obligations appropriately.

Rule 51 in probate in Arizona pertains to how claimants may file a creditors claim in probate. This rule establishes the procedures creditors must follow when seeking payment from an estate. Particularly, in relation to Chandler Arizona creditors claim in probate, it's crucial that all claims be filed within established deadlines to ensure a legitimate review. Utilizing resources, such as US Legal Forms, can aid you in adhering to these regulations effectively.

To contest probate in Arizona, you need to file a petition with the court, explaining your reasons for contesting the will or the probate process. Common grounds for contesting include lack of testamentary capacity or undue influence. If you find yourself involved in this process, ensure you are aware of Chandler Arizona creditors claims in probate as they can significantly influence the outcome.

You have four months from the date of receiving a notice of probate to file a claim against an estate in Arizona. If you do not receive such a notice, you have a full year from the date of the decedent's death. Acting within these time frames is critical for a successful Chandler Arizona creditors claim in probate.